NAKphotos

Investment Thesis

Crocs (NASDAQ:CROX) is a lifestyle footwear and accessories company. They are a leader in innovative casual footwear that combines comfort and style. Crocs’ products sales are growing across the world (North America, Asia, Europe, Latin America, and etc.), and their direct-to-consumer distribution channel has been working very well. Some investors have labeled Crocs as a “pandemic” stock, causing the stock price to drop substantially since late last year. I believe this is the mistake by the market, and I expect Crocs is a great investment option for the growth-oriented investor because:

- Crocs (now including HEYDUDE) is more popular than ever, and the revenue growth remains impressive.

- Strong brand recognition and the formidable combination of comfort and style give a definite economic moat. Their profit margins are well above the sector median.

- They are currently valued like a company in decline, which could not be further from the truth.

Strong Revenue Growth

Crocs has been growing rapidly around the world and across their product lines. They have positioned their brand image as a very unique combination of style and comfort, and their entire product line is growing at a very high rate. Also, their dual channel approach (wholesale and direct-to-consumer via e-commerce) falls very much in line with current shopping trends. Basically, Crocs’ management team is doing a great job at assessing and responding to trends in style, marketing, and operating efficiency.

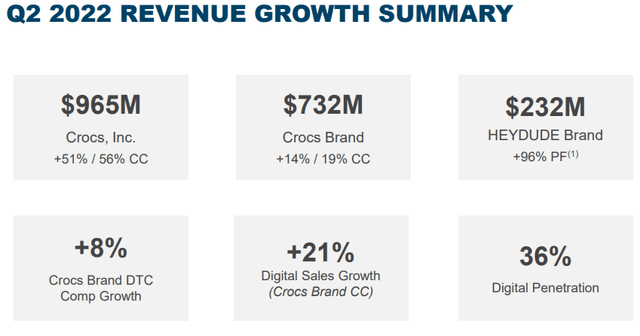

Crocs Growth Summary (Crocs Investor Relations)

In the most recent quarter, their revenue grew 56% on a constant currency basis, defying their label as a “pandemic” stock. Additionally, the acquisition of HEYDUDE at the end of last year has so far proved to be a superb strategic move. HEYDUDE exceeded the expectations of Crocs’ management, bringing in $232 M sales (almost double that of last year). Many investors worried that HEYDUDE wouldn’t be easily incorporated into Crocs, so the market responded poorly when Crocs announced the acquisition. However, Crocs has been proving the naysayers wrong so far. I expect Crocs to continue its impressive growth into the future.

Strong Economic Moat and Profit Margin

Crocs is doing an amazing job at increasing brand awareness through marketing. Fashion magazine Vogue has featured the Crush sandal, and the marketing team launched a digital marketing campaign in the metaverse featuring rapper Saweetie. Crocs shoes are hitting multiple points for customers by combining practicality, comfort, customization (with jibbitz), durability, and coolness factor, appealing to a wide range of customers across different regions.

Vogue Article Featuring Crocs (Vogue)

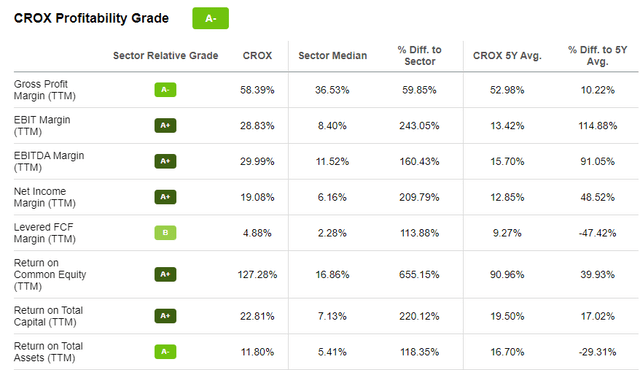

This strong and improving brand awareness and unique design has created a solid economic moat for the company, and this shines through in their profit margins. Across the board (EBIT margin, EBITDA margin, and Net Income Margin), Crocs’ profit margins are far superior to the sector median. Most of them are more than double the sector median. Crocs’ brand strength is well demonstrated by these metrics, showing that the company is able to charge a premium for their products.

Crocs Profit Margin (Seeking Alpha)

Favorable Valuation

Some investors predicted that recent growth was dependent on the pandemic environment and the stay-at-home trend, meaning that revenue would start to decline as soon as everyone started to leave their houses. Also, the HEYDUDE acquisition wasn’t received positively by the market. This double whammy brought Crocs’ stock down more than 50% from its November 2021 high, and they are now valued like a declining company.

However, looking at their revenue growth trajectory including HEYDUDE, they are clearly not a pandemic stock, and the acquisition of HEYDUDE will be a very successful one. Labeling Crocs as a “pandemic” stock would be a mistake, and I expect the market to realize this soon. The stock price and valuation will rise to reflect the true value of Crocs accordingly.

Intrinsic Value Estimation

Since my last article, Crocs revenue grew substantially. I updated my DCF model to estimate the new intrinsic value of Crocs. For the estimation, I utilized operating cash flow ($409 M) and current WACC of 8.0% as the discount rate. For the base case, I assumed cash flow growth of 20% (5-year average) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed cash flow growth of 22% and 25%, respectively, for the next 5 years and zero growth afterwards.

The estimation revealed that the current stock price represents a significant upside. Due to the mislabeling as a pandemic stock and negative reaction to HEYDUDE acquisition, Crocs is being traded at a substantial discount to its real value. Investors should take advantage of this opportunity.

| Price Target | Upside | |

| Base Case | $156.91 | 101% |

| Bullish Case | $168.80 | 117% |

| Very Bullish Case | $188.08 | 141% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- Cash Flow Growth Rate: 20% (Base Case), 25% (Bullish Case), 30% (Very Bullish Case)

- Current Cash Flow: $409 M

- Current Stock Price: $77.94 (08/12/2022)

- Tax rate: 20%

Cappuccino Stock Rating

| Weighting | CROX | |

| Economic Moat Strength | 30% | 4 |

| Financial Strength | 30% | 3 |

| Growth Rate vs. Sector | 15% | 5 |

| Margin of Safety | 15% | 5 |

| Sector Outlook | 10% | 4 |

| Overall | 4.0 |

Economic Moat

Crocs is doing a great job at creating a unique brand. Their products stand out and allow customers to personalize with jibbitz, which resonate with the younger generation. The brand also appeals to young professionals who want comfortable shoes for work at home. Their digital marketing campaign is also very effective.

Financial Strength

Due to the recent acquisition of HEYDUDE, their balance sheet is not in the best shape at this point, carrying relatively large debt against their cash position. However, Crocs is far away from any financial distress. Their business is generating tons of cash right now, so I don’t expect any trouble in the future.

Growth Rate

Both Crocs and HEYDUDE are the hottest brands in the market, and they are growing all around the world. Their revenue growth is far superior to the sector, and I expect that to be the case for a while.

Margin of Safety

Being mislabeled as a pandemic stock and the general negative sentiment toward growth stocks have created a great opportunity for investors interested in Crocs. Their stock is significantly undervalued, compared to their intrinsic value.

Sector Outlook

The market for shoes will continue to grow, and fashion accessory market will also grow. The growth won’t be explosive like some in the tech industry, but it will trend steadily with population growth and overall economic growth.

Risk

The fashion industry moves at a fast pace, and consumer’s tastes can change without warning. Crocs’ “ugly-chic” design is appealing to a wide range of customers across the world at this point, but, if management misreads the trends in the future, the company’s growth will be in jeopardy. Therefore, investors should pay close attention to their quarterly numbers and market trends.

As Crocs used a substantial amount of cash ($2.0 B) to acquire HEYDUDE, their balance sheet now carries large debt ($3.0 B), balanced by only a relatively small amount of cash ($187 M). Their liquidity (current ratio of 1.94x) falls on the lower side compared to competitors. They are nowhere close to financial distress, but the investor should pay attention to their debt level and debt servicing expenses going forward.

Conclusion

Crocs has been a superb growth company in the past couple of years. Riding the home office and remote work movement allowed their growth to explode around the world. Exceptional marketing campaigns and a distinctive product aesthetic have created a substantial moat for the company, and I expect that to continue going into the future. The high debt level is something to be watch, and the fast pace of the fashion industry does create some risk. However, I believe Crocs is substantially undervalued by the market at this point, and I expect a large return for those who invest.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment