morgan23

Investment Thesis:

Crocs, Inc. (NASDAQ:NASDAQ:CROX) is a global entity that specializes in the design, development, distribution, marketing, and sale of lightweight footwear to people of all demographics. Their primary brands are the classic Crocs clogs, which are renowned for their comfort and unique mold, while their new acquisition of HEYDUDE also presents another notable brand with their lightweight, stylish, and comfortable shoes.

I believe Crocs offers significant potential to offer above-market returns for the next few years due to their best-in-class margins dwarfing all of their competitors, large growth potential paired with a dirt cheap valuation, rapid de-leveraging, and an overall phenomenal business model that’s complemented with a great management team. Due to all of these factors, with very conservative assumptions, Crocs offer a 22% compounded annualized return over the next 10 years at today’s price of $80 a share with a $5 billion market cap.

Financial Breakdown:

Crocs is in a phenomenal financial state regarding their best-in-class margins paired with rapidly growing incomes. There is one issue that is present regarding their elevated debt load as a result of the HEYDUDE acquisition, but Crocs is taking the necessary measures to de-leverage.

Income Statement:

The highlight of Crocs’ income statement is their rapidly growing revenues and phenomenal margins. Since 2017, their revenue has grown 180% from just over one billion to now 2.8 billion. During that same period of time, they’ve slightly grown their gross margin from 51.7% to 57%. Additionally, their operating income has grown from 21.8 million to over 818 million which is an over 37.5x increase while they now boast an operating margin of 29.2%.

For comparison, their primary rivals in the footwear space such as Nike (NKE), Skechers (SKX), and Adidas (ADDYY) have significantly lower gross and operating margins. Nike, Skechers, and Adidas’ gross margins are 45%, 47%, and 50%, respectively, while their operating margins are 14%, 8%, and 7%. As you can see, Crocs’ margins dwarf that of their competitors, which contributes to one reason the business model is superior and why the company deserves a premium over others due to this moat. Lastly, I’ve only talked about their operating income in regard to profitability, as it’s a better measure of a business’s true output because net income is subject to many one-time expenses regarding write-offs, taxes, and much more.

Balance Sheet:

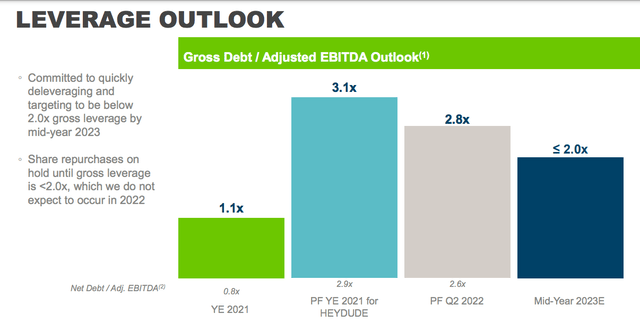

Crocs’ balance sheet is one of the only troublesome aspects of their business, yet the company is working to resolve the problem. Essentially, they have a somewhat small cash pile of just $187 million, their receivables are growing at an alarming pace over the past year from $200 million to $400 million which harms cash flows, and their inventories have also more than doubled in size from $200 million to $500 million most of which are a result of their acquisition. Then, the most notable problem on their balance sheet is their long-term debt, which has ballooned from $771 million to $2.7 billion. Overall, on the surface, it appears their fiscal state is quite weak, but there are measures being taken. First, they are planning on de-leveraging their debt to just 2x EBITDA or just $1.7 billion by mid-end of the year 2023.

Crocs Deleveraging (Crocs Investors Presentation)

Then, regarding their inventory problems, this should only be a temporary issue, as virtually all companies are experiencing inventory issues due to over-estimating demand and as a result stocking up inventory, which could lead to future issues if they are forced to lower prices in order to offload it. Fortunately, Crocs’ management team appears extremely confident in consumer demand for both of their primary brands, therefore, their inventory should be able to be offloaded at the usual prices, thereby protecting their brands and margins. Lastly, their shares outstanding have steadily decreased from 68.8 million to 61.6 million, although they have paused their share buyback program to focus on paying down debts. Fortunately, they have shown instances of aggressively buying back shares, therefore, with the cheap price and high earnings yield of 10.8%, a repurchase program in the near future will be very effective.

Cash Flow Statement:

Regarding their cash flows, Crocs’ free cash flow is significantly lower than their net income, $310 million compared to $540 million primarily due to large hits in their cash from operations as a result of massive increases in their accounts receivables and inventories. Overall, I don’t find their lower cash flows as a problem and over long periods of time, net income and free cash flow should be relatively the same. Therefore, I’m not worried about their low cash conversion rate over the past year.

Growth:

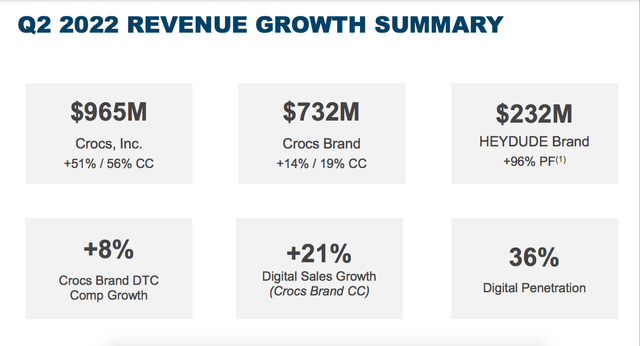

One of the primary factors driving the investment thesis on Crocs is the steady but rapid growth from their classic clogs paired with stunning growth from their HEYDUDE brand. In Q2 of 2022, their underlying Crocs brand grew 14% (19% on a constant currency basis) to $732 million in Q2. This phenomenal growth in the past year is reaffirmed with strong a strong outlook as they guided for 17% growth looking into the future. Additionally, Crocs boasted 21% digital sales growth, 36% digital penetration, and rapidly grew their revenues in foreign markets with 17% growth in Asia (28% on a constant currency basis). Overall, it appears that their underlying Crocs brand is continuously growing at a rapid pace in both domestic and foreign markets which is great to see, especially when considering the low multiples the business trades at.

Crocs Growth Breakdown (Crocs Investor Presentation)

HEYDUDE Brand:

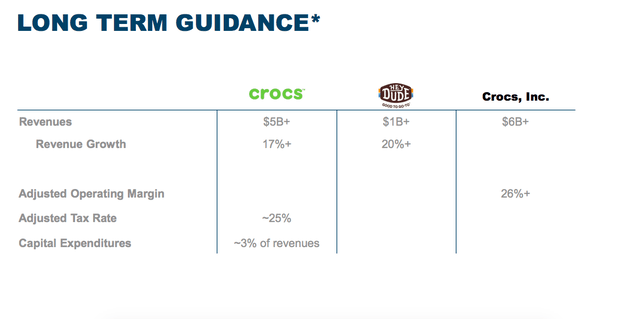

Although Crocs’ core business is growing steadily, the growth of the newly acquired HEYDUDE business displays extraordinary potential. In Q2 of 2022, the brand grew over 96% year over year (YoY) to $232 million in revenue during the quarter. Moreover, this growth exceeded the management team’s previous expectations and they now expect the HEYDUDE brand to reach $850-$890 million in revenues this year. Then, the long-term guidance issued by the company was also very strong as they guided for 20%+ growth from HEYDUDE and expect them to easily exceed the revenue goal of one billion dollars. Lastly, the operating margins noted by Crocs were also strong, as they believe they will maintain their best-in-class operating margins of 26% + going into the future.

Crocs long term guidance (Crocs Investor Presentation)

Valuation:

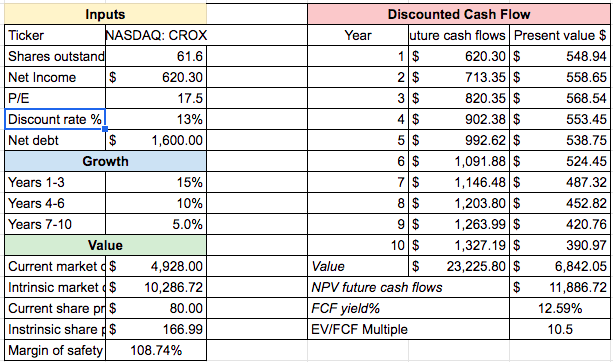

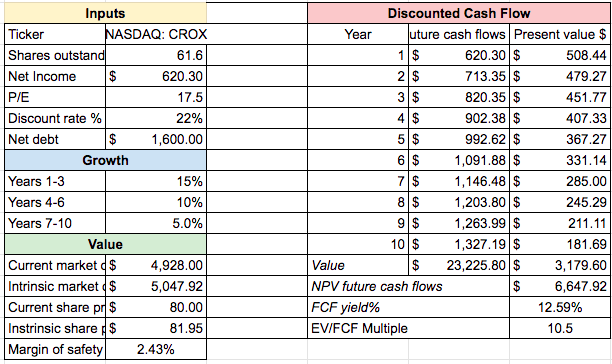

Now it’s time for the fun part, valuing this wonderful business. To value Crocs, I will be using a discounted cash flow model to project the future cash flows of the company and discount them back to today in order to determine what I should pay for the company in order to get my required rate of return. First, regarding the company’s profitability, I will be using full year 2022 EPS estimates provided by Seeking Alpha, which is $10.07 or $620.3 in net income. Then, regarding growth assumptions, due to Crocs’ guidance, and the potential for future buybacks and/or continued margin expansion, I conservatively assumed 15% growth for the next 3 years, where growth then dropped off by 5% in the subsequent 3-year periods after that. Next, I assumed a P/E of 17.5 which I believe is also extremely conservative as this business has proven to be high quality due to their best-in-class margins and strong brand paired with the management team.

These factors, paired with the rapid growth of the business, make this multiple very reasonable if not low. Then, regarding Crocs’ debt levels, they currently have $2.8 billion in net debt, but due to how quickly they are de-leveraging and how the management expects to reach less than 2x leverage by mid-year 2023, I have assumed 2x EBITDA leverage which would be $1.7 billion in debt due to their $851 million in EBITDA over the TTM. Lastly, I have chosen to set my discount rate at 13%, as when picking individual stocks, due to all of the work we are doing and to build in a further margin of safety, I want to outperform the market average of 8-10% over long periods of time.

DCF Model of Crocs (Rasoli Research: Seeking Alpha Financials)

As you can see, with these conservative assumptions, Crocs is trading at less than half of its intrinsic value today in order to receive a 13% return. Additionally, if we were to adjust the discount rate until the intrinsic value was at today’s price, assuming these assumptions were perfectly accurate, a 22% compounded annualized return could be achieved for the next 10 years.

Crocs DCF Model (Rasoli Research: Seeking Alpha Financials)

Risk Factors:

Although Crocs is a high-quality business that appears to have significant upside, there are still a few looming risks that could jeopardize the investment thesis such as the short-term macroeconomic climate and sustainability of demand for their products.

Macroeconomic Environment:

We all have observed the current and upcoming macroeconomic environment which appears to be extremely challenging. Due to the hyperinflation which has plagued the U.S. economy, the Federal Reserve has drastically raised interest rates which is propelling the economy into a recession. A recession of any kind could impact Crocs substantially as their footwear products aren’t an essential good, therefore, if the consumer is weakened it’s likely they cut out purchases of discretionary items such as footwear before other goods. This notion leads to the issue about whether the demand for Crocs’ products is sustainable, as not only have they observed a large surge over the past few years which may not be sustainable on its own, the possibility of a mild-severe recession could cripple demand for their products.

Final Thoughts:

Overall, I believe that Crocs presents significant upside over the next 5-10 years as their business continues to grow rapidly due to their recent HEYDUDE acquisition and natural growth of their core brand. Additionally, their valuation is extremely cheap due to them trading at just under 8 times forward earnings while growing over 15% while they also maintain a high-quality business that boasts best-in-class margins and strong brand name. Due to these reasons, I believe Crocs is trading at less than half of their intrinsic value in order to receive an above-market return.

Be the first to comment