Drazen_/E+ via Getty Images

CRH plc (NYSE:CRH) is a leading manufacturer of several types of building materials and products. It is the largest building materials business in North America, with operations in 46 States. CRH has successfully established itself in 28 countries spanning four continents in 3,235 locations. With operations in 18 European countries, CRH plc is also one of the largest building materials businesses in Europe.

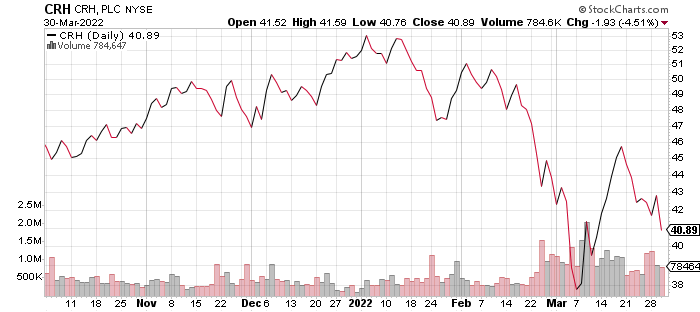

stockcharts.com

Founded in 1970, CRH plc has distinguished itself as a major supplier to different world markets. The company’s products have been used in some of the most iconic construction projects around the globe. Some of these construction projects include the Mercedes-Benz Stadium in Atlanta, the Queensferry Crossing in Scotland, the Gotthard Base Tunnel in Switzerland, and the Lighthouse Tower in Australia. With an outstanding performance in the last financial year coupled with the company’s transformation strategy, investors should consider building a long position in the company.

Financial Analysis

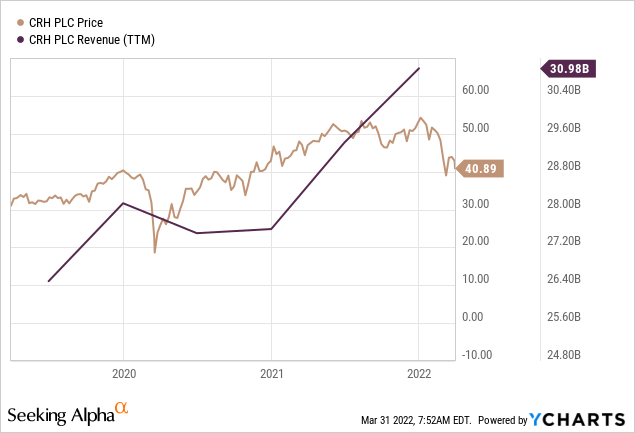

ycharts.com

CRH plc enjoyed resilient and progressive financials in the last few years. A highlight of the company’s performance in FY 2021 showcases a revenue generation of $31 billion, which is a 12% increase from the company’s sales revenue in FY 2020. The company’s profit after tax of $2.6 billion in FY 2021 was impressive and due to a rebounded in performance after the COVID 19 pandemic. This represents a 125% increase from last financial year. The construction industry has greatly suffered from the adverse economic effects of the pandemic in the last two years. No doubt, CRH revenues will continue to rebound with the ease of the global economy.

CRH revenue streams can be split into three divisions, the America materials division, the Europe materials division, and the building products division. It is important to note that the America materials division’s sales revenue, representing 40% of CRH global sales in 2021 is a testament to the company’s revenues getting back on track. Moreover, CRH plc is well-positioned to significantly benefit from the United States infrastructure program, which is worth over $1 trillion. With the renewed demand for infrastructure modernization in the United States, I expect the company to report revenue growth at the end of the current financial year.

Meanwhile, CRH plc started FY 2021 with steady progress. The company witnessed continuous demands for its products as it posted a 3% sales increase for Q1 2021 compared to Q1 2020. Nevertheless, the overall operation mechanism of the company was affected by weather challenges which disrupted the company’s production and distribution and, by extension, its revenue. CRH plc, however, had a more productive Q2 2021. The company posted a sales revenue of $14 billion in Q2 2021 due to more favorable conditions. An increase of 15% compared to Q2 2020. At the end of Q3 2021, CRH plc had expended $1.4 billion on acquisitions which symbolizes substantial opportunities for new revenue pipelines ahead. The company’s strategic acquisitions of complementing companies such as Angel Brothers Enterprise (An asphalt paving and infrastructure solutions business in Texas) will strengthen its operational management and open up more revenue streams from project backlogs.

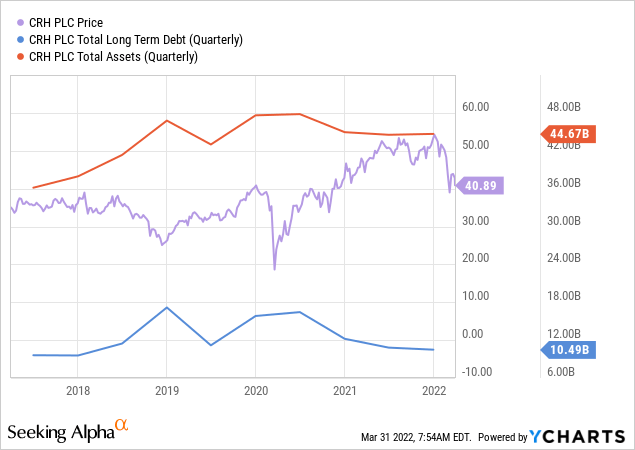

ycharts.com

By the end of FY 2021, CRH had delivered a record revenue of $31 billion, owing to the company’s integrated solution strategy to drive sales. A closer analysis of CRH plc’s long-term debt of $10.49 billion at the year-end of FY 2022 could be a bit alarming. However, comparing the company’s long-term debt with its total assets of $44.67 billion puts CRH at little risk of a significant financial burden. It is safe to say that CRH plc has enough to meet its debt obligations.

Risks and Mitigants

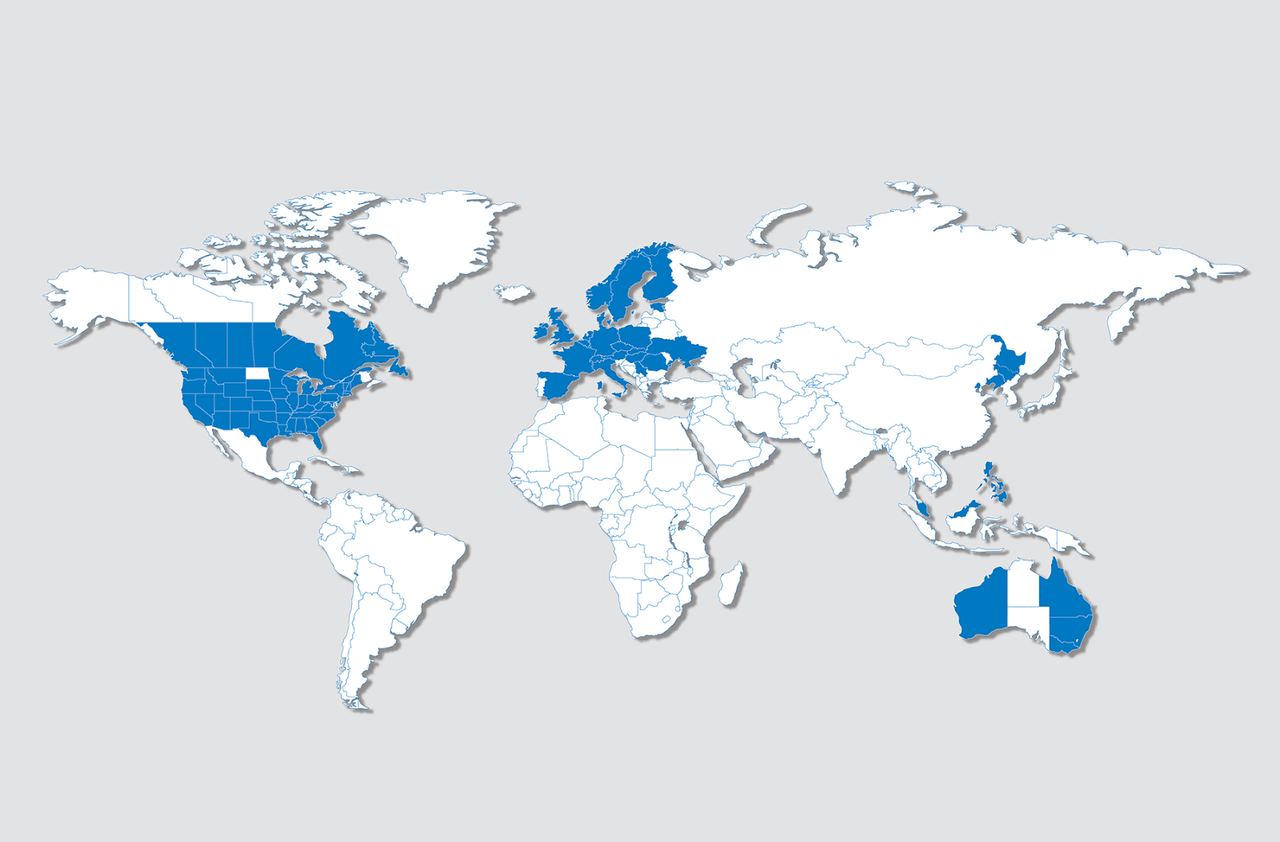

CRH plc’s Global Footprint (crh.com)

CRH plc is associated with some operational risks and uncertainties. As a multinational construction company, global and national economic circumstances, monetary policy, consumers sentiment, and weather conditions could hurt the company’s operations and revenue streams. With more than 3000 locations in 28 countries globally, CRH is also not immune to the negative impacts of local, national, or international political unrest.

For instance, CRH plc recently exited Russia following the invasion of Ukraine and the economic sanctions imposed on Russia. CRH lost two markets amidst the conflict between both countries. The company had to leave Russia, where it had a stake in six ready mix plants, and also had to halt operations in Ukraine, one of the largest cement producers. However, the company had prepared a contingency ahead for its operations in Ukraine, which is only responsible for 1% of the group’s annual sales.

Furthermore, as a commodity provider, CRH faces strong volume and price competition from similar companies. However, over the years, CRH has maintained a culture of strong customers relations while meeting customers’ preferences. In addition, CRH could also be adversely affected by local and international regulations. Public health issues like Covid 19 could negatively affect production, while uncertainty in taxation due to its international operations is also a risk factor.

Growth and Industry Valuation

CRH plc is an international group of businesses specializing in building materials. CRH has transformed over time using both organic growth and a series of acquisitions. CRH plc is a Fortune 500 company and one of the biggest companies in the world. One of the company’s largest acquisitions was Ash Grove Cement which it acquired in 2017. The acquisition, which was worth $3.5 billion, gave CRH more presence in the United States Midwest states. In 2015, CRH purchased the newly formed company LafargeHolcim (OTCPK:LFRGY) for $7.4 billion. Although the acquisition of LarfargeHolcim almost tripled CRH’s net debt, it made CRH plc “the world’s third-largest building materials group by market value.” In addition, CRH owes a significant portion of its development to its America Materials operation. Interestingly, the company has expanded $1.5 billion in acquisitions in FY 2021 to create new revenue streams and future pipeline opportunities for the company.

Furthermore, the company will significantly enjoy the desperate need for infrastructural modernization in the United States. The American Society of Engineers estimates that almost $6 trillion investment will be needed to upgrade the US infrastructure by 2029. In addition, CRH plc, as a leading construction company, is well-positioned to significantly benefit from the U.S. government infrastructure program worth over $1 trillion and the pipeline opportunities for the construction industry, which is expected to reach $16.6 trillion by 2025.

Future Outlook

CRH plc has a positive future outlook with the global market now open after a protracted lockdown. The company is a favorite among institutional investors. Some of the company’s largest shareholders include top names such as Goldman Sachs Group (GS), BlackRock Inc. (BLK), Bank of America (BAC), FMR LLC, and Boston Partners. CRH plc has enormous potential for the future. Its steady growth over the years showcases that this is just the beginning. Double-digit growth for the company at the end of the current financial year is not out of reach. As the company continues to expand operations through acquisition and partnerships, CRH plc is a buy for both short-term and long-term investors.

Be the first to comment