CPG’s visible value and hidden value in one picture. Allexxandar/iStock via Getty Images

Note: Prices discussed are in Canadian Dollars or US Dollars and are indicated as such.

When we last covered Crescent Point Energy (NYSE:CPG) [TSX:CPG], we gave it a buy rating as we expected strong crude prices to persist.

If there is one thing that stands against the investment case is that there is a serious chase on currently to get exposure to E&P firms. This makes it harder to find less risky entry points and the case for CPG is no different. That said, since we expect at least $65/barrel average prices over the next 5 years, we are still stamping this with a “Buy”.

Source: Valuation Still Compelling If You Expect $65 Oil

CPG rose from that point and at the highs was up over 112% from the date of that article. That euphoria was short lived as recession fears made CPG and oil, come back to earth. Where do we stand today?

Price Anchoring

Whether it is on the way up or the way down, price anchoring can be dangerous. We have been guilty of this as well and it is hard to separate recent price action with underlying value. But we are going to try here, in some shape or form. So for starters, let’s say you bought into our previously presented bullish piece and now are confronted with buying this stock, 30% higher.

Returns Since Last Article (Seeking Alpha)

Well, three quarters have passed since then. Let’s see what CPG has done. For Q4-2021, cash flow was $424 million CAD. For Q1-2022 it was $582 million CAD. For Q2-2022, our expectations are for $650 million CAD. If you subtract out the capex in those 3 quarters (Q4-2021 and Q1-2022 actual, Q2-2022 estimated), we are left with almost exactly $1.0 billion CAD. If you subtract capex and dividends paid, you are left with more than $920 million CAD. So all other things being equal, you should pay at least $920 million CAD more for the whole company than what you were willing to in October 2021.

That works out to $1.60 CAD per share, or about $1.22 USD.

In other words, CPG is at least as undervalued as it was in October 2021 since it has retained cash equal to about how much it has gone up.

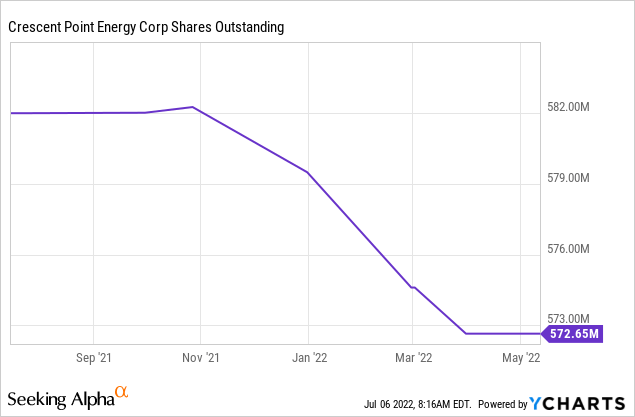

Multiplier Effect

The bulk of this cash has gone towards debt reduction and a small amount towards stock buybacks. Reducing debt generally enhances the multiple seen on equity, especially during distressed credit conditions. So in a normal world, CPG would be far less risky today, than what we saw in October 2021. This is even if you ignore that most commodity futures curves are higher today. Fortunately for you, that is not the case and the stock has actually retraced to a remarkably low-risk buy point.

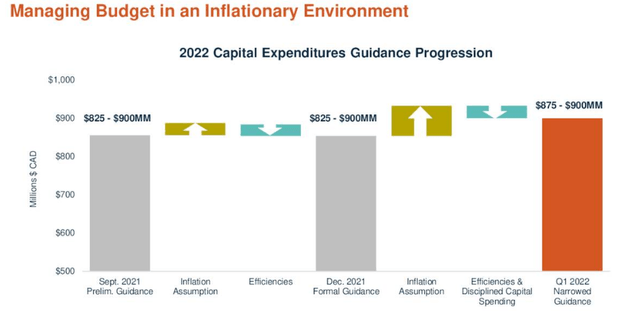

Inflation Impact & The Good Old Days

Like all firms, CPG is also facing an impact from inflation. So far they have contained the effects and only moved up the low end of their capex guidance.

This bears watching as the old CPG did not ever find a single well that it did not feel the need to drill. If those days return, you can expect a ballooning capex budget and a “spend through all disasters” policy. So far, management has shown an amazing amount of focus and they are not biting into “this time is different” in the oil cycle.

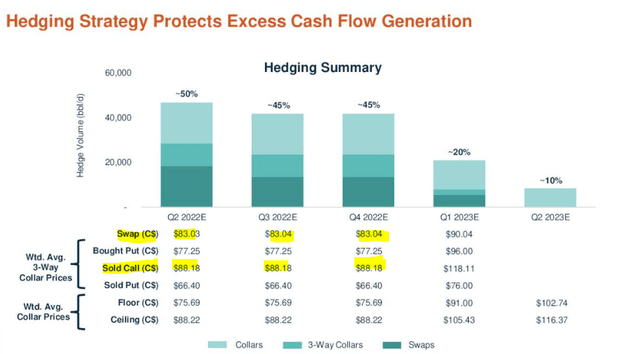

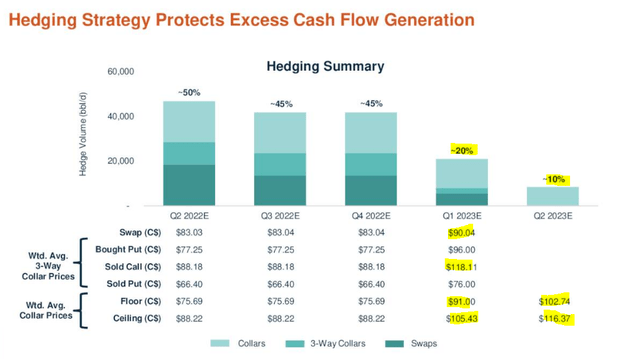

Hedges

One last point we want to touch on is just how badly CPG’s hedges are working against it. Looking at Q2-2022 down to Q4-2022, CPG’s swaps (fixed price) and sold calls (which basically are a fixed price above that number), are in the $80s. That is $83.03 CAD and $88.18 CAD below.

With Oil at $100 USD and USD-CAD at $1.30, the current price for West Texas Intermediate is $130 CAD. CPG is selling about half its production at $85.00 CAD. This of course hurts it on a day to day revenue collection. It also hurts it as royalties are paid on the raw price. In other words it pays royalties at $130 CAD, while getting mid $80s CAD in price. What’s our point?

Well it is definitely not to criticize the company. They hedged attractive prices when they saw it and created a clear definite path to deleveraging. Management deserves praise for prudent risk management and we are here to heap it on them. Our point though is that investors are underappreciating just how much cash flow can be generated even if oil falls from here. As prices fall, hedge losses drop and royalties drop as well. Impact to cash flow is extremely muted.

Let’s look at it another way. CPG has very little hedges in place as per their May presentation for 2023.

We will bet that this is higher today (2 months after this presentation was released), but still way below the Q2-2022 hedge levels. The prices are also much better. If in Q1-2023, crude oil prices average the same as they did in Q1-2022, CPG would likely have a cash netback of at least 30% higher. So the already large gusher of cash flow, becomes larger still.

Verdict

Based on the deleveraging to date and management execution, we are raising this to a Strong Buy from our earlier Buy rating. Based on our expectations of oil and natural gas prices, we see CPG becoming debt free by Q4-2023. We don’t think they will actually get there as it is unlikely CPG will choose to reduce debt to that point. They have certainly guided towards raising dividends and buy backs over time and that is what we will savor. Our price target ($10.00 USD and $13.00 CAD) is based almost exclusively on net cash generation (after capex and dividends) of about $2.1 billion CAD over the next 2 years and that comes to about $3.75 CAD per share or $2.85 USD per share. We are not taking into account valuation expansion from these levels, which could add substantially to returns.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment