bjdlzx

With inflation remaining stubbornly out of the Fed’s control despite raising interest rates to the point of a recession, and the continued Ukraine war, investors need to consider strategic investments.

These investments would be in products and firms that are resistant to inflation, firms that have a well-insulated and recession-ready balance sheet, and that are likely to benefit from (or immune to) geopolitical instability.

Enter Crescent Point Energy Corp. (NYSE:NYSE:CPG), a producer of light and medium crude oil, natural gas liquids, and natural gas reserves. I believe this firm is worthy of consideration by investors, given its financial strength and price attractiveness relative to its peers in the Oil and Gas Exploration and Production industry. Let’s explore…

(Data & prices correct as of pre-market 6th September 2022)

(The Top Oil and Gas Exploration and Production Stocks referred to can be found on this Seeking Alpha screener)

Crescent Point Energy Corp.’s Base Financial Health

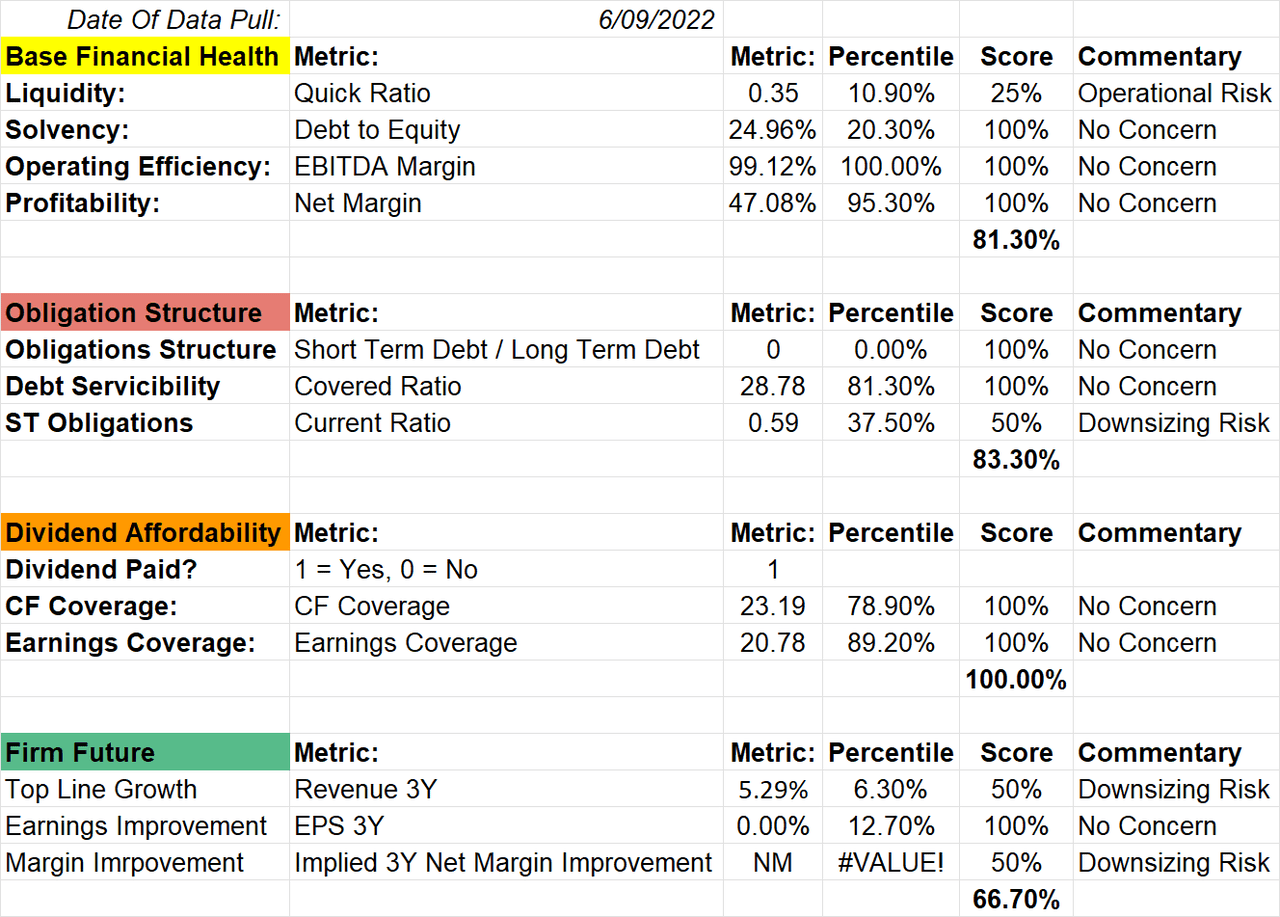

To begin an analysis of CPG, it pays to look at the firm’s base financial health to try and identify any areas of concern we might have. The following analysis compares CPG’s financial metrics to its 71 industry peers and shows us both the metric on its own, and where it sits compared to its peers.

Immediately we see an area of slight concern, a quick ratio metric of 0.35 which is considered significantly below-average for the industry, suggesting that in a catastrophic business environment, CPG may have issues with covering its obligations. This is of course the “absolute worst case scenario,” but still worth noting.

Moving through the rest of the metrics, we don’t see many other areas of considerable concern, other than noting a smaller-than-ideal current ratio and some mediocre margin improvements in the firm’s future.

Author

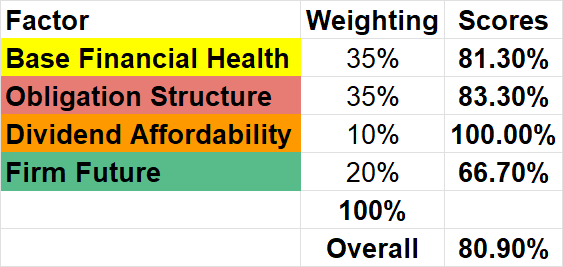

Overall, I give CPG a financial health rating of 80.9%, with a weary eye out for changes in the firm’s quick ratio, current ratio, and improvements in future forecasts.

Author

Assessing Crescent Point Energy Corp.’s Pricing Attractiveness

Next, we’ll look at how CPG is priced based on valuation metrics relative to the peer group.

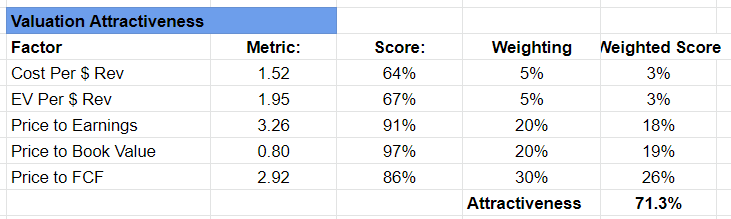

We’re looking at a broad-strokes view of industry peer valuations to see how attractive CPG’s current valuation places it, and assess if there is potentially a mispricing.

Across the board, CPG’s valuation metrics give us cause for further interest in the firm, with low valuation metrics compared to the peer group. Weighting each of the scores gives us a weighted valuation attractiveness score of 71.3%, putting CPG on our list of well-priced firms at a glance.

Author

Finding An Appropriate Valuation Method For Crescent Point Energy Corp.

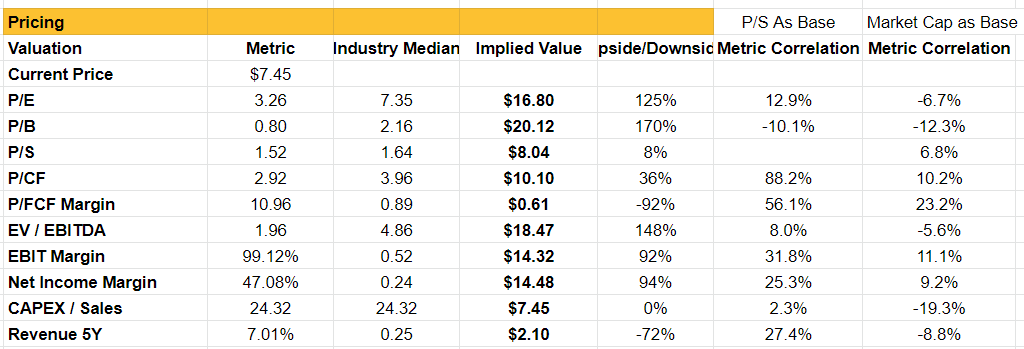

Next, we try to find the correct pricing mechanism for CPG based on how the industry at large is valued. To do this, we consider the variation across all firms when considering valuation metrics and their correlation to price/sales valuation, and market cap correlation.

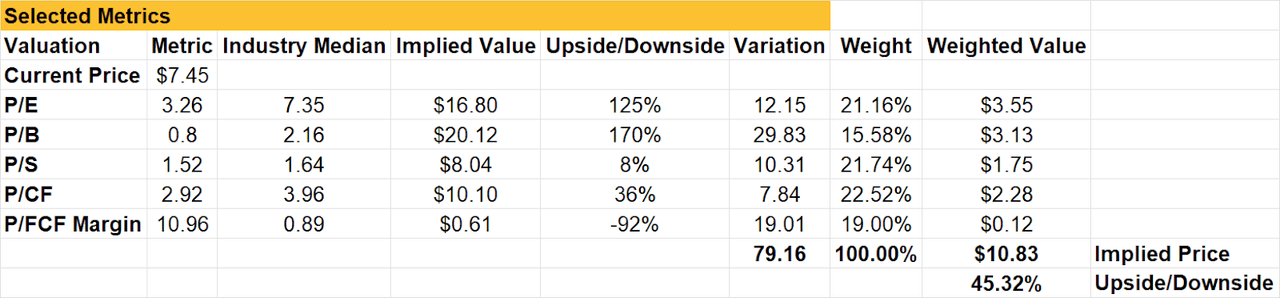

Firstly, we eyeball the entire list of normal and abnormal valuation metrics to see if anything stands out to us, and one item of interest is the price to free cash flow margin. While this is not a standard valuation metric, it is interesting to see that investors are currently paying a significant premium for FCF (free cash flow) margin compared to the industry at large. On the other end of the spectrum, price to earnings and book value are extremely undervalued for CPG.

Author

Working through the list and focusing on just a handful of valuation metrics, and weighting them based on their variation across the industry (more variation = lower weighting), we come out with a weighted value of $10.83, representing an upside risk of 45.32%.

Author

Closing Remarks

Overall, I see excellent potential for CPG and give it a Buy recommendation and price target of $10.83, but with a cautionary note around the firm’s liquidity, short-term obligations, and its margin improvement outlook.

With my own views around the likelihood of an impending Fed-driven recession, paired with the energy market’s historical outperformance in high-inflationary environments and geopolitical instability driving higher energy prices, I see a period of opportunity for CPG ahead.

Be the first to comment