blackdovfx

Investment thesis

Revenue for Credo Technology (NASDAQ:CRDO) in Q2 was in line with Wall Street forecasts, and guidance for Q3 was 2% higher than forecast. I still think CRDO is strategically important in enabling next-generation bandwidth, which will support a robust growth trajectory, despite a shaky macroeconomic backdrop and a difficult cloud capex outlook. I also think investors will come to value the company more highly as it expands because the concentration dynamics of its customer base will inevitably slow down as the business expands.

My revised estimate of CRDO’s value, combined with its recent stock price, suggests that the company is trading close to its true worth. I, therefore, recommend that investors wait for CRDO’s valuation to drop before going long.

2Q23 earnings review

In the second quarter of the fiscal year 2023, Credo reported revenue of $51.4 million, which was 1% higher than predicted. While revenue from intellectual property (IP) came in at $3.3 million below projections, revenue from products (including engineering services) was $48.1 million above projections. Non-GAAP gross margin dropped to 54.9% from 55.1% in the previous period, a 560bps sequential decline due to mix. The $0.02 in non-GAAP EPS was in line with the $0.03 that was anticipated by the market.

The continued rollout of AECs at Microsoft (MSFT) and robust traction in the LineCard market drove a 33% sequential increase in aggregate product revenues for Credo in the quarter, and a 143% year-over-year increase. When compared to other major networking players, such as Nvidia (NVDA), this expansion was significantly faster. Because of this, I believe that 2Q23 exemplifies the distinctive nature of Credo’s expansion profile, and I am confident that the company will achieve or exceed its FY23 revenue goal of $200 million despite entering a more selective IT procurement environment. Aside from this, other good news includes two more hyperscalers are looking into AECs, with one of them focusing on DDC applications; and a second Cloud customer has just qualified for a custom NIC-to-TOR AEC, with full-scale deployment beginning in FY24. These are some of the indicators that support my view of CRDO’s future prospects. It may be a few quarters before we learn whether or not AECs were a success at the third and fourth hyperscalers, but after hearing the earnings report, I feel confident that Credo will be able to grow its top line at extremely fast rates in the near future.

Credo’s quarterly OPEX growth rate of 37% was significantly lower than its quarterly revenue growth rate of 94%, demonstrating strong operating leverage. I expect the annual trend of expanding operating margins to continue, based on management’s guidance for 3Q23 revenue growth of 73% and OPEX growth of 43%. Finally, I remain confident that Credo will report a double-digit operating margin by the end of FY23. Because of the inherent scalability of the SerDes IP, I anticipate that operating margins will rise to 28% by the end of FY25. For sense check purpose, this is comparable to Marvell’s (MRVL) margins prior to the acquisition of Inphi.

Negatives

Credo’s largest customer, MSFT, accounted for 44% of quarterly revenue. Furthermore, the company’s top three clients constituted 80% of total sales. Credo’s growth and its success in providing a differentiated AEC solution have undoubtedly contributed to this degree of revenue exposure. But I worry that the stock’s multiple will be temporarily impacted by the company’s reliance on a small number of customers. Despite this setback, I see a silver lining in the fact that a second Cloud customer will initiate AEC deployment in FY24, which should serve to mitigate the impact of the situation on the quarter-to-quarter fluctuations. As NIC speeds increase and more hyperscalers adopt AECs due to their superior performance and lower cost, I have no doubt that the market for AECs will grow.

In my opinion, Credo’s $3.3 million in IP revenue for the quarter was too low, especially considering that the company’s non-GAAP gross margin was 510 basis points lower than its previous guidance. This quarter highlighted the segment’s inherent volatility and the consequential role it will play in driving future gross margins. That said, management did project a rebound in IP profits in 3Q23, with gross margins of 59-61%, which gives some level of comfort. Also, the company’s leadership is certainly optimistic about the second half of FY23 based on their guidance, in which they IP revenue to account for more than 15% of total sales.

In conclusion, despite a more than 100% increase in quarterly product revenues, the company’s management has stated that the worsening macroeconomic conditions in China are limiting the company’s optical DSP opportunity. The fact that the two Chinese hyperscalers who were supposed to be the adopters of Credo’s solutions are instead delaying massive rollouts is further proof of this. I anticipate that the ramp of optical DSPs may be slowed due to the ambiguity surrounding the timing of a recovery and the fluidity of government-mandated lockdowns.

Guidance

The range of $54-56 million in projected revenue for 3Q23 was 2% higher than the consensus estimate. The midpoint of the forecast for non-GAAP gross margin was set at 60%, representing a 510-basis-point increase from the previous quarter. Management also guided non-GAAP operating expenses between $25 and $27 million, an increase of 4% sequentially and 43% year-over-year at the midpoint.

Valuation

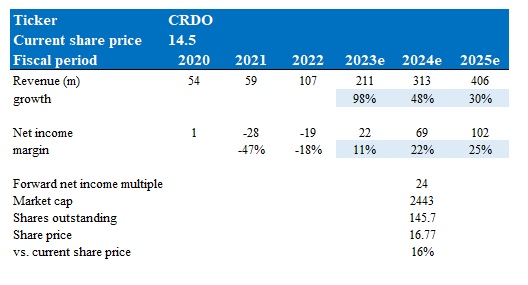

Based on the updated consensus estimates, which are still achievable based on the original thesis, I believe the upside has reduced from my original 30% to 16% over 2 years from the current share price. This also means that CRDO is becoming fairly valued than undervalued.

Model walkthrough:

- Revenue is expected to continue growing at a high pace as CRDO captures market share, from $107 million in FY22 to $406 million in FY25.

- Net margin to expand as CRDO benefits from fixed cost leverage.

- CRDO to trade at a mature-earnings multiple of 24x. While CRDO is trading at 26x today, it is 2x above its average, which I expect to rerate to the average over the longer term.

Own estimates

Conclusion

To summarize, I believe CRDO is approaching fair value. I continue to believe that it is a promising company in the data infrastructure market, providing efficient and high-performance connectivity solutions. However, the valuation does not provide me with a sufficient margin of safety to invest at this time.

Be the first to comment