Michael Vi

Coupang, Inc. (NYSE:CPNG) is the largest e-commerce business in South Korea, the fifth-largest e-commerce market in the world behind China, the U.S., UK, and Japan. The business was founded in 2010 by CEO Bom Kim and has grown rapidly to become a $32b behemoth offering a range of services across both their product commerce and developing offerings business segments.

| Product Commerce Segment | Developing Offerings Segment |

| 1P and 3P e-commerce (South Korea) |

1P and 3P e-commerce (international markets) |

| Rocket Fresh (grocery delivery) |

Coupang Eats (food delivery) |

| Advertising |

Coupang Play (video streaming) |

| Wow membership service |

Fintech (payments revenue) |

Coupang has expanded into a whole host of verticals outside of e-commerce in the South Korean market, however, as of their latest quarter (Q2 2022), 97% of Coupang’s net revenue was still generated from their core product commerce segment. Thus, while their developing offerings are exciting and increase their total addressable market (“TAM”), Coupang remains essentially an e-commerce and grocery delivery business.

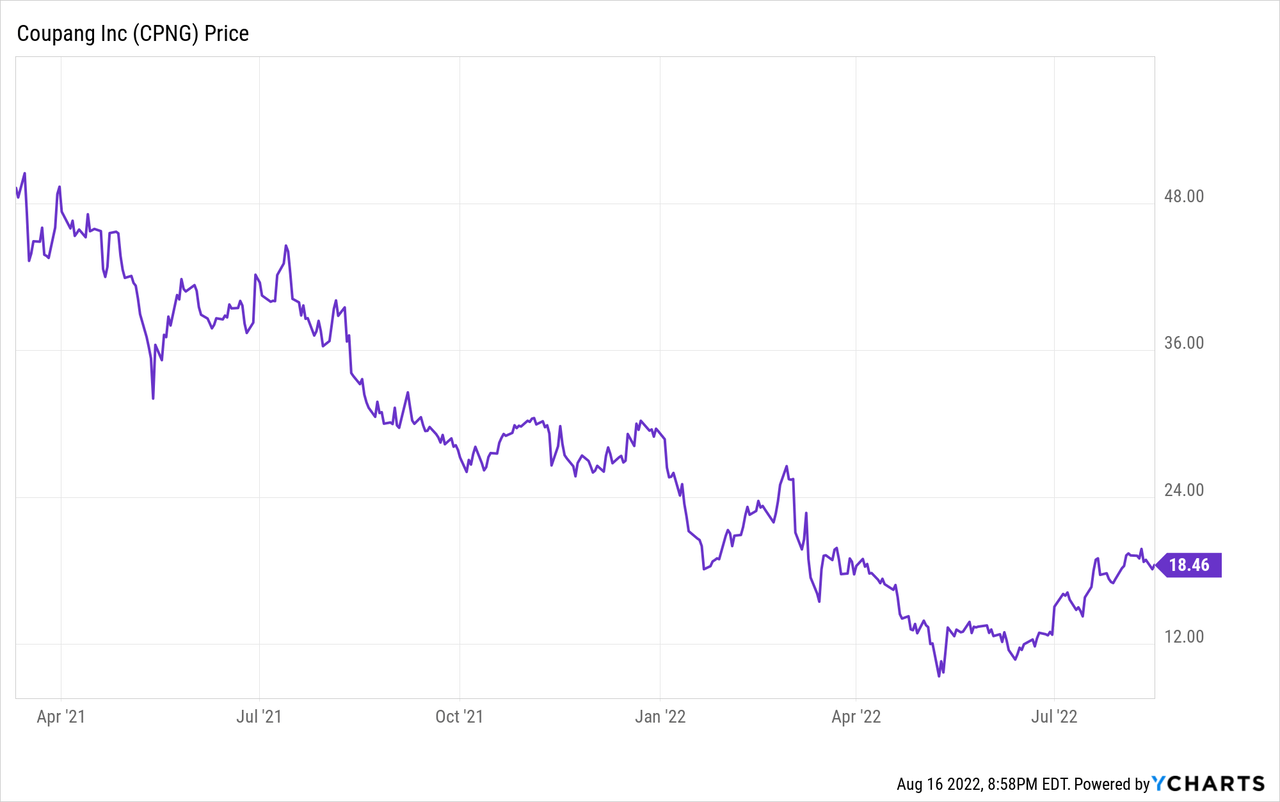

Despite attracting esteemed investors in the private markets, such as Sequoia Capital, SoftBank (TYO:9984), and BlackRock (BLK), Coupang has had a tough time in the public markets. Shares are down 36% so far in 2022 and 62% since their IPO in March 2021.

Admittedly, some of the fall in Coupang’s share price is due to external factors (e.g., a broader macroeconomic slowdown and sudden disdain for tech businesses), but some is also undoubtedly the result of Coupang’s “Amazon-esque” (NASDAQ:AMZN) vision to prioritize growth in long-term free cash flows over appeasing investors with short-term profitability. See the below quote from CEO Bom Kim in their latest earnings call. Sound familiar? Cue Jeff Bezos.

One, we exist to deliver new moments of wow for customers. Two, we don’t start with what looks easy. We work backwards from imagining jaw-dropping customer experiences and we embrace the hard work required to challenge trade-offs that customers take for granted. Three, we will employ technology, process innovation and economies of scale to create amazing customer experiences and drive operating leverage and significant cash flows over time. Four, we always prioritize growth and long-term cash flows. And five, we are disciplined capital allocators. We start with small investments, then test and iterate rigorously. We invest more capital over time in opportunities that have the best long-term cash flow potential (CEO Bom Kim, Q2 2022 Earnings Call).

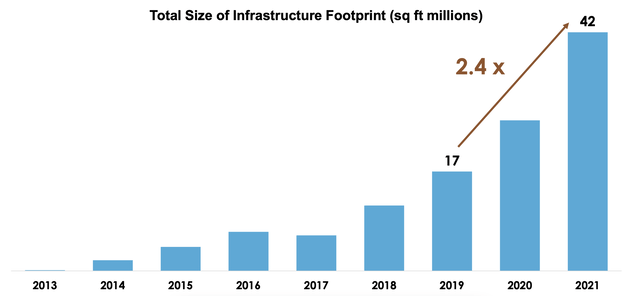

In response to the COVID-induced surge in e-commerce demand throughout 2020/2021, Coupang invested aggressively to build out their logistics and fulfilment capabilities, resulting in sharply negative operating margins. However, as Coupang has now completed this major CapEx cycle, both their gross and adjusted EBITDA margins have rapidly improved, resulting in a cleaner picture for investors and more confidence in their path to sustained profitability.

Coupang CapEx (Coupang Investor Presentation March 2022)

In this article, I discuss Coupang’s latest Q2 2022 results and why I think the business remains a buy, even after the almost 100% rise in share price over the past three months.

Growth is slowing, but Coupang continues to gain market share

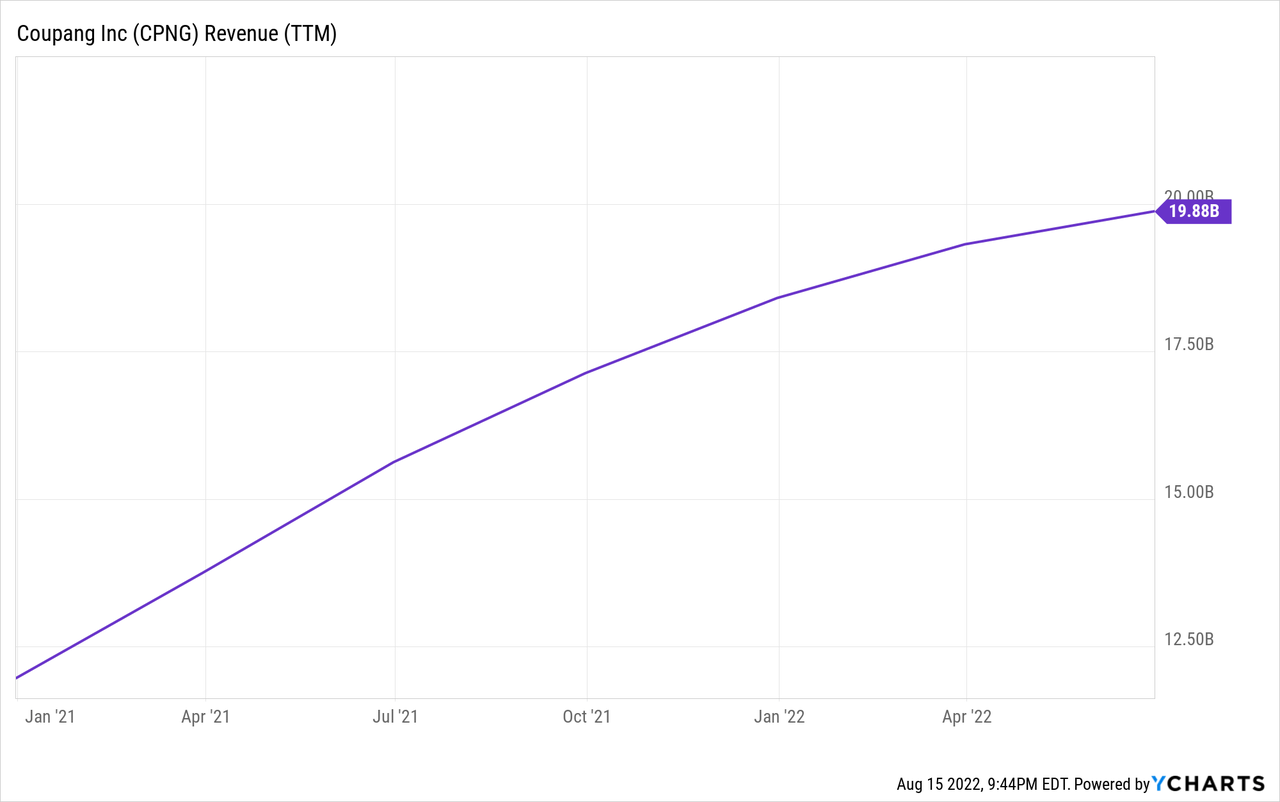

On the surface, the rapid deceleration in Coupang’s revenue growth might appear a cause for concern. After 15 straight quarters of 50%+ YoY revenue growth (ending Q3 2021), Coupang’s growth rate has consistently fallen each quarter to a low of 12% YoY growth in Q2 2022.

| Quarter | Revenue Growth (No FX Adjustments) | Revenue Growth (Constant Currency) |

| Q1 2021 | 74% | 63% |

| Q2 2021 | 71% | 57% |

| Q3 2021 | 48% | 44% |

| Q4 2021 | 34% | 39% |

| Q1 2022 | 22% | 32% |

| Q2 2022 | 12% | 27% |

However, context is important. While currency tailwinds were supporting Coupang through the first three quarters of 2021, this trend has flipped and Coupang has experienced significant currency headwinds throughout the first two quarters of 2022. In constant currency terms, Coupang grew revenues 27% YoY in Q2, a healthy growth rate given: (1) their scale as the dominant e-commerce business in South Korea; (2) the tough comp being elapsed in Q2 2021 where Coupang grew revenues 71% YoY (57% in constant currency); and (3) their deliberate strategic decision to pull back on growth in their developing offerings to optimize for profitability.

It is also important to consider whether Coupang’s market share is increasing or decreasing. The answer to this question is clear.

Coupang is the leader in the South Korean e-commerce market and their competitive position has only strengthened since IPO, with product commerce revenues growing at more than four times the rate of the broader market in Q2. See the below comments from CEO Bom Kim in their latest earnings call:

Product Commerce revenues grew at 27% year-over-year and 3% quarter-over-quarter on a constant currency basis. In contrast, the broader product e-commerce segment in Korea grew 6% year-over-year and 0% quarter-over-quarter. Our share of product e-commerce growth has increased every quarter since we’ve gone public and this quarter was no exception, setting a new record (CEO Bom Kim, Q2 2022 Earnings Call).

Why is Coupang gaining market share? The answer is simple. They are following the classic Amazon playbook of offering greater convenience and lower prices for their customers. For example, Rocket Fresh customers who order groceries before midnight will receive their order before 7 AM the following morning. When is Coupang coming to Australia!?

In addition to providing unmatched delivery and service levels, we continue to offer the best prices to our customers. A recent study by KPMG found Coupang to have a 25% to 60% average price advantage compared to major competitors for top-selling items across the categories surveyed (CEO Bom Kim, Q2 2022 Earnings Call).

Increasing product penetration within their existing customer base

Until Q1 2022, Coupang had grown their total active customer count by at least 20% YoY for 16 straight quarters. However, as global markets (South Korea included) entered a macroeconomic slowdown, Coupang’s growth in active customer count has decreased substantially to 13% YoY in Q1 2022 and 5% YoY (with a 1% QoQ decline) in Q2 2022.

However, it is logical that at Coupang’s scale of 17.9m active customers (vs. a TAM of around 37m Korean online shoppers), a more realistic medium-term growth rate in active customers is around the 5-10% range, unless they substantially increase their presence in international markets like Japan.

Instead, Coupang’s main lever to drive revenue growth over the coming 3-5 years will be increasing penetration of their new products (e.g., food delivery, advertising, payments) within their existing customer base. In Q2, Coupang reported a total net revenue per active customer of $282, which increased 7% YoY on an absolute basis, but 20% in constant currency, driving the bulk of their 27% YoY revenue growth (constant currency).

Increasing customer adoption and engagement across more offerings is accelerating our flywheel (CEO Bom Kim, Q2 2022 Earnings Call).

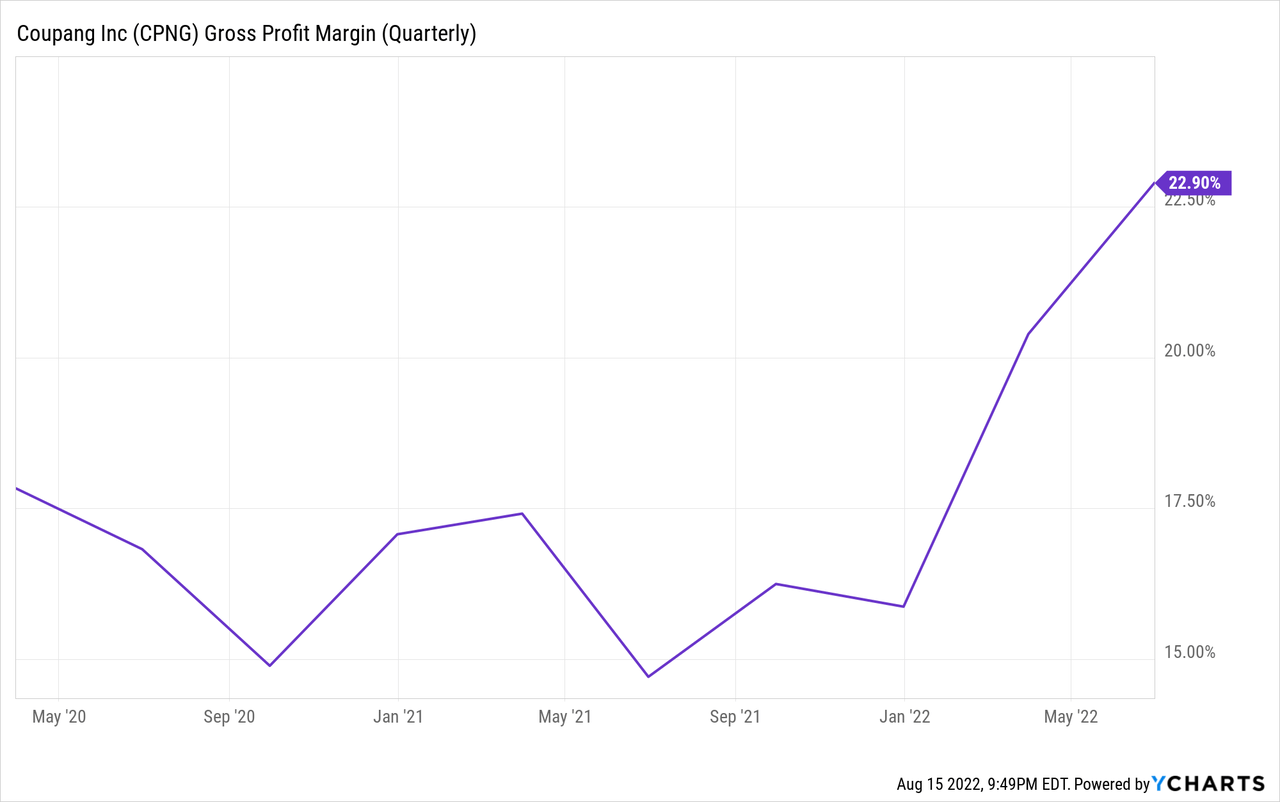

Rapid gross margin expansion

Coupang is a low gross margin business as a large proportion of their e-commerce sales come from first-party (1P) relationships where Coupang purchases products from a wholesale supplier, stores it in one of their warehouses, and controls distribution to the customer. While 1P sales require substantial upfront investment in infrastructure and generate lower margin revenue than third-party (3P) sales where Coupang simply acts as the marketplace intermediary connecting suppliers who ship products directly to customers, it allows Coupang to better control product quality and delivery times. Over time, Coupang expects to increase their proportion of e-commerce business coming from higher margin 3P sales:

Despite 1P being a harder problem to solve, we chose to invest in 1P before 3P because we believe 1P leadership is the foundation for providing the best overall experience, including the best 3P offering in the market. By breaking the trade-offs across price, service, and selection, our superior 1P offering attracts more and more customers to make Coupang their default shopping destination. This increased traffic leads into more sales for 3P which attracts more 3P sellers, who further expand the selection on Coupang. That increases selection and convenience for customers, which in turn attracts even more customers and higher frequency, broadening the top of the funnel for both offerings (CEO Bom Kim, Q2 2021 Earnings Call).

Arguably, what is more important than Coupang’s absolute gross margin is the relative change in gross margin over time. Gross margin expansion, particularly from a small base, creates powerful operating leverage which can generate substantial improvements to the bottom line.

As can be seen in the below figure, Coupang’s gross margin hovered between 14-18% throughout 2020-2021 before rocketing higher in 2022.

In Q2 2022, Coupang reported a gross margin of 22.9%, up from 20.4% in Q1 2022 and 18.2% in Q2 2021 (excludes the impact of the fire at one of their fulfilment centers). As a result, Coupang’s gross profit in Q2 increased 41% YoY (excluding the fire) or 75% YoY (including the impact of the fire which suppressed Q2 2021 gross margin), substantially outpacing their revenue growth rates.

So, what’s driving Coupang’s rapid gross margin expansion? Well, it wasn’t price increases as Coupang kept all their pricing policies the same throughout the quarter. The answer is that Coupang has been heavily investing over the past few years in building out their logistics and fulfilment infrastructure to be able to meet increased COVID-19 demand, support their 3P sellers, and generate efficiencies with newer delivery services, like food (Coupang Eats) and grocery delivery (Rocket Fresh). These investments have been acutely suppressing gross margins, but Coupang is now in a position to be able to reap the rewards from these investments in vertical integration.

So, for example, a structural advantage in Fresh of combining Fresh and general merchandise on the same logistic infrastructure allows us to provide customers not only with the best experience and delivery within hours, but also the lowest cost structure that enables us to provide free shipping and low prices. You’ll continue to see that with economies of – or generate greater economies of scale, improved operational excellence across multiple segments for that reason (CEO Bom Kim, Q2 2022 Earnings Call).

It also appears that one-off operational costs associated with COVID-19 masked some of the underlying gross margin improvements in Coupang’s business:

And it was – as I mentioned in earlier calls, COVID last year obscured a lot of the underlying improvements and strength. And we had – our business went from – our business tripled from 2019 to 2021, while COVID presented unprecedented challenges to our operations. And we had – I cannot overstate how – what an incredible job the team did, not only this past couple of quarters, but throughout the couple of years of the pandemic when we had to – when we refused to compromise on customer experience and continued to make progress on the underlying structural – the underlying operational excellence. And so, I hope that’s clear. And I hope we don’t misinterpret these results as the output of a few months. And that operational excellence is a part of our DNA (CEO Bom Kim, Q2 2022 Earnings Call).

Based on these latest results, I remain highly confident that Coupang will achieve or even exceed their long-term gross margin target range of 27-32% as higher margin business segments (e.g., 3P sales, advertising, fulfilment and logistics services) became a larger part of Coupang’s overall revenue base.

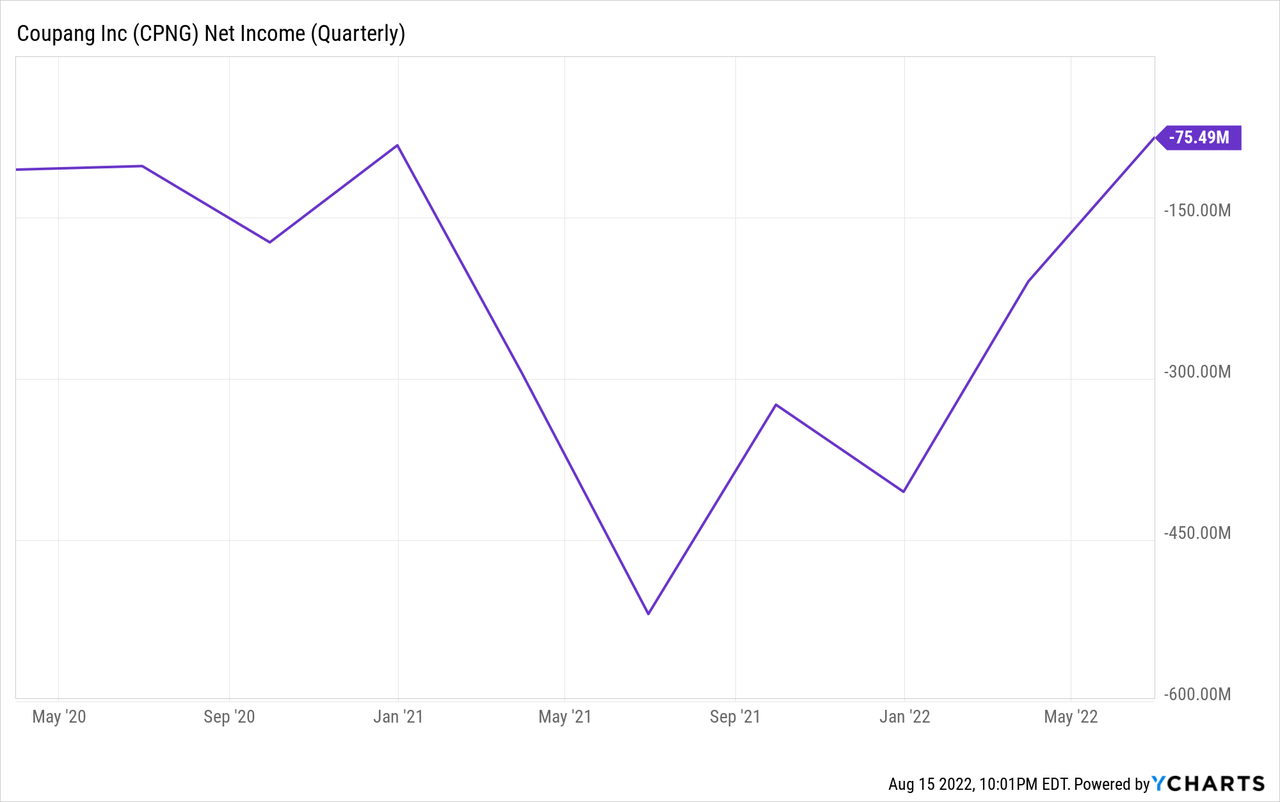

Turning on the profitability dial

From 2020-2021, Coupang’s consolidated adjusted EBITDA margin remained relatively flat due to their heavy CapEx cycle and one-off COVID-related costs. However, adjusted EBITDA margins have improved dramatically through the first two quarters of 2022 due to the aforementioned gross margin expansion and a more deliberate focus on unit economics (i.e., profitable growth) in their developing offerings segment.

Owing to strong Q2 results, Coupang raised their FY22 adjusted EBITDA guidance from a loss of ($400m) to positive adjusted EBITDA.

| Quarter | Adjusted EBITDA (thousands) | Adjusted EBITDA Margin (%) |

| Q1 2020 | ($41,845) | (1.7%) |

| Q2 2020 | ($57,030) | (2.2%) |

| Q3 2020 | ($176,649) | (5.6%) |

| Q4 2020 | ($81,620) | (2.1%) |

| Q1 2021 | ($132,966) | (3.2%) |

| Q2 2021 | ($122,147) | (2.7%) |

| Q3 2021 | ($207,434) | (4.5%) |

| Q4 2021 | ($285,089) | (5.6%) |

| Q1 2022 | ($90,872) | (1.8%) |

| Q2 2022 | $66,172 | 1.3% |

If we break down Coupang’s adjusted EBITDA by their two business segments (note: data is only available from Q1 2021), it is clear that their core product commerce segment has consistently remained near break-even or at a low single-digit adjusted EBITDA margin, while their developing offerings segment has been bleeding red for some time, but narrowed its losses substantially in Q2 2022.

| Quarter | Product Commerce Adjusted EBITDA Margin (%) | Developing Offerings Adjusted EBITDA Margin (%) |

| Q1 2021 | (1.7%) | (58.3%) |

| Q2 2021 | (1.1%) | (51.1%) |

| Q3 2021 | (2.6%) | (54.7%) |

| Q4 2021 | (2.5%) | (105.8%) |

| Q1 2022 | 0.01% | (51.9%) |

| Q2 2022 | 2.0% | (19.8%) |

Improvements in Coupang’s adjusted EBITDA margin has also flowed through to the “true” bottom line, with net loss of $75.9m in Q2 2022 representing a manageable (1.5%) net income margin, a stark improvement from the (11.6%) net income margin reported in Q2 2021.

These strong Q2 results gave CFO Gaurav Anand the confidence to again re-iterate Coupang’s long-term target for adjusted EBITDA margins of 7-10% (or better). I believe this guidance is highly achievable and likely quite conservative given their dominant market position, strong pricing power, and greenfield opportunities within their nascent product offerings:

We believe that our position and customer value proposition will continue to drive significant revenue expansion as well as increase our operating leverage. In light of our performance to-date, we are more convinced than ever of our potential to generate long-term 7% to 10% or greater adjusted EBITDA margins (CFO Gaurav Anand, Q2 2022 Earnings Call).

Greater focus on profitable growth in developing offerings

One of the main concerns I had about Coupang (at least prior to this quarter) was their horrific adjusted EBITDA margins in developing offerings, such as food delivery and video streaming. As we’ve seen with former market darlings turned dogs like Uber Technologies (UBER), DoorDash (DASH), and Netflix (NFLX), generating consistent profitability and free cash flow in these business segments is tougher than it looks, even with immense scale and strong brand recognition.

While e-commerce (particularly 3P) is a more established business model which can be highly profitable at scale, the path to profitability in these newer business verticals is less certain. Pleasingly, Coupang has begun to dial back their “growth at all costs” mindset with their developing offerings and focus only on segments with strong unit economics. This will mean slower revenue growth (i.e., Q2 developing offerings revenue growth in constant currency was 24% vs. 79% in the prior quarter) but with substantially improved margins (Q2 developing offerings adjusted EBITDA margin was (19.8%) vs. (51.9%) in the prior quarter).

Growth has also not been our priority this past quarter, as we mentioned in our last call … We saw significant improvement in Eats’ profitability in Q2 due to our focus on improving operational efficiencies this quarter. We’re also exploring synergies between Eats and other offerings in our ecosystem to expand value for customers and improve efficiency before the next phase of expansion (CEO Bom Kim, Q2 2022 Earnings Call).

Strong cash position

Coupang has a strong balance sheet and is in no danger of a dilutive capital raising. They have $3.1b in cash and cash equivalents with around $643m in debt (both short-term and long-term). With positive adjusted EBITDA forecast for FY22, cash burn should be minimal and Coupang should begin to generate significant free cash flow from FY23 onwards as margins continue to expand towards their long-term targets.

An attractive valuation relative to listed peers

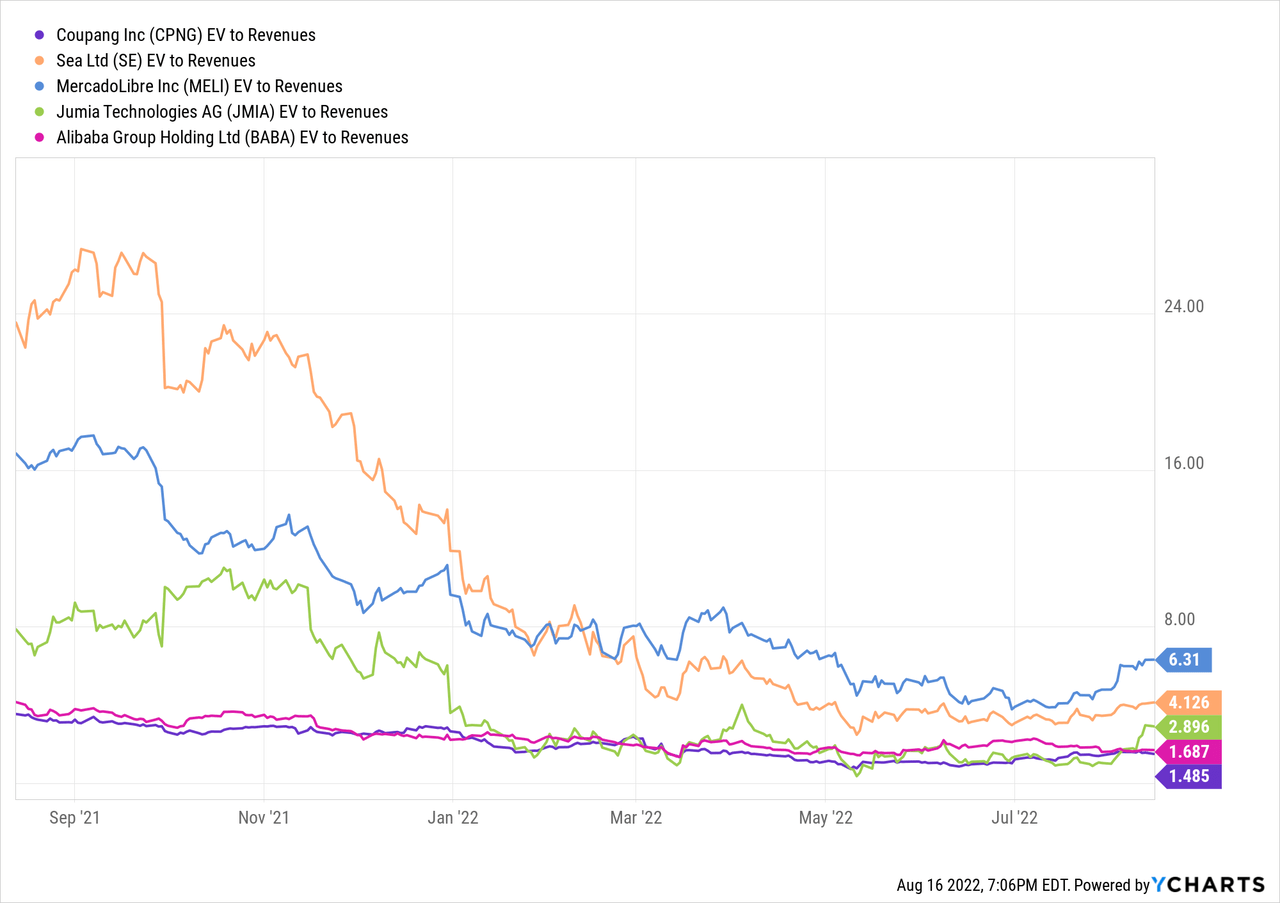

Although there are no direct public e-commerce comps to Coupang given their low (but rising) gross margins, high proportion of 1P sales, and geographical proximity within South Korea, we can gain some insight from evaluating other e-commerce businesses operating outside of the US, such as Sea Limited (SE), MercadoLibre (MELI), Jumia Technologies (JMIA), and Alibaba (BABA, OTCPK:BABAF).

Indeed, Coupang trades at the lowest trailing EV/sales (1.5x) of these listed competitors and has remained in this position over the past 12 months. As Coupang continues to diversify their business away from pure 1P e-commerce sales and realizes significant gross margin and adjusted EBITDA margin expansion over the coming 12-18 months, I expect their valuation to trade more in line with these listed peers.

Conclusion

Coupang is a fascinating business and a worthy case study in any MBA program. Following the “Amazon” playbook of relentless customer obsession, Coupang has grown to become the dominant e-commerce business in South Korea. While revenue growth is understandably slowing due to increasing scale, Coupang is beginning to reap the rewards of their heavy investments in vertical integration and is seeing explosive growth in both gross and adjusted EBITDA margins.

We believe the progress we’ve made and the 2% adjusted EBITDA that we recorded in Product Commerce in Q2 is just a glimpse of the significant long-term profitability of our business. The rate of improvement won’t be consistent or as dramatic each quarter, but we’re excited about the potential ahead (CEO Bom Kim, Q2 2022 Earnings Call).

With significant opportunities in nascent business streams, such as advertising, 3P commerce, payments, and food delivery, Coupang is well-placed to continue to monetize their highly engaged customer base and reward shareholders for many years to come. I’m a buyer at these levels.

Be the first to comment