JHVEPhoto

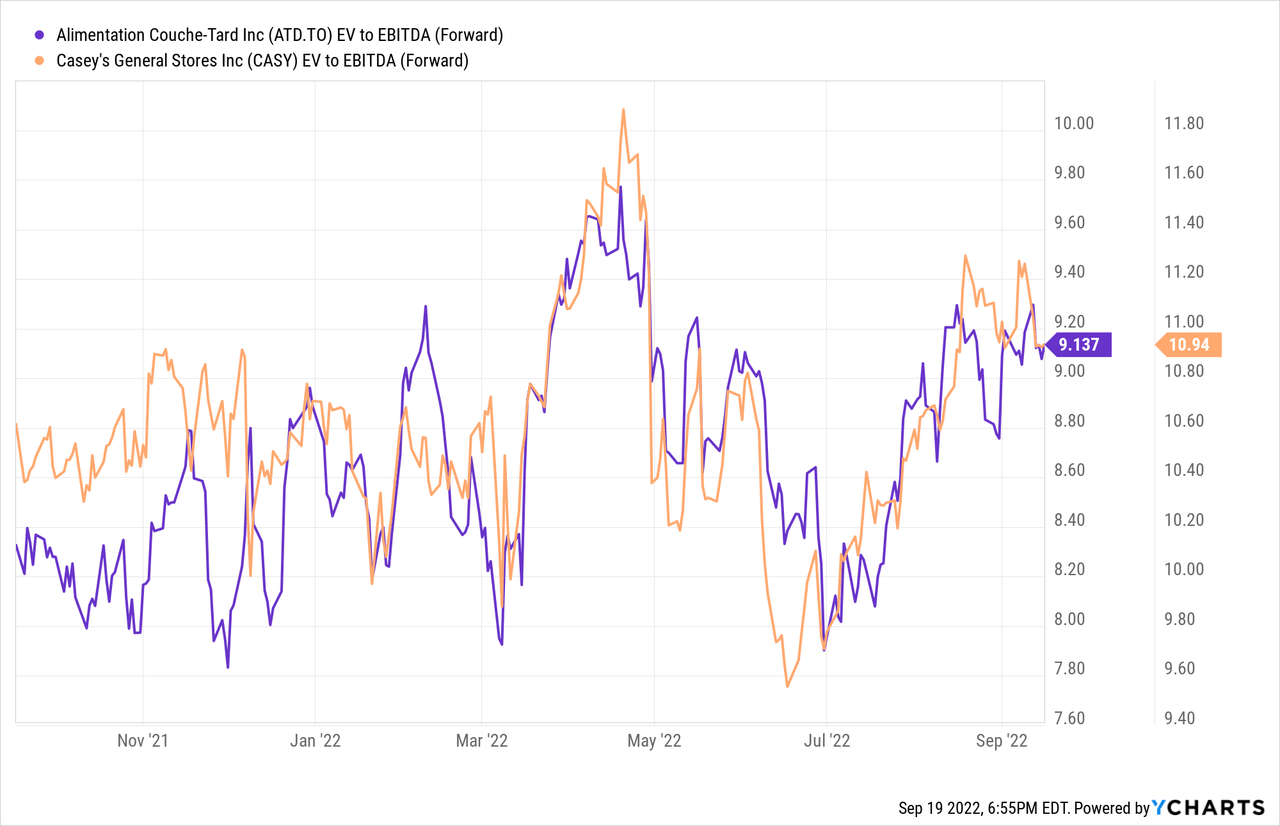

Fuel margin strength was the key driver of Canadian convenience store owner and operator, Alimentation Couche-Tard’s (OTCPK:ANCUF) record Q1 ’23 earnings outperformance, although cost discipline and same-store sales growth resilience also contributed. The financial strength was especially impressive considering the backdrop of elevated fuel prices and their impact on consumer behavior throughout the quarter. As we move closer to a recession, I continue to see Couche-Tard’s relevance with consumers as a key strength, allowing it to sustain strong FCF generation across cycles. The fortress balance sheet also leaves the company well-positioned for strategic M&A opportunities amid the recent rate hikes, while also paving the way for more share buybacks. With shares trading toward the lower end of the historical range and at a discount to peer Casey’s General Stores (CASY) on EV/EBITDA, I would use the current valuation as a buying opportunity.

Elevated Fuel Margins Drive Earnings Outperformance

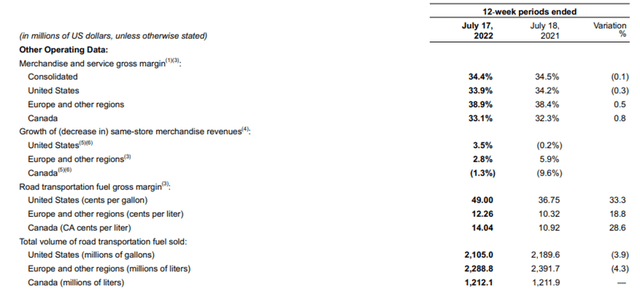

Despite the inflationary environment, Couche-Tard beat top and bottom-line expectations in Q1 ‘23 on the back of fuel margin strength across all geographies. The US led the way at a fuel gross margin of 49.0 cents per gallon, followed by Canada at a margin of 14.04 cents per litre, as healthy North American market conditions and ongoing supply chain optimization across Couche-Tard’s network contributed. The result was especially impressive considering the record fuel prices at the pump during the quarter, with management noting changes in consumer purchase behavior from the broad-based inflation pressures. Notably, the company saw a worrying c. 10% decline in the average fuel fill rate per trip across its network. The fuel volume pressures were, however, more than offset by resilient fuel margins, as Couche-Tard’s industry-leading scale and sourcing capabilities allowed it to navigate the headwinds unscathed.

Couche-Tard

Encouragingly, the top-line outlook is improving. Wholesale gasoline prices have been declining into the upcoming quarter, supporting the case for lower US fuel prices and robust fuel margins ahead. Admittedly, there are risks to this trajectory, with the hurricane season looming. Even if volatility in energy prices returns, however, Couche-Tard has proved time and time again that it can outperform the industry in difficult times. And with management also leveraging its growing data and analytical capabilities to optimize pricing, promotions, and assortment, I see upside risk to the near-term revenue trajectory. Also worth noting is the successful Circle K fuel rebranding, which offers an attractive runway for store growth relative to the c. 3.5k sites today (the fiscal 2025 target is approximately c. 5k). Couche-Tard’s tactical investment in building brand awareness and loyalty will also be worth monitoring, potentially opening up new recurring revenue opportunities over the longer-term.

On Track to Exceed Fiscal 2023 Profitability Targets

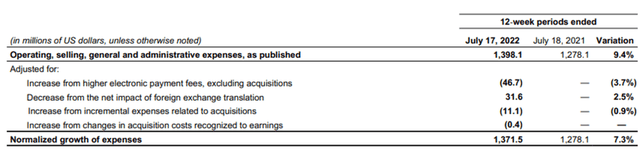

Operating expenses may have risen 9.4% Y/Y, but after taking into account one-off items like increased interchange fees (from elevated retail fuel prices), normalized expense growth was impressively below inflation at 7.3% Y/Y. Notably, management has seen a meaningful improvement in access to labor and as a result, better staffing levels at its stores, with hiring rates moving ahead of termination rates. As labor conditions normalize further in the upcoming months, Couche-Tard is well-positioned to reduce its reliance on overtime pay, a major driver of operating expense growth in Q1 ’23.

Couche-Tard

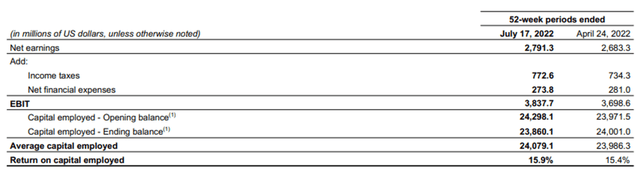

Thus far, Couche-Tard’s track record of resilient earnings has kept its return on capital employed at a strong c. 16% (+50bps Y/Y) despite the inflationary pressures. With oil prices easing in Q2 ‘23, I see further tailwinds for merchandising and fuel margin, which in tandem with the ongoing business improvement initiatives such as fresh food fast and cost/fuel optimization, sets the company up for more upside surprises ahead. While Couche-Tard has not updated its EBITDA target of $5.1 billion in fiscal 2023, EBITDA has already reached $5.4 billion in the last twelve months. With more acquisitions potentially contributing to the fiscal year results, I see a good chance the company exceeds its profitability target and raises fiscal 2024 guidance in the upcoming quarters.

Couche-Tard

Robust Balance Sheet and Cash Generation Create Valuable Optionality

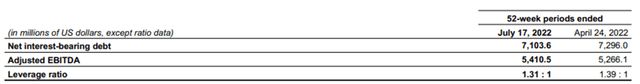

Despite elevated capex and robust share repurchase activity (c. $1.9 billion in fiscal 2022 and $478 million in Q1 ‘23), Couche-Tard’s free cash flow generation remains as healthy as ever at c. $2.1 billion in the last twelve months. Management has utilized the cash influx to further lower net leverage, which is approaching multi-year lows at c. 1.3x (far below the 2.25x leverage target).

Couche-Tard

As this cash flow looks likely to sustain through any upcoming economic downcycle, the company is in a great position to fund growth via reinvestments and M&A. Considering its disciplined acquisition track record, I have confidence in management driving value creation ahead, especially with the recent rate hikes creating a more constructive environment for deal negotiations. While waiting, shareholders get ‘paid’ via a lucrative repurchase program, which aims to retire c. 10% of the float per year for the next two to three years. As such, I continue to view Couche-Tard’s attractive capital allocation options as underappreciated at the current valuation discount.

Final Take

Couche-Tard validated the bulls in its recent quarter, putting up a solid set of quarterly results featuring an EPS and EBITDA beat on the back of stronger fuel gross margins. Volumes declined in response to elevated fuel prices, but at a slower pace than anticipated, while management’s cost discipline resulted in a Q/Q opex growth deceleration. The near-term earnings growth trajectory looks even brighter, as labor pressures are showing signs of softening (due to improved availability and lower retention costs) and costs in the second half of the year will be helped by easier Y/Y comps. The balance sheet also offers excellent optionality, with plenty of acquisition opportunities now that valuations have declined, along with a robust share buyback. At the current relative valuation discount to CASY, Couche-Tard shares offer a great defensive option in the current uncertain economic environment.

Be the first to comment