ipuwadol/iStock via Getty Images

Couchbase Inc. (NASDAQ:BASE) has presented impressive growth all year although the stock hasn’t been immune to the broader market volatility, down more than 40% in 2022. Part of the challenge for the enterprise database management software provider is that profitability remains elusive in a highly competitive segment and up against macro uncertainties. On the other hand, several industry drivers including the increasing adoption of NoSQL solutions and database-as-a-service tools support a positive long-term outlook.

The company’s upcoming quarterly earnings will help set the tone for the year ahead. The expectation is for continued top-line momentum while margins slowly move in the right direction. The setup here looks interesting with shares rallying in recent weeks off their lows but our take is that some mixed signals and lingering questions warrant caution.

BASE Q3 Earnings Preview

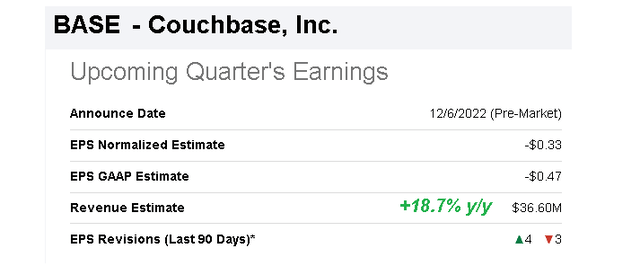

Couchbase is set to report its fiscal 2023 Q3 earnings on Tuesday, December 6th, before the market opens. The current consensus is for a headline EPS loss of -$0.33 which compares to -$0.29 in the period last year. The market is also looking for revenue to reach $36.6 million, representing an 18.7% increase from Q3 fiscal 2022, but also a decline from a stronger $38.8 million in the last Q2 where revenues climbed by 34% y/y.

Management notes that the metric of annual recurring revenue (ARR) is the best measure of its subscription business that avoids quarterly noise, noting a Q3 ARR growth guidance of around 23%. The strength here beyond capturing new business is also related to a climbing level of firm-wide ARR per customer that reached $230k in Q2, up 12% y/y and expected to continue as accounts add features with the ability to expand the professional relationship

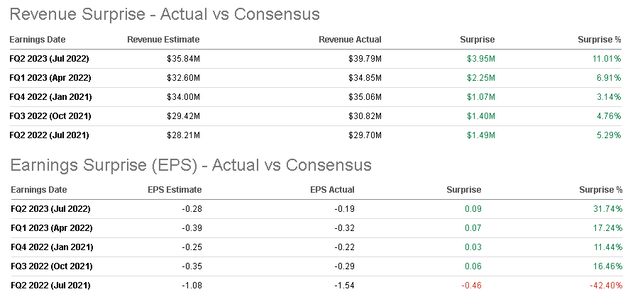

Notably, BASE is on a streak of beating both the consensus revenue and earnings in each quarter over the past year. By this measure, a surprise higher to the headline estimates next week is on the table with the earnings print largely dependent on the pace of R&D and sales & marketing spending this quarter.

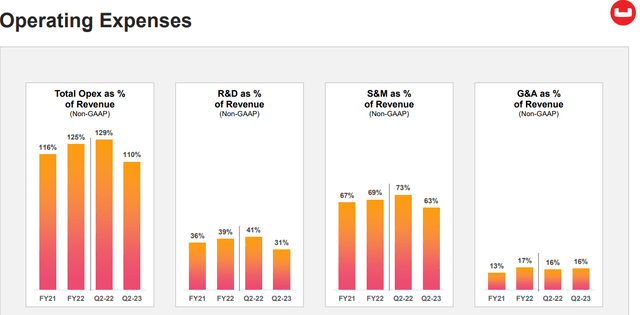

Q2 operating expenses as a percentage of revenue at 110% declined from 125% in fiscal 2022. An effort at improving efficiency and cost controls resulted in the negative non-GAAP operating margin narrowing to -21% compared to -41% in the year prior.

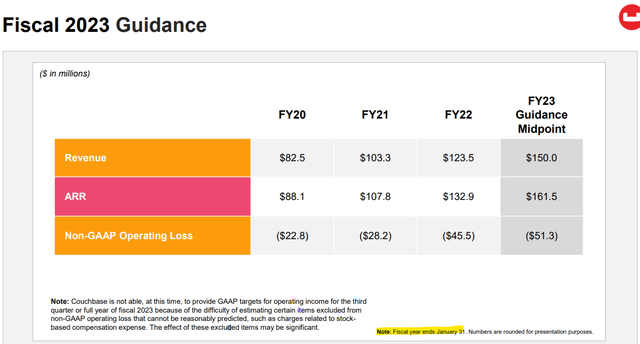

This encouraging margin trend last quarter appears to have been somewhat of an outlier, considering the full-year fiscal non-GAAP operating loss guidance at -$51.3 million representing a negative margin of -34%. In other words, the focus continues to be on growth with investments targeted towards capturing what the company believes to be a “generational opportunity”. Profitability continues to take a back seat.

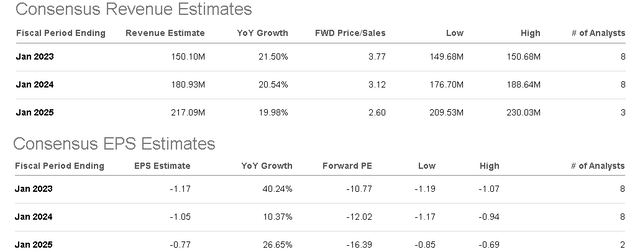

Looking ahead, the consensus is for revenue growth to average around 20% over the next 2 years. From a current year negative EPS forecast of -$1.17, the market sees only a slight improvement to -$1.05 in fiscal 2024, and -$0.77 in 2025. The long-term strategy is to simply scale to a level sufficient for sustainable profitability, although the understanding is that heavy Capex will be required to continue developing cutting-edge solutions.

What’s Next for BASE

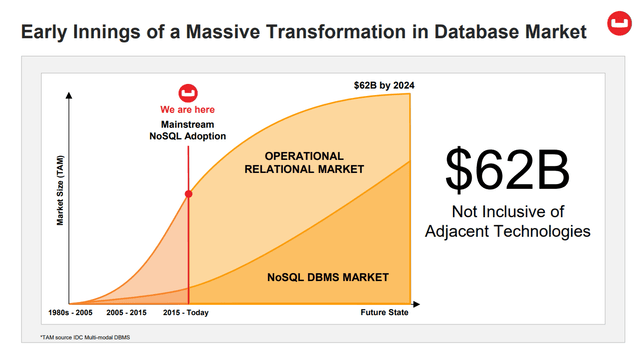

It’s fair to say that cloud database management platforms are not among the most high-profile software tech segments in the market. At the same time, it’s important to recognize what is estimated to be a $62 billion market by 2024 in which Couchbase sees is still in the early stages of an ongoing transformation.

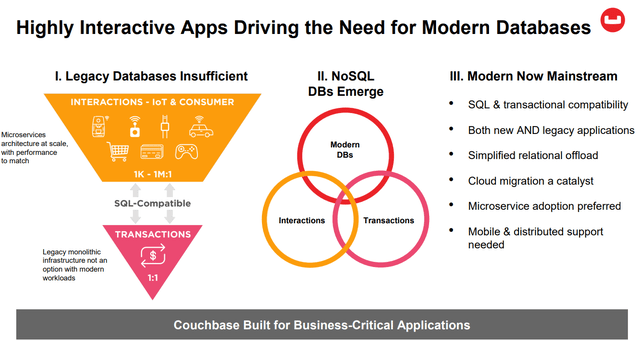

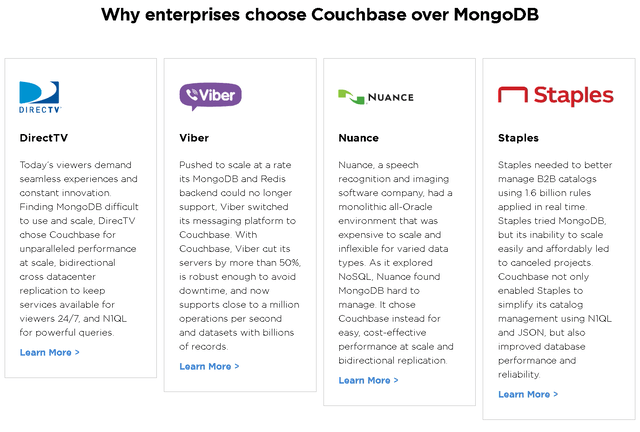

To get a sense of what exactly Couchbase offers, consider that all businesses across various industry verticals require a system to track and manage potentially hundreds of millions of customer interactions covering traditional web, mobile, and internet-of-things applications. The idea of NoSQL is that the application developers have greater flexibility to combine different architectures and coding languages for faster deployment. Couchbase is also recognized for its highly scalable design.

All that being said, the proverbial boogeyman for Couchbase comes down to its larger competitor in MongoDB Inc (MDB) which is about 20x larger in terms of market cap and approximately 10x larger by annual revenue. Each company has key differences in their vision for the ideal database management solution, but are seen as effectively interchangeable for most applications. It’s notable that both companies specifically cite each other on a dedicated comparison page claiming to be the premier alternative.

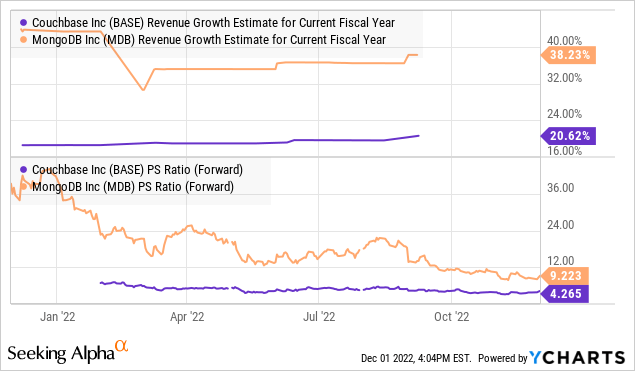

As it relates to the stock outlook, the reality is that MongoDB is generating stronger growth with a full-year revenue growth outlook at 38% maintaining momentum to 27% next year compared to Couchbase’s 20% trend. MongoDB is also expected to reach profitability in 2023 well ahead of its smaller peer. The result is that MDB trades at a premium to BASE in terms of its sales multiple at 9x compared to MDB at 4x.

There’s a good case to be made that this spread is justified with MDB as the higher-quality corporate with stronger fundamentals and segment leadership. From there, BASE would need to significantly accelerate growth as evidence of capturing market share to support some evidence of being materially undervalued in our opinion.

To be clear, we sense that the market is large enough for both players and it’s still possible BASE could outperform MDB to the upside going forward. A more favorable macro backdrop with signs inflation is cooling with interest rates stabilizing could support more positive risk sentiment and momentum to lift all tech stocks going forward as part of the bullish case.

Final Thoughts

The upcoming quarterly report will provide the opportunity for management to update investors on corporate developments and current operating conditions. The main risk would be that a slowdown of economic activity during the quarter impacted the sales momentum while financial margins will be a key monitoring point.

Putting it all together, we haven’t seen enough to make a bullish call on BASE beyond the technical chart pattern that appears to have broken out of a long-running downtrend. We rate shares as a hold, representing a neutral view over the near term.

A move above $20.00, reclaiming a level last reached in Q2 would help put the bulls firmly back in control. On the downside, it will be important to hold the cycle low around $11.00, with a break lower likely indicating more structural issues. The outlook for recurring losses and negative free cash flows should keep shares volatile for the foreseeable future.

Be the first to comment