YvanDube/iStock Unreleased via Getty Images

The hot dogs at Costco (NASDAQ:COST) are obviously cheap, but the stock does not appear obviously cheap itself. With the stock trading at 44x forward earnings, investors may wonder if the valuation has gotten ahead of itself. That said, with a stock price just shy of $600 per share, a stock split may be on the horizon. In this article I discuss the company’s history with stock splits, the likelihood of a future stock split, and the valuation as it stands today.

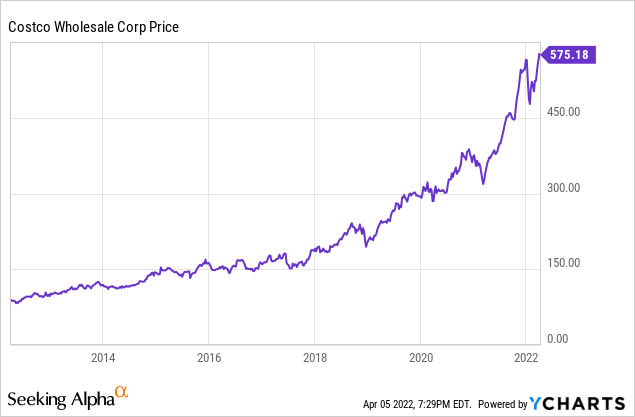

COST Stock Price

While COST is not a tech stock, it has generated tech-like returns over the past several years.

Trading at around $575 per share, the stock is around all time highs in spite of all the ongoing volatility. While COST has materially grown its bottom line during this time period, multiple expansion has driven quite a bit of the returns.

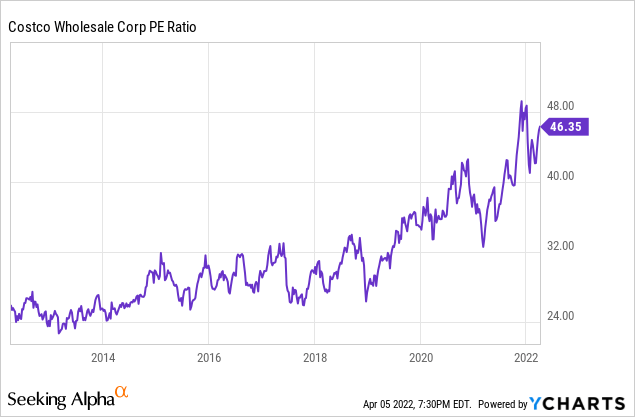

COST Stock Key Metrics

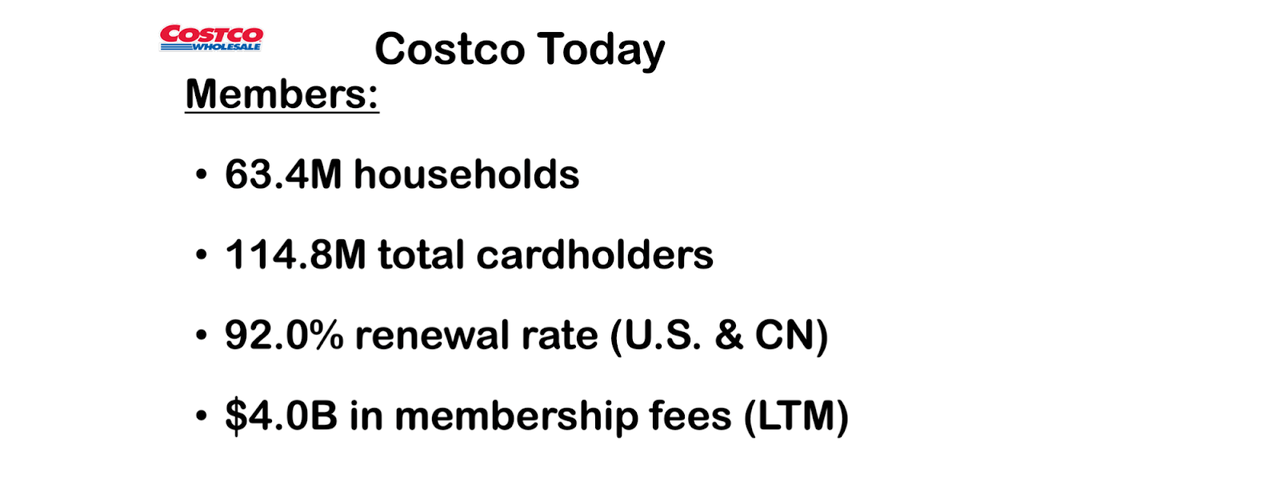

Today, COST boasts a customer list spanning over 63.4 million households and 114.8 million total cardholders. The 92% renewal rate in spite of the membership fee underscores the perceived value delivered by the company.

Costco Today 2022 Presentation

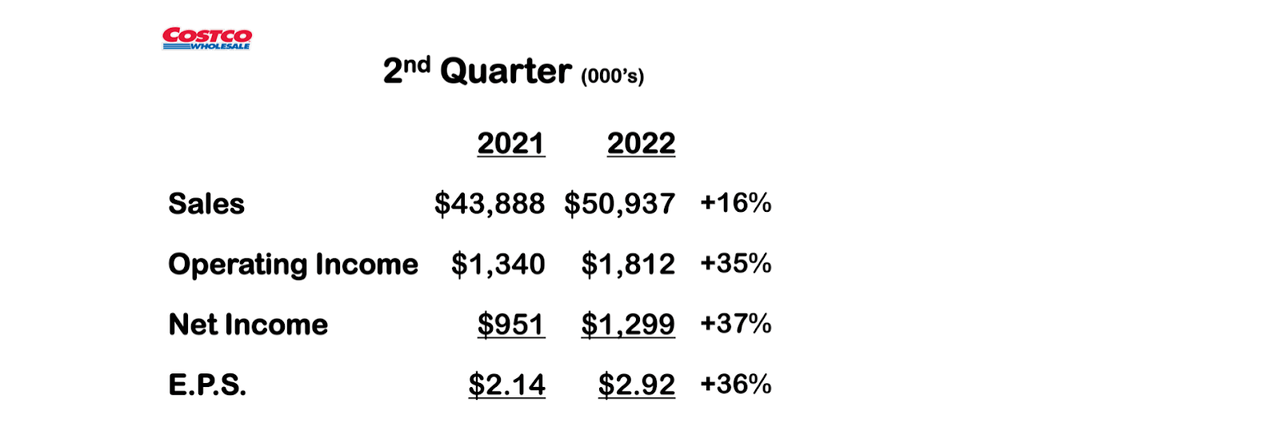

In the latest quarter, COST sustained strong 16% sales growth and grew net income by 37%. Same store sales of 14.4% were impressive especially considering that the company is lapping difficult pandemic comparables.

Costco Today 2022 Presentation

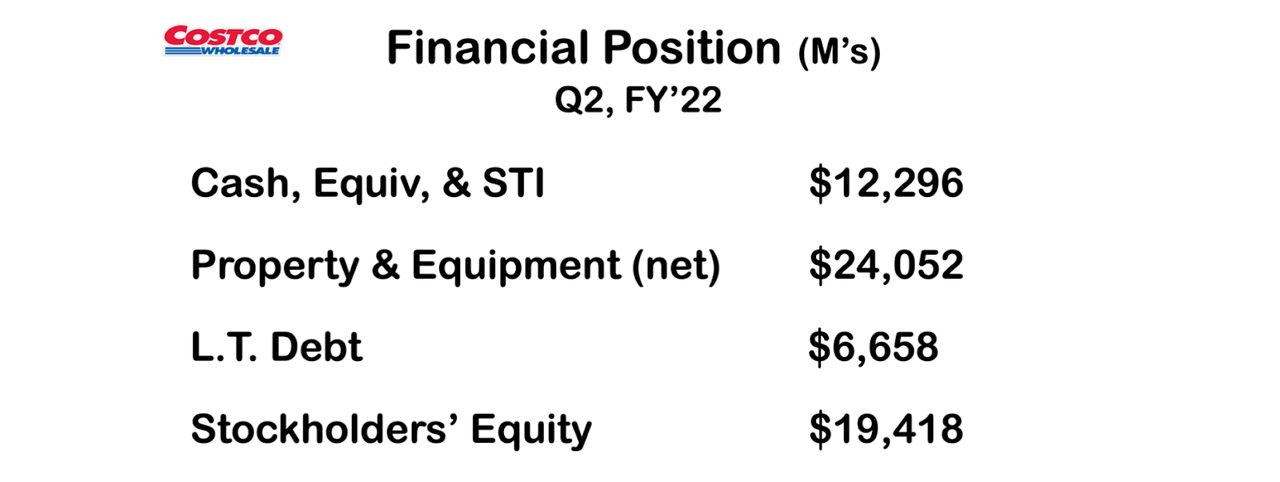

COST ended the quarter with $5.6 billion of net cash. I expect COST to maintain net leverage over the long term. The current balance sheet position represents a significant long term catalyst for shareholder value.

Costco Today 2022 Presentation

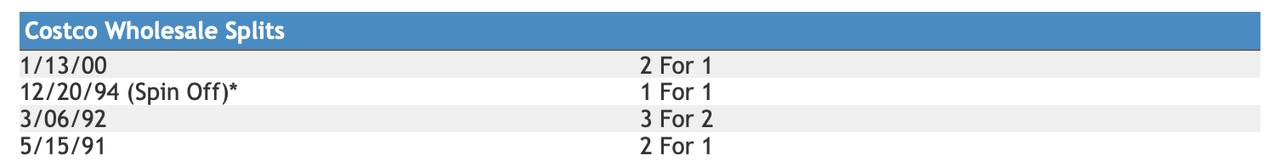

How Many Times Has Costco Stock Split Before?

COST has split its stock three times before – in 2000, 1992, and 1992 as seen below.

Costco Investor Relations

When it split its stock in 2000, the stock traded at around $100 per share. When it split its stock in 1992, the stock traded for around $50 per share. When it split its stock in 1991, the stock traded for around $60 per share.

Is Costco Likely To Stock Split Again?

Now with the stock trading near $600 per share, it seems plausible to expect a stock split at some point. The company has split its stock at far lower prices, and with the earnings multiple not clearly cheap, management might view a stock split as being an efficient way to continue driving shareholder value, even if it does not directly change anything on a fundamental basis.

What Is The Future For Costco Stock?

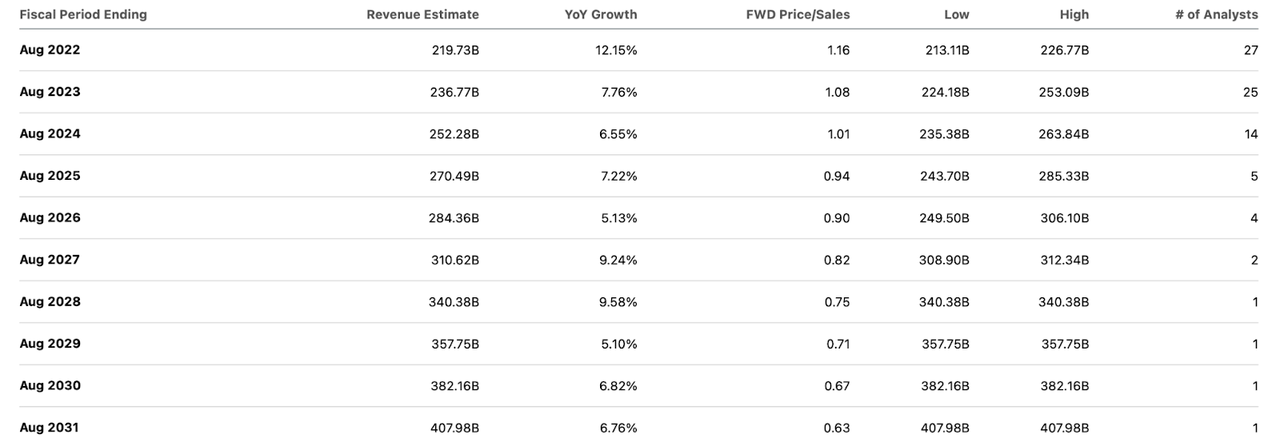

Looking forward, Wall Street expects COST to sustain high single-digit revenue growth over the next decade.

Seeking Alpha

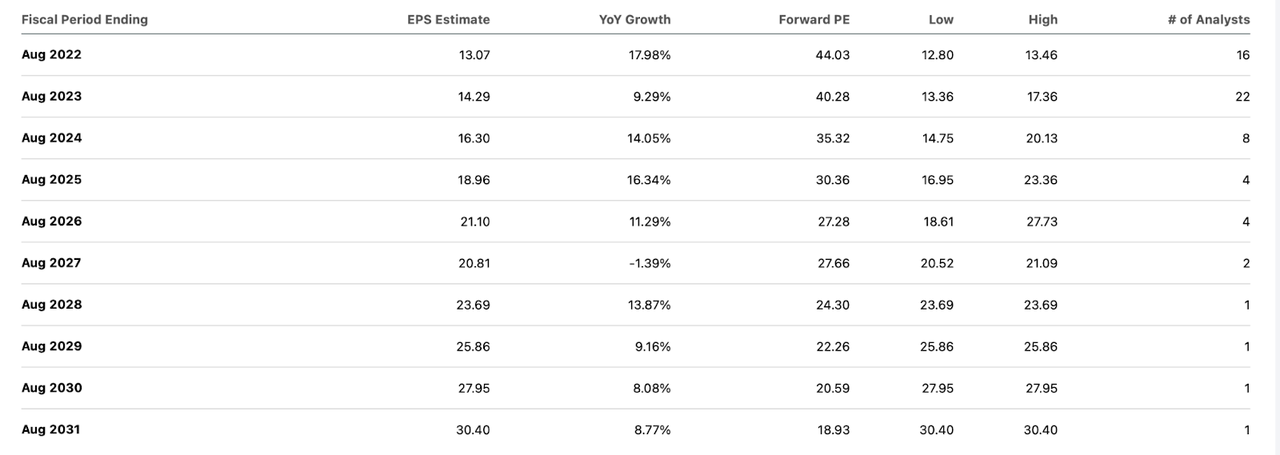

Consensus earnings estimates look far too low. Whereas analysts expect COST to grow revenues by 86% through 2031, analysts only expect 133% earnings growth through the same time period.

Seeking Alpha

COST’s business model is one which inherently has a lot of operating leverage, and thus I expect earnings to grow much faster than revenues going forward. It is worth noting that earnings growth was more than double revenue growth in the latest quarter. In 2021, COST grew revenues by 17.7% and earnings by 25%.

Is COST Stock A Buy, Sell, or Hold?

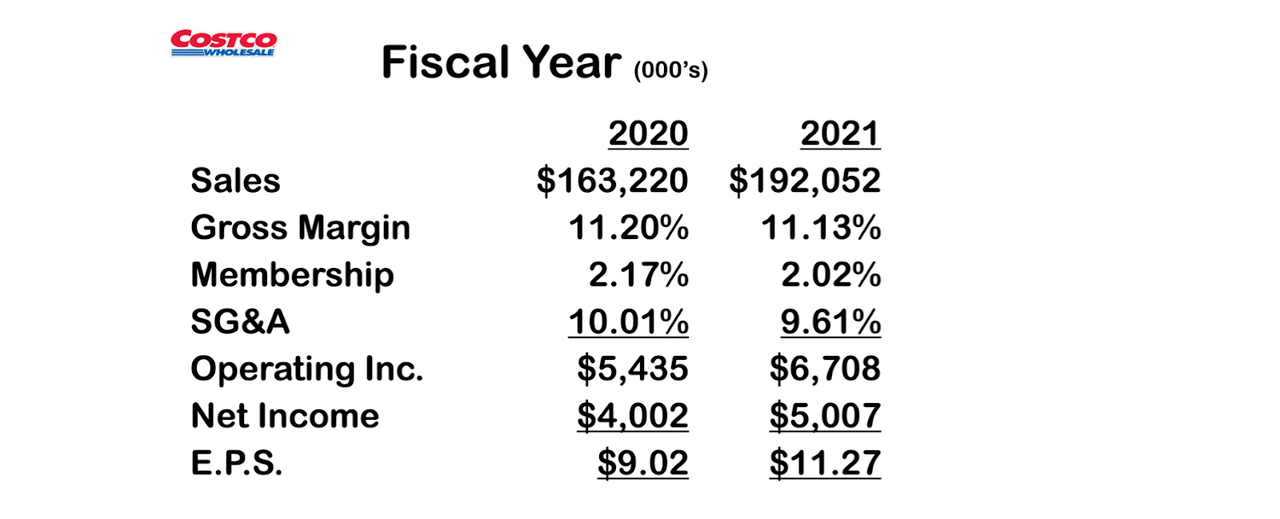

Operating leverage is fundamental to the COST bull thesis and explains why I still own the stock in spite of the 44x forward earnings multiple. We can see below a snapshot of the income statement.

Costco Today 2022 Presentation

Whereas COST generated $195.9 billion in total sales in 2021, it generated only $5 billion of net income. Membership fees totaled $3.9 billion, making up the vast majority of net income. Historically, membership fees have driven the bulk if not all of net income, leading investors to believe that the company’s strategy is to only make money from membership fees. In my view, that is underestimating the company’s ability to drive operating leverage. Sure, the company has utilized an aggressive pricing scheme to continue taking retail market share. Yet there is no reason why the company couldn’t increase its margins ever so slightly. Because COST’s current operating margins are so low, very slight increases in gross margins could lead to dramatic increases in net income. I note that the 11.1% gross margin posted in 2021 is quite higher than the 10% gross margin posted in 2012. I assume COST can easily drive another 1% of gross margin expansion. This might occur through a combination of increasing prices to customers and suppliers. 100 basis points of gross margin expansion would have led to $1.9 billion more of gross profits and boosted net income by nearly 40% in 2021. The stock would trade at just over 31x earnings using that adjustment for long term earnings power. Based on consensus estimates, COST is expected to earn a 3.3% net margin by 2031 – only slightly higher than the 2.6% net margin posted in 2021. Assuming COST continues its practice of increasing membership fees by $5 every 5 years, the company might increase fees by at least 20% over the next decade (there should be 2 or 3 fee increases during this time period), which itself could already lead to net margins expanding to 3.0%. While COST trades at 18.9x 2031 consensus earnings estimates, the stock trades at just 13.5x that year’s earnings power (using the above projected 100 basis point gross margin expansion). I could see the stock trading up to 40x earnings power by 2031, suggesting just under 200% upside over nine years. That’s a 12.8% compounded annual return – much lower than the typical stock I’m buying these days. That said, I see a high likelihood that COST outperforms consensus estimates, and the sturdy business model is one in which the stock can provide a combination of low volatility and solid returns – giving it a place in most portfolios even at these valuations. The key risks to this thesis include competition from the likes of Walmart (WMT) and Amazon (AMZN). While consumers seem generally happy with their Costco shopping experience, it is unclear if the company can sustain market share if competitors offer cheaper prices and/or online marketplaces offer more convenience. The most clear indication of a breaking in the fundamental thesis would be seen in a weakness of same store sales. I rate shares a buy especially if one is seeking a source of safety in today’s volatile market.

Be the first to comment