YvanDube

Warehouse chain Costco (NASDAQ:COST) has been a perennial winner in the broadline retail space for many years. It has a unique model that provides consistent profits to shareholders, and it continues to draw in ever-rising numbers of shoppers due to its high value proposition. However, since the peak earlier this year, Costco stock has been a dog, and after fourth quarter earnings last night, investors are selling the news once again.

Warnings of more downside potential ahead

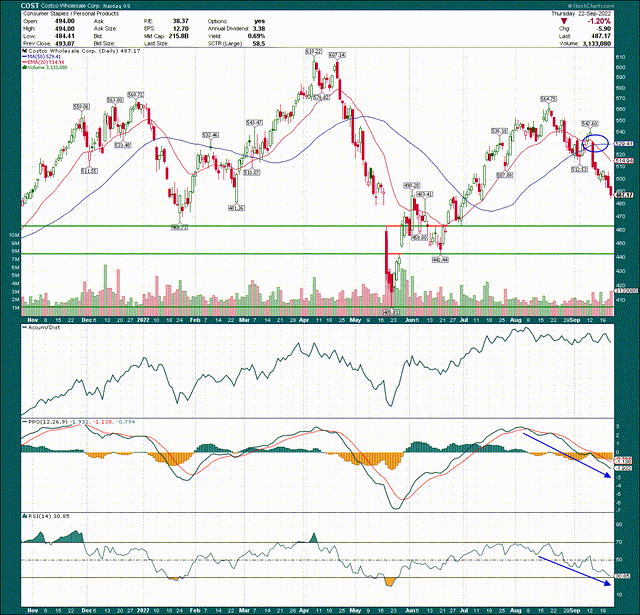

Let’s begin with a look at the daily chart to get the lay of the land from an intermediate-term perspective. We can see immediately two peaks to the left and right of a larger peak in the center. That has the look of a head-and-shoulders pattern, which is something we’ll get to in a bit. For now, let’s focus on recent price action on a daily basis, because it’s certainly not a good look if you’re long.

The fact that the most recent rally in August topped at almost exactly the same spot as the December rally is not a good start. The peak was nowhere close to the April double top, and it’s been all downhill from there. The moving averages are headed lower and the 20-day exponential moving average made a bearish crossover of the 50-day simple moving average a few weeks ago.

The accumulation/distribution line still looks good, but the PPO and 14-day RSI are hideous. Both are showing absolutely no signs of waning bearish momentum and both are in bear market territory. With the stock indicated to open lower again today off the earnings report, the momentum picture is almost certain to get worse before it gets better.

I’ve noted levels of support at $462, $442, and $406, respectively, but they’re all weak. There wasn’t enough price action and volume at those levels to make me think the bulls are going to defend them, so I’m not suggesting you buy at those levels. In fact, based on the look of the weekly chart, I’d suggest you don’t.

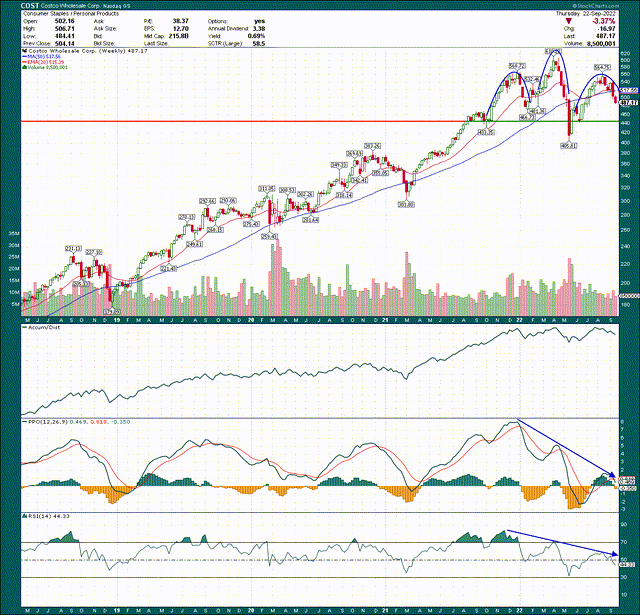

We can see on the weekly chart the head-and-shoulders pattern I mentioned above, and it’s actually a well-formed H&S. A lot of times a potential H&S is lopsided or otherwise messy, but this one is quite textbook. That does not guarantee it will complete, but based on what I’m seeing, the odds look pretty good. Good enough, in fact, that I won’t be going near this one on the long side anytime soon.

We can see the weekly PPO and 14-week RSI are both heavily down trending, with the PPO back into negative territory. Bounces are getting progressively weaker which means selling momentum is accelerating, not exhausting. With the momentum indicators as weak as they are, and a high-potential H&S forming, there’s distinct risk to the downside and essentially no upside catalyst from what I can tell.

Great execution, but is that enough?

Results from last night showed fourth quarter revenue rising 15.2% to $70.8 billion, up from $61.4 billion in the year-ago period. For the year, the top line was up 16% to $222.7 billion. For investors that follow Costco on a regular basis, you’ll note this is par for the course for one of the best retailers on the planet. I’ve noted in prior coverage of Costco that the model is great; the company draws in shoppers with its razor-thin margins – which means low retail prices for shoppers – and generates huge amounts of 100% margin membership revenue to power profits. It’s great for Costco and shoppers alike. That hasn’t changed, but the way Costco is being viewed by investors has, in my view.

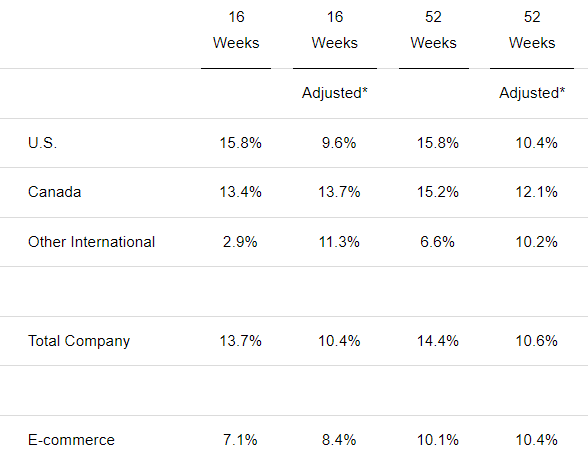

Comparable sales were extremely impressive once again in Q4, as we’re accustomed to seeing from Costco.

Seeking Alpha – earnings release

Fuel prices remain elevated, so once we strip those out of comparable sales, we see 9.6% in the US for the fourth quarter, and 10.4% for the year. For the full company, those numbers were 10.4% and 10.6%, respectively. Those are outstanding for any retailer, but particularly one that is of the size and scope of Costco. This company just never seems to run out of growth, but with margins in focus more than ever, and the market generally willing to pay less for earnings, Costco is in a tough spot.

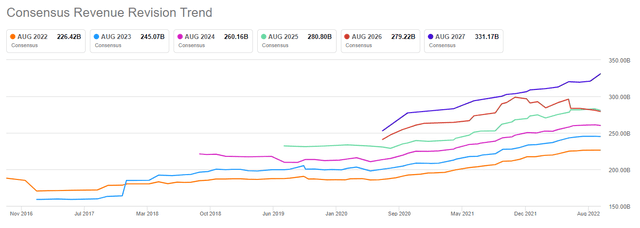

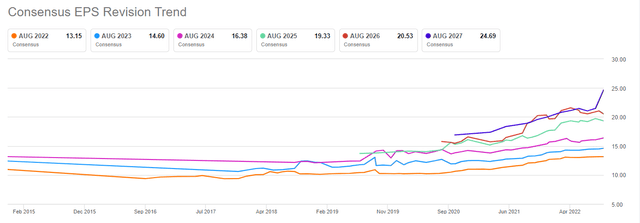

Still, analysts continue to expect robust revenue growth in the years to come, with both ample growth from year to year, and continuously higher revised estimates.

There really isn’t anything more you could ask for that isn’t on this chart. Costco just delivers, and that’s why it has been afforded a premium valuation for many years. More on that in a bit, but the point here is that Costco’s demand generation is not the problem.

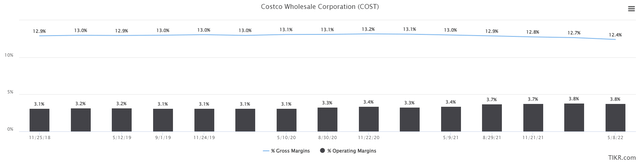

What I think investors are more worried about – and rightly so – is its ability to maintain its rock-bottom pricing structure in the face of soaring costs. Here’s a look at trailing-twelve-months gross and operating margins for the past few years to give us an idea of the long-term trend.

Costco deliberately operates with almost no retail margin, because it relies upon membership fees to generate profits. That’s why gross margins are in the low double-digits, and why that’s okay. The problem is that leaves almost no room for inflationary pressures, and as we can see, gross margins have been in steady decline for some time. Costco has been able to combat this with comparable sales leveraging down things like rent/utilities/labor/etc. That’s how gross margins have declined while operating margins have continued to creep up. However, it would appear those days may have ended, at least for now.

Q4 gross margins came in at just 10.2%, which is much lower than it has been in recent quarters. Operating income was just 3.5%, which is a pretty drastic reduction from 3.8%. Doesn’t sound like much, but that’s an 8% decline in operating margin. That’s the issue Costco is facing today, and on the evidence of the Q4 report, it doesn’t have an answer at the moment.

Thus far the impact on earnings has been fairly minimal, and estimates continue to rise.

This again looks great, and shows ever-rising estimates commensurate with the soaring comparable sales we looked at earlier. The problem is that these estimates appear to be at significant risk given the persistent inflationary pressures Costco and other retailers are facing today. If we see sustained gross margin pressures, and Costco chooses not to sacrifice some of its low-price mission for the sake of margins, these estimates are at much higher risk of declining than rising. That is what I believe is driving price action, and based on Q4 results, it appears we’re nowhere near the end of that cycle. That’s a big risk for the stock.

Costco’s unsustainable valuation

All of this becomes a more serious problem when we realize that Costco is still trading at 35X forward earnings today, which is fairly incredible given how poorly it has performed in recent months.

That’s an average multiple for the past five years – with the mean at 34X for this period – but well off the peak of 45X. We’re not going to see something like that again for a long time given Costco wasn’t facing immense margin pressure when it traded for that valuation, and that it’s likely to take months or quarters to get out of it. Given Costco is a long way from being cheap at the moment, I think there’s downside risk to 30X earnings, or perhaps lower than that based upon how long these margin pressures persist.

Final thoughts

Costco still has one of the best models in retail, and that’s not going to change. It has built a following of millions of shoppers that find great value in it. But right now, that’s just not enough. There are inflationary pressures all across the industry, including things like freight costs, labor costs, and input costs for Costco’s suppliers. Unless the company is willing to drastically raise prices, which compromises its model to an extent, these pressures are likely to put more downward pressure on the stock price.

The Q4 report showed continued, strong momentum in revenue, but at this stage, that’s not enough. I don’t think this is a stock you want to own until a sustainable bottom has been made, and to my eye, that’s likely to be a lot lower than today’s price.

Be the first to comment