svetikd

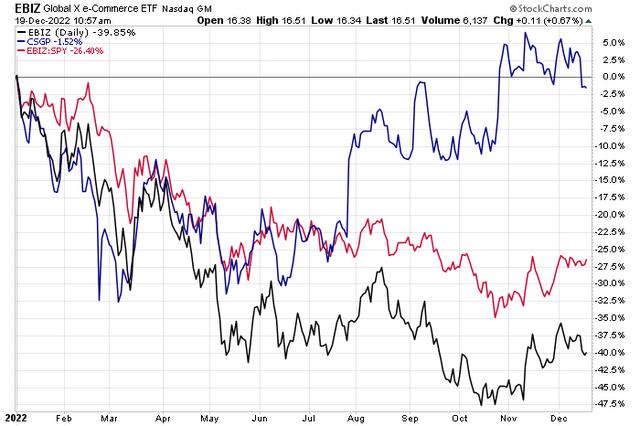

Real estate and professional services e-commerce sounds like a tough place to allocate capital too. An ETF tracking the broader space is the Global X E-commerce ETF (EBIZ) which has indeed fallen hard in 2022 – far worse than the S&P 500’s drop.

One name in the fund features a YTD return near the flat line, though. With earnings growth ahead, will positive price action in CoStar (NASDAQ:CSGP) keep up? Let’s take a look.

E-Commerce Troubles in 2022; CoStar Shines

According to Bank of America Global Research, CoStar Group provides commercial real estate information, analytics, and online marketplaces. Key brands include CoStar, Apartments.com, LoopNet, Land.com, Ten-X, Homesnap, and Homes.com. The company has nearly doubled its web traffic since 2019 through development, insight, and acquisitions.

The Washington D.C.-based $31.7 billion market cap Professional Services industry company within the Industrials sector trades at a high 91.4 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

CoStar was recently initiated as an overweight by analysts at JP Morgan due to its attractive revenue and profitability outlooks. That upbeat news came after the stock was added to the Nasdaq 100 index. There is clearly some bullish momentum behind the name, and that’s seen in a string of earnings beats. Back in October, the firm beat on both bottom and top-line estimates. Shareholders should monitor stock issuance risks as CSGP priced a $750 million offering in September.

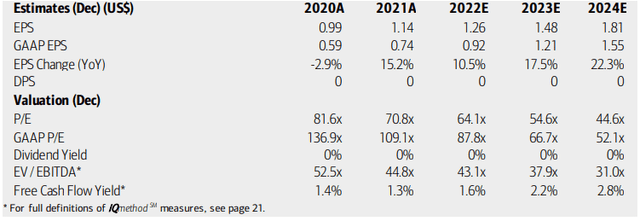

On valuation, analysts at BofA see earnings growing sharply over the coming years despite a tough macro environment. Per-share profits are expected to rise 11% this year with an acceleration into 2023 and 2024. Value investors might be concerned, though, about the stock’s very high operating and GAAP P/Es and extreme EV/EBITDA ratio. What’s good, however, is that CoStar is free cash flow positive. With a forward operating PEG above 3 and a price-to-sales ratio near 15, you are still paying a premium for this growth name.

CoStar: Earnings, Valuation, Free Cash Flow Forecasts

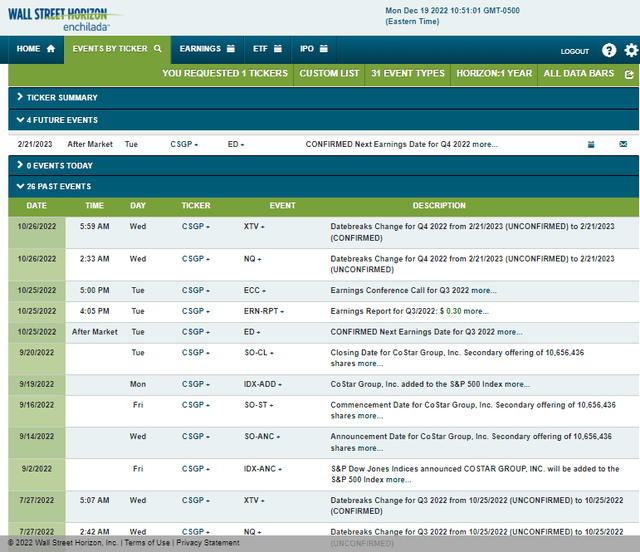

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q4 2022 earnings date of Tuesday, February 21 AMC. The calendar is light aside from the reporting date.

Corporate Event Calendar

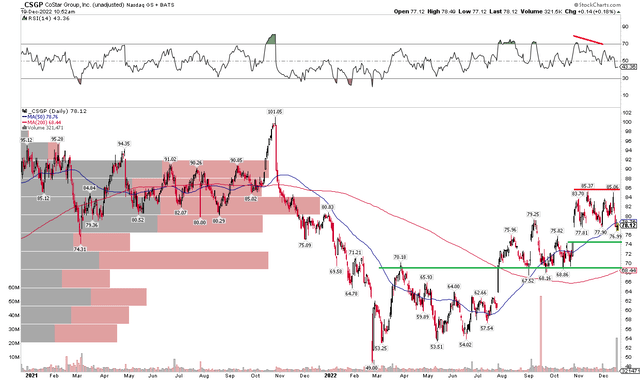

The Technical Take

CSGP’s uptrend appears intact but is in jeopardy of falling into a gap. I see near-term support near $74 which would fill the gap with further cushion in the $68 to $70 range. Notice how the stock’s 200-day moving average is on the rise, which is rare in today’s market. Lending credence to the notion of a further pullback in the stock is bearish RSI divergence that took place in November as the stock made a new high in price, but momentum failed to confirm. Shares also ran into overhead supply starting in the low $80s, so it’s natural to expect the stock to fall from that resistance point. I think this is a buy-the-dip play targeting around the $70 area which is where the 200-day should come into play.

CSGP: Uptrend After Basing Mid-Year, Eyeing Support Near $70

The Bottom Line

While CSGP has a very high valuation, I am impressed with its earnings growth outlook next year while so many other growth stocks see weakening profits. Moreover, a somewhat bullish chart looks favorable despite the near-term risk of a pullback. Be patient with this one to get your price, but I think it is a long-term buy.

Be the first to comment