jetcityimage

Today, Corteva (NYSE:NYSE:CTVA) just released its Investor Day update and we are back to comment on the latest company developments. Here at the Lab, we have analyzed the company twice already in 2022 and we suggest that our readers check up on our precedent publications so that they are well acquainted with the story up to now (Corteva’s initiation of coverage and Q2 results comment).

Since our last update, the company has remained flat at the stock price level, however, our internal team emphasized five positive key takeaways to support Corteva’s earnings growth profile and to enhance the company’s future profitability. With this latest release, Corteva is clearly raising the bar and we expect that Wall Street Analysts will adjust upwards their internal numbers (and accordingly their valuation).

In our scenario analysis, combining our buy case recap, our conclusion was: more research and developments, new and better product offering versus competitors, an increase in price and product mix development and higher operating leverage that equal more profits in a continuous positive circle.

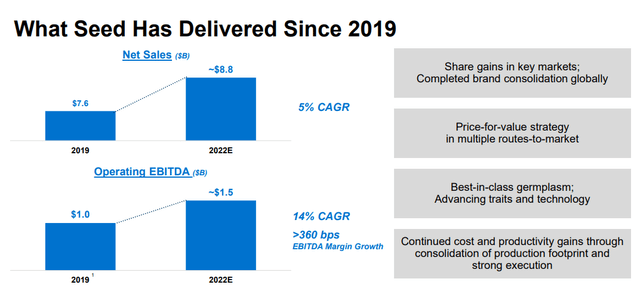

Corteva Seed Division EBITDA evolution

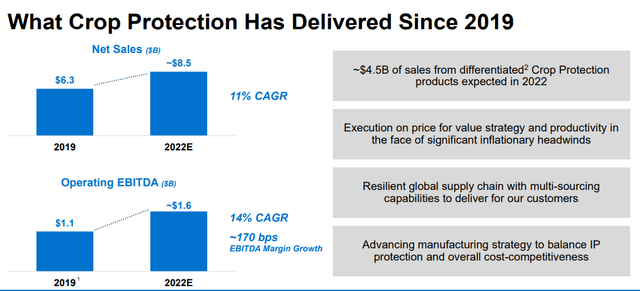

Corteva Crop Division EBITDA evolution

Source: Corteva Investor Day Presentation

Thanks to a supportive macro environment, Corteva delivered strong results. The company’s track record is already impressive, and so, now there is a question that haunts Wall Street: how much Corteva might increase its profit over the medium-term horizon?

Looking at the presentation, the company aims to:

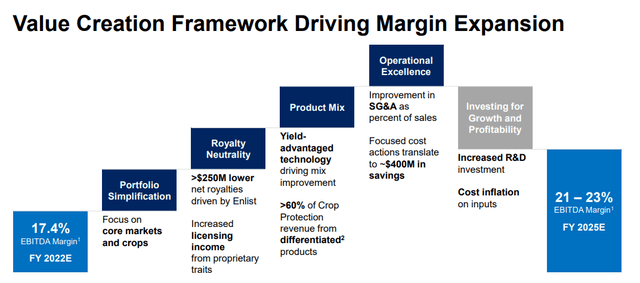

- Simplify its product portfolio

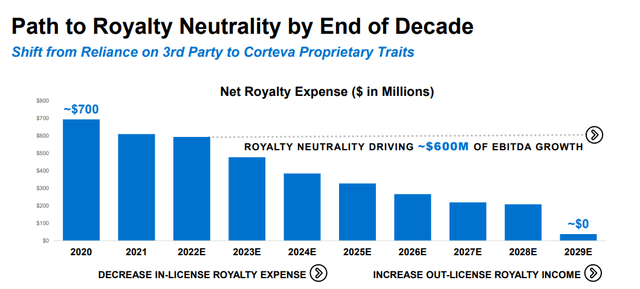

- Lower its royalty fees. Our internal team already analyzed this development, and in detail, we explained how DuPont’s glyphosate agreement will soon be expired and will be supplied thanks to in-house new traits. This will enhance future profitability in the seed division; however, we were already estimating 100 basis points more at the EBITDA level starting from 2023. In the meantime, the company is increasing its estimates to license out more products, top-management expects 120 basis points more at the 2025 EBITDA level.

- Better product mix and cost structure development.

According to Corteva, this path will set a new stage for a continuous EBITDA improvement over the period between 2022 and 2025.

Corteva margin expansion

Corteva Royalty neutrality

Source: Corteva Investor Day Presentation

Conclusion and Valuation

Before going to the valuation, the agriscience company announced a further buyback program for a total consideration of $2 billion. As communicated in the note, this new share repurchase plan is complementary “to the company’s existing $1.5 billion program announced in August 2021, which had $650 million remaining at the end of June 2022″. After having analyzed the new Investor Update, we conclude that we are already forecasting most of the management EBITDA improvements. On the valuation side, we remained cautious, we are positive on Corteva’s future but downside risks are equally important. The ongoing energy crisis might further reduce the company’s operating profit and a strong US dollar is not supportive for export.

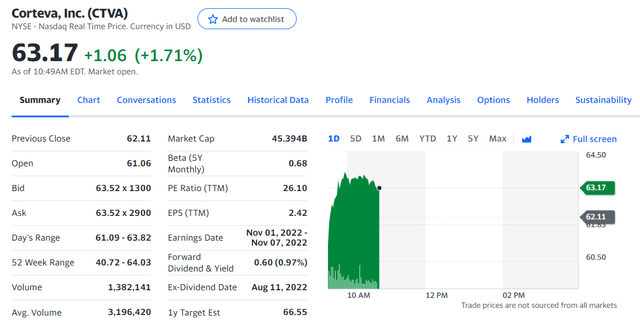

Our internal team believes that Corteva is fairly valued both at P/E estimates, but also on an EV/EBITDA level. We reaffirm our $65 target price per share (versus the current stock price of $63), maintaining a neutral rating.

Within our chemical coverage, we prefer Dow and BASF which are currently offering a compelling valuation and a higher dividend yield. You can check up on their Q2 performances:

In addition, Corteva and BASF have recently signed a collaboration agreement to deliver the future of weed control to soybean farmers.

Corteva stock price evolution

Source: Yahoo Finance

Be the first to comment