jetcityimage

In our initiation of coverage, we concluded that Corteva Agriscience (NYSE:NYSE:CTVA) had no further upside. However, we were optimistic about the company’s future emphasizing that Corteva could profit from Russian restrictions and the ongoing inflationary pressure. Whereas over the long-term horizon, we said that Corteva’s “activities are going to grow further due to global food requirements, which is continuously growing, and also due to worsening environmental conditions which could make it increasingly necessary to use the right crop protection measures”.

Today, we focus on the released Q2 results and add some exciting and positive considerations for Corteva’s long investors.

Starting from the latter:

- Corteva is currently spending almost 8% of its total turnover on research and developments (quite impressive versus competitors) – over time, price evolution is mainly driven by new product-offering improvements meaning that high R&D expenditure will lead to higher revenue generation;

- In comparison with FMC Corporation (FMC), the company is an undisputed leader in seed production but is also among the five prominent global leaders in pesticide production;

- In particular, in the seed business more and more products are sold directly to farmers reducing supply chain constraints while increasing profitability;

- DuPont’s glyphosate agreement will soon be replaced with in-house traits providing margin support to the seed division (we are forecasting 100 basis points more at the EBITDA level starting from next year);

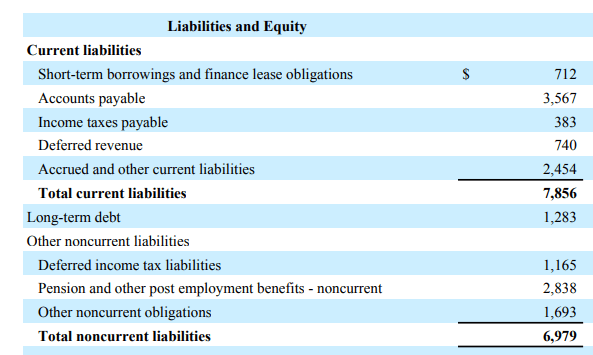

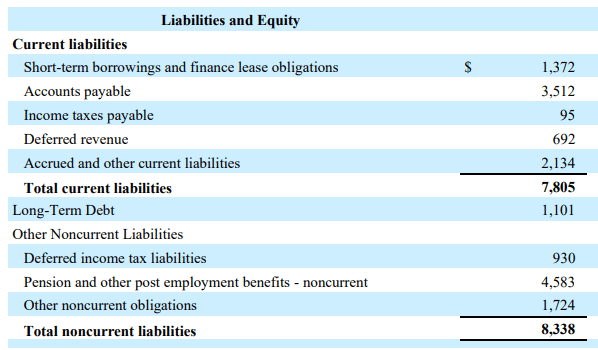

- Looking at Corteva’s balance sheet and thinking about the rise in interest rate (due to the current inflationary environment), pension liabilities will soon be eliminated. In Q3 2021, according to our internal calculation, we valued pension liabilities at $4 per share (post spun off from DowDuPont in 2019, we were looking at a number > $7 per share). As a reminder, Corteva is also well capitalized with positive cash in hand.

Pension in 2022

Source: Corteva half-year results in 2022

Pension in 2021

Source: Corteva Q3 press release in 2021

Source: Corteva Q3 results in 2021

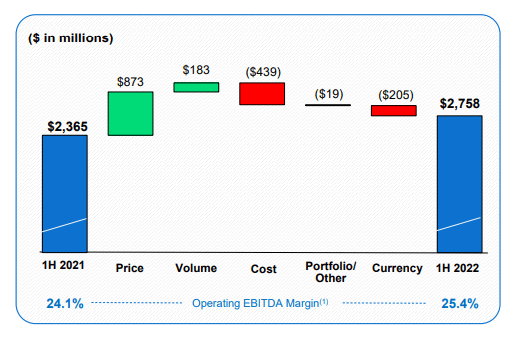

Q2 performance

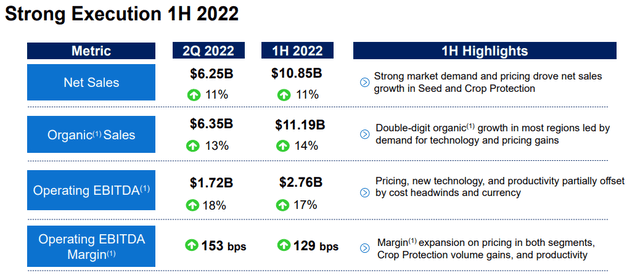

Let’s now analyze the quarterly financial results. Corteva delivered a very good second quarter confirming the 2021 positive trends. Last year, the company recorded sales growth and an EBITDA margin of 10.11% and 16.36% respectively. Looking at the Q2 accounts, Corteva posted a further top-line sales increase of 11% and reached an operating EBITDA margin of 18%. Volumes also grew in both businesses. Despite the higher cost sustained in the period and unfavorable currency development, the company again demonstrated a positive pricing delta. Cross-checking the Wall Street analyst consensus expectation, both seed and crop protection divisions manage to beat their forecast.

Source: Corteva half-year results

Corteva EBITDA evolution

Source: Corteva half-year results

Conclusion and Valuation

Our internal team reaffirms Corteva’s positive report and we remain optimistic about the company’s pricing power. After our initiation of coverage, today we included additional upside to take into account. Adjusting our numbers, we believe that Corteva is fairly priced at this valuation (P/E estimates but also on an EV/EBITDA). However, in a new normal, rolling over a forecast 2023 EBITDA of 3.3 billion and a historical EV/EBITDA multiple of 13x, we derive a valuation of $65 per share (versus the current stock price of $58).

Not long ago, we provided two analyses on Dow and BASF. Currently, we believe that these two companies offer a better value proposition (and also a higher dividend yield). You can check up on their Q2 performances:

Be the first to comment