CasarsaGuru

Editor’s note: Seeking Alpha is proud to welcome Stock Info as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Corsair Gaming (NASDAQ:CRSR) is a well-known manufacturer and seller of computer peripherals and gaming components. Corsair Gaming had an awful Q2, but Q3 saw meaningful improvements.

In an upcoming recession, Corsair’s sales of computer peripherals and gaming components will more than likely decline. In addition, the company continues to struggle with its cash position, as is shown by its recent public offering (more on that below). This is why I believe Corsair Gaming is a Sell in its current condition. At the time of writing, the shares were trading at $17.21.

Company Overview

Corsair Gaming is a business focused on manufacturing computer peripherals and gaming components. In addition, the company is a leading name in the gaming industry, and has grown exponentially due to acquisitions. If the industry continues to expand, Corsair Gaming could become a multi-bagger.

The Current State

Corsair Gaming has suffered significantly after two incredible years in which it profited from COVID-19 headwinds. This can also be seen in the stock price, which at the moment of writing is down over 65% since its all-time high back in November 2020.

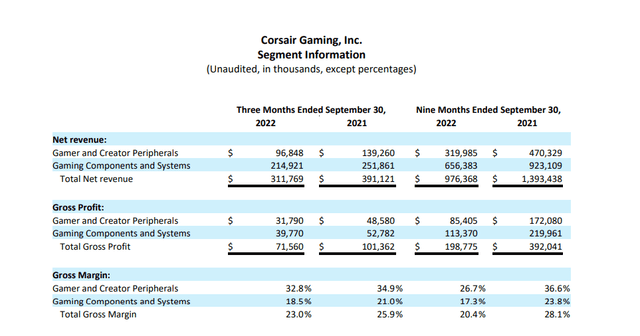

We will get straight to the point. Fundamentally, the company isn’t in its best shape right now. The company has seen a significant decrease in net income, total revenues, and gross profit. Let’s take a look at the table below from Corsair Gaming’s latest 10Q. Net revenue decreased in every segment. When we compare the total net revenue over the last 9 months over the same time period last year, we see a decrease of close to 30% from $470,329 million to $319,985 million. Furthermore, total gross profit decreased from $172,080 million to $95,405 million, which is almost 50%. Lastly, we can also see that gross margins declined by 7.7% to 20.4%. Such declines in gross margins are especially worrisome to see. This indicates that CRSR might be losing ground and materials are becoming more expensive.

Q3 Earnings Report (Investor Relations Corsair.com)

Corsair has seen a significant decrease in net income, total revenues, and gross profit. In addition, the operating income went negative. Currently, the company has a net debt of $238.7 million. It has been in a need of cash as its cash position decreased quickly. The company had solved this problem by doing a public offering of 4,545,455 shares of common stock at a public offering price of $16.50 per share. The gross proceeds are estimated to be $75.0 million.

Investment Thesis

The company had its IPO back in 2020. This IPO was very successful as the stock rose 200%+ in two months. Corsair Gaming even became a meme stock, as the company caught the eye of retail investors after the GameStop (GME) short squeeze. I see this as a positive as there are more eyes on the stock and Corsair Gaming is now a more well-known name, which might benefit the company in the future.

K57 RGB Wireless Gaming Keyboard (Corsair.com)

CRSR currently trades at a forward P/E ratio of 116.97. This is extremely high. In addition, multiple important financial metrics such as the ones mentioned above decreased. This can be seen on the balance sheet. By example:

- FCF Yield: 1%, indicating that the company would need 100 years to buy itself back. This ratio should improve before I would consider investing in this company for the long term.

- ROIC: -5.32%, which indicates the company is destroying its own capital

- Gross Margin: 21.56% TTM. Which is moderate, but this might decline further in the future as competition becomes larger.

- Revenue 5-year annual growth rate Revenue (CAGR): 9.65%, this is pretty solid, driven by Covid-19 tailwinds. However, this could remain consistent as the business benefits from a growing industry.

The Short Term

In the short term, I expect Corsair Gaming to suffer further. One of the main concerns is that I believe the company will need to continue investing heavily in its business to maintain its market share. The Gaming industry is a business with a lot of competition. Corsair simply doesn’t have the same financial powers as other big players within the industry. Furthermore, videogame sales continue to fall, with another 5% drop in the third quarter which means consumers are buying less equipment from Corsair Gaming.

The current recession, which is hurting consumer confidence and consumer spending, is already impacting sales across the globe. Corsair and other brands are also being affected by this. We believe this declining trend in sales for Corsair Gaming and its competitors like Razer Inc. (OTCPK:RAZFF) and Logitech (LOGI) will likely continue for a while as there are no signs of an improving economy quite yet. In addition, Corsair’s customers have low switching costs, which could make them turn to cheaper alternatives if the current recession gets worse.

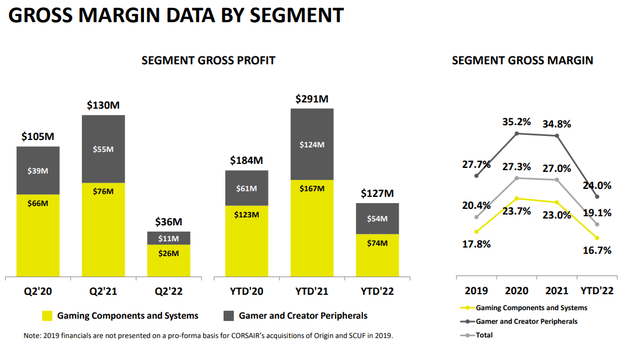

The sales declines were massive in the past quarters, with Q2 seeing a decline of 40% Y/Y. This was mainly due to increasing inventories in their warehouse and retail channels. In addition, the cash position got quite low, which has now been solved by a public offering, as was mentioned above. When we take a look at the image below, which is from the Q2 presentation 2022, we can see that the gross profit went down in each segment in the first half of 2022. In addition, the segment gross margin also dropped for each segment. This clearly illustrates that Corsair Gaming has struggled in 2022 as demand declined. Gross margins are even below 2019 levels.

Corsair Q2 Presentation (Investor Relations Corsair.com)

In Q3 we saw an increase in revenue compared to Q2. This is mainly due to the fact that inventory overhang reduced. CFO Michael G. Potter stated: “We remain in a challenging environment in Q4 2022, with the strengthening of the US dollar against other currencies and continued weakness in Europe being headwinds for us. Worldwide channel inventory levels improved during Q3, removing much of the overhang from orders placed due to longer lead-times in prior periods caused by the effects of the COVID pandemic.”

In the meantime, significant headwinds remain: Russia-Ukraine war, inflation, decreasing consumer demand due to high inflation, and reopening of the economy. This is one of the main reasons we remain hesitant before going long on CRSR. We would like to see improvements in the general economy as a whole. In addition, we would like to see Corsair Gaming improving its fundamentals and getting back to growing at a faster pace before we take any significant position. This is why we give CRSR a Sell rating for the short term as there are too many uncertain factors. We need to see how the company deals with these headwinds and how it affects their business in the upcoming quarters. That said, Q4 will more than likely be a decent quarter due to holiday season.

The Long Term

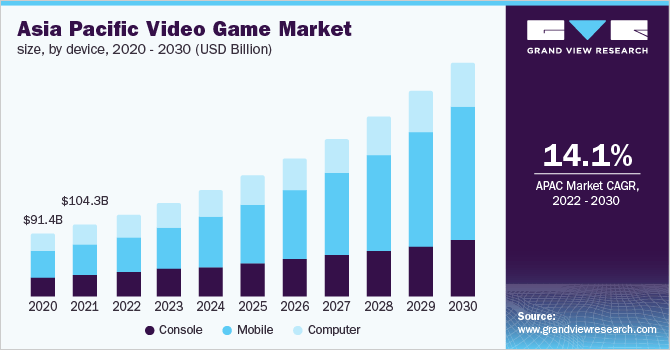

If we take into consideration that the gaming industry will continue to grow in the future. According to Grand View Research, “the global video game market size was valued at USD 195.65 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.9% from 2022 to 2030.” This gives a revenue forecast of $583.69 billion by 2030. CRSR would be able to capture a small part of this, but more than enough to give a significant boost to its share price if they remain to be one of the industry leaders in the peripherals and gaming components market. We believe this is likely to be the case. Furthermore, we believe Corsair Gaming could become a potential acquisition target in the future for more prominent companies like Meta Platforms (META) and Microsoft Corporation (MSFT) to name a few.

Grandview Research

Popularity and Brand

Corsair has an amazing brand name as has been mentioned earlier. I have been a user of Corsair Gaming’s products in the past myself and as we speak I’m typing this article on a Corsair keyboard. Corsair has a good name within the industry and a loyal fan base. This is due to the fact that the company creates quality products, which gamers like. You can ask every serious gamer which gaming brands they know, and they will mention Corsair. It is important to mention that the gaming industry is very competitive and thus it isn’t guaranteed that Corsair Gaming will remain popular in the future as the gaming industry evolves rapidly. If we take a quick look on YouTube and search for the term “Corsair Gaming”, we can see that the top results are all quite recent and have good reviews.

Acquisition Strategy

Management tries to pursue aggressive growth by doing acquisitions. As mentioned above, the gaming industry innovates at a rapid pace. A company like Corsair can fall behind quickly if they don’t continue to innovate. Corsair has been losing market share and is not able to finance its growth through acquisitions as it will need to continue raising cash. Initially, the company mentioned that they were committed to deleveraging, but we didn’t notice any of this deleveraging process in 2022 as the company continues its M&A strategy. That said, I believe the company has done great by acquiring Elgato and SCUF Gaming. Both companies are well-positioned and are market leaders in their respective niches and will continue to grow in the future.

Elgato

Elgato was acquired by Corsair Gaming back in June of 2018. The company is a world-leading provider of audiovisual technology for content creators on all video sharing platforms. It helps creators with streaming and recording their content. I believe this was a great acquisition by Corsair Gaming. Elgato is the only major player within this niche and with the creator economy growing at a rapid pace, I expect it to generate a significant amount of revenue in the future. The Creator Economy is estimated to be worth $104 billion as of today. As can be seen in the chart below, the creator economy has been growing exponentially. A graph of The Creator Economy can be found by clicking HERE.

SCUF Gaming

SCUF Gaming was acquired back in early 2020. According to the company website, “SCUF Gaming is a global innovator and creator of high-performance gaming controllers, providing superior accessories and customized gaming controllers for console and PC that are used by top professional gamers as well as casual gamers.” Again, SCUF Gaming is a leader in its niche, and no other brand has quite the same loyal following and hype around it as SCUF Gaming has. I believe they are well-positioned to profit from the growing gaming industry in the next couple of years. SCUF controllers are a must-have in competitive gaming, as they give a slight advantage to the user. At the professional level, every edge you can get counts. That’s where SCUF comes in.

SCUF Controller (Scufgaming.com)

Major Shareholder

Corsair Gaming has one major shareholder, EagleTree Capital. As of the latest 13F filings, EagleTree Capital holds 59% of the shares of CRSR. This is a significant amount as you can imagine. Given that EagleTree Capital is a PE firm, this isn’t ideal as they will slowly sell out of their position while the price rises. This will put selling pressure on the stock in the future, which could harm future returns. Big institutions would be good for the company, but we don’t like PE firms, which hold a significant amount of shares. In addition, as of today, the company has a short interest of 15.41% according to Seeking Alpha, and this adds some more sell pressure as well. If this percentage increases in the future, this could give short squeeze possibilities, but as of now, this is not the case.

Insider Transactions

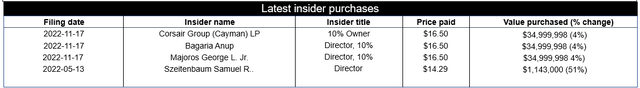

As can be seen in the table below, there weren’t many insider purchases in 2022. Furthermore, the only legitimate insider transactions are the purchases of Szeitenbaum Samuel R. The others are one transaction by EagleTree Capital, which bought 46.67% of the recent public offering. The directors had to file independently as they are both majority owners and both are linked to EagleTree Capital. It is interesting to see that this is the first time that EagleTree Capital bought shares. This indicates that they might believe the company is currently undervalued. That said, we would like to see insider purchases increase as this would show the confidence of the insiders. I firmly believe in this quote from Peter Lynch: “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

Insider Purchases (Stock Info with OpenInsider)

The Charts

The chart below shows that Corsair Gaming had a lot of success in the beginning. The meme stock craze and the “free money” narrative drove the stock to ridiculous valuations. Currently, the stock is fighting against the $17.45 resistance level, which currently corresponds with the 50 weekly EMA. If the stock is able to push through we could see it testing the red trendline resistance again, but we believe this is highly unlikely in the current environment. The most important support level seems to be the $14.09 level. We might see some immediate support as well at the $16.50 level as that’s where the recent public offering price was at. If the situation gets a lot worse and Corsair Gaming doesn’t start to turn things around, we could be heading lower toward the $10.97 all-time low again.

Conclusion

I believe there are too many uncertainties right now to make a significant long-term investment. Corsair Gaming could potentially be a long-term gem and a multi-bagger when you buy it in the low teens and everything works out in the future. I believe the bull case would be for Corsair Gaming to get bought out at a significant premium. The cash position will remain an issue if the business doesn’t improve and the industry remains under pressure. This indicates that the company would need to continue raising cash as mentioned earlier.

I think the company certainly has its place in the market, but the fundamentals aren’t great. As of now, I believe Corsair Gaming is a Sell, but if conditions improve I think this could be a great stock to hold as it operates in a growing industry. Furthermore, Corsair Gaming could become a buy-out target in the future, but for now it remains a Sell as there are better opportunities out there in the market.

Be the first to comment