RyanJLane/E+ via Getty Images

When we last covered the earnings released by CorEnergy Infrastructure Trust Inc. (CORR), we did not pull our punches.

We think the risk is high and there are far better prospects elsewhere. We extend this thinking to even the CorEnergy Infrastructure Trust, Inc. Preferred Shares (CORR.PA) where interest plus preferred dividend coverage is hovering near 1.0X. We are still staying away from both classes of equity.

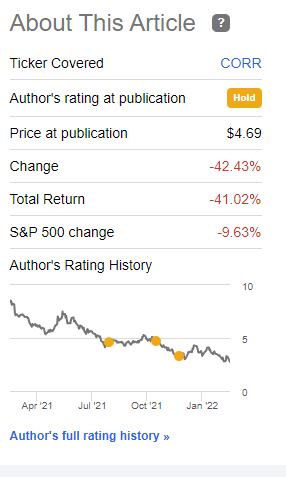

Readers might have found the words harsh but the proof is in the pudding. CORR declined 42.43% from that point.

Performance Since Last Article (Seeking Alpha)

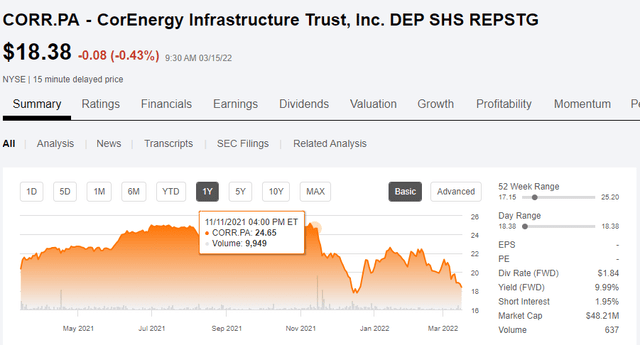

That is quite a stunning result in light of the energy rally we have had in the timeframe. The preferred shares have also run into headwinds and are down over 20% since then.

CORR Preferred Shares (Seeking Alpha)

CORR just announced its Q4-2021 results and we dived in eagerly to see if there was a light at the end of the tunnel for long suffering bulls.

Q4-2021

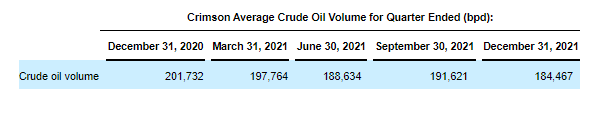

For the fourth quarter, CORR reported revenues of $35.8 million and adjusted EBITDA of $12.27 million. The prior year comparatives are presented in the report, but don’t amount to much as the recent acquisition of Crimson is pretty much the driving force for everything we see this year. A better comparative is the third quarter. In Q3-2021, revenue was $37 million and adjusted EBITDA was $13.26 million. The decline in revenues can be attributed to the decline in oil flowing through the pipelines. Average transported crude oil volumes decreased 3.7% from the third quarter. Since December 2020, the volume story has disappointed the bulls.

Volumes (CORR 10-K)

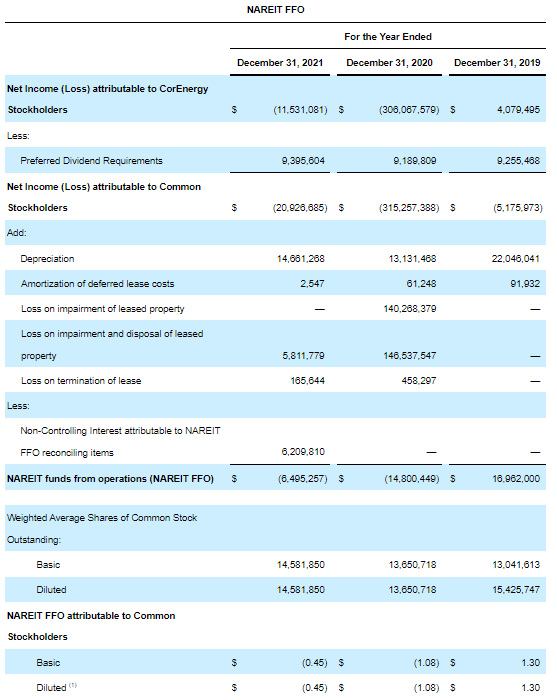

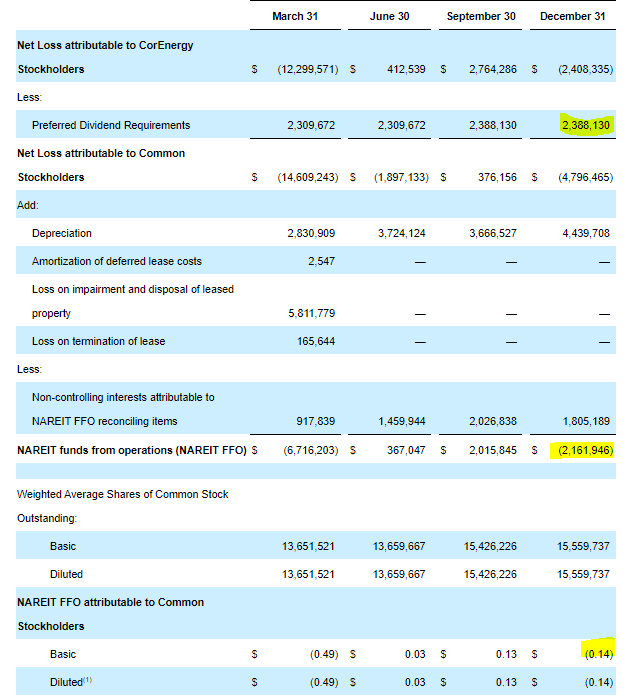

The only reason that EBITDA has not fallen even more is that CORR was able to pass on price hikes in late 2021. For the full year, NAREIT funds from operations (FFO) was negative 45 cents.

FFO (CORR 10-K)

Q4-2021 was particularly rough with FFO of negative 14 cents.

FFO By Quarter (CORR 10-K)

Investors may notice that Q1-2021 was worse, but that was prior to the integration of the Crimson assets. Post that integration, Q4-2021 was clearly the worst.

Outlook & Valuation

CORR guided for $45 million (midpoint) in adjusted EBITDA for 2022. This is a good deal below the annualized run rate we saw in Q4-2021 ($49 million) and far below the Q3-2021 ($53 million) annualized rate. With $45 million though, CORR can definitely meet its interest ($12 million), maintenance capex ($9 million) and preferred share ($9.5 million) requirements. We also need to deduct $8.0 million of principal loan repayments that are mandatory for the company. Assuming there are zero cash taxes and that is certainly probable considering the armada of losses CORR has racked up, we think CORR can make it through 2022. There won’t be a lot left after the common stock dividend of $0.20 though and we don’t think a CORR can manage to increase that dividend in 2022.

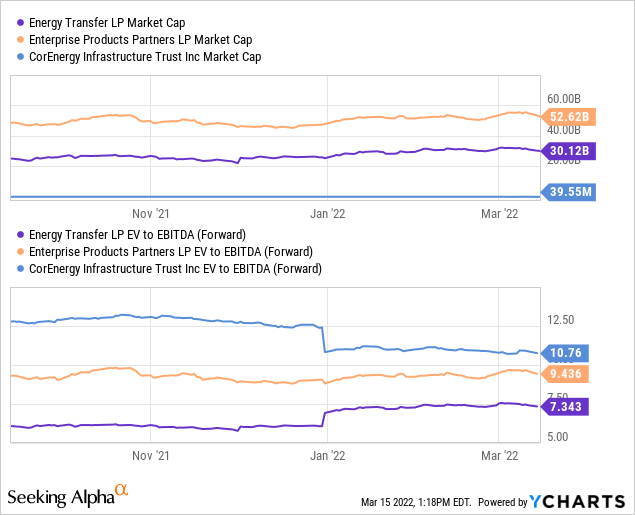

From a valuation perspective, the stock appears cheap when you glance at just the equity market capitalization. But when you consider the total debt and preferred shares standing ahead of the common equity, this rings in expensive. Total valuation (EV to EBITDA) is close to a 11X multiple. We could think of two midstream firms right away, Energy Transfer L.P. (ET) and Enterprise Product Partners LP. (EPD) that trade cheaper than that, have larger yields and have far more diversified set of assets.

Verdict

We think CORR will maintain the dividend in 2022 but have no hopes for an increase. The sustainability of the dividend, and we might add the company itself, will depend on whether those volume declines can be arrested any time soon. Of course there is a regulated element here and of course the preferred shares are higher up and hence more resilient. No argument from us on either of those cogent points. But we will test the limits of those arguments if volumes continue to decline. CORR passed on a 10% surcharge last August and it remains to be seen how much extra can be tagged on to the remaining barrels in 2022. We did an abrupt reversal on CORR in early 2021 and since then have been fortunate to be able to make the right decisions all along. That right decision has been to stay out.

Be the first to comment