Deejpilot/iStock via Getty Images

Introduction

Among our Bitcoin (BTC-USD) mining company watchlist since 2021, Core Scientific, Inc. (NASDAQ:CORZ) has one of the highest expected capacities by the end of 2022. in 2021Q4, CORZ was expected to achieve up to 42 EH/s by the end of 2022. Unfortunately, that figure was revised downwards to 30 EH/s. Nevertheless, CORZ still has one of the highest expected capacities on our watchlist, which is about the same as Marathon Digital Holdings (MARA) in terms of self-mining. Moreover, CORZ’s revenue is diversified into 3 business segments.

We’re excited to revisit CORZ now that the company has gone public. Based on the Form 10K and FORM 10Q released in recent months, we now have better visibility into the company’s financials. Hence, the main objective is to examine CORZ’s investability from various angles.

ESG Risk: The Problem With Being Carbon-Neutral

We have maintained the criteria that Bitcoin mining operations must be powered by nothing short of renewable energy since our coverage on Bitfarms (BITF) back in 2021.

Being carbon neutral is risky due to the large estimation error in measuring the absorption of carbon from the atmosphere. Changes in the measuring methodology could cause a company to lose the status of being carbon neutral and be liable to additional compliance risk.

CORZ acknowledges this risk:

Increasing scrutiny and changing expectations from investors, lenders, customers, government regulators and other market participants with respect to our Environmental, Social and Governance (“ESG”) policies may impose additional costs on us or expose us to additional risks.

If major institutional funds are being critical of ESG compliance, then CORZ’s upside might be limited due to less demand for its shares.

Therefore, being powered by renewable energy is the safest path to ensure investability in the future. This is an aspect worth considering before being invested in CORZ.

Bitcoin is currently trading at the $20,000 price level. We predicted this decline back in May 2021 and advised against investing in Bitcoin mining companies due to high Beta and additional risks. We expect Bitcoin to drop to $10,000 by end of 2022 before bottoming out.

Before CORZ’s SPAC merger, we estimated its Bitcoin mining cost (cost of revenue) to be around the $22,000 – $35,000 range depending on the type cost included. The estimation was referenced from other Bitcoin mining companies. Thanks to CORZ’s latest Form 10Q, we can validate this estimation.

CORZ managed to mine 3,202 Bitcoins in 2022Q1 while incurring a cost of revenue totaling $68.75mil. This implies CORZ’s gross mining cost per BTC to be $21,470, which aligns with our previous estimates.

Since Bitcoin mining revenue is 69% of total revenue, the revenue-weighted business cost (R&D, Sales & Marketing, General Administrative, and Interest Expenses totaling $66.574mil) assigned to the self-mining segment is $45.936mil, which implies $14,346 per BTC. We expect this “per BTC” figure to reduce over time as CORZ achieves more economic of scale (e.g., hitting 30 EH/s) by end of 2022. We also acknowledge that this method of assigning presumably shared business costs this way has its limitations.

Hence, we estimate CORZ’s business cost to be $35,816 per BTC. This also aligns with our initial estimates.

With Bitcoin trading at the $20,000 price level now, it is not unreasonable to expect CORZ’s self-mining segment to barely break even. If other business costs are included, CORZ’s Bitcoin mining business would be losing $15,000 on paper per BTC.

Potentially 66% Upside Could be Lost to Dilution

Some might argue that many of these expenses are non-cash without realizing that non-cash expenses cost shareholders by dilution. For instance, CORZ’s outstanding shares increased by 52,988 in 2022Q1 from 271,576 to 324,564 outstanding shares. This implies a dilution of 17%.

What this means is that the CORZ can increase in value without increasing the share price if dilution continues. Hence, shareholders might not be able to realize the expected full upside. As of the end of 2022Q1, CORZ has about 96.9mil unvested/unexercised Restricted Stock Award (RSA) and Restricted Stock Unit (RSU). 11.9mil RSUs were granted to employees and the management during the quarter while another 1.4mil RSUs were approved to be granted. To our knowledge, unvested RSAs/RSUs are still excluded from shares outstanding. Following this rationale, investors should expect approximately 30% dilution after fully vested based on 2022Q1 outstanding shares. We excluded stock options weighted average exercise price is $8.76, well above the current CORZ share price.

Some might also wonder why are these potentially dilutive securities not included in the diluted earnings? According to CORZ’s FORM 10Q:

Potentially dilutive securities includes securities not included in the calculation of diluted net loss per share because to do so would be anti-dilutive and contingently issuable shares for which all necessary conditions for issuance had not been satisfied by the end of the period.

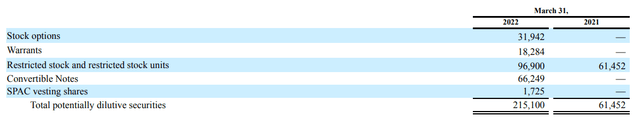

However, this might not be limited to CORZ and might be common in many other Bitcoin mining companies as well. CORZ’s potentially dilutive securities are shown in Fig 1.

Fig 1. CORZ’s Potentially Dilutive Securities Could Dilute Investors by 66% when Fully Vested/Exercised. (CORZ)

Can CORZ’s Hosting and Equipment Sales Segments Hedge Against the Bitcoin Downturn?

Although CORZ is topline-diversified, CORZ’s bottom line is much less so. 69% of revenue is generated from the self-mining segment, but 91% of gross profits are generated from the self-mining segment.

Therefore, it is safe to say that hosting and equipment sales won’t be sufficient to compensate for any drawdown in the self-mining segment at the moment.

Nevertheless, we still expect CORZ’s business to be net positive when impairment losses are excluded because impairment losses can be reversed when Bitcoin rebounds.

Will CORZ Need To Dilute Shareholders to Operate in 2022Q2 and 2022Q3?

We’ve established that CORZ’s cost of revenue per Bitcoin is $21,470. CORZ’s self-mining capacity grew 25% QoQ. Extrapolating this growth, we expect CORZ to mine more than 4,000 Bitcoins in 2022Q2. Bitcoin was trading at an average of $32,500 in 2022Q2. This would provide CORZ with a gross profit of $44.120mil.

Based on the 2022Q1 report, we should expect a 6% gross profit for CORZ’s hosting segment. Extrapolating 15% QoQ hosting capacity growth, we expect only $2.28mil hosting gross profit. There is no visible trend in the equipment sales department, hence, we assume no changes at $3.77mil

Therefore, we estimate CORZ 2022Q2 gross profits to be $50.17mil, down from the current $70mil. Assuming operating expense does not change (~$45mil), CORZ operating income would be $5mil.

What about the $21.676mil interest expense? Well, $21.5mil out of the $40.16mil general and administrative expenses is non-cash. So CORZ shouldn’t need to dilute shareholders to operate in 2022Q2.

We can’t say the same for 2022Q3. Following the same assumption, we expect CORZ to mine 5,000 Bitcoin. Bitcoin’s price in 2022Q3 only averaged sub $20,000 so far. This is lower than the self-mining cost of revenue per BTC, even before accounting for another business cost.

In this case, CORZ still has about $100mil of cash and 8,427 Bitcoins as of 2022Q1 to cover business costs. We expect CORZ to deplete cash on hand and Bitcoin reserves before raising funds from new shares in the near term. We can’t say the same if Bitcoin stays below $20,000 for a prolonged period.

Relative Valuation Against Other Miners

Recall that 91% of gross profits are contributed from the self-mining segment, it is forgivable to omit its hosting and equipment sales segment for the time being.

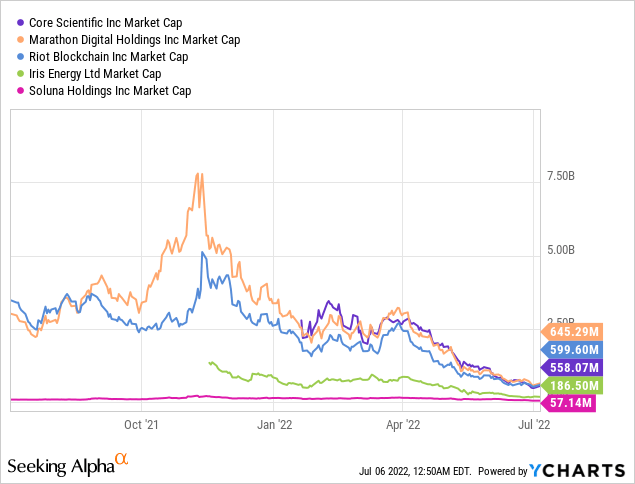

CORZ is priced lower than MARA and Riot Blockchain (RIOT) despite having much higher built-up capacity than both and higher expected capacity than RIOT (Table 1). On this basis, CORZ could be more undervalued than MARA and RIOT. More studies are required to validate this.

Table 1. Current and Expected Future Self-Mining Capacity as of 2022Q1

| Company | Current Capacity (EH/s) | Expected 2022-2023 Capacity (EH/s) |

| CORZ | 8.3 | 16 |

| MARA | 3.9 | 23.3 |

| RIOT | 4.3 |

12.8 |

| IREN | 1.1 |

15 |

| SLNH | 1.021 |

4 |

Source: Author

Verdict

We will not be looking to invest in Core Scientific because it doesn’t meet our pre-requisite of being powered by renewable energy. Secondly, there is a chance of a 66% dilution that might prevent us from realizing the company’s full upside.

Thirdly, during this Bitcoin downturn, we’re looking for Bitcoin mining companies priced near the value of non-mining assets net of the total liability. So far, we found that Iris Energy (IREN) has fulfilled our pre-requisite of being powered by renewables yet is not limited to only curtailed renewable energy, like Soluna (SLNH), and is priced near its non-mining asset value net of the total liability.

We expect Bitcoin to fall to $10,000 before completing its bear market by end of 2022. Given CORZ’s 2022Q1 cost structure, we expect more downside for CORZ. A worse-case scenario would be the depletion of Bitcoin reserves to realize impairment losses and further dilution via equity offerings.

Be the first to comment