Olemedia

Note: Unless otherwise stated, all references to dollars ($) are to the Australian currency.

Core Lithium Ltd’s (OTCPK:CXOXF) share price took a bit of a hit in recent weeks after major holder Ganfeng Lithium Co. trimmed its shareholdings in the stock. An announcement on September 30th that the company was going to raise $100 million through a private placement that priced the stock at a AUD 1.03 per share, 6.8% lower than the previous day’s close on the ASX, didn’t help either. But these passing events shouldn’t hold the share price down too long. On October 10th, the company announced the long-awaited official opening of the Finniss Lithium Mine in the Northern Territory of Australia. As the mine ramps and commercial production starts to eventually generate positive cash flow, the stock should eventually recover from the dip and go onto reach new highs.

Company Backgrounder

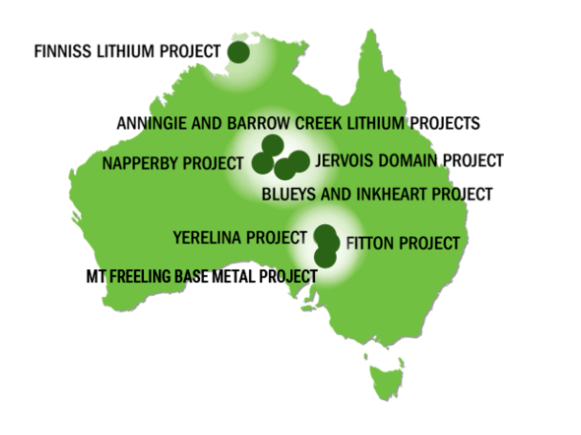

Core is an Australia-based company with numerous tenement holdings all over Australia. The junior miner has done exploration work at these properties geared towards finding uranium, lead, copper, and zinc. But its efforts have met with mixed results and most of these projects are still at very early stages of development.

corelithium.com.au

The company, however, has had much more luck when it comes to exploring for lithium. In the NT, Core was granted tenements covering an area of over 500 km2 at the Bynoe Pegmatite Field where it discovered an economically viable lithium ore deposit that subsequently became its flagship Finniss Lithium Mine.

Finniss’ Reserve

The Finniss project has an ore reserve of 10.6Mt (P&P) at an average grade of 1.3% and a total resource estimate of 18.9Mt (M&I&I) grading at 1.32%. Exploration work done at the site has resulted in the resource estimate being upgraded by 28% in the past year while the reserve estimate was increased by an impressive 43%.

But even after these notable expansions, there may still be more room growth. That’s because Core plans to use a good portion of the aforementioned $100 million equity raise on new exploration work at the site. In the press release announcing the raise, Core sighted strong lithium spot prices as one of the main reasons for it wanting to pursue, “aggressive exploration programs designed to rapidly grow” Finniss’ resource and reserve.

So, although the placement was issued at a discount to prevailing market prices, the company’s ability to quickly access and deploy capital may nevertheless greatly benefit shareholders in the medium-to-longer term. Recently released assay results point to the pegmatite body stretching deeper than previously assumed.

But regardless of whether or not the resource size is expanded, the stock should eventually reprice higher given the value of existing operations.

Valuation

Finniss will have a mine life of 12 years and the total anticipated production over that time period will be 1.92m tonnes of spodumene concentrate (“SC5.5”). At Core Lithium’s enterprise Value of US$1.26 billion, the market is pricing those tonnes at just US$656. Granted, looking at it in these terms doesn’t take into account a number of factors, but it does serve to quickly point out the gaping difference between SC5.5 spot prices and what the market is pricing into Core’s stock. It’s an amount that is well below the US$6,988/dmt that SC5.5 was bidding at Pilbara Minerals Limited’s (OTCPK:PILBF) most recent BMX Auction just a few weeks ago.

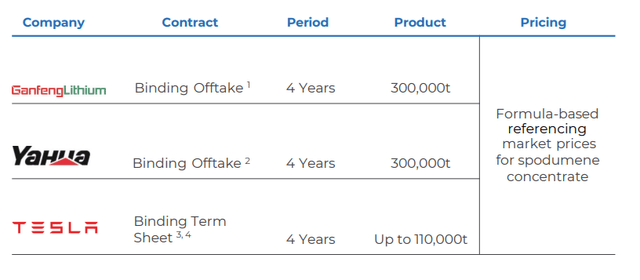

However, it should be noted that Core won’t be selling most of its production in the spot market. The company has already committed its supply through a number of binding agreements for a period lasting 4 years, the terms of which are outlined in the exhibit below. But while the agreements are formula-based, those formulas will reference SC5.5 market prices and therefore maintain a link to price changes in the broader market.

Investor Presentation

It should also be noted that high operating costs are not the reason for the pullback in Core’s share price. In fact, Core estimates All-in Sustaining Costs on a per tonne basis to come in at US$539/t over the life of mine. The cost of shipping the ore to midstream converters in China should also be very reasonable given Darwin Port’s northerly location.

Takeaway

Given the well publicized deficit in lithium supply, a pre-production lithium junior that’s beginning to ramp production should be trading at a higher level than what the shares of Core Lithium are currently trading at today. Recent events such as the sale of a large block of shares by Ganfeng and the company’s discounted private placement may have acted to push the stock price lower. But it shouldn’t be too long before this pullback reverses. The gradual ramp of production at Finniss should remind the market of Core’s underlying value and its share price should eventually start reaching new highs.

Risk

The primary risk to the thesis is a fall in lithium prices. The metal’s price has run up substantially over the last year, and if it were to pull back sharply Core would be negatively impacted.

Be the first to comment