golero/E+ via Getty Images

Introduction

Every so often, the market tosses us a bone. The selloff in Core Laboratories N.V. (NYSE:CLB) could be one such bone, depending on your risk profile. Better times are coming for CLB due to a shift in priorities to conventional reservoirs in the offshore environment. More on that in a minute. I will also note that I’ve covered CLB a number of times previously, and commend you to those articles for deep background on this company.

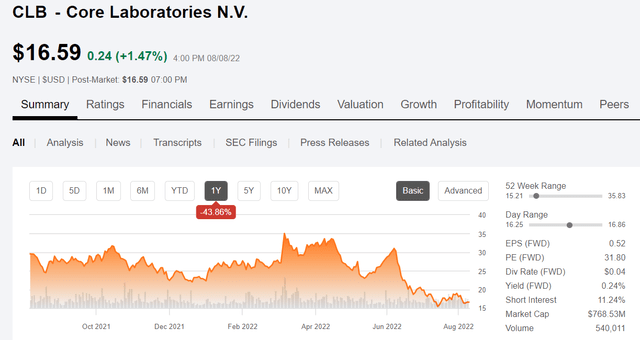

CLB price chart (Seeking Alpha)

Core Labs has a long history in the oilfield, with its primary legacy competence in Reservoir Description services. In recent years, they’ve expanded their remit to Production Enhancement services, putting them in competition with some of the other companies we cover. That’s ok, because over the last few years, Schlumberger (SLB), Halliburton (HAL), and Baker Hughes (BKR) have entered the reservoir description business. Tit-for-tat.

CLB also has several new offerings to the industry that should provide traction in an expanding market. In particular, some countries are interested in their experience in U.S. shale as they look to characterize and explore their own unconventional and CCUS potential.

I think CLB is in a buy zone for investors with an aggressive risk profile, at current prices, and will discuss why in this article.

The Macro Environment For CLB

Rystad notes in a June letter that budgets for offshore E&P related expenditures are on the increase. You will note in the graphic below that most of the money buckets are on the increase for this year and the next. CLB can stick a straw in all but one of those buckets to draw revenue.

Rystad notes the obvious as regards the EU pivoting to development of their own oil and gas supplies as they increasingly shun Russian sources.

This would present vast opportunities for players within the rig and well segment as European energy consumers would be forced to find large replacement volumes within a short space of time. Even if the EU stops short of a full freeze on imports of Russian crude, it appears inevitable that Europe will heavily reduce its imports from Russia and will be shopping for alternative sources of oil supply.

Evaluation Services, Drilling Materials, Drilling Services, and Well Intervention all can fall under CLB’s remit. In some areas, particularly reservoir evaluation services, they have a substantial moat. CEO, Larry Bruno, commented in this regard-

I visited with our major clients across the Middle East region. Key takeaways from those visits include: one, all of our clients have significant production growth plans over the next several years; two, project work for Core Lab has started to pick up and the growth in work volume is expected to accelerate as we move into the second half of 2022 and beyond.

The Thesis For CLB

As noted above, their legacy reservoir description business thrives when long cycle projects are on the rise. With the dearth of long cycle capex the last few years as low oil prices forced operators to focus on short cycle shale and low risk tie-backs, a renewed focus on finding new conventional reserves will benefit Core Labs.

As noted above, they have a number of other levers to pull that should drive business their way in the coming long cycle expansion, as well as in-fill type work.

Lever #1

Applying reservoir description services to lithium resources. This mineral is in high demand for EV batteries, and current supplies are inadequate to meet future demand. Core has a project underway in Nevada at the present. Larry Bruno comments-

During the second quarter of 2022 Core Lab under the direction of 3PL Operating, Inc. commenced work on a multi-well core project to evaluate lithium production opportunities from Railroad Valley in Central Nevada. 3PL Operating has targeted a Pliocene continental evaporite sequence with extensive metalliferous deposits that include sodium, phosphorus, tungsten, boron, lithium and other metals, potentially making the Railroad Valley deposit one of the most promising in the world of this type.

Lever #2

Plug and abandonment (P&A) work will be on the rise as older wells reach terminal decline, and await their final appointment with a slug of cement. The normal process for this can be tricky and expensive time-wise, and technology that improves the process is an easy sell. Larry Bruno comments on the new Helios perforating technology-

During the second quarter of 2022, working with a client in North Sea, Core Lab successfully launched its innovative energetic perforating system, Helios, aimed at improving the efficiency of plug-and-abandonment programs. The Helios technologies unique engineering and design generates a high-density perforation matrix that provides access to the cement between the outermost layer of casing and the geologic formation. The Helios perforation matrix creates an optimized design that allows for greater circulation and more efficient debris removal in the annular space during perf and wash operations.

This is tricky work that often seems to be one-step forward and three back. Oftentimes, the plan is P&A a lower zone, come up the hole and complete an upper interval. Until we do the lower P&A we can’t move forward. Asset retirement (ARO) work that is the obligation to ensure abandoned wells are left in proper condition is also an outlet for this service.

Lever #3

Downhole imaging

We use pressure and temperature data to tell us an amazing amount about what’s happened at the bottom of the well. Nothing tells a story like a picture or a log-which can be the same thing, and that’s what imaging brings. Larry Bruno comments on this service-

Core’s SpectraStim, SpectraScan and PackScan downhole imaging technologies were utilized in a client’s deepwater Gulf of Mexico well to evaluate a frac pack completion.

Logging of sand control treatments, to include frac packs, is the Holy Grail of downhole services. Visualize this scenario: you just spent millions pumping a frac pack and pressure and temperature data have you scratching your head as to how much sand remains in the annulus. You must cover the screen and leave some excess in the blank section to come out of the hole. Until you come out of the hole, you can’t release the rig and the daily rental continues on a big ticket item. What do you do? Do you pump a top off job or not? There are risks either way, and I getting way too wonky to provide a lot more detail now. The answer is to have CLB on standby to log the pack.

Larry Bruno comments on a recent job (emphasis added):

Based upon traditional volumetric measurements during the frac pack treatment a successful frac pack was initially interpreted to have been placed on the well. However, when Core’s Production Enhancement engineering team analyzed the diagnostic data retrieved from its SpectraScan and PackScan logging tools, the results revealed a major void in the annular pack, (A void in the pack is a total train-wreck that can lead to failure of the well.) as well as inadequate proppant reserve at the top of the screen.

Core’s experts recommended a top-off proppant treatment to ensure complete screen coverage. The top-off procedure was successfully pumped and a relog of the completion using Core’s PackScan logging tool confirmed the successful profit infilling on the annular void along with an adequate proppant reserve placement above the top of the screen. This avoided a multi-million dollar remedial, completion intervention.

This, too, is an easy sell.

Lever #4

Other countries are starting to evaluate their shale resources. America has been the envy of the world the last decade or so as we took big strides in developing a previously unusable resource. CLB’s experience in characterizing these reservoirs will be in demand. A related lever involves CCUS investigations, that evaluate the feasibility of injecting CO2 into a subterranean cavern. Larry Bruno comments on these applications:

In addition to Core’s traditional involvement with conventional reservoirs in the Middle East, there is a broad focus across the Middle East region on leveraging Core’s expertise in unconventional reservoirs with opportunities in both Reservoir Description, as well as for completion products and completion diagnostics. And finally, multiple Middle East NOCs have begun engaging with Core Lab on their carbon capture and sequestration initiatives where Core Lab has established itself as an industry-leader in subsurface evaluation of prospective CO2 sequestration sites.

Core grew revenue 5% QoQ to $120.9 mm. Currency devaluation and a decline in Russian activities offset this growth. EBITDA was $17.1 mm or $64 mm on an annualized basis. Debt stood at $188 mm, and the company has $16 mm in cash on the books, down from $22 mm in Q-1 due to adverse collection activity related to Russia and working capital builds. In July, the company extended the maturity on their revolver to 2026, with a max ratio of 2.75. Current leverage is a 2.47 and the company expects it to decline through the year as it prioritizes debt repayment with free cash. The company also has authorization to sell $60 mm in shares in an At The Market-ATM facility, with no shares sold so far. With annual capex of $12 mm-ish and dividend obligations, the company faces no liquidity barrier.

The cash burn should be noted and was dealt with in the call. Historically over the last couple of years, the company has the ability to generate $95-110 mm in OCF annually, making the current depressed conditions an outlier.

Your Takeaway

CLB is a company you buy when you are maxed out in Halliburton, (HAL), Schlumberger, (SLB), and Liberty Services, (LBRT). It is at the absolute nadir as a result of recent events that have shaved the oil price into the $90’s. If you buy the notion that with a pivot to long cycle drilling is underway, CLB might fit into the risky part of your portfolio for growth.

At current levels, it is still expensive on an EV/EBITDA basis, trading at 15X. The current dour view of the market toward everything oil is a weight that’s taken it down from the mid-$30’s to its present level. CLB is a speculative buy for better times that we think are coming in this space.

Be the first to comment