FabrikaCr

A while back I listened to a fantastic Bloomberg podcast on copper, which analyzed key industry trends, and expectations thereof. I found the subject incredibly interesting, so thought to write an article on a copper miners equity index ETF. The Global X Copper Miners ETF (NYSEARCA:COPX) fits the bill.

COPX’s investment thesis rests on several key copper industry trends. Copper is predominantly used to make electrical wiring and cable conductors. Copper demand is skyrocketing, due to increased renewable energy investment, and electric vehicle adoption. Copper supply is stagnating, especially in Chile, the largest producer, due to environmental, legal, and regulatory concerns. Copper prices have significantly increased as a result, as have revenues, earnings, and cash-flows for most copper producers, including most of COPX’s underlying holdings. Strong financial performance has led to significant, market-beating returns for COPX in the past. Performance is set to continue, in my opinion at least. COPX is a buy, but only appropriate for more aggressive, risk-seeking investors, due to the risky / cyclical nature of commodity equity investments. COPX yields 3.6%, above-average for an equity fund, but not a significant yield, nor a key component of its investment thesis.

COPX – Basics

- Investment Manager: Global X

- Underlying Index: Solactive Global Coppers Miners Index

- Expense Ratio: 0.35%

- Dividend Yield: 3.60%

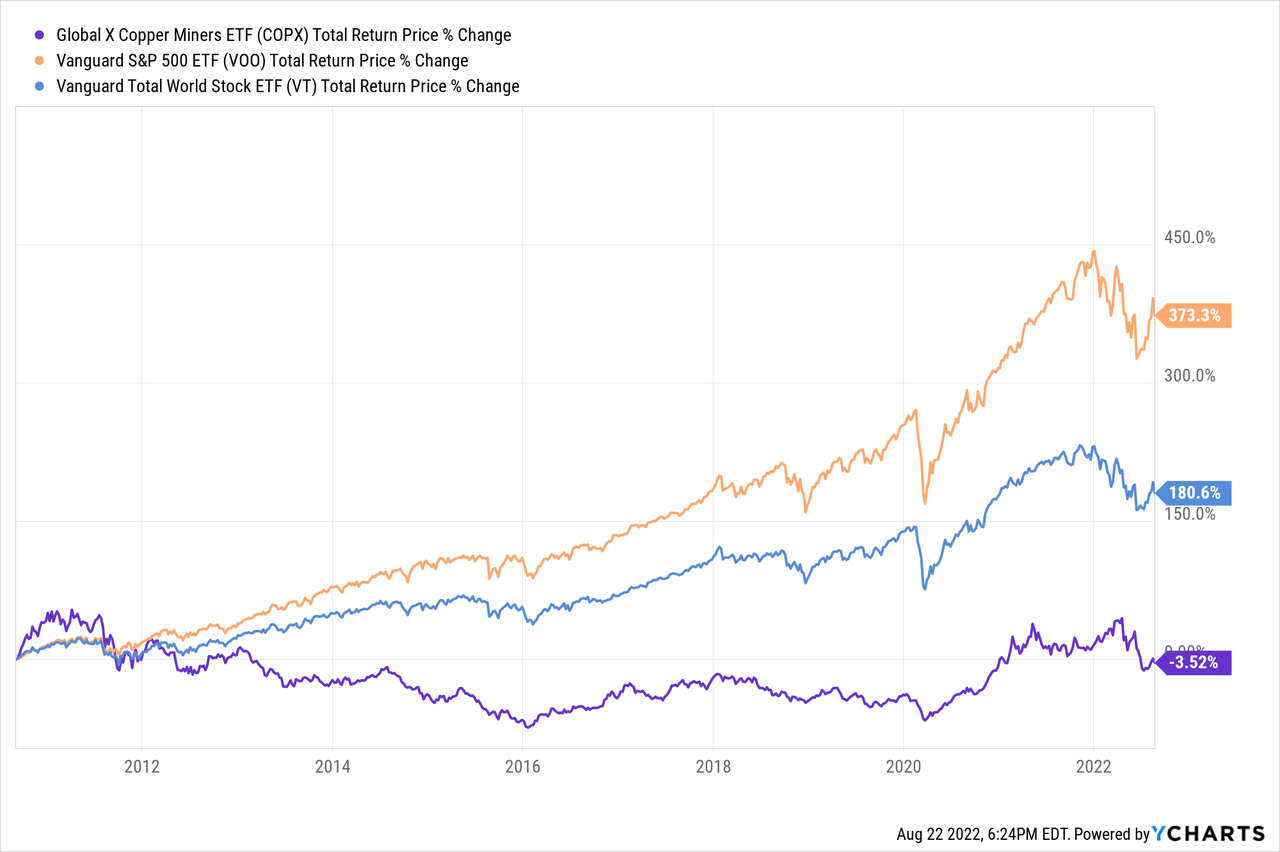

- Total Returns CAGR 10Y: 1.0%

COPX – Overview

COPX is an equity index ETF, investing in global copper miners. It tracks the Solactive Global Coppers Miners Index, an index of these same securities. It is a relatively simple index, investing in companies engaged in copper mining and closely related activities from across the globe. The index includes diversified mining companies with significant copper mining operations. As with most indexes, there is a basic set of liquidity, trading, and size criteria, although these are quite lax, owing to the tiny investment niche targeted by the index. It is a market-cap weighted index, with a 4.75% security cap, meant to ensure a modicum of diversification.

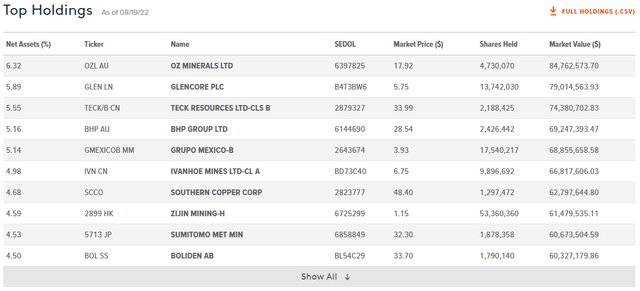

COPX targets the copper industry, a tiny, niche industry, so diversification is low, and the fund’s performance is strongly dependent on the performance of said industry. There is some diversification from the fact that several of COPX’s underlying holdings are diversified miners, not pure play copper miners, but commodity prices and commodity companies are somewhat correlated, so diversification remains low. COPX invests in 40 different companies, a reasonably good amount for a niche industry fund. The fund’s ten largest holdings are as follows.

COPX

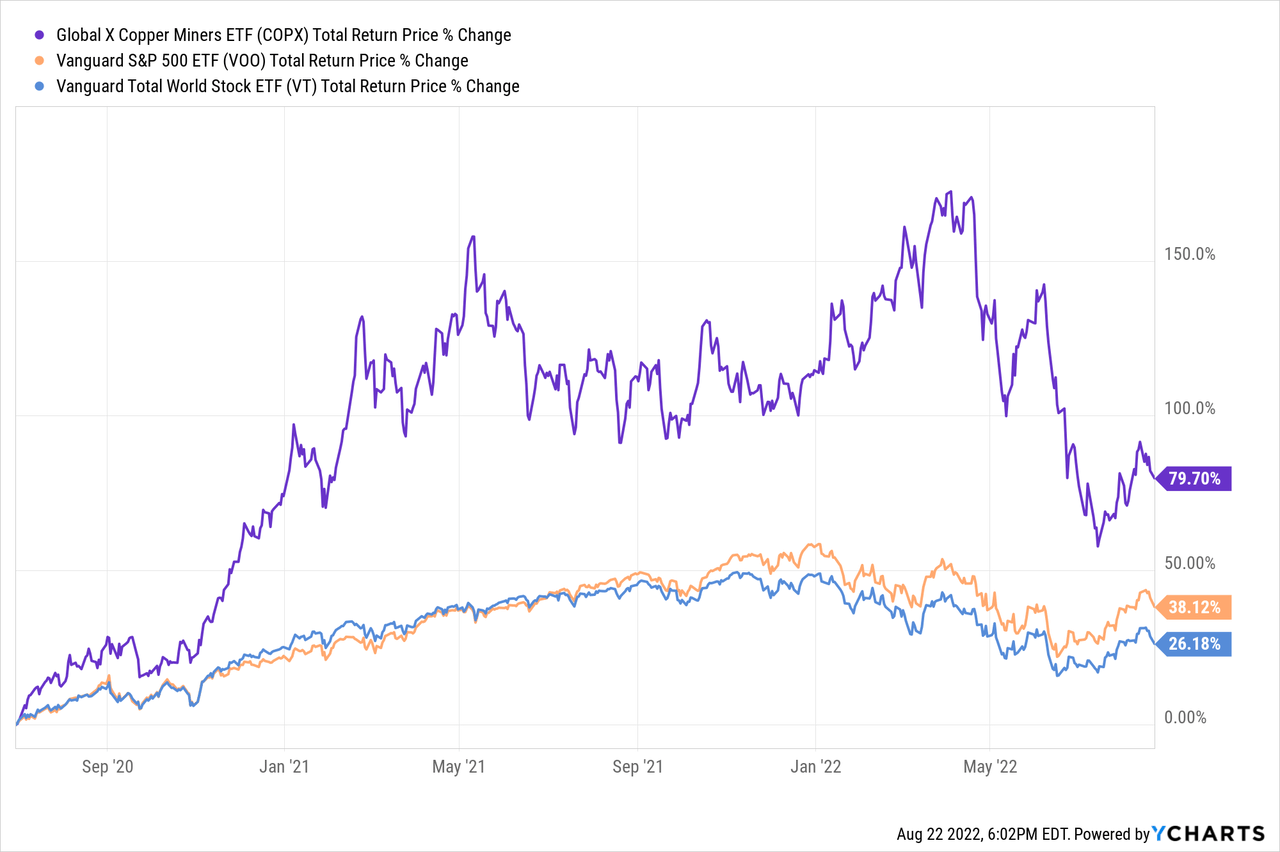

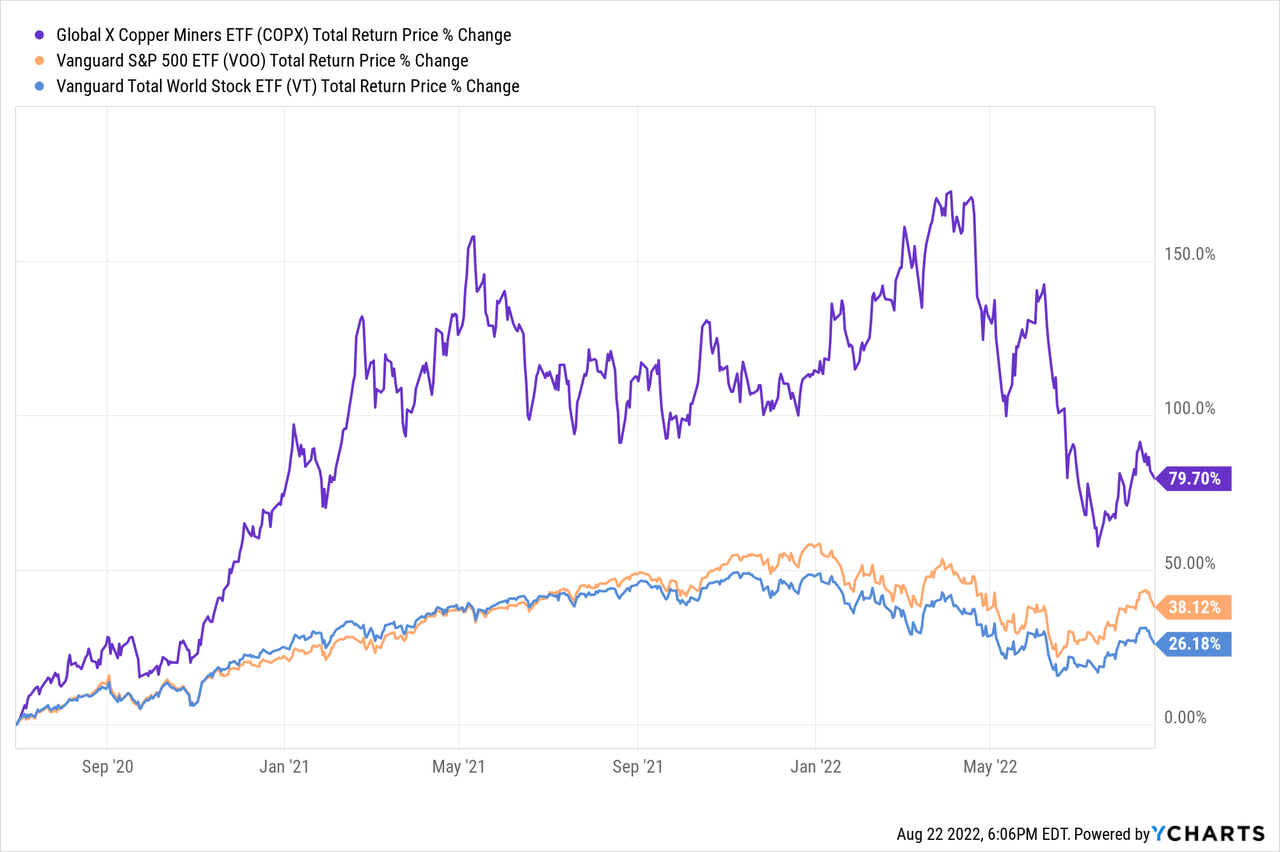

As COPX focuses on the copper industry, fund performance is strongly dependent on the performance of said industry, and on copper prices. Expect significant, market-beating returns when copper prices increase, as has been the case since mid-2020, during which copper prices have increased from $2.75 a pound to $3.65 a pound, as per Macrotrends.

Let’s summarize the above.

COPX is a global copper miners equity index ETF. Fund performance is strongly dependent on copper industry performance and copper prices, which brings me to my next point.

COPX – Investment Thesis

COPX’s investment thesis rests on the fund’s strong expected returns, underpinned by strong industry performance and increasing copper prices. Specifically, demand for copper is rapidly increasing, while supply is stagnating, which should ultimately result in higher copper prices, and better financial and shareholder performance for COPX and its underlying holdings. Let’s have a look at these two points.

Copper Demand Analysis

Copper is predominantly used to make electrical wiring, cable conductors, and electricity transmission lines. Demand for copper is skyrocketing as increased renewable energy generation and investment necessitates the construction of new transmission lines, which use tons (literally) of copper. As per the International Energy Agency, global energy investment is growing at a double-digit annual growth rate, and is shifting towards renewables, infrastructure, and power generation, and away from fossil fuels. Shifting investment trends will serve to boost demand for copper, which should lead to higher copper prices and sales.

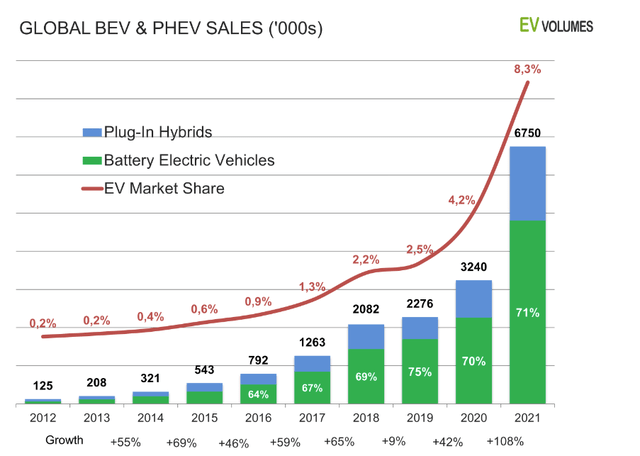

Copper is also a (minor) component in electric vehicles / batteries. EVs are a booming industry, with rapidly increasing adoption and sales. EVs have grown at a double-digit CAGR for around a decade, and even reached triple-digit growth in 2021. Most analysts are forecasting further double-digit growth for years, due to environmental concerns, favorable government regulations, and high gas prices. Increased EV adoption should also boost copper prices and sales.

EV Volumes

Increased demand for copper should lead to higher copper prices, ultimately resulting in increased financial and shareholder performance for copper miners, including COPX’s underlying holdings.

Copper Supply Analysis

Rising copper demand and prices increases the profitability of prospective copper miners, which should result in greater CAPEX, investment, and, ultimately, new miners on the part of copper miners. In theory at least. In practice, environmental and regulatory concerns have caused copper supply to stagnate. As per Bloomberg, the permitting process for new mines has increased from around 6 months to 2 years in most relevant markets. Regulatory uncertainty has increased too, with most permit applications being denied by the relevant authorities. As per Bloomberg, no new copper mines have been permitted in the past two years, and it is unclear under what conditions will new ones be allowed. Several other issues are negatively impacting the copper industry too, including rising costs, lack of qualified personnel, and rising financing costs. These are relatively minor issues, but their impact is still negative.

Stagnating copper supply all but ensures that copper prices will remain high, as production is set to stagnate. Even if copper miners are ultimately successful in expanding production, it will take them years to go through the permitting process, and more time still to actually set the mines up. As things currently stand, copper supply will almost certainly stagnate for years, regardless of what copper miners do.

Increased copper demand and stagnating copper supply should lead to rising copper prices, as has been the case for the past two years or so. As mentioned previously, copper prices have increased from $2.75 in mid-2020 to $3.65 as of today. Increased copper prices have led to significant revenue and earnings growth for global copper miners, causing COPX to outperform relative to most of its peers.

Insofar as current trends continue, which seems likely, COPX will almost certainly continue to outperform.

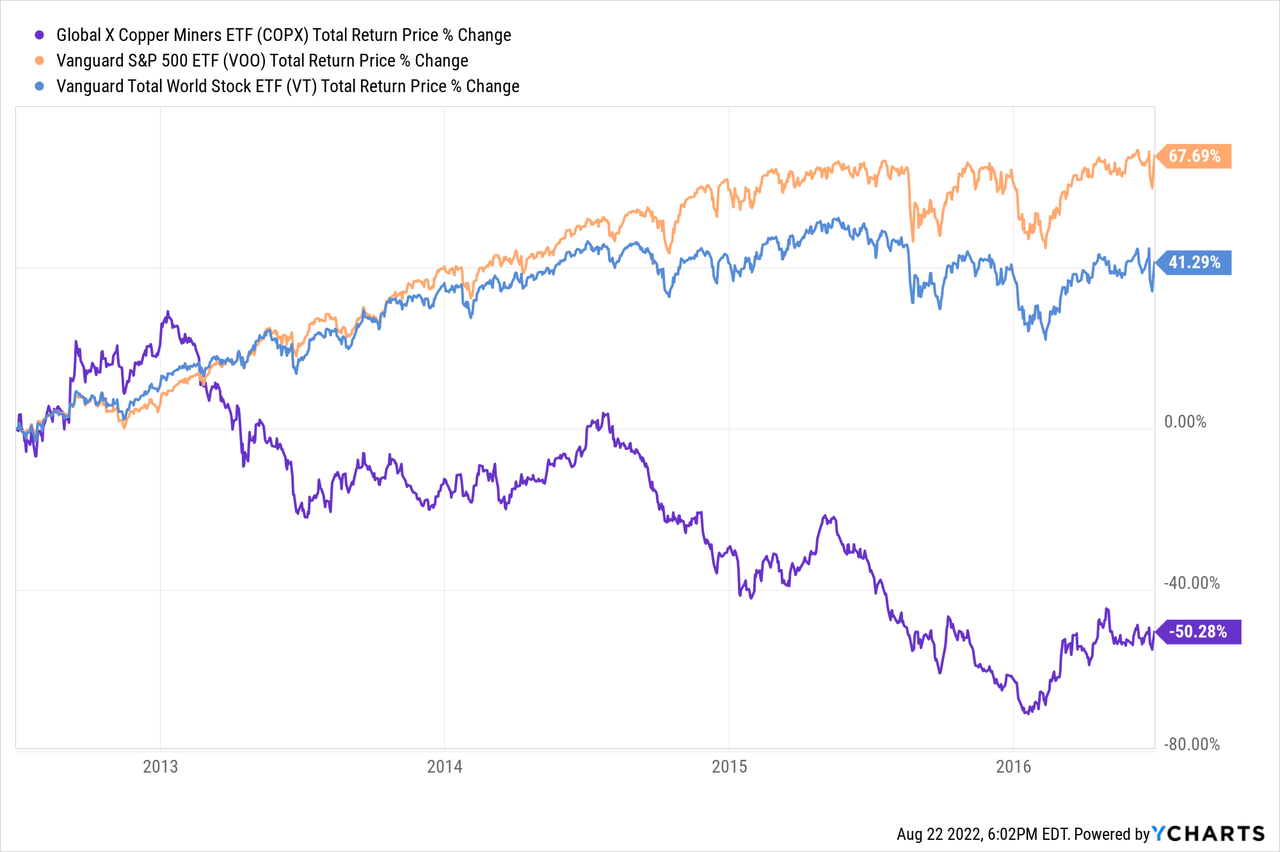

As a final, more negative note, there is obviously no guarantee that current trends will continue. COPX should underperform if copper prices moderate, and should significantly underperform if these plummet. Although current trends and signs point towards high / higher commodity prices, the longer-term trend has been towards lower commodity prices due to increased supply, technological change, and a shift towards less resource-intensive economic sectors. Due to this, COPX has significantly underperformed since inception.

In my opinion, COPX’s future returns will be materially stronger than above, as has been the case these past few years. Still, the long-term performance track-record is incredibly weak, an important negative for the fund.

Conclusion

COPX is a global copper miners equity index ETF. Rising copper demand and stagnating copper supply have caused copper prices to skyrocket in the past two years, leading to significant, market-beating returns for COPX and its shareholders. In my opinion, the trend is set to continue, which should result in further gains for COPX and its shareholders. The fund is a buy, but only appropriate for more aggressive, risk-seeking investors.

Be the first to comment