The outbreak of Coronavirus has tested the world’s medical professionals like never before. With the number of infections growing exponentially, doctors and nurses are in short supply, as is the medical equipment necessary to address the global pandemic. The microscopic virus has triggered the most significant risk-off event since the 1930s. The market volatility has surpassed the 2008 financial crisis. As the number of cases mounts, fear and uncertainty have gripped people around the world. Markets reflect sentiment, and panic selling has impacted markets across all asset classes.

In the world of commodities, copper is often a barometer of the health and wellbeing of the global economy earning it the moniker as “Doctor Copper.” The price of the red metal that is the leader of the nonferrous metals that trade on the London Metals Exchange was sitting above the $2 per pound level on March 24, after probing below that level over recent sessions. The Invesco DB Base Metals Fund (DBB) replicates the price action in copper, aluminum, and zinc.

Copper probes below $2 per pound

Doctor Copper moved lower during the risk-off period, but it has bounced from the $2 per pound level. The red metal is sitting on the edge as the number of cases and fatalities rise. The World Health Organization said that the epicenter for Coronavirus is now in the United States and Europe. Copper may be sitting above $2.20 per pound on March 26, but the red metal remains vulnerable for a far deeper decline.

Source: CQG

The quarterly chart shows that copper is likely to put in a bearish reversal on the long-term chart in the first quarter of 2020. The price traded above the high from the fourth quarter of 2019, and if it closes below the Q4 low of $2.5150, it will result in a technical formation that could push the price appreciably lower. Price momentum and relative strength are falling below neutral readings. At the same time, the total number of open long and short positions in the copper futures market has declined from just under 267,000 contracts in late 2019 to the 181,229-contract level. Typically, falling open interest when the price of a futures contract falls is not a validation of a bearish trend, but these are hardly ordinary times. The decline in the open interest metric reflects risk-off conditions pushing market participants to the sidelines. Quarterly historical volatility at over 20% is at the highest level since 2013.

The thing to remember is copper’s reaction to the global financial crisis in 2008. The price dropped from a high of $4.2160 to $1.2475 per pound from May through December. Additionally, before 2005, copper never traded above $1.6065 per pound.

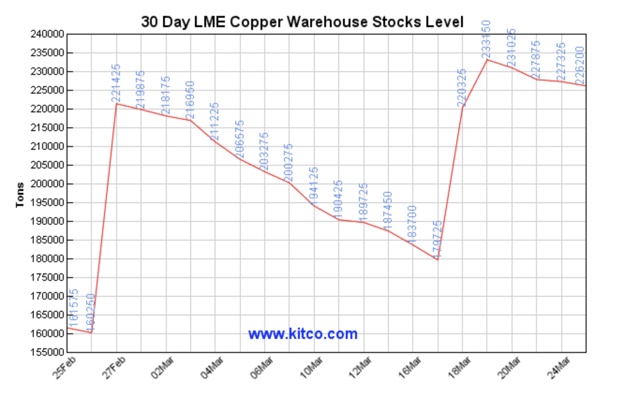

Stockpiles rise

Copper stockpiles on the London Metals Exchange have increased since the end of February.

The chart shows that inventories rose from just over 160,000 tons in late February to 225,175 tons as of March 23, a rise of over 41%.

The chart shows that inventories rose from just over 160,000 tons in late February to 225,175 tons as of March 23, a rise of over 41%.

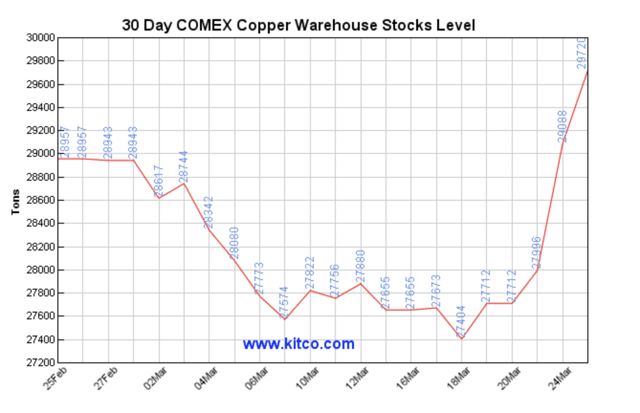

Source: Kitco/COMEX

The chart shows that copper inventories on COMEX have also begun to edge higher, rising by over 2300 metric tons since March 18. Rising stocks reflect the sudden halt in economic activity. We could see volatility in the inventory data based on events in the world’s leading consuming and producing nations over the coming weeks.

Copper is all about China

China is the demand side of the equation when it comes to copper and other nonferrous metal consumption. While China may be a barometer for the global economy, the price is highly sensitive to economic trends in China.

The Asian nation was ground zero for the outbreak of Coronavirus, and reports have been that the world’s most populous country is over the hump when it comes to the global pandemic with declining infections and fatalities. However, trusting the data out of China involved a significant lead of faith as they were not forthcoming with information at the beginning of the pandemic and may not be releasing accurate data at this time.

China has told the world that it has gone back to work, but there is no way to know for sure if the virus is not still claiming growing victims in the world’s most populous nation.

Shortages in South America are possible, but risk-off is a danger

On the other side of the world in Chile, the world’s leading producer of the red metal, and in Peru, the nation with the second leading output, medical technology may not be sufficient to address the global pandemic. The data on infections and fatalities from these countries is suspect in the early days of the pandemic. At the same time, if lockdowns in South American countries persist, we could see a slowdown in production. China is the third leading producer, followed by the United States. The longer it takes to develop treatments and a vaccine, the higher the potential for a halt to copper production around the world, which could eventually create shortages. In the aftermath of the global financial crisis in 2008, the price may have declined to under $1.25, but in 2011 it rose to a higher high of $4.6495 per pound.

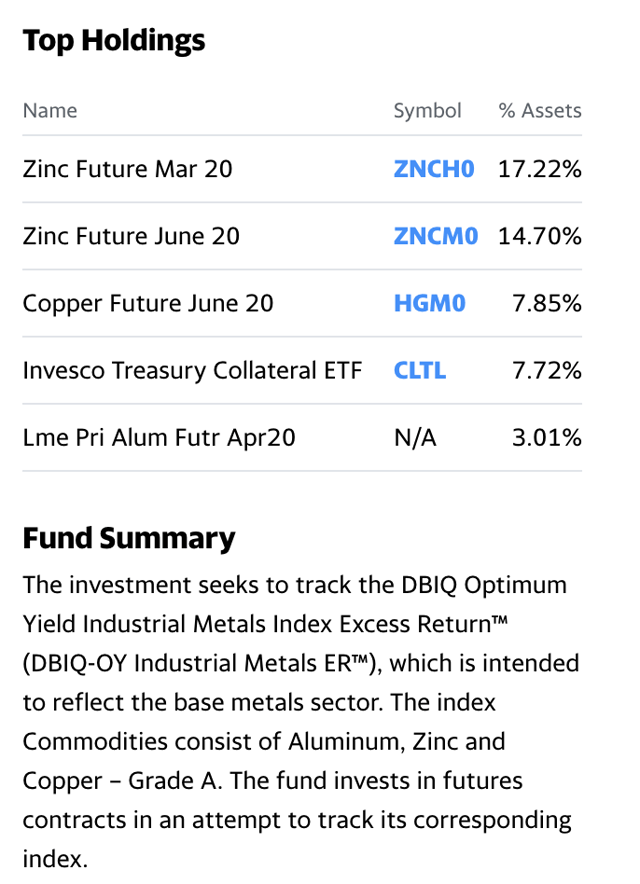

DBB is the base metals ETF product, and copper is the leader

We should prepare for lots of volatility in the copper market. Price variance in all markets will reflect not only the unprecedented halt to business activity but the tidal wave of central bank liquidity and fiscal policies to address the economic disaster created by the pandemic. Falling prices could cause a halt to the production of copper and many other commodities, but the liquidity and programs will increase deficits and devalue currencies. We could see the current deflationary spiral turn into an inflationary explosion once the virus is under control. A trail of economic ruble is likely to follow in its wake.

The top holdings and fund summary of the Invesco DB Base Metals Fund (DBB) include:

Source: Yahoo Finance

DBB has net assets of $101.42 million, trades an average of 110,072 shares, and charges an expense ratio of 0.75%.

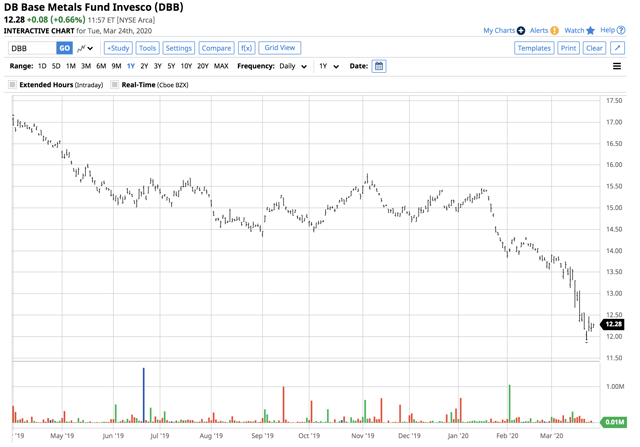

Source: Barchart

DBB has been making lower highs since 2018. The peak in 2020 was at $15.46 per share in mid-January. At $12.28, the ETF was 20.6% lower. Copper was sitting at a vulnerable level on March 26, even though the price bounced from below $2 to the $2.2170 per pound level. The first price to watch on the downside is the January 2016 low of $1.9355. The longer risk-off conditions persist, we could see the price of the red metal experience a downdraft. The DBB could be a tool when copper and the other base metals find a bottom. The treatment for the asset markets could cause an inflationary period that lifts prices in the months and years ahead. I would only buy copper and other commodities on a wide scale, leaving plenty of room to add during periods of price weakness. It is virtually impossible to pick the low in any market.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Be the first to comment