hroe/iStock via Getty Images

Better than boring alone is a stock that’s boring and disgusting at the same time. Something that makes people shrug, retch, or turn away in disgust is ideal.

Peter Lynch, One up on Wallstreet, Chapter 8 (3)

Peter Lynch is one of the best investors of all time. Having led the legendary Magellan Fund at Fidelity Investments between 1977 and 1990, Lynch averaged a 29.2% return over the 13 years and increased assets under management from $18 million to $14 billion before retiring. Peter Lynch loved to invest in companies that weren’t hyped or popular. Instead, he looked for boring and dirty businesses that most people don’t want to talk about, let alone invest in.

If I could avoid a single stock, it would be the hottest stock in the hottest industry, the one that gets the most favorable publicity, the one that every investor hears about in the carpool or on the commuter train – and succumbing to the social pressure, often buys.

Peter Lynch, One up on Wallstreet

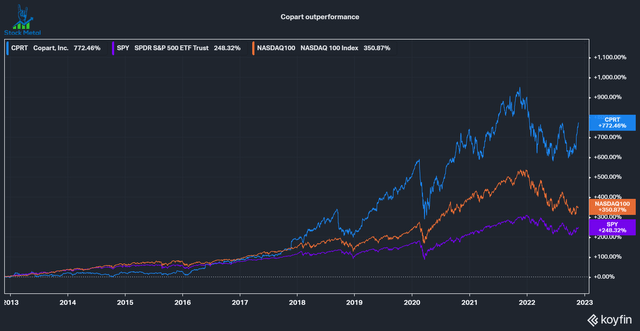

Copart (NASDAQ:CPRT) has been a tremendous success over the last ten years, doubling the returns of the Nasdaq 100 and tripling the S&P 500’s returns. The company is a company much to the liking of Peter Lynch: A company in a boring industry that some even would find disgusting or repulsive. Most certainly, it’s a dirty business, though. It isn’t a fancy, high-tech company. They operate scrapyards and an auction platform. Let’s look at how Copart outperformed and determine if it can continue to do so.

Copart’s ten year outperformance (Koyfin)

What does the business do?

Copart operates an online car auction website and owns car salvage yards, which is quite a boring business. The company mainly works with insurance companies. After a car is involved in an accident, the insurance company calculates if it is worth repairing. If the car price minus the repair costs is higher than the salvage cost, the car gets repaired. Otherwise, the vehicle is considered totaled and is getting salvaged for parts. Copart has the largest auction platform for vehicles, with over 265,000 vehicles available, more than three million sales per year, and buyers in over 190 countries.

The business has several tailwinds which give Copart a significant runway for growth:

A growing and aging car fleet:

According to recently acquired competitor IAA (IAA), the US used vehicle market keeps expanding by about 2 million vehicles a year.

If you do the quick math, given that they are on average 14 million vehicles entering the market every year and only about 12 exiting that means that the number of vehicles on the road increases each year, creating an expanding fleet of aging vehicles that propels the growth of our market.

John Kett, CEO at IAA

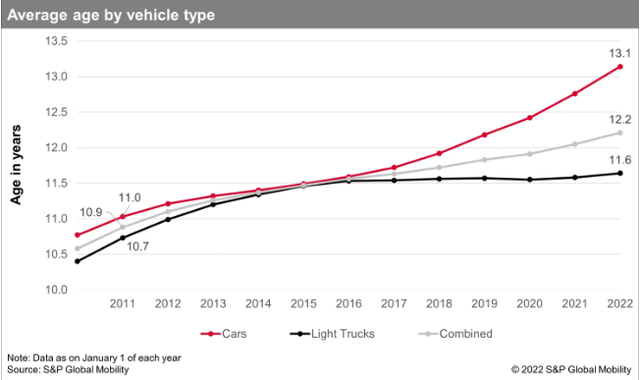

Older cars are less likely to get repaired and are most likely going to get salvaged for parts. The graphic below from S&P Global (SPGI) shows that the average age for all vehicle types has increased over the last decade.

Average age by vehicle type (S&P Global Mobility)

Vehicle complexity:

Vehicles are becoming more and more complex every year, with trends like the switch to electric vehicles and autonomous driving solutions. I also wrote about this in my recent Texas Instruments (TXN) article. This increased complexity keeps driving total loss rates (total loss is when a car is salvaged instead of repaired) up, from 8.5% in 2000 to 20% in 2019. The pandemic dropped rates below 18% because the semiconductor and car shortage drove up used car prices. This made repairing a vehicle a lot more lucrative in many cases. This is just a short-term trend, though, and these rates will keep increasing over the long term.

What about competition?

Copart is not the only player in this market but holds roughly 40% of the US market. The second-largest player, IAA, recently announced a merger with Ritchie Bros. (RBA). The announcement saw Ritchie Bros dive 20%, leaving many analysts scratching their heads at the lack of synergies between the businesses. Ritchie Bros also operates auction sites, but they do no business with insurance (the main customers for Copart and IAA). This leaves me questioning the strategic synergies for this merger. I believe that the real winner of this merger is Copart. I do not expect IAA, which has struggled a lot on its own in the past and had an activist call to fire the CEO earlier this year, to strive under the umbrella of Ritchie Bros. This opens an opportunity for Copart to increase its market share gains.

An excellent management

Willis Johnson has founded Copart (he still owns 6.8% of shares outstanding) and even though he does not lead the company anymore, his family still does in a way. Current CEO Jay Adair started at Copart in 1989 at age 19 and became CEO in 2010. He also married Johnson’s daughter Tammi and accumulated 3.7% of his father-in-law’s company over the year. He fully aligns with shareholders and only gets a one-dollar salary plus equity-a truly remarkable story.

Copart’s management is owners, and they think like owners for the long term. Rarely do you find executives talking about the next 40 years as their time horizon, like Copart did in their Q4 2022 earnings call. This long-term thinking can be seen in the company’s strategy to acquire and own the land they buy, rather than leasing it as competitor IAA mostly does. Copart is looking for long-term relationships with its insurers and is very focused on that. Companies that focus on their customers and aim to increase their value rather than short-term profitability often prosper. Since Covid, Copart, for example, started to virtualize the workflow for insurance employees who couldn’t check on their cars daily. Copart keeps taking work away from the insurances and doing it themselves more efficiently, creating an advantage for both parties. This helps the long-term relationship and creates another moat.

they [insurers] have faced some of the same hiring and retention challenges that the economy more broadly has as well. And as a result, they are asking us to do more, and we are offering to do more

Copart Q4 2022 Earnings Call

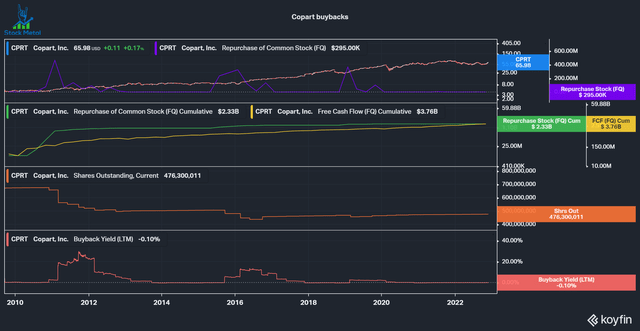

Copart is one of the few companies that do buybacks well. Unlike most companies that buy back all the time at all prices, Copart buys back huge quantities of stock at depressed levels. For example, Copart repurchased 29% of shares outstanding in 2011 and 12% in 2016. Copart’s priority is reinvestment in the business by growing its yard network or expanding into new regions. Still, they are ready to buy back a lot if they see an opportunity.

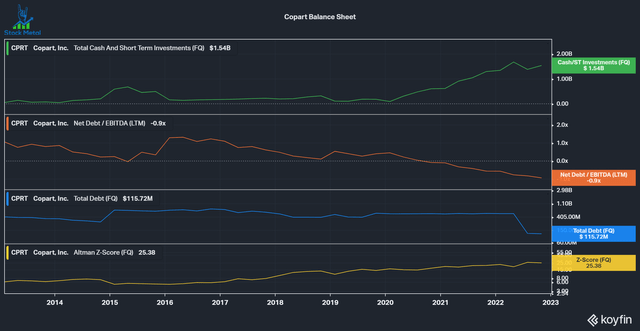

Balance sheet

Copart has a very clean balance sheet, with $1.4 billion in net cash and an ever-growing Altman Z-Score that currently sits at 25. The company does that for two reasons: The opportunistic buybacks I mentioned above, and the other is being prepared for all types of catastrophes. In its mission to serve its customers the best way possible, the company wants always to be ready to serve, no matter the circumstances. The balance sheet will allow for quick action, whether in a financial or natural disaster.

Priced at a premium

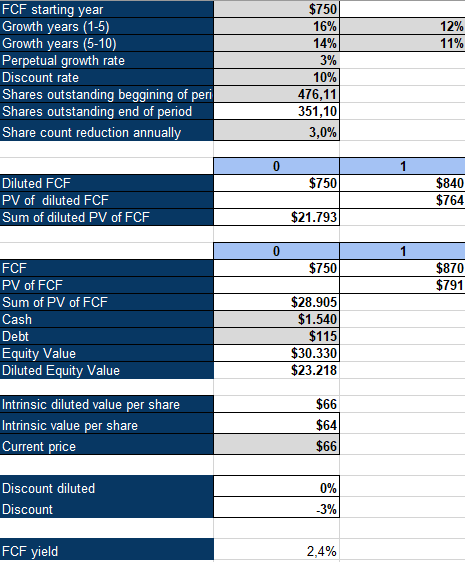

To value the company, I use an inverse DCF model, assuming a 3% perpetual growth rate, a 10% discount rate/required rate of return and a 3% annual buyback yield in line with its history. The market expects an 11-12% growth rate for the next ten years, well below its historical 19% five-year CAGR. I believe that even at their scale, the company can grow at this speed. We also need to remember that I use a 3% perpetual growth rate after year 10, the model assumes 3% growth. Most high-quality businesses can grow at high rates for a very long time. If we, for example, increase the perpetual growth rate from 3% to 5%, the needed FCF growth in the first ten years drops to 8-9%.

Copart Inverse DCF (Authors Model)

Copart is high up on my watchlist

Copart is a very high-quality business in a dirty industry like Peter Lynch must love. The company has a long-term mindset and is aligned with shareholders. Several tailwinds support the company’s growth, and opportunistic buybacks can also significantly boost returns. Copart is currently very high on my watchlist and could be the next stock I’m adding to my portfolio to hold for the long term.

Be the first to comment