golibtolibov/iStock via Getty Images

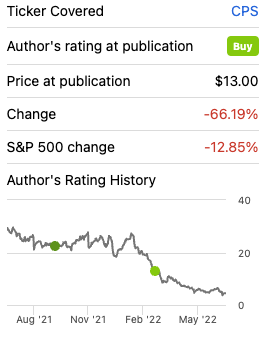

Since my last article, Cooper-Standard Holdings (NYSE:CPS) stock dropped a whopping 66%. In this article, I will go over the Q1 results, its debt, liquidity position and what options management has.

Seeking Alpha

Weak Q1 results due to inflation and the continued chip shortage

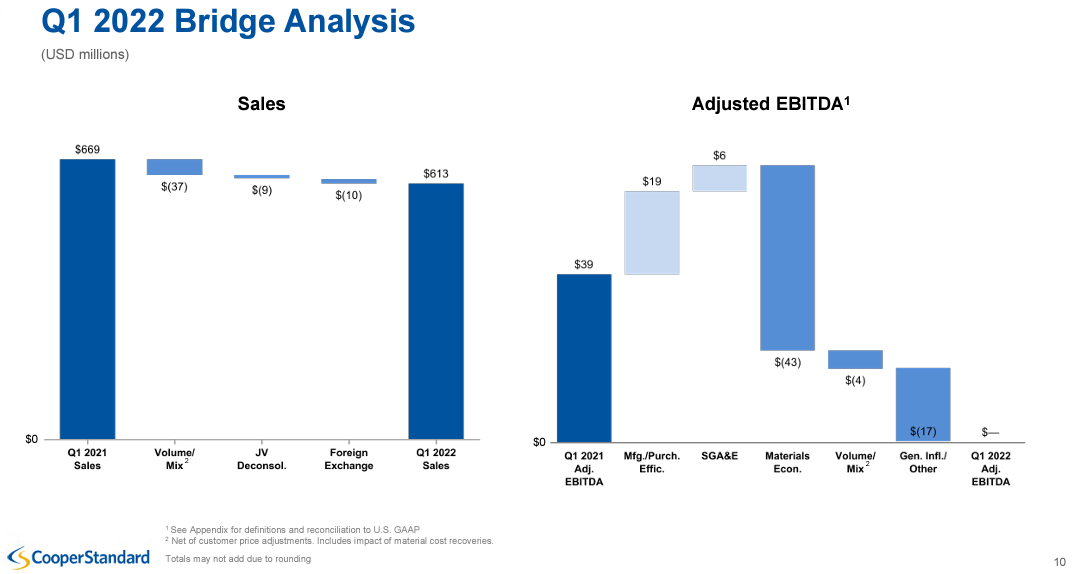

Revenues declined 8.4% to 613M USD mainly driven by lower volumes. Note that the volume drop is higher than 37M USD as the figure is net of any price adjustments and material cost recoveries. EBITDA went from 39M USD in Q1 2021 to almost zero (100k USD) in Q1 2022. While efficiencies brought 25M USD of benefits, it was not enough to offset inflation.

Cooper-Standard Presentation

While the chip shortage was not expected to be solved in a quarter as it takes years to build new plants, the addition of inflation converted the situation into a distressed one. On February 25, S&P downgraded CPS debt to CCC+ due to the lower sales and production volumes of clients as the industry is continuing to battle the supply chain issues.

CPS has a high debt burden

In late 2018, the share price traded above $140 per share, and the company used that opportunity to issue debt. However, as the auto industry is in the unfavourable part of the cycle, all that debt is a high burden for the operation.

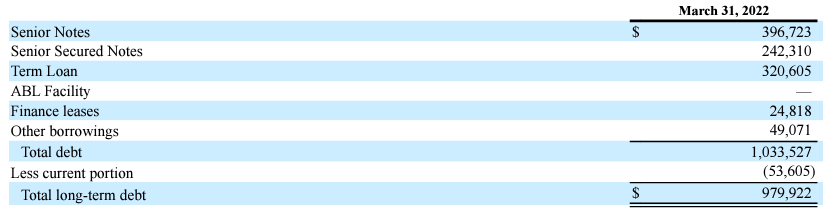

Currently, the total debt is well over 1Bn USD. The main three debts are a 400M USD note (5.625%) maturing in 2026, a 250M USD secured note (13%) maturing in 2024 and a 340M USD term loan. Note that the balances seem lower in the fillings due to unamortized debt issuance costs.

Company 10-Q

Enough liquidity to survive till Q3 2023

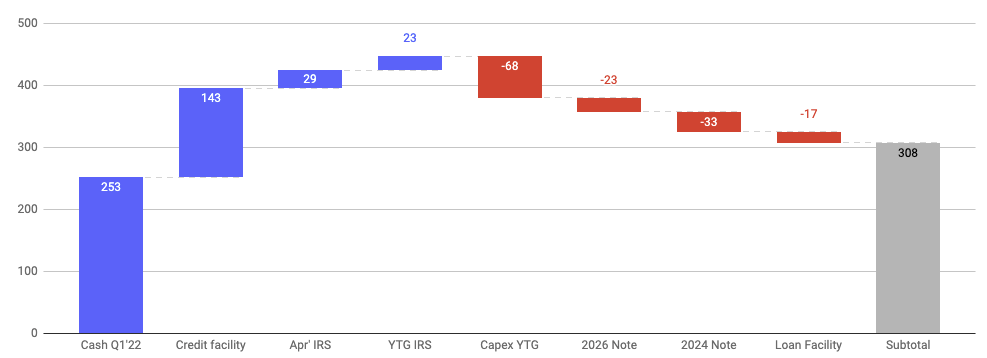

CPS closed the quarter with 253M USD in cash, however, including the 143M USD facility and 52M USD in tax credits, liquidity stands at 448M USD. We know that roughly 140M USD would be burnt on the capex remaining for the year and payment of the bonds and loan facility. That would lower liquidity to 308M USD before we consider any cash generated or consumed by the operation as illustrated below.

Company Presentation & Author estimates

So the main question is how long can CPS survive before the chip issue is alleviated and inflation is under control. As I explained in this article, the chip shortage should be fully solved by 2024, I expect some recovery in 2023 as the chip manufacturers re-allocate more chips to auto manufacturers. There are many forecasts as to when inflation would return to 2% but some ‘experts’ (the same experts that believed this inflation to be transitory) believe inflation would endure a couple of years.

CPS has done a great job at indexing more than 60% of its revenue. This means that in the coming months, the impact of inflation should be partially mitigated.

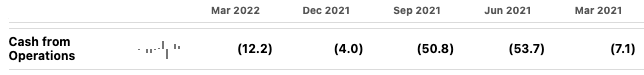

Below is the cash consumed in the last five quarters. While inflation has been escalating, the cash burn in the operation declined from +50M USD in the second and third quarters of 2021 to 12M USD in the latest quarter. This is the result of the cost-saving efforts and some of the indexed contracts. For example, just in Q1 of 2022, CPS avoided 25M USD in costs thanks to its saving programs.

Seeking Alpha

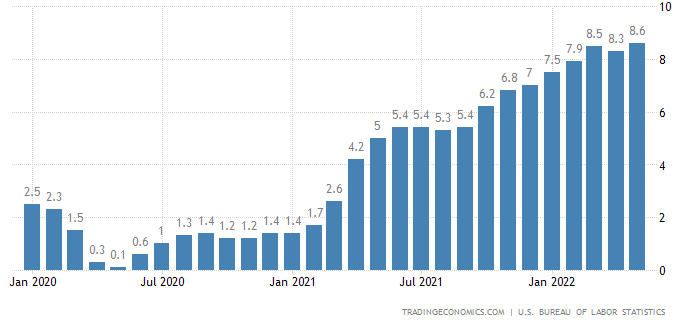

US monthly inflation

TradingEconomics.com

In the last earnings call, management increased the full-year cost related to inflation from 70M USD to 100M USD, assuming 50% would be absorbed by the contracts, there is a 15M USD extra cash burn from the new inflation estimates. However, if we assume that CPS will burn 50M USD per quarter, they have enough cash to last till Q3 of 2023.

Management has tough decisions to make

It would be a bad decision to just hope the issues would be resolved before the cash evaporates, so I am glad management is looking at options. I think management has four alternatives, I really hope they go for a combination of the third and fourth options.

Option 1: Issue shares

The most unpopular alternative is to issue shares. At $4 a piece, the dilution for current shareholders would be devastating. If they raise 500M USD, they would need to issue 125M shares, which would lead current shareholders to just own 12% of the company.

Option 2: Find a buyer

This would be an okay alternative not the best for shareholders as the buyer likely wouldn’t pay more than a 100% premium, at $8 per share many investors would still be losing on this investment. Also, finding a buyer right now is very challenging, inflation, supply chain issues and the war in Europe are significant deterrents. However, there are some buyers, Apollo agreed to acquire Tenneco (TEN) earlier this year for a 100% premium (you can read my thesis on TEN here if interested).

Option 3: Sell non-US operations

I really like this option. Besides adding liquidity from the proceeds, it reduces the company’s exposure to inflation and increases the profitability of the company as the non-US operations have lower historical gross margins. The two drawbacks I see here are the potential loss of some of the synergies acquired in the last couple of years and the difficulty finding a buyer (same as option 2).

Option 4: Buy some 2026 notes

This option would lower the interest burden and enhance the capital structure. These notes are trading at 50 cents. However, this would not mitigate the inflation and chip issues and would exhaust most of the company’s liquidity. That is why I really prefer to combine the third and fourth options as it would lower inflation exposure and optimize the capital structure.

Conclusion

I was very bullish on CPS even with the chip shortage as you could tell from my previous articles. However, the persistency of inflation has turned the story. While I still see value in the company, it needs to survive till inflation is under control and the supply chain issues are resolved. I believe management has the opportunity to come out stronger from this situation. I think the best option is to sell the non-US operation (or part of it) as it would kill two birds with one stone. It would enhance the capital structure, and it would eliminate the least profitable segment of the company.

However, selling the business in this macro environment is not a walk in the park and maybe issuing new shares is the only option. In that case, current shareholders would be significantly diluted. As this is a very fluid and risky situation, I recommend a small exposure to CPS (CPS represents 0.4% of my portfolio).

Be the first to comment