luismmolina/iStock via Getty Images

Preamble

Ask anyone about the world’s population, and they will tell you that the planet’s population is exploding higher. A well-read individual will quote the UN report, which suggests that the population of the earth will balloon to 9.7 billion souls by 2050. But is this really likely? I’m old enough to have been exposed to many such projections. Does anyone remember the “Doomsday clock”? This jolly sounding metaphor came to prominence for me in the 70’s. At that time, midnight was suggested to be the onset of a nuclear catastrophe, and it always seemed to be 23.55. This was a boon for the manufacturers of both miniature underground nuclear shelters and sedatives. Then in the 80’s, as I recall, we had something new to give us sleepless nights; climate change. If a Dutch person read a newspaper from the period, they would discover that they are now living six feet underwater, which would come as a surprise for those Dutch citizens sipping their morning cappuccino on Utrechtsestraat.

There are numerous reasons to conclude that the world’s population may well shrink rather than expand. Let’s begin with the UN’s claim that life expectancy will increase over time. A recent study conducted by the BMJ and Yale have concluded that life expectancy globally has in fact declined in recent years. In the US, a fall in life span began in 2019, and now due to the pandemic, this has accelerated. Even more disturbing have been the recent reports from US insurance companies describing an almost 40% increase in all-cause mortality amongst 18 – 64 year olds since 2021, and these deaths are not necessarily linked to COVID. Clearly, amongst those unfortunate individuals are persons who would have expected to help form the next generation.

In addition to those of child rearing age dying prematurely, fertility is dropping in many countries at an alarming rate. By now, many readers will be aware that Japan’s population is in decline. Specifically, there are 6.95 births per 1,000 of the population whist the death rate is 11.59 per 1,000. It doesn’t take a PhD in physics to realize that mathematically, if this trend continues, the population will, at some point, reach zero. But readers may not realize that the pattern is being repeated in countries throughout Asia; China for example. The most recent report for China suggest that 1.30 is the current fertility rate of women, although some data calculates an even lower figure of 1.16. In fact, China currently has one the lowest fertility rates in the world. The figures for China are actually less than that of Japanese women; 1.36.

Even in areas of the globe where large families are the cultural norm, birth rates are falling; the Middle East and North Africa for instance. In Iran, Lebanon, Tunisia, and Turkey, fertility is at or below the replacement level of approximately 2.1 children per woman.

Birth rates in Europe are marginally better than Asia, although the direction of fertility is also South. The latest data for the EU reveals that in 2020, the total fertility rate was 1.50 live births per woman, compared to 2.5 in 1960.

And of course, the pattern of declining birth rates is repeated in the US. From the CDC publication, the number of births for the US in 2021 was up 1% from 2020, which was the first rise since 2014 (the number of births dropped by an average of 2% per year from 2014 to 2020, including an increased decline of 4% from 2019 to 2020). Even though the birth rate climbed 1%, the current rate is still will below the value needed to continually replace the population.

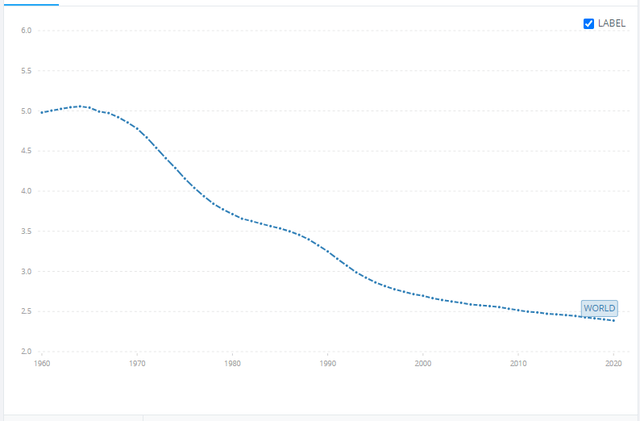

Whilst it is true that in many countries the local population is rising, the world bank estimates that the average fertility is on the decline, as the graphic below shows. Furthermore, in those countries with a high birth rate, child mortality is typically higher.

fertility data from the World Bank (The World Bank)

Graph courtesy the World Bank

Many reasons have been touted for the dwindling birth rates. In China for instance, for many years there was the one child policy and more recently, the costs associated with having a family have been rising. In the Middle East and North Africa, researchers have put forward the theory that there is now a greater emphasis on economic aspirations among citizens and the rise in the age of marriage.

In Europe and the US, a host of potential factors have been suggested, including; a greater popularity of contraception, the extortionate cost of raising children, improved employment opportunities for women, and the high level of student debt. It is conceivable that all of the explanations listed play a role, however there are a far more insidious possibilities; environmental factors.

Over the years it has been observed that not only is male fertility on the way down, but also female fertility is showing the same trend. And now the situation has become so bad that circa 15% of couples in the US are having difficulties in making babies. Even more astonishing, globally, 48.5 million couples experience infertility at some point in their relationship. Given the nature of the trend, it’s fair to assume that a greater number of couples will be in the same predicament in the future.

Whilst it is certainly true that life style choices can impact fertility, the more likely culprits are the huge numbers of hormone disrupting chemicals that we all come into contact with by simply getting on with our daily lives. I’ve previously written about Bisphenol A, one of the most widely known of these harmful chemicals, but there are many more.

For instance, a class of chemical that has appeared in the news quite often in recent years is phthalates. These chemicals are found in the plastics used for food containers and the plastic film used to wrap foodstuffs in supermarkets. As phthalates are not chemically bound to plastics, they tend to leach into food; thereafter, into you, the consumer. Rather than act as a kind of nutrient, these compounds can adversely affect hormones, lower sperm count and produce thyroid problems. And a recent piece of research has shown that many Western men are exposed to levels of hormone disrupting chemicals that are far beyond levels that are considered safe.

There are those in our society who applaud these developments since they may believe that our planet cannot sustain huge numbers of our species. However, there are people who have both the means and the desire to have a family.

The Cooper Companies to the rescue

Followers of The Cooper Companies (NYSE:COO) will know that the enterprise has two divisions; CooperVision, which supplies contact lenses and CooperSurgical, which includes the fertility division. As you may gather, the focus of this article is the fertility division.

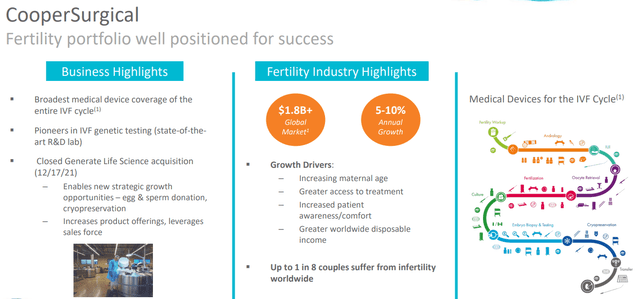

From the graphic, you can see that the company provides an end-to- end solution for the IVF industry. They have a product portfolio that encompasses both consumables and capital equipment. And much of the capital equipment supplied is highly sophisticated and includes AI-based genetic testing, which doctors used to select the best embryo transfer. Their proprietary technology is a significant differentiator and is a compelling moat against competitors.

The Cooper Industries Quarterly Report (The Cooper Industries )

Graphic courtesy The Cooper Companies quarterly report

According to the Q2 2020 report, the fertility segment of the company generated $83.4 Mn in sales. In the equivalent period this year, the fertility business produced $114.4 Mn in revenue, which represents a whopping 34.7% increase YoY.

At the present time, the fertility segment makes up a relatively small percentage of their revenues (Total quarterly revenue Q2 2021 -$829.8 million), however, given the drivers listed, it is my contention that this will grow significantly going forward, and this growth has yet to be fully appreciated by the market.

Company Valuation

By a number of measures, the company would appear to be a tad overvalued. For example, you may note that the Price/Cash Flow is well ahead of its peers in the health care sector. Also, the shares are trading at a Price/Earnings of around 25; again, ahead of others in the sector.

Header (Seeking Alpha) Seeking Alpha

Graphic courtesy Seeking Alpha

However, according to the last quarterly report released in June, the company is showing good growth. The release stated that revenue was $829.8 million, up 15% from last year’s second quarter, which is not too shabby. It is my opinion that despite the relatively rich valuation, the future prospects are excellent.

Risks

I would say that there are two main risks facing Cooper. First of all, the doomsayers may be right and there will be a market correction of biblical proportions. If this occurs, then it is likely that all assets fall in value.

Secondly, as with all companies, there are competitors who may leapfrog Cooper to become the dominant player in the sector. As far as I can tell, there are only two companies whose focus is purely fertility; Swedish company Vitrolife (OTCPK:VTRLY) and Hong Kong listed Jinxin Fertility Group Ltd (OTCPK:JXFGF).

Summary

The market for fertility services is set to continue growing due to a variety of factors. It would appear that this trend is unstoppable. Since The Cooper Companies is best placed to benefit from this situation, I’m recommending an investment in the company despite the current valuation.

Caution

Please be advised that I am long The Cooper Companies, so please carry out your own due diligence.

Be the first to comment