Daria Nipot

Amazon (NASDAQ:AMZN) has had a couple of tough quarters with overly pessimistic investor sentiment, in my view. While covering Amazon over this period, I do see growing evidence that points to expectations being set too low and improving fundamentals at the company. As such, I think that this may make a great investment for the contrarian investor who sees an opportunity in taking an opposing opinion from the majority that is negative on the stock.

Investment thesis

I have written about Amazon in earlier articles that can be found here. While there have been challenges that are thrown into Amazon’s way, I think that the investment case for the company is rather clear and remains intact.

The first is that Amazon has made huge investments in the past 2 years to ramp up fulfilment capacity for its e-commerce business. These investments will bear fruit in the near future as Amazon is able to maintain its leadership in e-commerce and have more than sufficient capacity for future e-commerce growth. With excess capacity in the near-term, the company is managing this by tapering off these heavy investments in the near-term.

Secondly, Amazon highlighted in the first quarter that it is moving to accelerate productivity improvement and streamline its cost structure as a result of incremental cost headwinds of $6 billion highlighted in the first quarter. These improvements are starting to show results in the second quarter and we will likely see a much more efficient cost structure for Amazon’s business by the end of the year.

Last but not least, I continue to be positive on AWS as it continues to sustain its growth both in revenues and operating margins in the second quarter despite strength in the previous quarter. With a shift in capital expenditures from e-commerce to AWS, the business will continue to grow faster than the industry and AWS is likely to maintain its market leadership.

Solid second quarter results as revenues beat

Before talking about the 2 Prime days, I think it’s important to understand the current context of the company by looking at the 2Q22 results. Because Prime day was shifted to July, the second quarter will not have any effects of Prime day like in prior years.

However, Amazon’s earnings for the second quarter came in rather solidly against the back drop of growing pessimism and fears due to high base effects from the pandemic as well as incremental cost headwinds, as highlighted in previous quarters. Revenues grew 10% year on year excluding the effects of foreign exchange, which was better than what market expected and at the high end of its guidance. Even AWS revenue growth of 33% year on year was higher than expected by the market consensus, with the backlog growing 65% year on year. Also, advertising revenues were also better than market expectations as management commented that there is progress made with rolling out a wider range of ad products.

Operating income skewed to the positive in the second half of 2022

There were also signs of improvement in margins and progress on cost headwinds. Operating income was $3.3 billion in the quarter, above market expectations and at the top end of Amazon’s guidance. AWS operating margins for 2Q22 was 29%, higher than the expectation of 26%. Based on the total of $6 billion in incremental cost headwinds disclosed in 1Q22, the company has made solid progress in reducing these in the current quarter as it was reduced to $4 billion in the current quarter, as per management’s expectations.

There continues to be externally driven cost headwinds driven by higher energy, labor and freight costs that will not disappear overnight and will likely persist into the third quarter. However, the company made progress in improving the productivity of its fulfilment network as the overstaffing situation was more aligned to the demand situation in the second quarter, and the fulfilment network was better optimized for the expected demand for the quarter. Amazon also continues to see improvements in the transportation by improving the density of each delivery route and increasing the deliveries per hour that will drive cost efficiencies over time. Last but not least, management expects that the fixed cost leverage situation will improve in the second half of 2022 as they continue to grow into their capacity as utilization rates start to pick up in the second half, and as the company continues to slow new capacity additions.

All in all, I think that while good progress has been made in the cost headwinds front in the second quarter, we are likely to see more material improvements to these cost headwinds in the second half of 2022 as the productivity improvements and more streamlined cost structures meet higher demand and better utilization. As such, I expect that while the external inflationary headwinds may persist, based on my checks, I see that Amazon’s operating income for the second half is positively skewed to the upside.

Prime Day in July and another to come in October

Management continued to shrug off concerns about end demand concerns in its core e-commerce business, highlighting a successful Prime Day event in July. According to Adobe, Prime Day event in July resulted in online spending increasing by 8.5% in the United States in July. This July Prime day event resulted in more than 300 million items sold in the 2 days, more than any previous Prime Day. While the total sales figure was not reported, the larger number of items sold showed the durable demand we are seeing in Amazon’s customers as inflation continues to bite. As reported, the categories that customers moved towards during Prime Day included categories like home goods, consumer electronics and even Amazon-branded devices, all of which were the top-selling categories.

With strong commentary about the July Prime Day event, I can see the case for management deciding to do another Prime Day event in the same year. While it is the first for Amazon to have two Prime Day events, the next one in October could potentially show stronger sales than that of the July event given its proximity to the holiday season. With the October Prime Day expected to start on 11 October, I think that this helps Amazon take more of the market share from holiday spending as it undercuts competitors while being in good proximity for customers in need for a good bargain for their holiday shopping.

Furthermore, I think that while inflation may seem to hurt consumer facing businesses like Amazon, there are some benefits to Amazon in holding another Prime Day event given that consumers are now more cost conscious and may trade in for lower priced goods and hunting for bargains. As such, I think that the mix in products bought during both the July and October Prime Day in 2022 could be relatively different from that of 2021 as consumers might be starting to trade down. This, in my view, might be the reason Amazon is not disclosing the sales figures for the recent July Prime Day event, while only disclosing the number of items sold.

All in all, with a strong July Prime Day event in 3Q22 and a potentially even stronger October Prime Day event in 4Q22, I think that Amazon is well positioned to see a relatively strong revenue growth in the second half of 2022 and thus, sentiment could change in the second half of the year.

Valuation

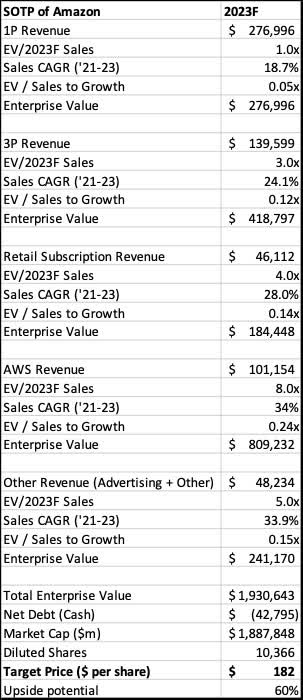

I use a sum of the parts valuation model to value Amazon. I think that the 2.4x EV to Sales to Growth levels for AWS is justified given the strong industry tailwinds that Amazon is benefiting from its leadership position in the industry, with one of the stronger and sustainable growth profiles amongst its other business segments. My 1-year target price for Amazon is $182, implying 60% upside from current levels.

Amazon SOTP Valuation (Author generated)

Risks

Macroeconomic environment

Without a doubt, the challenging macroeconomic environment poses one of the biggest risks for Amazon. While consumers may choose to trade down and thus limit the downside for Amazon, there is undoubtedly going to be a negative impact when consumption declines and recession fears materialize. The worst scenario is when consumer demand falls off the cliff and uncontrollable external environment causes higher cost headwinds. These factors could bring increasing risk to the 2023 forecasts for Amazon.

Competitive pressures

While the other competitors like Walmart (WMT), eBay (EBAY) are rather small in an e-commerce market so dominated by Amazon, I think that there is definitely a risk that the leader could face fast growing competitors or new entrants vying for market share. As a result, Amazon needs to continue to improve on its competitive advantage, which the company has been aggressively doing through investments and capital expenditures in e-commerce. As a result, Amazon is better able to serve customers by offering next day or same day delivery when other peers are unable to do so. However, in the case where competitors do increase competitive pressures, this could dilute growth and margins for Amazon.

In addition, there are large and well capitalized players in the cloud computing space like Microsoft (MSFT) and Google (GOOG) that may bring new innovation that may threaten Amazon’s leadership in the space.

Investment pace risks

While I do think that management has been rather proactive in ensuring that the capital expenditures that they are spending are adjusted according to the demand situation and business conditions, there may be unexpected increase in pace of investments that may upset market expectations. This is especially so when the market is pricing in a slower pace of investments and capital expenditures in the near-term.

Scaling up higher margin businesses

While there are signs that Amazon’s cloud computing business, as well as its emerging subscription business are both seeing continued momentum, there is the risk that the company is unable to successfully scale the business, affecting the long term potential of the business.

Conclusion

I think that the second quarter print for Amazon showed that much of the fear and negative sentiment has been priced into the expectations and stock price. With regards to the fears for missing e-commerce estimates due to a higher base caused by the pandemic, the second quarter e-commerce growth proved stronger than expected. With regards to negative sentiment on cost headwinds, the management has showed ability to execute on reducing these cost headwinds despite the tough external inflationary environment. Lastly, AWS continued to sustain and beat on revenues and operating margins as the cloud computing business remains resilient.

As such, I think that Amazon is looking to be a very attractive investment for contrarian investors as so much of the negativity has been priced into the stock, while the fundamentals of the company is heading in the right direction, with results coming in the form of positive surprises in second half of 2022, in my view. As such, Amazon looks to be attractive at these levels and with its leadership in its business segments with strong secular growth. My 1-year target price for Amazon is $182, implying 60% upside from current levels.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment