Jose Luis Pelaez Inc/DigitalVision via Getty Images

Although ContextLogic Inc. (NASDAQ:WISH) has fallen 97% from its IPO price, I believe the business is fundamentally flawed as it focuses on selling cheap, throwaway products that may or may not be delivered as advertised. At the same time, I don’t think WISH is a short, as the company has ample cash to sustain the current burn around. I think investors are best served to watch the turnaround from a distance, and if successful, buy the company at a higher valuation.

Brief Company Overview

ContextLogic Inc. is an ecommerce company that operates the platform Wish. Wish connects value-conscious consumers (mostly from Western countries), directly with merchants (from China and other emerging nations). Wish uses Artificial Intelligence (“AI”) to figure out users’ interests and preferences and display products from relevant merchants.

Once a darling of the market, WISH IPO’d in December 2020 at a $17 billion valuation. Founded by ex-Google and Yahoo executives, WISH stormed out of the gates with over 100 million monthly active users (“MAU”) and $1.7 billion in revenue for the 9 months to September 2020.

Based on bubble-ish investor sentiment and analyst initiations, WISH stock rallied to a high of almost $33 / share, a 38% increase from its $24 IPO price (Figure 1). However, since the January 2021 highs, WISH has been a one-way ticket down, as the company experienced repeated earnings misses, slowing sales forecasts, resignation of its CFO and CEO, all in a matter of months.

Figure 1 – WISH Stock Price Has Been One-Way Ticket Down Since IPO (stockcharts.com)

With the shares trading down 97% from its IPO price, is WISH a bottom-fishing candidate?

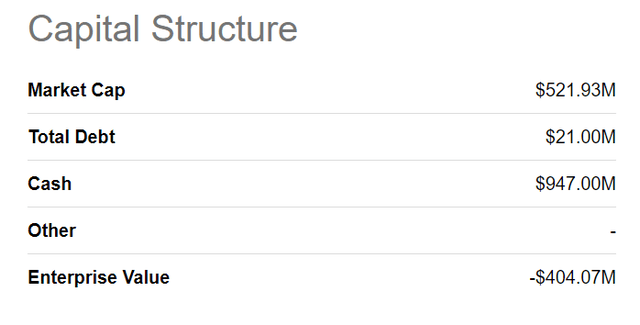

Valuation Cheaper Than Liquidation Value

The main attraction of ContextLogic stock at this point is its low valuation. With almost $1 billion in cash and little debt, WISH has an enterprise value of -$400 million (Figure 2).

Figure 2 – WISH capital structure (Seeking Alpha)

Net-net investing, or buying stocks below their liquidation value, was popularized by Benjamin Graham in the 1930s. According to Net-net investing principles, WISH looks attractive, as it has $1.40 in cash and short-term securities vs. a current stock price of $0.72.

But Poor Business Fundamentals Suggest This Is A Value Trap

The low valuation looks too good to be true, what is the catch?

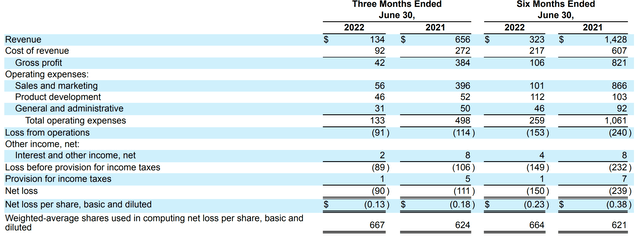

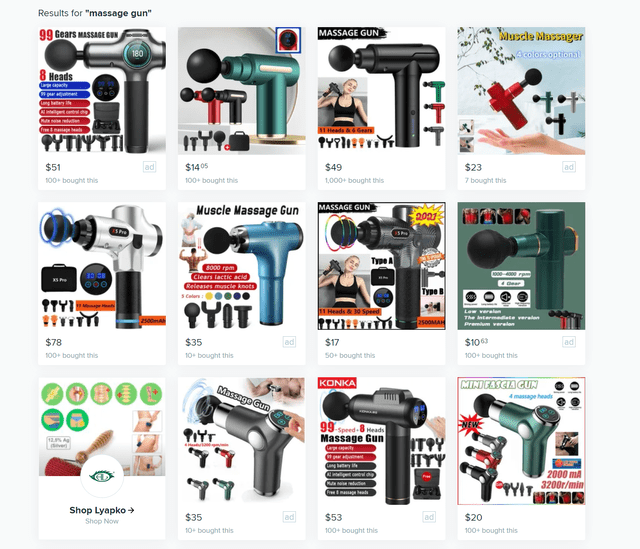

The catch is that ContextLogic’s business fundamentals are terrible. Looking at the latest quarterly results, we see that revenues have collapsed by an epic 80% YoY in Q2/2022 (Figure 3).

Figure 3 – WISH Q2/2022 Revenues declined 80% YoY (WISH Q2/2022 10Q Report)

Although expenses were cut as well, WISH still ended up with a $0.13 / sh loss in the latest quarter.

MAUs declined from 110 million at IPO to 23 million in the latest quarter, as the novelty of the WISH platform and products on offer wore off (Figure 4).

Figure 4 – WISH Key Performance Indicators (WISH Q2/2022 10Q Report)

Cheap Product Novelty Wearing Off

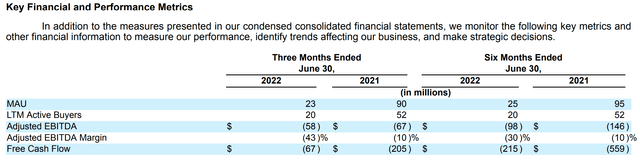

In my opinion, the primary reason behind WISH’s poor business fundamentals is because of the nature of the products it sells. By design, WISH displays low-dollar value items, such as phone cases and trinkets, and knock-offs of popular products. For example, a percussion massage gun that retails for upwards of $70 on Amazon can be purchased for under $15 on WISH (Figure 5).

Figure 5 – WISH search for Massage Gun (Author created screenshot on wish.com)

The problem is that WISH has hundreds, if not thousands of merchants selling essentially the same products with little to no quality control. Consumers have no way to gauge whether the $14 massage gun is a good value, or the $23 version.

In fact, often the products on display is not the same as the products consumers actually receive. There is a cottage industry of websites and forums dedicated to showing failed purchases made from WISH, including giant-sized AirPods, rugs that turned into doormats and shoes that turned out to be slippers. While they may be good for making funny memes, after a while, the novelty is bound to wear off.

Although the company recognizes the issue and is attempting to rebrand and enhance the consumer experience, even a cursory glance at the platform shows that WISH continues to display cheap, throwaway products that may or may not turn out as advertised (Figure 6).

Figure 6 – WISH most popular products (Author created with screenshot from wish.com)

Risks

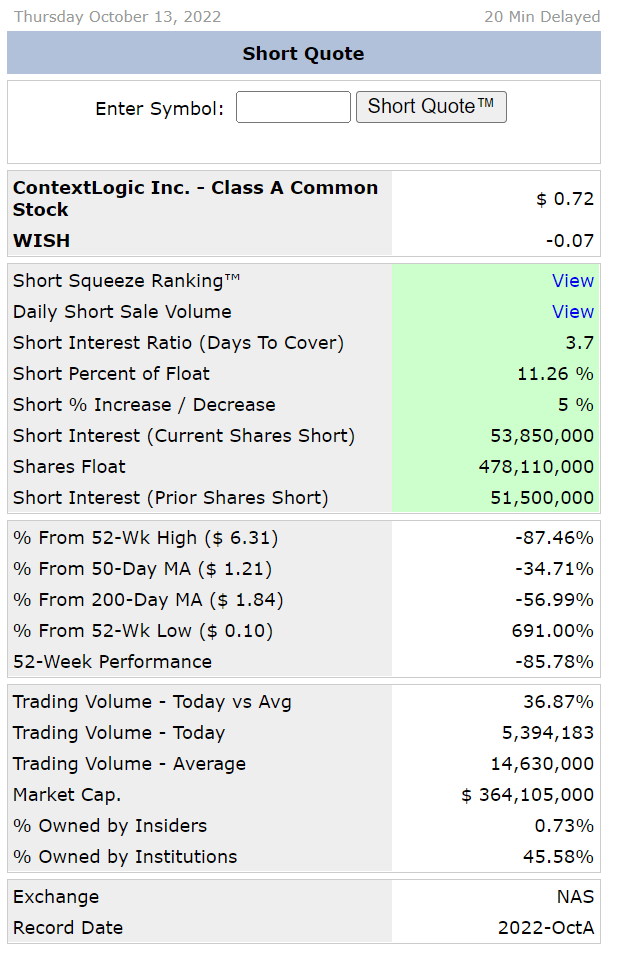

One of the big risk with being overly negative on broken stocks like WISH, and why I do not recommend a short of the shares, is that these stocks are heavily shorted, and any slight improvement in the business fundamentals can cause a painful short-squeeze. WISH currently has 11.3% of its share float shorted, which is fairly high (Figure 7).

Figure 7 – WISH Short Interest (shortsqueeze.com)

WISH’s cash balance of $947 million means the company can sustain operational losses for more than 2 years (latest quarterly operating loss was $91 million and H1/2022 cash flow from operations was -$213 million).

Furthermore, with business, anything is possible, and we may even see a turnaround if WISH is able to change gears and execute. For example, the popular fast fashion platform shein.com has a private market valuation of $70 billion. Shein’s business model is a virtual design house / brand that connects millions of female western consumers with thousands of ghost factories in China. If you think about it, Shein is really not that different from WISH. The key lies in execution, or lack thereof.

Conclusion

I believe the best course of action with broken stocks like ContextLogic is to stay away. While the business model is flawed and fundamentals are poor, they are not worthwhile as shorts as the company has ample cash to sustain the current burn rate for many quarters. I would much rather buy the company at higher valuations once they have successfully turned around the business.

Be the first to comment