Foryou13

By Brian L. Kloss, JD, CPA

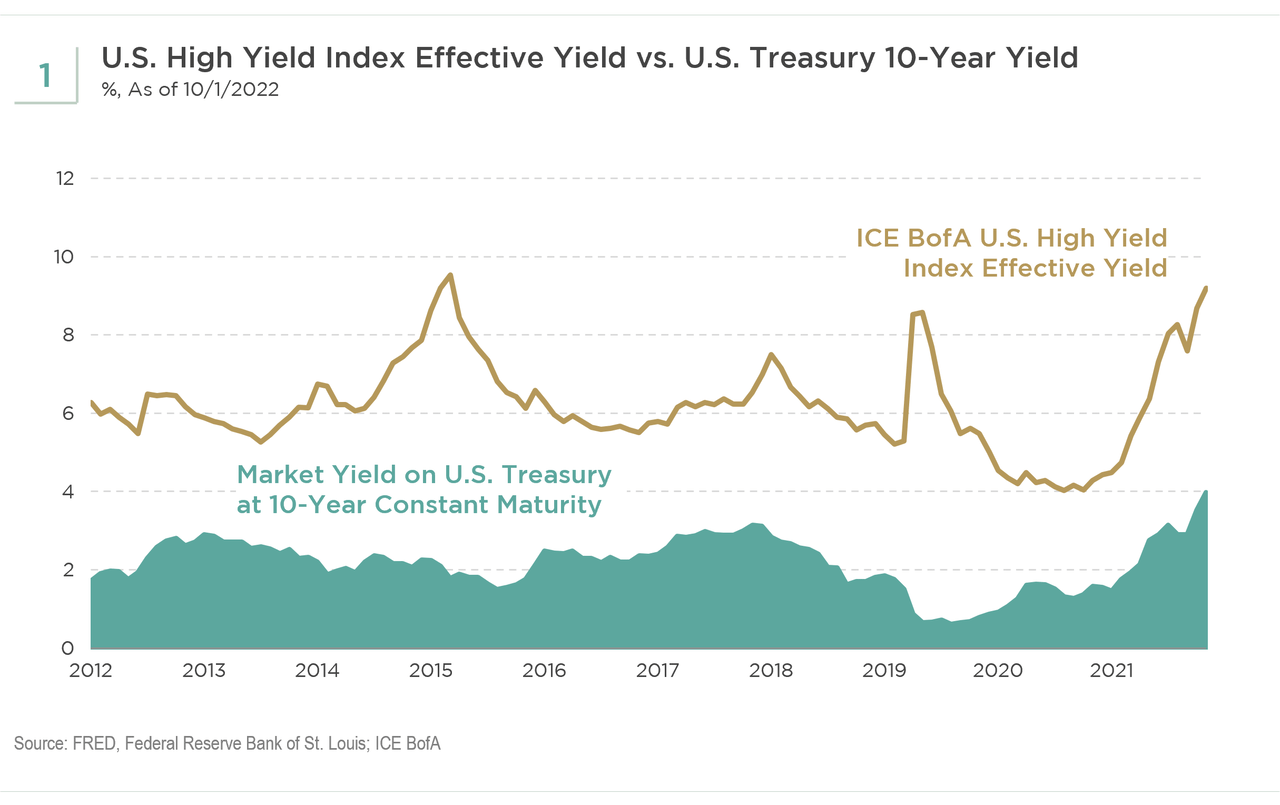

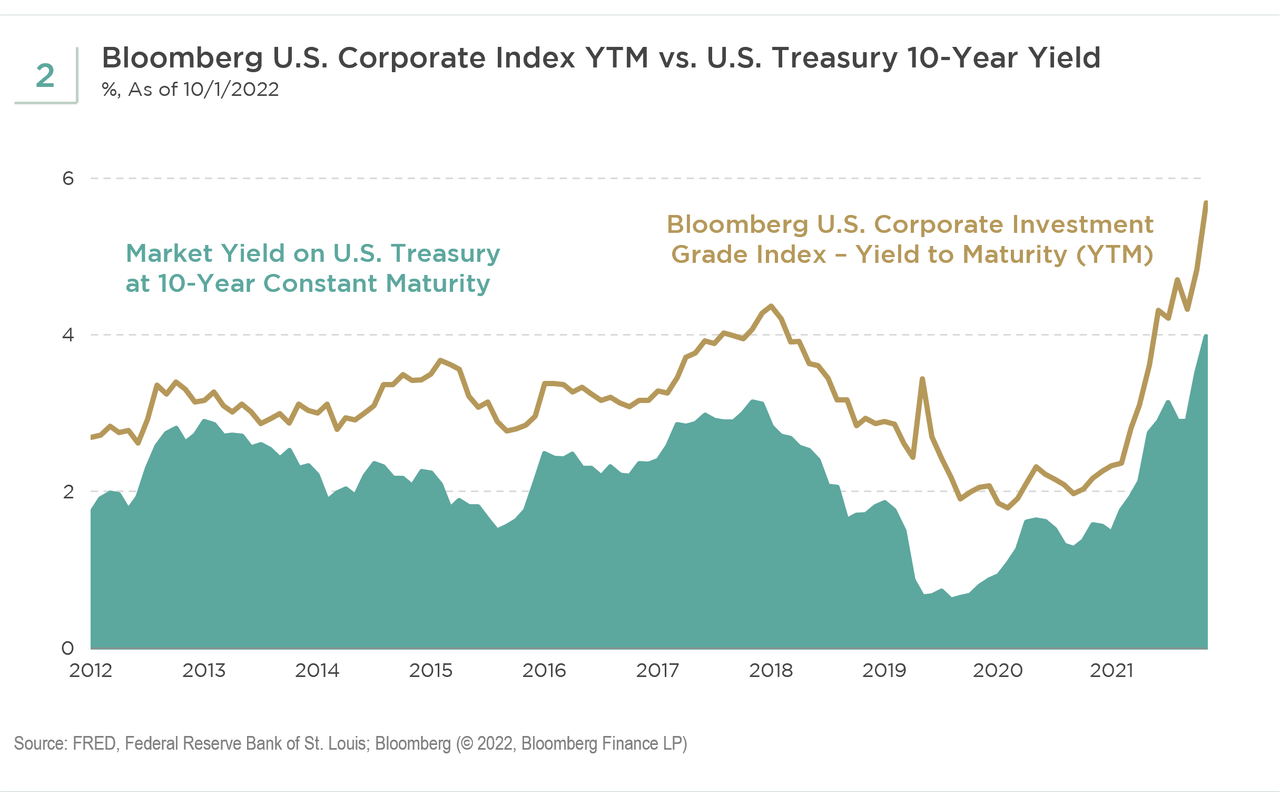

U.S. investment grade and high yield spreads have been very resilient this year. To understand the drivers behind this resiliency, we differentiate between the two different primary components of yields: the spread component and the absolute yield based on the underlying Treasury curve. This year we have seen a material repricing of the underlying risk-free asset, Treasury bonds, given the aggressive rate hikes on the part of the Federal Reserve (Fed) (see Figure 1 and Figure 2). Treasury yields could move up further if the Fed continues to ratchet up expectations for its terminal federal funds rate. One could argue that much of the spread risk that we discussed in our recent podcast, “Where Credit Is Due,” has actually been embedded in that underlying curve.

We do not expect dramatic spread widening unless or until we actually see underlying credit conditions deteriorate. That risk may still play out, but an earnings recession may not be pronounced until well into 2023. Bond investors always worry about the downside risks, evaluating the possibility that we do not get paid back. However, we are managing those risks by focusing on careful, specific security selection and active sector rotation. We currently prefer high-quality companies with strong asset protection, a solid business model, and a capital structure that we believe can withstand the volatility in the next 24 to 36 months. We anticipate attractive returns for those who can withstand the volatility over the next several years.

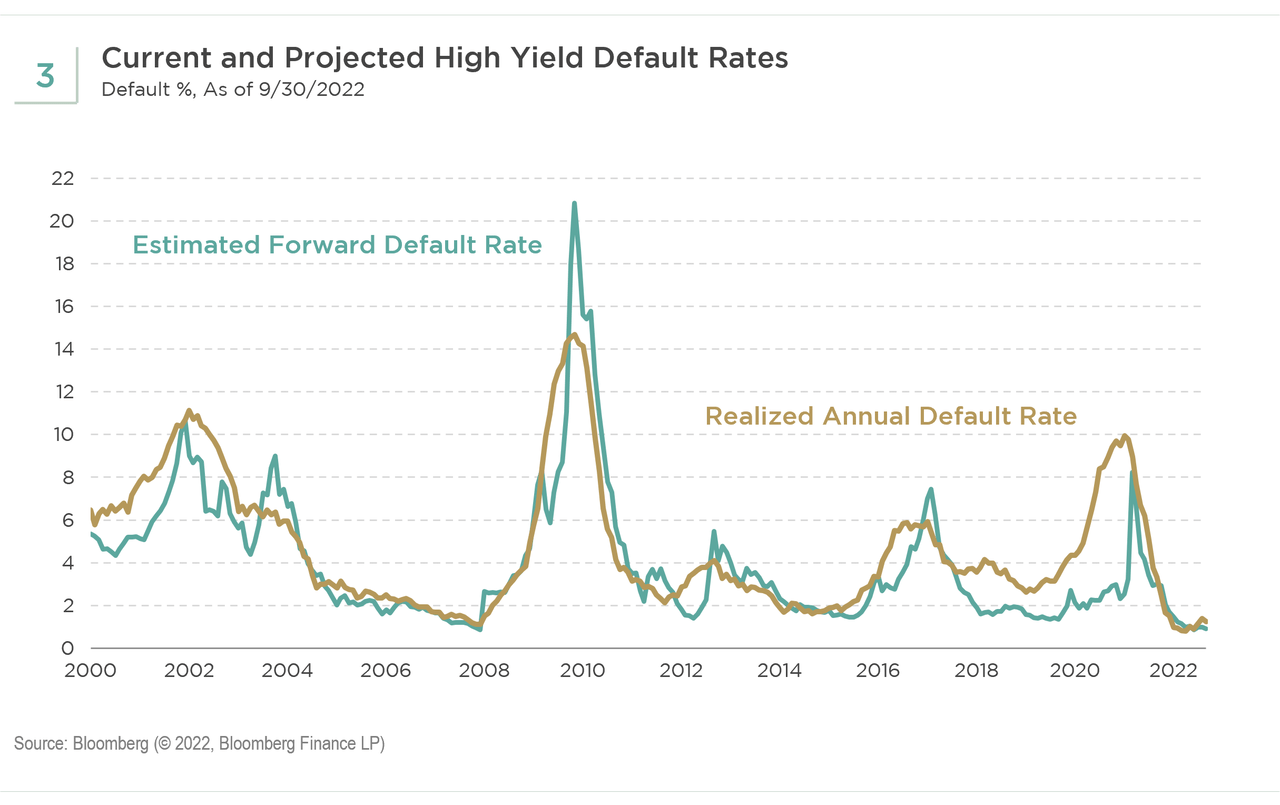

Default expectations remain low (see Figure 3). A default is generally caused by a missed principal payment, missed interest payment, or some type of breach of a covenant. Given that we do not have a significant maturity wall over the next two years, the likelihood of a sizable default wave is very unlikely in the public markets. We may see credit risk in the low-quality end of the credit spectrum, and this market segment is quite large. However, good security selections should minimize default risk. We are finding the best opportunities where investment grade and high yield intersect.

Our team is constructive on spread duration. However, we are all dependent on the Fed and the data it is watching, and do not yet know where rates will settle out. This uncertainty presents risks, and we are never going to be able to precisely call the tops or bottoms in spreads. At this juncture, as always, what we need to do is assess what the valuation risk is relative to the information risk that is out there. As valuations have widened, spread risk becomes much more attractive. When we consider the paths that the Fed can take, we want to continue to add spread duration, starting with entities that do not have as much underlying credit vulnerability. As we find clarity about the outlook for monetary policy and inflation, and around the potential shape and duration of any likely recession, we will layer on additional “risky” spread risk.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment