Kolbz/iStock via Getty Images

I first wrote about Constellation Brands, Inc. (NYSE:NYSE:STZ) on October 2021, and I expected a higher move around $270 and although it successfully challenged its previous 52-week high of $243.90 as expected, the stock got rejected at $258ish. With the current bearish sentiment, such as potential dilution, flat outlook on its fiscal 2023, negative bottom line, slowing efficiency and deteriorating liquidity, I am lowering my expectations and will look for a better entry point at its potential pullback.

Q4 2022: Update

On April 4 2022, the management confirmed that they received a non-binding proposal from one of the largest shareholders of the company to convert each of the its Class B common stock into 1.35 shares of Class A common stock. This will result in a simpler capital structure, however, its successful conversion will potentially dilute its Class A common stock. This negative catalyst was countered right away by the announcement of $500 million worth of its Class A through accelerated share repurchase on April 7, 2022. This resulted in an 8% price increase from April 6 up to the current price of $248.83.

Despite the current market environment, STZ generated a positive revenue growth of 2.39%. However, when compared to its previous record of 3.25% set last year, it appears that our primary bullish catalyst has been tested. So I checked the status of its peer Ambev S.A. (NYSE:ABEV), but it appears that STZ is losing momentum against the former, which generated a two-digit YoY growth of 23.46%. Upon further investigating, we can still see an outstanding growth in its Beer segment amounting to $6,751.6 million, up 11% from $6,074.6 million last fiscal year. Additionally, the company started to produce its first positive organic growth after 5 years of consistent decline in its Wine and Spirits segment; which generated $2.069.1 million, up from $1,898 million excluding effects of the segment’s divestitures.

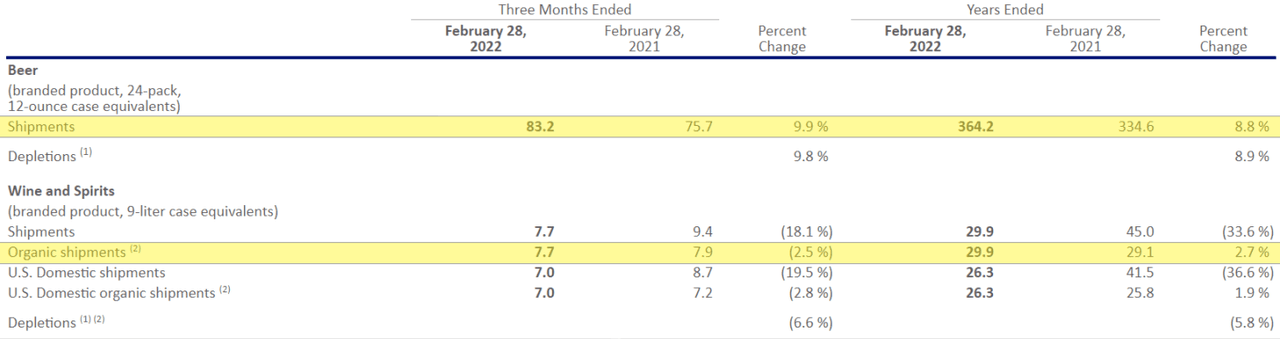

The company is still in the process of divesting its Wine and Spirits segment and excluding the effects of the divestiture provides a more accurate picture of the company’s real organic growth. STZ’s consolidated organic sales actually generated a double digit growth of 11%, up from $7,972.6 million recorded last fiscal year. This is because of higher Beer shipments which grew 8% this year and depletion shipment by 8.9%, while its Wines and Spirits segment showed positive figures as shown in the image below.

STZ: Supplemental Shipment and Depletion Information (Source: Q4 2022 Preliminary Report)

Looking at its Canopy segment, it still contributed negatively to the company’s bottom line with -$178.2 million, down 22% from last year. A potential catalyst is still the legalization of cannabis; recently, the house of representative passed a bill to decriminalize the use of marijuana at the federal level. Positive news from the Senate could boost cannabis stocks such as Canopy Growth (NASDAQ:CGC), potentially reversing STZ’s current negative status on its investment in CGC.

STZ continues to bear positive catalysts, however, I believe it is already priced in and is bound to set for a correction. This is true especially while looking at its slowing GAAP operating margin of 26.4%, down from 32.4% recorded last fiscal year and its bottom line entering in negative territory amounting to -$40.4 million.

Expansion Update

Despite the uncertainties, the management provided an aggressive outlook about its capital expenditures to be between $1.3 and $1.4 billion, highlighting an estimated $1.2 billion budget for Mexico beer operations. This may alleviate risk from slowing top line growth and losing market share. In fact, according to the management it continues to be the leader in the high-end beer industry.

First, our strong overall performance continues to be headlined by our Beer business, which delivered its 12th consecutive year of volume growth. Our beer portfolio led by our Modelo and Corona brand families posted net sales growth of 11% and added 30 million cases of high-end growth, extending its leadership position as the #1 high-end beer supplier and the #1 share gainer across the U.S. beer market. Source: Q4 2022 Earnings Call

With the planned capacity expansion, in my opinion, we might see a future upward revision on its 10 year revenue consensus estimate, which will invalidate my valuation problem on the stock. Looking at its Wine and Spirit segment, the company acquired Lingua Franca, a high-end Oregon winery and others to help sustain its current positive organic growth.

As part of the evolution to the high end, we acquired Lingua Franca as well as the remaining interest in Austin Cocktails from our ventures portfolio, 2 businesses positioning categories with significant growth tailwinds behind it. From a finance perspective, these transactions collectively, along with My Favorite Neighbor, which was fully acquired in fiscal 2022, were almost entirely self-funded through the sale of one of our successful venture investments, which generated a significant return on investment. Source: Q4 Earnings Call

The Outlier

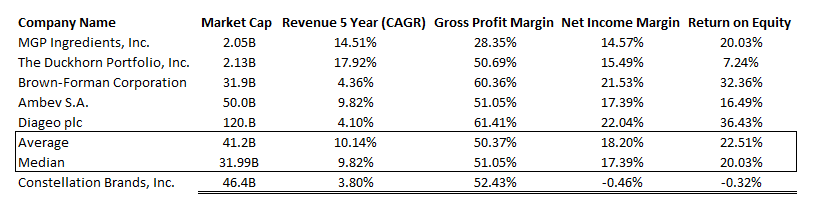

STZ: Key Financial Ratios (Source: Data from SeekingAlpha.com. Prepared by InvestOhTrader)

By looking at the image above, we can see that STZ is currently the outlier among its peers due to its slower revenue growth and the fact that it is the only company with a negative bottom line. Additionally, it generated a concerning free cash flow as shown in the image below.

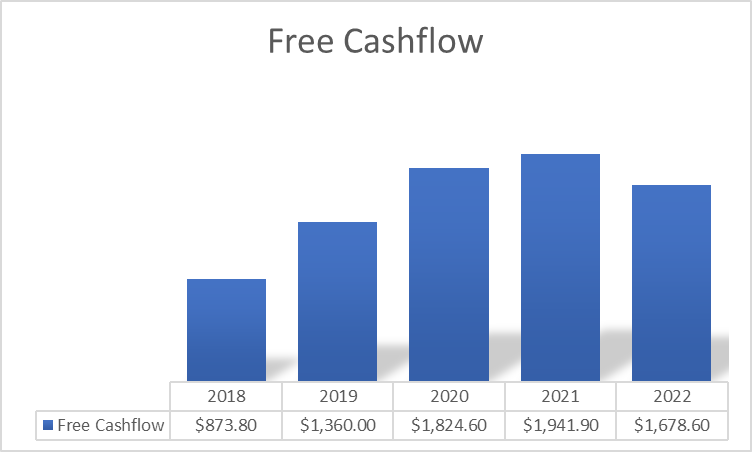

STZ: Broken FCF trend (Source: Data from SeekingAlpha. Prepared by InvestOhTrader)

On top of the below fiscal 2020 figure of $1,678.60 million this fiscal year, the management provided a negative forecast on its free cash flow to be in between $1,300M-$1,400M in fiscal 2023.

Declining Valuation

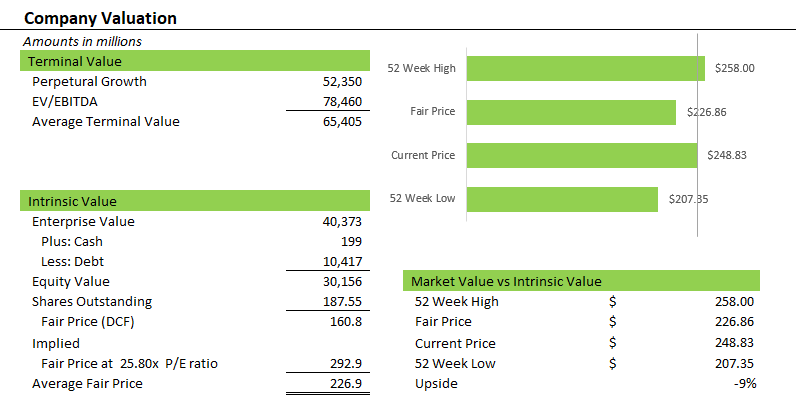

STZ: Company Valuation (Source: Prepared by InvestOhTrader)

Due to the rising treasury yield rates, rising CAPEX outlook and no significant top line growth revision from the analysts, I am lowering my expectations to $226ish as my average fair price. I kept most of my assumptions from my previous article on this stock, especially with the growing operating margin but its still provided a lower intrinsic value derived from a 10 year DCF model.

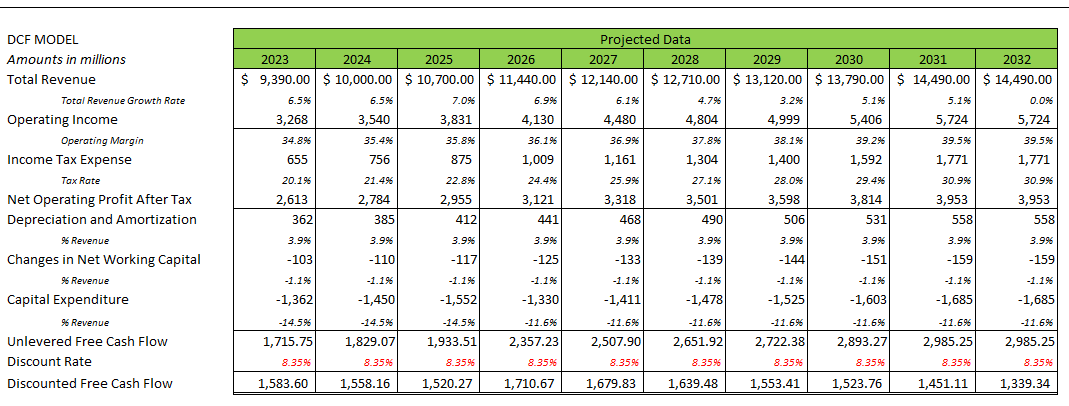

STZ: DCF Model (Source: Prepared by InvestOhTrader)

I completed my 10 year DCF model with the help of the analysts’ projection. Despite a slowing operating margin as discussed earlier, I projected it to grow to 39.5% with the assumption of a lesser effect of its Wines and Spirits segment’s divestiture. I also assumed a stronger CAPEX spending compared to my last model, which is aligned with the current plan of the management.

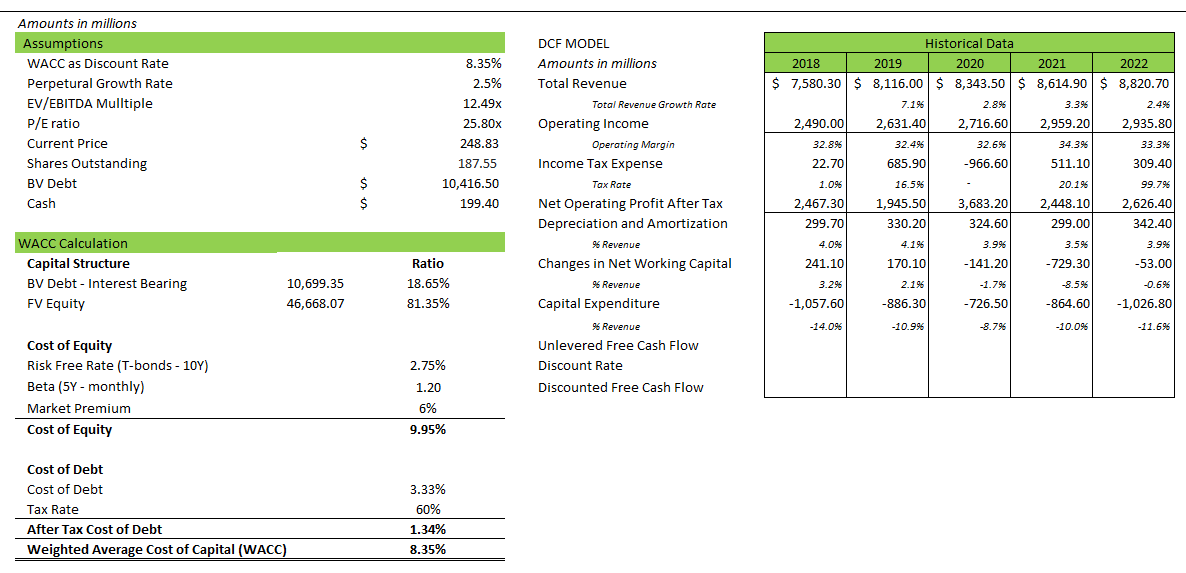

STZ: DCF Model (Source: Data from SeekingAlpha and Yahoo!Finance. Prepared by InvestOhTrader)

The above image contains my assumptions, WACC calculations and selected historical data of the company that I used to complete my DCF model.

Ripe For Correction

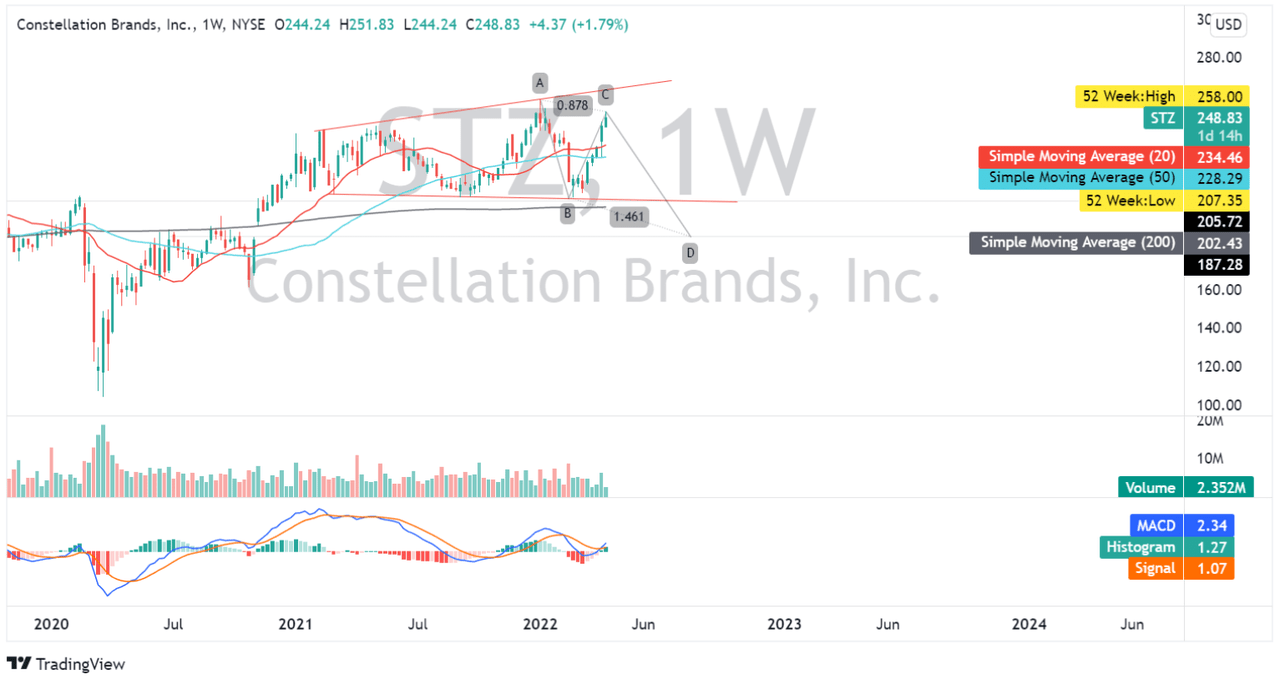

STZ: WeeklyChart (Source: TradingView.com)

STZ is currently in a strong rally from its recent pullback this February. However, looking at its current trend as shown in the chart above, it seems mature already. Despite its current valuation, it will not provide a strong short opportunity at today’s price, especially with the improving sentiment of slowing growth in core CPI of just 0.3%, better than last month of 0.5%. Although, as of today, inflation rose to 8.5% which is a bit higher than some experts’ 8.4% expected rate. On the contrary, economists now see a positive outlook for the US inflation as quoted below.

“The big news in the March report was that core price pressures finally appear to be moderating,” wrote Andrew Hunter, senior U.S. economist at Capital Economics. Hunter said he thinks the March increase will “mark the peak” for inflation as year-over-year comparisons drive the numbers lower and energy prices subside. Source:CNBC.com

Nonetheless, looking at STZ’s short-term perspective, the company will continue to be under pressure by higher inflation which may affect both consumer demand and its margin. If there will be a pullback, I believe a completion of its AB=CD pattern around $190ish will provide a better entry point as compared to its current price action.

Final Key Takeaways

Despite a strong expansion catalyst, Constellation Brands’ short term will be under pressure due to its declining efficiency, valuation and slower outlook on its FCF as discussed previously. Additionally, bearish sentiment continues as it generated a declining current ratio of 1.23x, down from 2.4x last fiscal year, and a deteriorating debt to equity ratio of 0.86x, compared to its 0.76x recorded in fiscal 2021. I believe buying STZ at today’s price is risky and should be avoided.

Thank you for reading and have a great day!

Be the first to comment