yujie chen/iStock via Getty Images

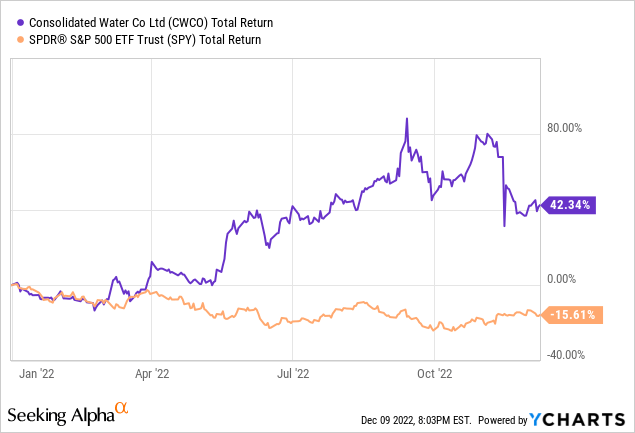

Continuing my recent coverage of water stocks, a traditional safe haven sector during recessionary periods, today I’ll be taking a look at the most exotic of the bunch, Consolidated Water (NASDAQ:CWCO). Having stayed on the sidelines during its remarkable 42% YTD return versus SPY‘s -15.6%, I’ll examine its historical earnings, current valuation, and risk/reward profile to determine its attractiveness as a long-term investment at current levels.

Potable Water For Remote Places

Founded in 1973 and headquartered in the Cayman Islands, Consolidated Water is a relatively small water solutions company with a $225M market cap and a unique business mix. It combines a retail water utility serving Grand Cayman Island, a water desalination business operating in partnership with government utilities in The Bahamas, the British Virgin Islands, the Cayman Islands, Bermuda, and Indonesia, a potable bulk water sales business, and an engineering business that builds desalination and wastewater treatment facilities for municipalities and corporate clients around the world. Breaking down the numbers, the company’s operations produce over 70 million gallons of potable water per day at 39 sites, including 14 desalination plants across 6 countries.

CWCO’s basic mission is to provide potable water, desalination plants, and water infrastructure in places where fresh water is scarce, and until relatively recently the company focused exclusively on growing tourist destinations. However, in recent years they have expanded their wastewater and desalination engineering businesses along with their geographic footprint by acquiring smaller US-based firms.

Growth via Acquisition

To augment their desalination plant manufacturing subsidiary DesalCo, in 2016 Consolidated acquired a controlling share in Florida-based Aerex Industries, which designs and manufactures wastewater systems and parts. Then in 2019, it purchased a controlling stake in PERC Water for just $4M, another wastewater infrastructure design and construction firm based in Southern California.

PERC is turning out to be a fantastic investment, as just this year it has landed two major contracts worth a combined total of $130M over ten years. The first project is for the construction of a new $82M wastewater treatment plant for Liberty Utilities in Goodyear, AZ, revenue from which is already starting to be realised in Consolidated’s earnings reports. The second is for the operation and maintenance of two existing wastewater facilities in Los Angeles and Long Beach, CA for $49.2M over ten years, with two optional five-year extension periods.

On top of PERC’s strong performance in 2022, Consolidated’s Cayman operation also won a contract to construct a new desalination plant for the Water Authority of the Cayman Islands that should bring in an estimated $20M over the next 11 years. With its engineering businesses firing on all cylinders, the company has forecasted strong revenues in 2023 and I expect that management will be able to deliver on that promise.

Geographic Risk & Economic Sensitivity

Serving these often-remote geographic areas strengthens the company’s competitive moat but presents a number of challenges for investors.

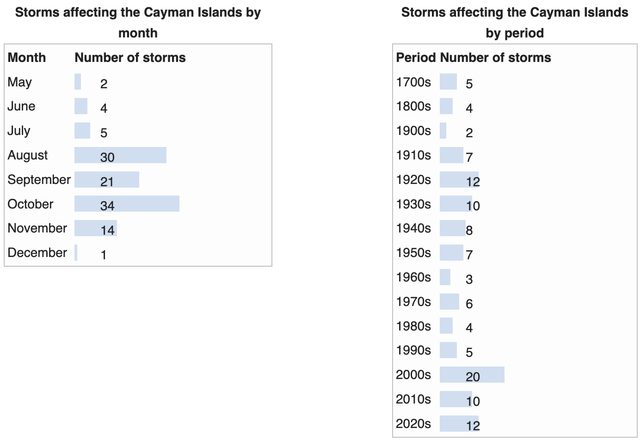

First, the Caribbean region in which most of its operations are based is notorious for hurricanes and tropical storms, and the last 20 years have seen an increase in the frequency of storms due to climate change. The peak storm season lasts from August through November, and as many storms have hit the Caymans from 2000-2022 as did from 1930-2000. Considering the elevated risk of catastrophic damage to its facilities and local infrastructure, unfortunately CWCO will never be a “Sleep Well At Night” investment.

Cayman Islands Storms (Wikipedia)

Second, organic customer growth is difficult. Third, many of CWCO’s largest customers are resorts and hotels, so the company’s revenues are more seasonal and economically cyclical than a typical landlocked utility. These resorts pay higher per-gallon rates than its residential customers, but their usage greatly fluctuates based on high and low tourist seasons, the overall economic climate, and of course COVID travel restrictions. And while travel has largely recovered to pre-COVID levels, a coming recession could have an adverse effect on island tourism involving expensive travel, and any future unexpected pandemic-level events could once again decimate the tourism industry.

Inconsistent Earnings

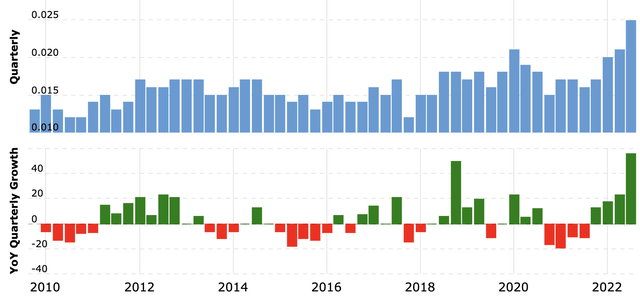

CWCO Historical Revenue (Macrotrends.com)

As we can see, CWCO’s revenues are choppy but have been trending upward over the long term, with the latest quarter setting a record high. However, earnings per share have been a much different story:

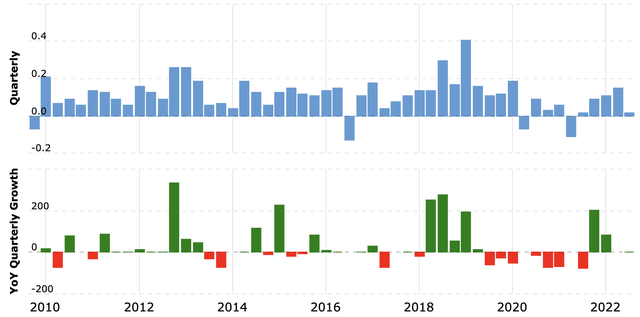

CWCO Historical EPS (Macrotrends.com)

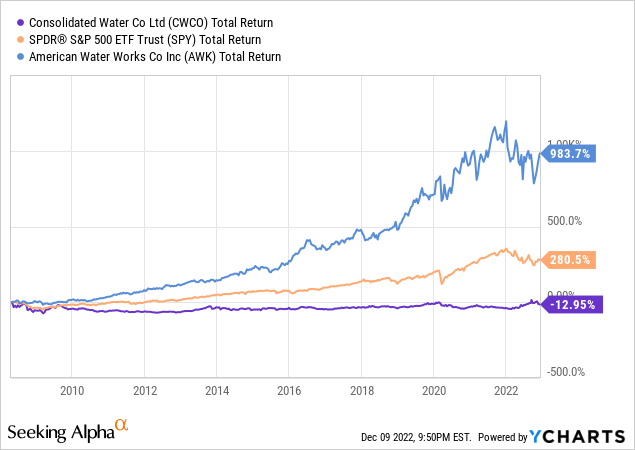

While one can parse CWCO’s earnings reports for the exact reasons why they have been unable to grow their earnings over the past 10 years, the bigger picture above clearly shows that management is either not very focused on increasing shareholder value or that their business model and/or geographic footprint make it very difficult to do so. To me at least, it seems to be a combination of both, and even though the stock has been performing well recently, it has greatly underperformed the S&P and the highly profitable AWK since the last time the worldwide economy was in the early stages of a recession at the beginning of 2008:

Shrinking Margins

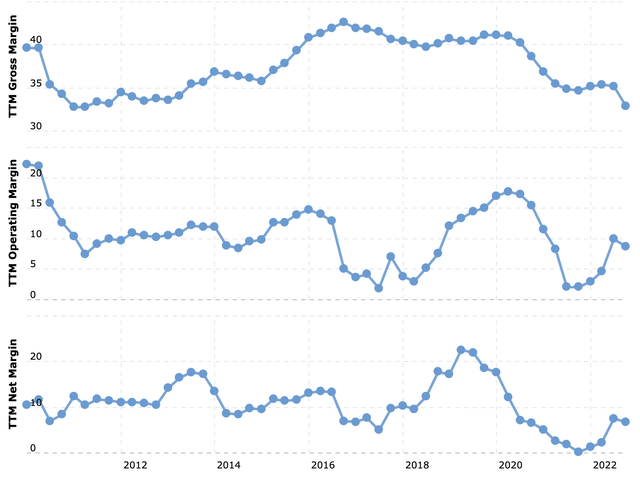

Many bullish articles on CWCO focus on the promising growth potential of its water infrastructure contracting businesses. It’s true that PERC, Aerex, and DesalCo are driving increased revenues, but let’s consider the effect that this recent push into US wastewater plant manufacturing, maintenance, and operation is having on Consolidated’s margins:

CWCO Margins (Mactrotrends.com)

In short, the results have not been great for profitability. CWCO’s gross margin has shrunk to its lowest level in ten years, its operating margin is up from COVID lows but still half of what it was ten years ago, and its net margin is hovering around a paltry 7%. In contrast, the largest US water utility American Water Works boasts a net margin of 34%.

However, this all makes sense if viewed through the lens of the company’s evolving business mix. Consolidated is essentially transitioning from primarily operating as a higher-margin utility business to a lower-margin industrial contractor. I expect that as this becomes more apparent over time and excitement over contract wins gives way to questions about converting these new revenues to consistent earnings growth, CWCO’s valuation will contract to be more in line with industrials sector averages.

Valuation & Yield

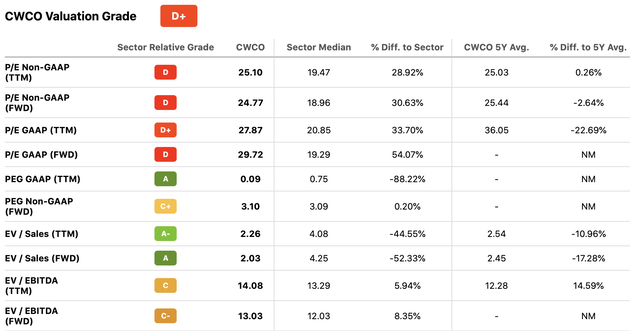

Where I more of a fan of Consolidated’s business model, I might find its current valuation more compelling. Despite Seeking Alpha’s D+ valuation grade, which is to be expected for a water utility stock, CWCO is trading below its 5-year averages for forward PE and EV/Sales, although its profit-based metrics are higher than average due to its disappointing recent earnings.

Sales are indeed higher than ever, and were CWCO a pure play water utility the above metrics would look great. But if we value it instead an industrials stock, it only appears fairly valued on sales metrics and looks overvalued on earnings-based metrics, especially given its unpredictable earnings record.

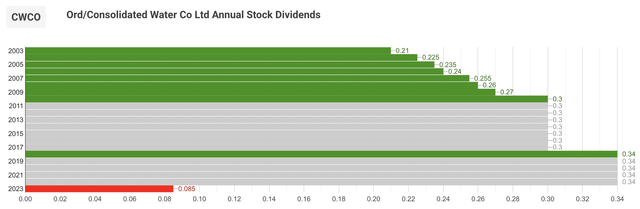

Likewise, while its 2.29% dividend yield is above average for a water utility and about average for an industrial stock, it is below CWCO’s 5-year average yield of 2.57%, and its dividend growth record and 92% payout ratio compare quite poorly to peers. Of course if the company can continue this year’s impressive revenue growth, it should be able to maintain its current dividend level going forward given that it also impressively has almost no long-term debt (only $200K). But its inability to consistently grow earnings along with the lower margin wastewater and desalination construction businesses driving its future revenue growth does not bode well for future dividend hikes. And as we can see, despite technically growing since 2003, their dividend has been in a holding pattern since 2018, with the previous raise occurring in 2010.

Conclusion

Consolidated Water has some attractive attributes. A fair valuation, a wide competitive moat within its geographic footprint, near-zero debt, a decent yield, and a growing desalination and wastewater treatment engineering business. However, these positives are counterbalanced by inconsistent earnings, declining margins, cyclical revenues, significant climate risk, and a higher-than-average payout ratio and share price volatility.

The problem for me is that while CWCO straddles the line between a utility and an industrial stock, it does not offer investors many advantages over the top companies in either of those sectors, and its dual focus may actually hold it back from being a truly great water infrastructure investment.

Although I expect it may perform well during a market rebound, after a strong year of outperformance I rate CWCO a sell primarily because I think there are safer options that offer consistent earnings, revenue, and dividend growth and superior total return potential in both water utilities and industrials.

Be the first to comment