ansonsaw

Introduction

Following years of money flooding into clean energies, the thermal coal industry was pushed aside by investors, although this quickly changed in 2022 as the fallout of the Russia-Ukraine war resulted in a global energy shortage. Due to this geopolitical event, CONSOL Energy (NYSE:CEIX) saw a resurgence that few investors would have ever expected and after cleaning up their balance sheet, their focus is shifting to dividends, which sees a tidal wave of cash incoming for shareholders as their upcoming third quarter of 2022 results approach.

Coverage Summary & Ratings

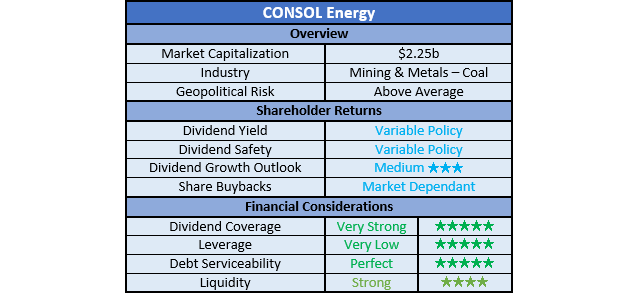

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

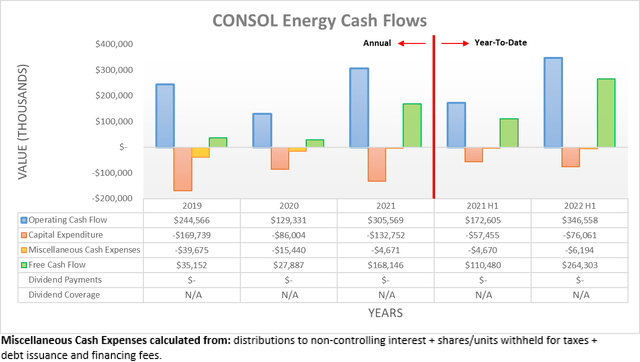

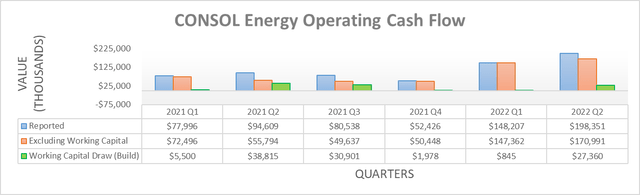

After already enjoying a solid recovery during 2021 coming out of the severe downturn of 2020, the global energy shortage provided a cash windfall. As a result, their operating cash flow during the first half of 2022 already reached $346.6m and apart from being around 100% higher year-on-year, it also beat their full-year result for 2021, despite being merely half the length of time. Thanks to their continued restrained capital expenditure, a very large portion was translated into free cash flow of $264.3m during the first half of 2022 with working capital movements only playing a relatively minor role.

When looking across both the first and second quarters of 2022, they only saw working capital draws of $0.8m and $27.4m, respectively. Whilst these helped, the vast majority of their free cash flow was obviously generated by their operations, obviously thanks to these booming operating conditions that have seen coal prices reach levels seldom ever thought possible. They have never provided dividends in the past but this now appears set to change with a new variable shareholder returns policy to be initiated following their upcoming third-quarter results, as per the commentary from management included below.

“We have engaged many of our shareholders during the second quarter and based on their feedback, we believe it is prudent to initially focus on dividends as the preferred means of shareholder return with the flexibility to opportunistically repurchase shares of our common stock.”

“Here’s how the shareholder return program work. Under this program, at the discretion of the Board of Directors, CEIX will return a portion of its free cash flow generation back to shareholders in the form of quarterly dividends and/or share repurchases.

Based on the free cash flow results from Q3 ’22, the first payment under this new program will happen in the fourth quarter and return approximately 35% of free cash flow.”

-CONSOL Energy Q2 2022 Conference Call.

When announcing their upcoming third quarter of 2022 results, they are initiating their new variable shareholder returns policy that aims to return 35% of their free cash flow, seemingly focused upon dividends. Since will see their dividend payments scaling with their free cash flow, their coverage will always be very strong, at least until their shareholder returns are likely ramped up in 2023 once their net debt is eliminated, as subsequently discussed. In the interim, they also declared a one-off $1 per share dividend following the second quarter of 2022 to get the ball rolling.

Since they generated $264.3m of free cash flow during the first half of 2022, it stands to reason the second half could see at least $300m, if not even $350m or greater as coal prices continued climbing during the third quarter with early October seeing a new record. The extent will be influenced by coal prices during November and December but suffice to say, the cash windfall does not appear over and thus bodes extremely well for their upcoming dividends.

Even with their relatively low 35% payout ratio, $300m to $350m of free cash flow could see a very high dividend yield of circa 13% to 16% given their current market capitalization of approximately $2.25b, which is only for a half a year and thus if sustained on an annualized basis, this would climb to a massive 20%+ dividend yield. Whilst easily appealing, as these booming operating conditions obviously cannot last forever, it is more important to consider their outlook for a middle-of-the-road scenario, which first requires consideration of their financial position.

Since the dividend attributable for the fourth quarter of 2022 will not be paid until the first quarter of 2023, the majority of their free cash flow during the second half of 2022 will be retained, which is an important variable for their subsequently discussed financial position. Meanwhile, given their latest outstanding share count of 34,867,738, their first-ever dividend of $1 per share will have only cost $34.9m during the third quarter, which is relatively insignificant given the free cash flow they are currently generating.

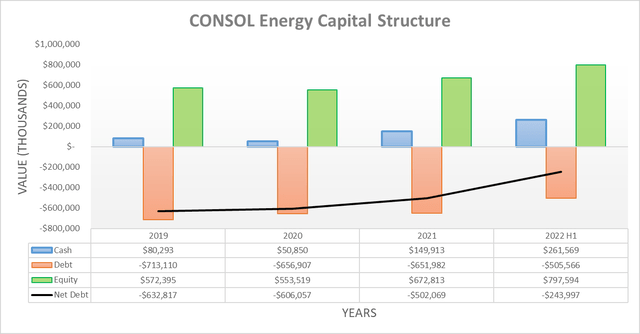

Thanks to their lack of shareholder returns during the first half of 2022, they made very solid inroads reducing their net debt, which slightly more than halved to $244m versus its previous level of $502.1m at the end of 2021. Unless they dramatically ramp up their shareholder returns higher than planned when announcing their upcoming results for the third quarter, their 65% of retained free cash flow will very likely see the remainder of their net debt eliminated very soon, quite possibly by the time 2022 ends given their outlook for a continued cash windfall.

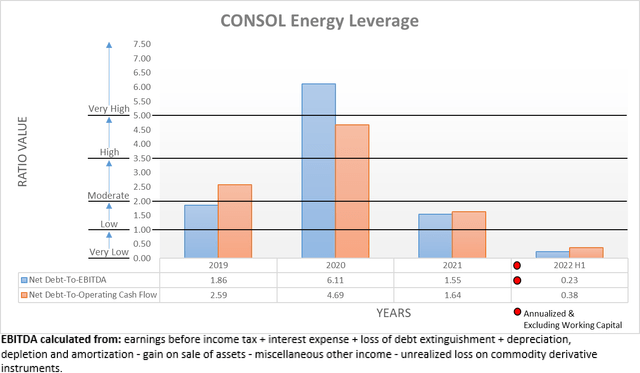

When plunging net debt is accompanied by booming financial performance, it creates the most powerful force to push leverage lower. As a result, the first half of 2022 saw their leverage fall into the very low territory with their net debt-to-EBITDA of 0.23 and net debt-to-operating cash flow of 0.38 both well beneath the applicable threshold of 1.00. Whilst this already marks a world of difference compared to earlier years, the prospects of seeing their net debt eliminated by the end of 2022 means that going forwards, their leverage will probably cease being a consideration. This opens the door to see their shareholder returns ramped up during 2023 and beyond, potentially seeing a tidal wave of cash incoming as they could return 100% of their free cash flow.

Normally, I am not necessarily a fan of companies running with zero leverage because making an already safe investment a little safer does not necessarily help create shareholder value versus higher dividends or share buybacks in the short-term. Although for coal companies, I nevertheless feel this path is well suited due to their questionable access to debt markets in the medium to long-term as the world moves towards clean energy and ESG investing places pressure upon financial institutions to sever ties, regardless of their business merits.

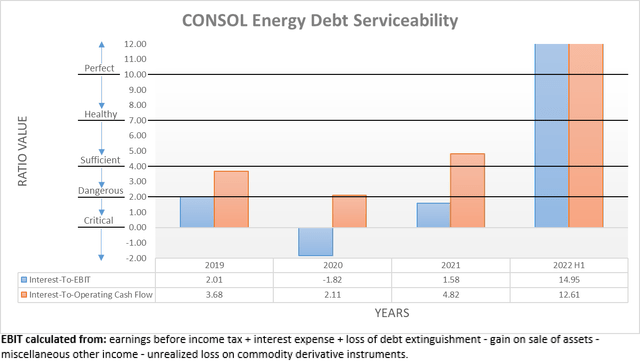

Unsurprisingly, their ability to service their debt saw similar improvements as their leverage following the first half of 2022, which is becoming increasingly important to consider as interest rates climb rapidly. Thankfully, they are benefitting from the global energy shortage that is helping drive this era of high inflation and thus high interest rates. As it stands right now, their interest coverage is perfect regardless of taking an accrual or cash-based approach with results of 14.95 and 12.61 when compared against their EBIT and operating cash flow, respectively.

Similar to their leverage, the prospects of net debt being eliminated also stands to see debt serviceability taken off the table as a consideration by the time 2022 ends. Apart from obviously enhancing their resilience for whatever the future may hold, as they progressively repay their debt it also opens the door for higher free cash flow as their interest expense begins disappearing. This stands to provide a lasting benefit regardless of the prevailing operating conditions, thereby further boosting the tidal wave of cash incoming in 2023 and beyond.

Whilst not necessarily too important during these booming operating conditions, the benefit is more noticeable during less favorable years, as their interest expense would have been a relatively larger drag on their free cash flow. If taking 2021 as an example, their interest expense was $63.3m and thus without this outflow, their free cash flow of $168.1m would have instantly been another circa 37% higher at $231.4m. This could be utilized as a basis for a middle-of-the-road scenario, as mentioned earlier and thus would see a very high free cash flow yield of circa 10% on current cost given their current market capitalization of approximately $2.25b, which will likely find its way back to the pockets of shareholders.

Although the ability to still receive a double-digit yield even without booming operating conditions sounds very desirable, it should be remembered that as a thermal coal company, they will always trade at a steep discount to most companies. Furthermore, in the medium to long-term it remains to be seen how long this could persist, as they still face threats as the world certainly moves away from thermal coal once the global energy shortage subsides. Like it or not, thermal coal is a fuel of last resort for most of the world and forms 88.70% of their combined reserves and resources at the end of 2021, as per their 2021 10-K.

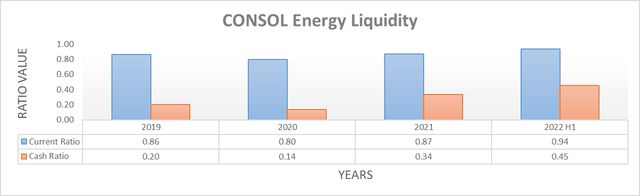

The benefit enjoyed elsewhere continued flowing through to their liquidity during the first half of 2022, which now sees its current and cash ratios climbing to 0.94 and 0.45 respectively, which in the case of the latter, makes a strong rating warranted. Throughout previous years, their debt maturities would have posed a greater risk to their liquidity as ESG investing grew ever stronger and pushed capital away from thermal coal companies, thereby making refinancing difficult or if possible, risked being too costly. Thankfully, this is no longer a concern given the rate at which they can repay their debt and thus, regardless of whether debt markets are open or not, they can now sustain their strong liquidity indefinitely, even if central banks further tighten monetary policy.

Conclusion

They played their cards skillfully by not wasting these booming operating conditions and first ensuring their financial position is solid before initiating shareholder returns. Thanks to the lasting benefits of their net debt being eliminated, shareholders can look forward to a tidal wave of cash incoming. Even though I am a fan of their focus on dividends over share buybacks, I nevertheless only believe that a hold rating is appropriate given the medium to long-term threats to thermal coal demand once the global energy shortage subsides, which weighs against the appeal of seeing a very high double-digital yield in the short-term.

Notes: Unless specified otherwise, all figures in this article were taken from CONSOL Energy’s SEC filings, all calculated figures were performed by the author.

Be the first to comment