BeyondImages/iStock via Getty Images

Introduction

Coal is back. Prices have skyrocketed, production volumes are increasing, and emerging markets are accelerating demand as natural gas has become too expensive. CONSOL Energy Inc. (NYSE:CEIX) has been on my radar for a while as it’s one of America’s strongest coal companies. Not only does the company have a focus on export, but it also has a healthy balance sheet, strong free cash flow, and the ability to boost production.

In May of 2021, I wrote that CEIX had 50% more upside after its rally. This has turned into a 142% rally. Now, it’s time to re-assess the risk/reward as I became cautious in September. Since then, the stock has added more than 60% (included in the 142% I mentioned). In this article, I will update my call and explain why I’m bullish while I also recommend people to take some profit.

Coal Is Back

ESG (environmental, social, governance) is being delayed. Everyone loves the climate but an increasing number of people are now finding out that any energy transition cannot be rushed. I have often discussed that coal, just like oil, is not the perfect energy source. It’s polluting and dangerous to mine – at least in emerging markets.

Yet, our entire western prosperity is built on coal as it’s an affordable energy source that comes with reliability and a lot of jobs. Renewable energy has a lower energy density (excluding nuclear energy) and it’s increasingly expensive due to high metal prices.

In my daily newsletter on Intelligence Quarterly, I included a few comments on the global coal industry that apply here as well:

The surge in natural gas prices has caused countries to switch to cheaper, but polluting coal supply: Another unintended consequence of Europe’s energy crisis has reared its ugly head halfway across the world, in the mountains of northern Pakistan. After a key supplier of liquefied natural gas cancelled deliveries, the country has found themselves unable to pay the very high spot price that LNG currently commands. To cover the shortfall, Pakistan’s energy-hungry industries have turned to coal, and Afghan coal specifically. Exports from its northern neighbor have shot up from nothing last summer to 500,000 tons a month now.

That Europe’s gas crunch is driving up demand for coal is evident from looking at how dramatically price points for major coal exporters have increased. South African coal skyrocketed to a high of about $400 a ton following the invasion: it’s normally between $50-100. The widely-used Australian Newcastle coal benchmark hit similar highs to South Africa, and is trading far above its pre-invasion peak.

Herein lies a big problem that Russia’s invasion of Ukraine presents. Diversifying away from Russian gas as quickly as possible, without enough increased gas production, renewables use, or energy demand reduction to replace it, will drive global LNG prices up. For European gas consumers, this will be bad enough: firms could have to shut, and poorer households will struggle financially without government assistance.

Even Germany is now coming out saying that it needs to extend the planned coal phase-out. Merkel initially wanted a coal exit by 2038. The new coalition moved that target to 2030. Now, they are figuring out that this isn’t possible.

This is where the US comes in. It’s the fourth-largest coal export country in the world, exporting 84 million metric tons in 2019 according to a report released in 2021. While it’s far behind Indonesia, Australia, and Russia, the US is a go-to-market given the pressure on Russia.

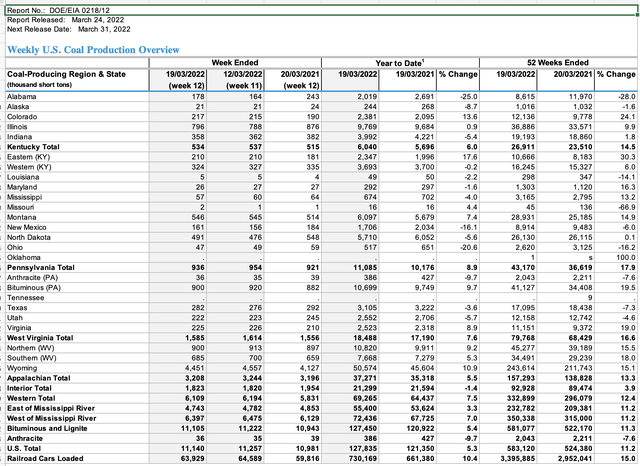

According to weekly production data, the US produced 11,140 thousand short tons of coal in the week ending March 19, 2022. That’s up from 10,981 thousand short tons in the prior-year week.

Year-to-date, production is up 5.3% as the table below shows. On a 52-week basis, we’re dealing with 11.2% higher production.

So, what does this mean for CONSOL Energy?

Revisiting The Risk/Reward

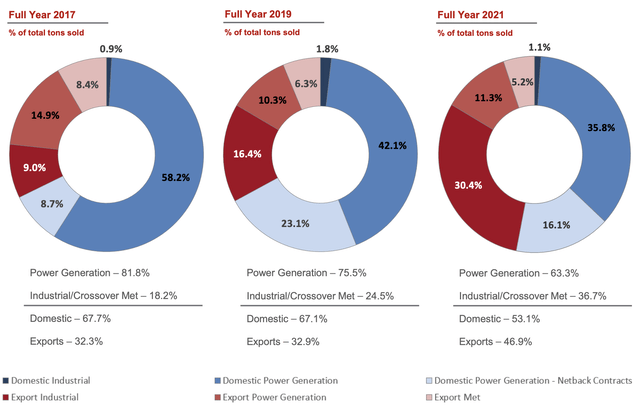

CONSOL is the best place to get exposure to export coal. Roughly half of the company’s coal production is going to export customers (industrial, power generation, and metallurgical). This number used to be closer to 1/3rd in 2017, which left the company more prone to domestic use, which is in a steady downtrend.

In this case, the company benefits from underinvestment in LNG (liquid natural gas), which will increase by 100 to 155 million tons per year over the next two to three years. Unfortunately, infrastructure is not supporting accelerating demand yet, which supports coal. For example, in the case of Germany, it’s easier to boost coal while waiting for LNG infrastructure to be put into place.

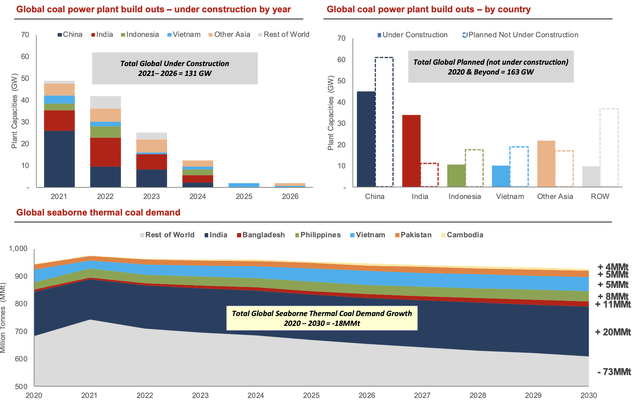

Especially, emerging markets are boosting coal demand. Last year, more than 50 gigawatts were added – mainly in China. This year, it’s closer to 40 gigawatts as India is taking over from China. In 2023, that number is 25 gigawatts. Note that this is demand under construction, which will likely rise further in the future as new projects are approved.

As a result, demand is expected to be steady on a long-term basis as emerging markets are bringing online demand that western nations are shutting down. It’s a bit ironic, isn’t it, as we all live on the same planet.

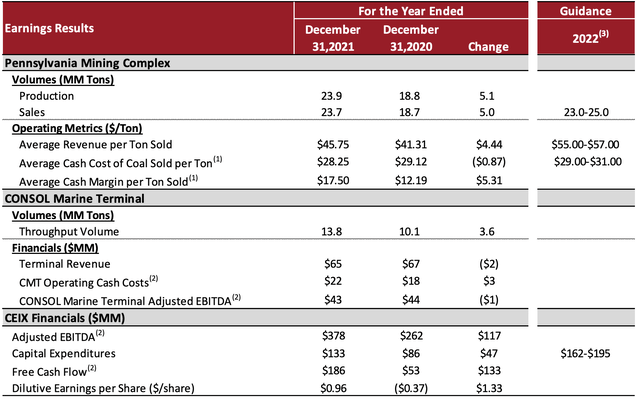

Anyway, in 2022, the company looks to sell between 23.0 and 25.0 million tons of coal. The average revenue per ton sold is expected to be at least $55.0 with average cash costs being subdued between $29-$31. In 4Q21, total costs per ton sold were $30.81, which was up from $27.49 in 4Q20 as a result of a steep increase in freight expenses among others like labor.

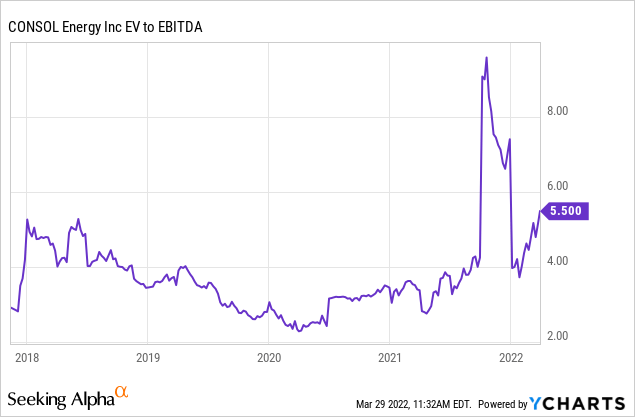

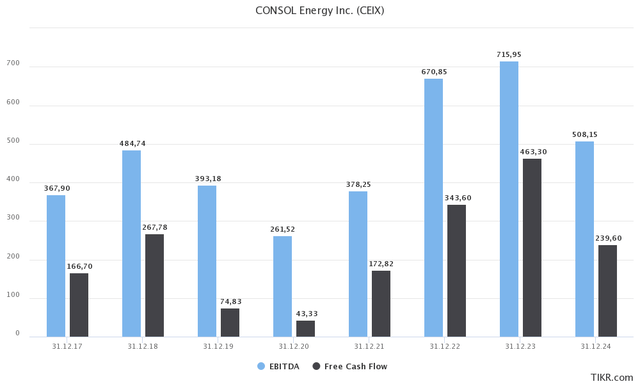

The graph below shows that the company ended last year with $378 million in EBITDA (it’s also mentioned in the table above). This year, the company is expected to do close to $700 million in EBITDA, which is reasonable given that the year started strong, which was not the case in 2021.

Free cash flow has rebounded as well, which the company uses to repay debt and repurchase shares. In its March investor presentation, the company mentioned that it still has $127 million available under its repurchase program. $193 million worth of stock has already been bought.

This year, free cash flow could exceed $343 million.

As a result, the valuation is still attractive.

Valuation

First of all, the company has a $1.3 billion market cap. $343 million in free cash flow implies an FCF yield of 26%, which is impressive. The company has roughly $524 million in net debt and close to $355 million in pension (and related) liabilities. This gives us an enterprise value of $2.2 billion. That’s roughly 3.1x expected EBITDA ($700 million average for 2022/2023).

That’s not an expensive valuation. And I do believe the stock has room to run to $45-$50.

However, please bear in mind that CEIX isn’t deep value anymore. For me, the risk/reward is not good enough to recommend starting a *large* position. If anything, I think it’s best to maintain a small position, which means selling some when sitting on a big profit or buying just a small position when bullish.

Takeaway

Coal came back to life last year. Global energy demand rebounded after the pandemic, which is now resulting in bottlenecks that are made worse by the ongoing war in Ukraine. Everyone needs coal: emerging markets, developing nations, and even countries that wanted to exit coal well before the Paris Climate target of 2050.

While I am not a long-term bull due to the dependence on prices over volume, I believe that CEIX has room to run to $45-$50. EBITDA is set to accelerate and free cash flow is high enough to eliminate net debt.

However, please be aware that CEIX is extremely volatile. Do not buy a large position. If anything, use strength to take some profits if you bought low. It never hurts to “de-risk” a bit after a rally this big.

(Dis)agree? Let me know in the comments!

Be the first to comment