MF3d/E+ via Getty Images

Introduction

As a dividend growth investor, I am constantly looking at my existing holdings as I am looking for positions that I should consider adding to. Moreover, I am screening for companies in sectors where I lack exposure to find decent investments. I analyze several companies every month to grow the number of options available.

One company that I own in my dividend growth portfolio is Texas Instruments Incorporated (NASDAQ:TXN). The company is in the IT sector, and it operates in the semiconductor industry. This is an industry that produces products with increased demand and a shortage in supply. Therefore, it has the potential to become a very interesting dividend growth play.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same methodology to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, Texas Instruments manufactures and sells semiconductors to electronics designers and manufacturers worldwide. It operates in two segments, Analog and Embedded Processing. The Analog segment offers power products to manage power requirements at various levels. The Embedded Processing segment offers microcontrollers that are used in electronic equipment, digital signal processors for mathematical computations, and applications processors for specific computing activities.

Wikipedia

Fundamentals

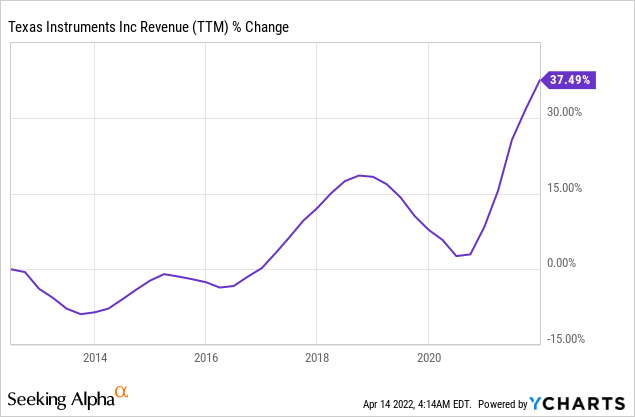

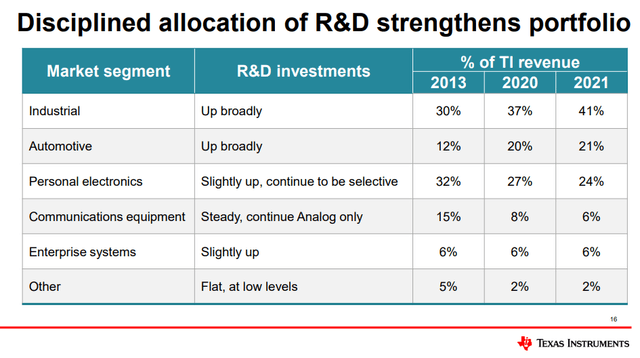

Texas Instruments has seen its sales growing by 37.5% over the past decade. This is a modest growth of roughly 3% annually. This growth is the result of R&D investments that amount to $30B over the past decade. The company didn’t spend money on M&A and focused on organic growth for the next 10-15 years mainly in industrial and automotive semiconductors. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Texas Instruments to keep growing sales at an annual rate of ~5% in the medium term.

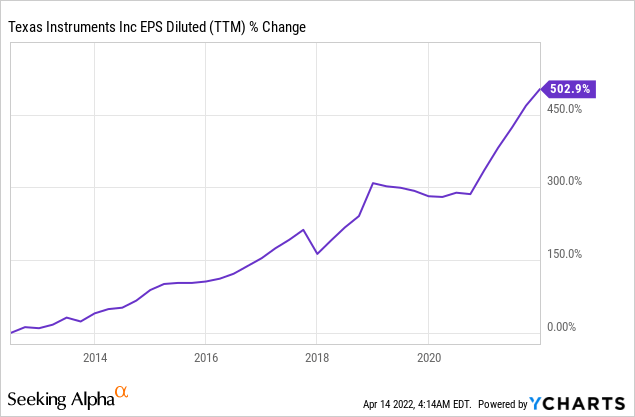

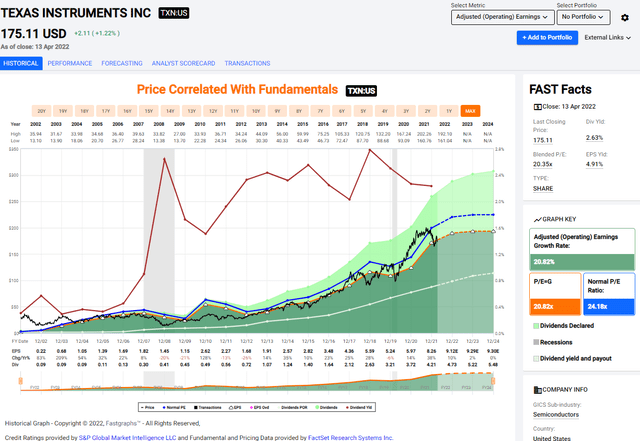

The company’s EPS (earnings per share) has grown at a much faster pace. The reason for that is the company’s buybacks and significant margin expansion. Texas Instruments more than doubled its operating margins over the last decade as the demand for semiconductors has grown significantly. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Texas Instruments to keep growing EPS at an annual rate of ~5% in the medium term.

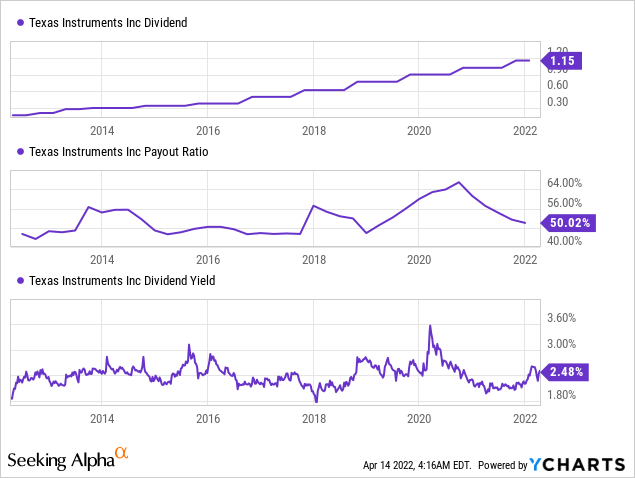

Texas Instruments have been paying a growing dividend for the past 18 years. Moreover, it hasn’t reduced the dividend in over 30 years. The company pays a safe 2.5% dividend with a payout ratio of 50%. The company has spent over $20B over the last decade in the form of dividends, and investors should expect the dividend to keep increasing. Investors should expect the rate of increase to be 5-7% in line with the company’s EPS growth.

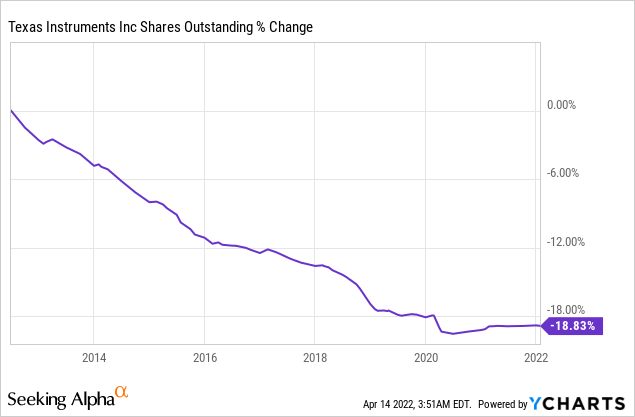

In addition to the dividend, the company is also buying back shares to return capital to shareholders. Over the last decade, Texas Instruments has spent over $20B on buybacks. It has resulted in a 19% decrease in the number of shares outstanding. As a dividend growth investor, I find buybacks in addition to the dividend advantageous, as it supports EPS growth. As long as the company has enough capital for growth, buybacks are a good use for excess capital.

Valuation

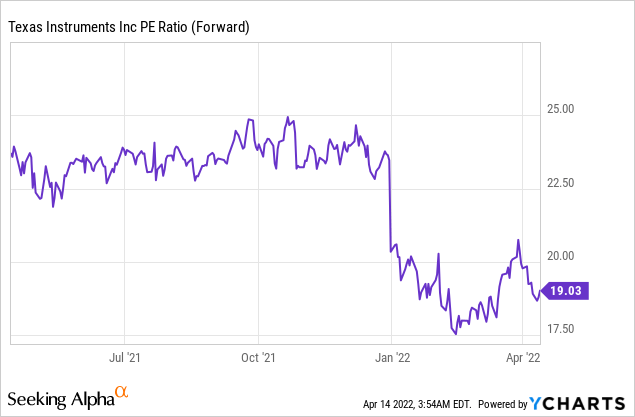

The company’s current P/E (price to earnings) ratio is almost at its lowest point over the last twelve months. The company is trading for 19 times its forecasted 2022 earnings. During most of 2021, the company was trading for more than 22.5 times its forward earnings. Therefore, the company is at one of its cheapest points in the last year.

The graph below is from Fastgraphs.com, and it shows that the stock is trading for a fair value at the current price. Over the last two decades, shares of Texas Instruments were trading for an average P/E ratio of 24, and now the valuation is over 20% lower. On the other hand, the company’s current forecasted growth rate is significantly lower than the average growth rate over the last two decades which stands at 21%. Therefore, I believe that the discount is in place, and the company is fairly valued and not overly attractive.

To conclude, Texas Instruments is an extremely solid investment. The company enjoys solid fundamentals that lead to growth in sales and EPS. The growth is then translated into dividend payments and share repurchases. This package comes at a fair valuation of 19 times 2022 earnings, which suits the slower than average forecasted growth rate.

Opportunities

There is a shortage in semiconductors that is driving prices upwards in the industry. The increase in demand and the lack of supply are pushing pricing upwards. It affects the company’s margins that are expanding. Therefore, as long as the shortage continues it will serve as a major tailwind both for Texas Instruments and its peers.

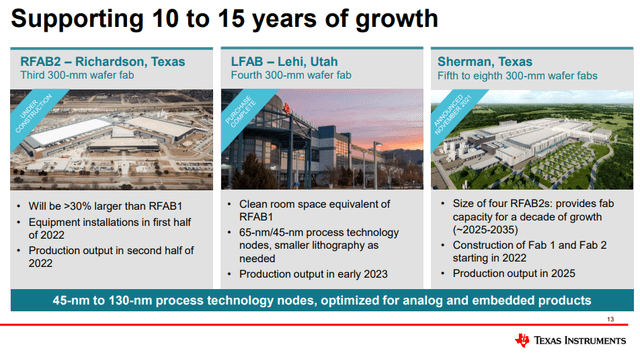

The American government is promoting the design, research, and manufacturing of semiconductors in the United States. It is doing so by incentivizing companies such as Texas Instruments to invest in the U.S. These incentives have an effect and as the slide below shows, investors should expect a production increase in the coming 2.5 years which will be translated into higher sales and EPS.

The automotive sector is the fastest-growing segment for Texas Instruments. Automotive accounted for 12% of revenues less than a decade ago, and its share has grown by 75% to 21% in 2021. Automotive is a fast-growing segment as electric cars require far more semiconductors compared to internal combustion cars. Therefore, it shows that the management is positioning itself toward growing segments.

Risks

The current forecast for semiconductor sales relies on the fact that the shortage is here to stay. In the long term, we can assume that supply growth will catch up with the demand. However, there are already several signs of a slowdown in the demand for semiconductors. If there is in fact decline in demand, we may see significant price corrections in most stocks in the industry over the short term.

Moreover, the semiconductors market is growing at a faster pace than 5% annually. 5% is the current forecasted growth rate for Texas Instruments. If the company grows slower than the market, the company is losing market share in the industry, even if it saves market share in a specific vertical. The company will attempt to keep innovating and improving its product to maintain its share and possibly increase it.

The third risk is the possibility of a recession. More and more professionals and economists forecast that we may see a recession in Q4 2022. A recession will hit first discretionary spending, and it will hurt Texas Instruments. The company increased its share of revenues when it comes to automotive and industrial. Both segments are sensitive to a decline in discretionary spending, and it puts some sales at risk.

Conclusions

Texas Instruments is a great company. For decades, the company has managed to achieve sustainable growth in the semiconductors industry. The strong fundamentals are paired with fair valuation. The company has several growth prospects both in the short term and in the long term. These initiatives will support future growth.

However, the company is currently forecasted to grow at 5% annually in the medium term. With possible headwinds, if a recession hits, there are some short-term challenges. Therefore, the current valuation is not cheap, but decent. I believe that despite possible headwinds, the current price is decent for a small addition together with future addition to your position along the way if the market gets more volatile.

Be the first to comment