AerialPerspective Works/E+ via Getty Images

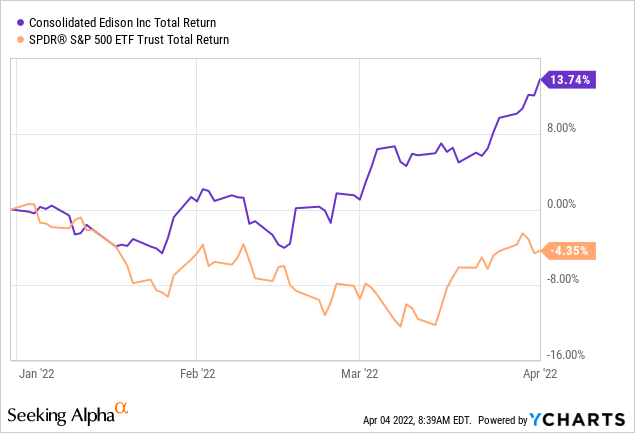

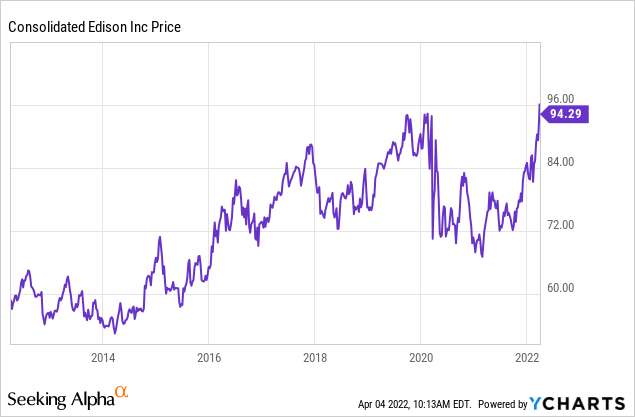

As most of you know, Consolidated Edison (NYSE:ED) operates a regulated electric, gas, and steam business that serves ~3.5 million people – as well as industrial, commercial, and government customers – in New York City, Westchester County, New Jersey, and Pennsylvania. The company recently announced a stunning Q4 EPS report that was a strong beat on both the top and bottom lines. As a result, the stock took off, is up 7% over the past month to a new all-time high, and has significantly outperformed the S&P500 this year (see chart below). However, the stock’s valuation looks long-in-the-tooth to me, especially given the current rising interest rate environment. Let’s take a closer look at the company, including the potential that the company may spin-off its clean energy business segment.

Investment Thesis

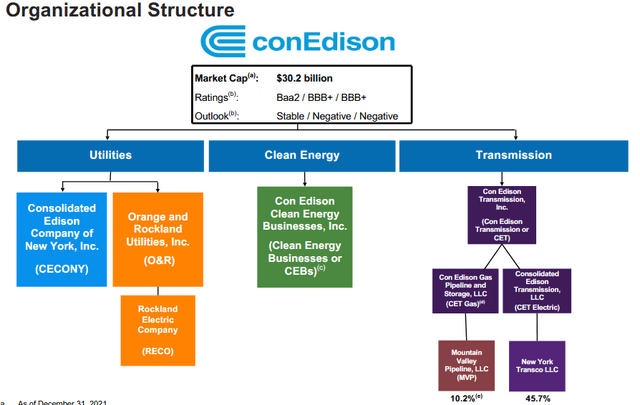

ConEd is an old-style utility company, long favored by safe-haven income-oriented investors. ED still gets ~85% of its revenue from its CECONY segment (Consolidated Edison of New York). However, ED has also embraced renewables and its relatively new Clean Energy Businesses already operates ~2.7 GW of solar and ~320 MW of wind. Altogether, ED’s Clean Energy segment represented 7% of FY2021 revenue but 19% of net income. ConEd also operates a Transmission Segment:

ConED Organizational Structure (ConED)

ED’s renewable assets are supported by long-term supply contracts. Over the long-run, and all things being considered, ConEd should be a beneficiary of the transition to EVs and the resulting increase in electricity demand. The company has committed to building the “grid of the future” that will deliver 100% clean energy by 2040.

In January, ConEd increased its dividend for the 48th straight year: boosting the quarterly payout to $0.79/share. On an annual basis, that is an increase of 6 cents/share (1.94%) to $3.16/share. The current yield is 3.3%.

Earnings

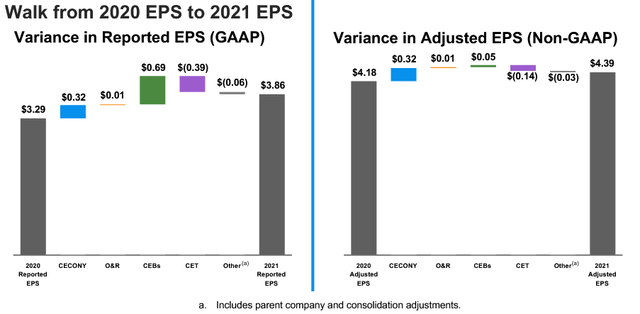

As mentioned earlier, ConEd’s Q4 EPS report was a strong beat on both the top- and bottom lines: non-GAAP EPS of $1.00/share beat by $0.10 while revenue came in a whopping $510 million higher than consensus. As of late, ConEd has generally been benefiting from higher gas revenue from colder weather, higher LNG export demand, and greater infrastructure spending due to the Biden administration’s BBB infrastructure legislation.

In the yoy earnings comparison waterfall shown below, note that earnings were boosted by strong contributions from the Clean Energy Business Segment (“CEB”), which were up $0.69/share yoy):

ConED 2021 Earnings Waterfall (ConEd)

There is some speculation that ED may spin-off its clean energy business. Indeed, the company itself said it is exploring “strategic alternatives” for the CEB business. Scotia Capital analyst Andrew Weisel commented that despite the forecast for 7-10% annual earnings growth of the segment, such a move:

… seems like a good strategy to us. CEB’s backlog of projects is large enough that management sees ample opportunity to continue to [develop projects and transfer to third parties], supporting future earnings growth. That said, management is evaluating strategic alternatives for the portfolio as a whole as the company doesn’t believe that the stock reflects the value of the business. We see a sale as reasonably likely, the proceeds from which could reduce [ConEd’s] equity needs.

A divestiture pf CEB could boost ConEd’s dividend growth rate going forward because it would potentially reduce equity dilution required to fund and invest in new green-space clean energy projects. I won’t speculate further on what ED may or may not do with CEB, but I do expect more clarity on the company’s strategy going forward during the upcoming Q1 conference call. Bottom line here is that ED’s CEB segment is a positive catalyst moving forward.

Valuation

As mentioned earlier, ConEd’s stock has been on quite a run lately – despite the dual headwinds of high inflation and the outlook for significantly higher interest rates. Inflation typically hurts utility earnings and ROC because they generally have fixed (rate-regulated) revenue, relatively high labor and capital costs, and energy costs that typically get passed-through to customers without positively impacting earnings. Such an environment makes it critical that ConEd receive timely rate adjustments by regulators. Typically utility stocks see these increased risks factored into their stock price – which makes ConEd’s recent move to all-time highs rather remarkable in my opinion. I am sure the discussion about the unleashing of shareholder value through a strategic move with the CEB segment has fueled the move higher in the stock.

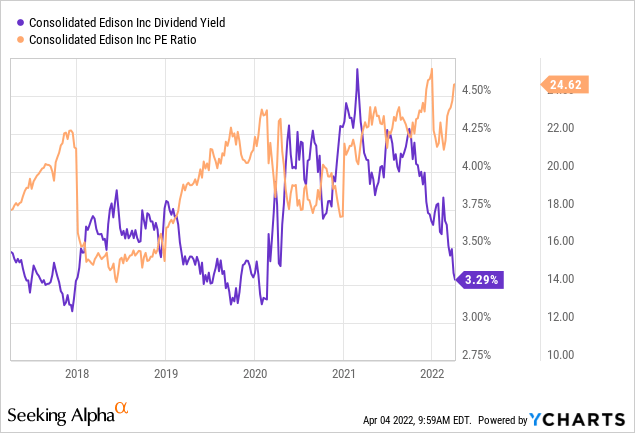

As a result of the recent move, ConEd is now trading with a forward P/E of 21.4x and a yield of 3.3% – metrics that on an historical 5-year basis arguably indicate a top:

That is, the P/E is high on an historical basis, while the yield is low.

Risks

I’ve already discussed the potential negative impact of high inflation and rising interest rates. Given the overall macro environment, ConEd will rely on timely rate regulatory relief given the generally higher labor and energy costs the company faces. However, the intense political climate in New York means achieving those rate increases can be tough. ConEd also maintains relatively old infrastructure as compared to newer utility company. As SuperStorm Sandy showed, these assets are vulnerable to the impact of global warming.

Upside risks include the spin-off of the Clean Energy Business segment. Such a move would likely increase shareholder value by enabling CEB to be more highly valued on an independent basis. This is a very positive development for ED shareholders.

Summary & Conclusion

YTD, ConEd’s stock has been on a strong run and is currently valued at the high end of its 5-year P/E and the low-end of its 5-year yield. That being the case, I rate the stock a HOLD and caution investors about the relatively high valuation level given the dual headwinds of high inflation and a rising interest rate environment. That said, the market response to a potential strategic move of spinning-off the CEB segment (or other steps to increase that segment’s value), has obviously been positive and could unleash significant shareholder value for ConEd investors.

I will end with a 10-year price chart for ConEd stock:

Be the first to comment