FreezeFrames/iStock via Getty Images

Comstock Resources, Inc. (NYSE:CRK) is a somewhat little-known American independent exploration and production company. The fact that the company is not particularly well-known does not mean that it cannot be a good investment, though. Indeed, Comstock Resources has returned a phenomenal 150.07% over the past twelve months, which makes this one of the few stocks to truly reward investors in today’s choppy markets. As might be expected, this impressive performance was largely due to the surge in energy prices that we saw over the time period, as well as Comstock Resources’ fairly impressive first-quarter results. There are certainly quite a few other things to like about the company as well and when we combine this with the firm’s very attractive valuation, there may be some reasons to add the company to your portfolio.

About Comstock Resources

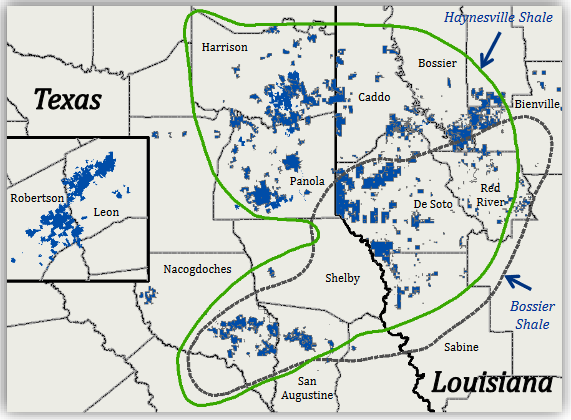

As stated in the introduction, Comstock Resources is an independent exploration and production company just like many of the others that I regularly discuss on this site. However, Comstock Resources is somewhat of a unique one because it operates exclusively in the Haynesville shale. The company controls approximately 372,000 net acres in the basin:

Comstock Resources

Admittedly, the Haynesville shale is a play that we do not hear about particularly often. As we might be able to guess from the map above, the play covers much of southwestern Arkansas, northwest Louisiana, and East Texas. As is the case with the Marcellus shale, the Haynesville shale is primarily a natural gas play. In fact, it is the second-largest natural gas play in the United States, with the United States Energy Information Administration estimating that the basin contains approximately 75 trillion cubic feet of recoverable natural gas. As such, we might expect that Comstock Resources is primarily a producer of natural gas. This is indeed the case as currently, Comstock Resources is one of the only energy companies whose production mix is 100% natural gas. This is a good place to be because, as we will see later in this article, the long-term fundamentals of natural gas are much better than those for crude oil. This is a very different situation than we had a few years ago when producers would flare off natural gas as it was not worth actually bringing to the market.

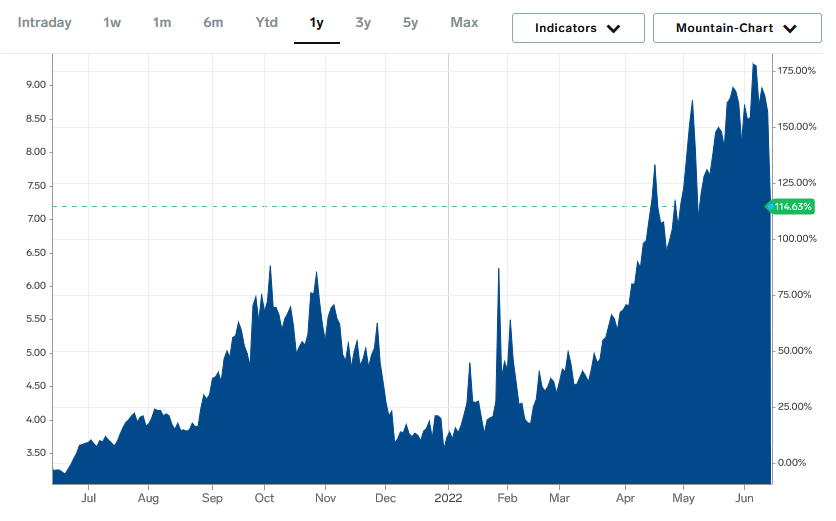

As anyone who uses natural gas to heat their home is certainly aware, gas prices today are much higher than they were a year ago. As of the time of writing, the price of natural gas at Henry Hub is $7.58 per thousand cubic feet, which represents a substantial 114.63% increase over the past year:

Business Insider

We certainly saw the results of this tremendous price increase reflected in Comstock Resources’ first quarter 2022 earnings results. In the most recent quarter, the company reported an adjusted EBITDAX of $332.994 million compared to $262.347 million in the first quarter of 2021. This is undoubtedly one of the biggest reasons for the strong performance that the company’s stock delivered over the past year. The rising price of natural gas is not the only reason to like Comstock Resources, however.

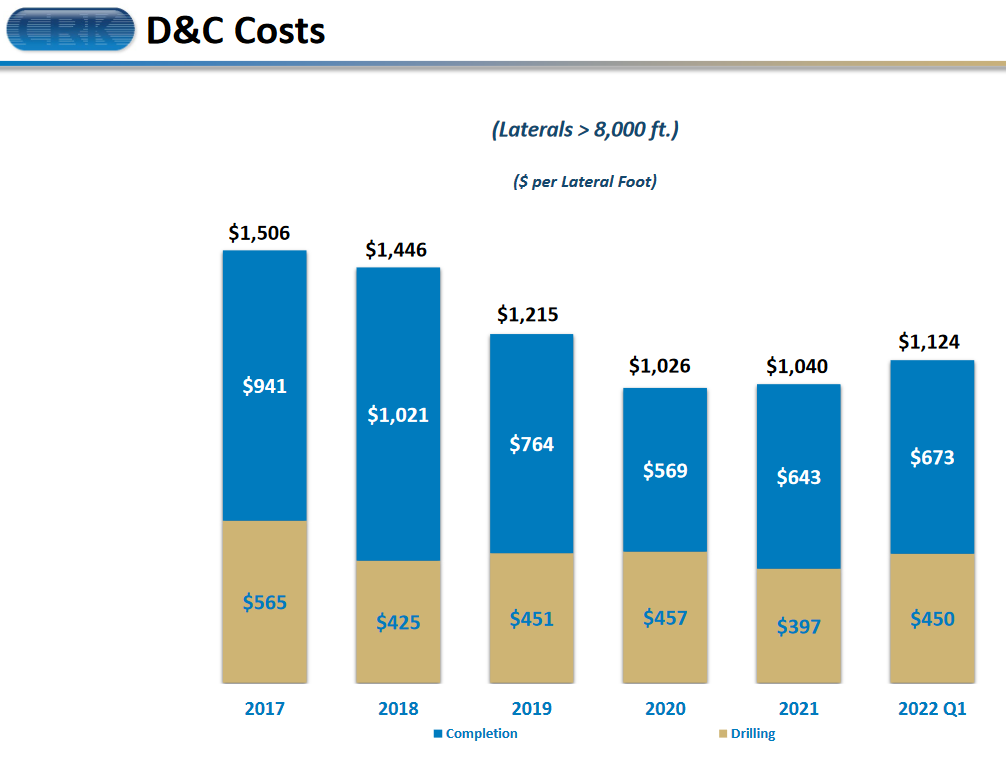

As I discussed in various previous articles, one of the biggest expenses for a shale operator is drilling wells. While this is a major expense for any oil and gas producer, it is especially bad for shale operators because of the extremely high decline rate of the wells. As I discussed in a previous article, this essentially forces the shale operator to continually drill new wells if it wishes to simply maintain, let alone grow, production, which is why many companies in the sector have historically struggled to generate any sort of free cash flow. It should be appealing to learn then that Comstock Resources has been working to address this problem and has managed to reduce its drilling expenses over time. It currently costs the company about $1,124 per foot to drill a well, which is a notable improvement over the $1,506 per foot that it cost the company back in 2017:

Comstock Resources

Some readers may note that the company’s drilling and completion costs increased in 2021 and in the first quarter of 2022. This is not necessarily a problem, though. The costs were artificially low in 2020 and throughout much of 2021 due to the lack of demand for drilling and oilfield services as a result of the pandemic-driven low energy price environment but that situation has since begun to change. The most important points of comparison are today’s costs against 2019’s and as we can see, the costs are much lower today. This is nice because the less money that the company spends on its capital expenditures, the more that is available to make its way to the shareholders in the form of free cash flow. A company’s free cash flow is the money that is available to perform tasks that ultimately benefit shareholders such as paying a dividend, buying back stock, or reducing debt. In the trailing twelve-month period, Comstock Resources reported a leveraged free cash flow of $820.9 million, which the company has been using to pay down its debt and thus strengthen its balance sheet. In the first quarter of 2022 alone, the company paid down $85 million of debt and states that it intends to get its leverage ratio (defined as net debt-to-trailing twelve-month EBITDAX) down to less than 1.5x by the end of this year. This helps to address one of the biggest concerns that I had in my last article on Comstock Resources, which was the company’s high leverage. While this is nice to see, that ratio is still higher than Comstock Resources’ most well-capitalized peers so the company will still have some work to do on this in 2023.

One thing that we have seen among independent exploration and production companies is a reluctance to grow production despite today’s high prices. There are a few reasons for this, one of which is a desire to improve their returns to investors as the sector has generally underperformed most others over the past decade. Comstock Resources, however, is not doing this. The company has guided for an average production level of 1.39 to 1.45 million cubic feet of natural gas equivalent per day over the full-year 2022 period. This is a fairly substantial increase over the 1.278 million cubic feet of natural gas equivalent that the company produced on average during the first quarter of 2022. This is almost certainly a reaction to today’s natural gas prices as Comstock Resources is able to generate positive free cash flow from each unit of natural gas that it produces. Thus, the company clearly is attempting to grow its free cash flow and indeed it is on track to generate a cumulative $2 billion to $3 billion of cash flow between now and the end of 2024. This is of course contingent on natural gas prices remaining at today’s levels, but as we will see shortly, that will almost certainly be the case. As already mentioned, Comstock Resources is currently using its free cash flow to reduce its debt but it seems likely that it will eventually do something else with it to reward its shareholders once it achieves its desired leverage level. It has not stated how it will seek to accomplish this, but the institution of a dividend could be a real possibility. This could very easily be a substantial one like Continental Resources (CLR) is currently paying. Any investor could appreciate this.

Fundamentals Of Natural Gas

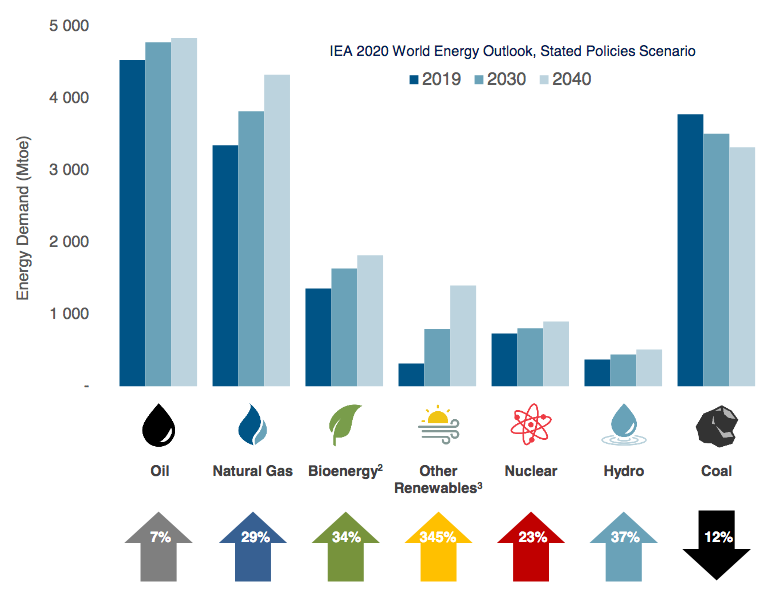

As already mentioned, Comstock Resources’ production is entirely natural gas, making it one of the few energy companies that can make that claim. As such, it may be a good idea to have a look at the fundamentals of natural gas as part of our analysis. Fortunately, these fundamentals are quite strong and point to a high likelihood that high natural gas prices will be with us for a very long time. The biggest reason for this is that the demand growth for the substance is likely to exceed the natural gas supply growth going forward. This may be surprising considering that many in the government and the media have been predicting the end of the use of fossil fuels. However, according to the International Energy Agency, the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

The biggest reason for this demand growth is the global concern about climate change. As everyone reading this is certainly well aware, these concerns have caused governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. One of the most common strategies being used to accomplish this is to encourage the retirement of old coal-fired power plants, which are then replaced with renewables. However, renewables alone are not reliable enough to support the power needs of a modern economy. After all, solar power does not work at night and wind power does not work when the air is still. Many utilities have been compensating for this by supplementing renewables with natural gas turbines. This is because natural gas burns much cleaner than any other fossil fuel and is reliable enough to keep the grid running when renewables are unable to do so.

The various shale producers in the United States such as Comstock Resources are among the few companies that are able to increase production sufficiently to satisfy this demand growth. This is due to the incredible wealth of regions like the Haynesville Shale. However, most indications are that production will not increase to the degree needed. This is because the energy industry in aggregate has been chronically underinvesting in production and midstream capacity since the energy bear market in 2015. We can see this exemplified in the fact that the offshore drilling industry never recovered from that event. According to Moody’s, the energy industry must immediately increase upstream spending by $542 billion in order to avoid a supply shock. It seems highly unlikely that the industry will do this when we consider the incredible pressure that it is under from politicians and environmental activists to improve its sustainability and investors to improve returns. Thus, it seems that we will have a situation in which demand growth exceeds supply growth, which economic law dictates will lead to rising prices. However, that does not mean that all companies will fail to grow production. After all, we have already seen that Comstock Resources is planning to boost its production, enabling it to take advantage of the high-price environment. Investors stand to benefit from this.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. After all, overpaying for any asset is a surefire way to generate a suboptimal return on that asset. As mentioned earlier, Comstock Resources appears to currently boast an extremely attractive valuation, which is quite nice. We can see this by looking at the stock’s forward price-to-earnings ratio, which tells us how much we are paying today for each dollar of earnings that the company is expected to generate over the next twelve months. As of the time of writing, Comstock Resources has a forward price-to-earnings ratio of 4.69. Although the overall market has been somewhat choppy lately, there are still very few stocks with a ratio of less than 10 so the company does appear to offer a good value. However, let us compare it to a few of its peers to establish a better point of comparison:

|

Company |

Forward P/E |

|

Comstock Resources |

4.69 |

|

Range Resources (RRC) |

6.45 |

|

EQT Corporation (EQT) |

14.37 |

|

Antero Resources (AR) |

5.88 |

|

Chesapeake Energy (CHK) |

6.40 |

(all data sourced from Zacks Investment Research)

As we can see, although nearly the entire industry appears to offer reasonably attractive valuations, Comstock Resources is by far the most attractive. This is likely because of its high leverage relative to some of these other companies but as we already discussed, the company is working to address this problem. Thus, we can conclude that it might be worth amassing a position, especially if natural gas prices remain high.

Conclusion

In conclusion, Comstock Resources is a little-known independent exploration and production company that is exclusively focused on the production of natural gas. This is a good place to be considering that the fundamentals for gas are quite strong and that natural gas prices are likely to remain high over the long term. Comstock Resources’ biggest problem is its debt load, which may explain the cheap valuation even relative to its peer group, but this is something that the firm is working to address over the next year or two. After its debt problems are resolved, Comstock Resources could very easily join in the industry trend of providing investors with a sizable dividend. Overall, it might be worth dipping a toe in given the valuation, which will hopefully increase as the company reduces its debt and its risk.

Be the first to comment