bjdlzx/E+ via Getty Images

By John Baldi, Michael Clarfeld, CFA and Adam Meyers

At its core, a conservative, low-risk dividend portfolio will have companies with strong balance sheets, recurrent predictable revenues, healthy free cash flow and wide economic moats — sustainable competitive advantages such as special intellectual property, dominant market positions or unique physical assets. In recent years, many commodity companies, subject to boom and bust cycles, have often been the opposite of that. However, several factors have changed since the COVID-19 pandemic began that have made certain commodities attractive for even more conservative dividend investors.

The current appeal of commodity investments reflects the combination of: improved fundamentals, with fortified balance sheets and more flexible dividend structures that prioritize returns to shareholders; the ability to actively target companies with low-cost resources that drive superior profitability in up markets and protect the bottom line in downturns; and favorable supply/demand conditions. After years of limited interest in commodity companies, natural gas, oil and copper are now squarely on the radar of active dividend investors.

Strong Fundamentals, Base-Plus-Variable Dividends Lower Commodity Risk

It is imperative that commodity companies operating in these spaces have strong balance sheets to weather the vagaries of price fluctuations. After years of fiscal conservatism and significant debt repayment, many of these companies now have terrific balance sheets. Further, we analyze the companies’ position on the cost curve to assess the competitiveness of their resource. Companies with lower costs are both more profitable and more defensive.

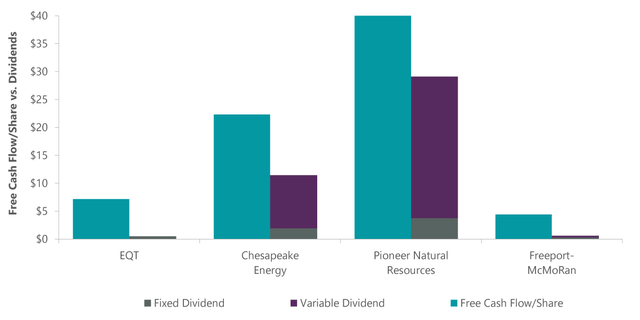

Additionally, dividend investors will want to ensure commodity companies’ capital allocation philosophy is fit for purpose. Given the impact of fluctuating commodity prices on earnings, we prefer commodity companies with small, base dividend payouts which can be maintained throughout the cycle. Some companies choose to top up these amounts with variable payments that flex with the commodity price and free cash flow generation, which we believe to be a sensible approach to returning shareholder capital. With this dividend structure, Pioneer Natural Resources (PXD) and Chesapeake Energy (CHK) look to be among the highest-yielding companies anywhere in the stock market with total dividend yields of 10% and 18%, respectively, in 2023 at recent futures prices.

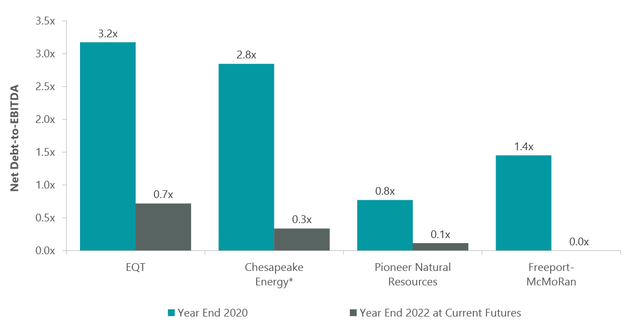

A look at the balance sheets and dividend payout ratios of select commodity companies highlights their financial health (Exhibits 1 and 2). EQT (EQT) and Chesapeake, both focused on natural gas, Pioneer, focused on oil, and Freeport-McMoRan (FCX), focused on copper, have recently significantly reduced their debt. This paves the way for high variable dividends during commodity price upcycles as leverage profiles are near 0.0x.

Exhibit 1: Balance Sheet Strength for Select Gas, Oil and Copper Companies

*Pro Forma Chief Acquisition. As of May 24, 2022. Source: ClearBridge Investments, Bloomberg

Exhibit 2: Free Cash Flows Amply Cover Dividends

As of May 24, 2022. Source: ClearBridge Investments, Bloomberg

Financial Strength Can Combine with Low-Cost Resources for Natural Gas, Oil and Copper

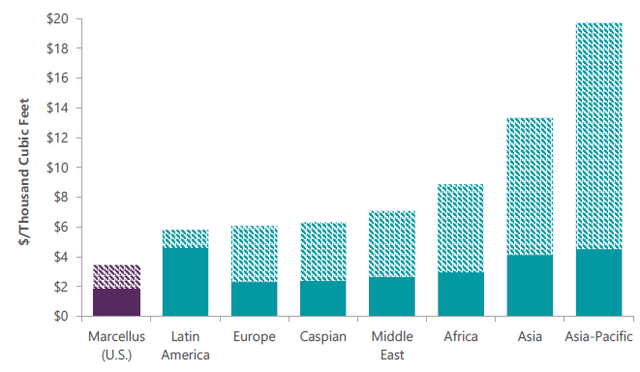

On the natural gas side, EQT and Chesapeake are two of the largest natural gas producers in the U.S. Both have leading operations in the Marcellus Shale — the largest and lowest-cost gas basin in the country (Exhibit 3). The Marcellus is the most economic gas supply in the U.S. and one of the lowest-cost basins in the world.

Exhibit 3: Natural Gas Break-evens by Global Region

As of May 24, 2022. Source: ClearBridge Investments, Bloomberg. Shaded area indicates range between high and low break-evens within each region.

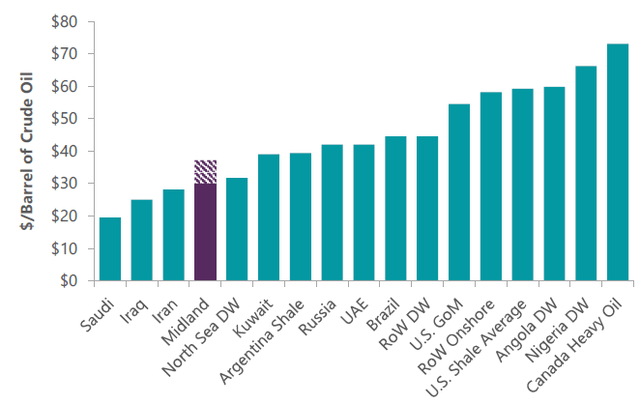

Pioneer Natural Resources is the largest independent oil producer in the U.S. with an attractive acreage position in the Midland Basin, a production region located within the larger Permian Basin. The Midland Basin is the largest production basin in the country and one of the lowest-cost basins in the world (Exhibit 4).

Exhibit 4: Oil Break-evens by Global Region

As of May 24, 2022. Source: Goldman Sachs, ClearBridge Investments (Midland). Shaded area indicates range between high and low break-evens within the Midland Basin.

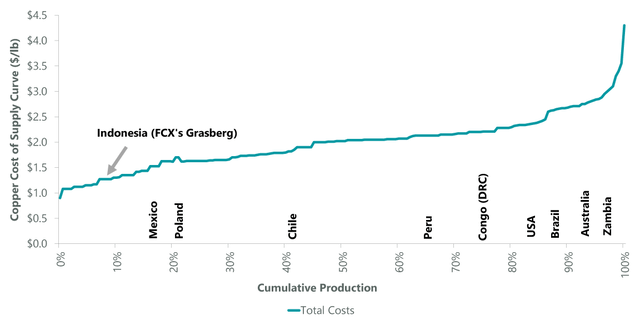

On the copper side, Freeport-McMoRan offers a similar example of strong fundamental characteristics that enable the company to weather the storms of commodity price fluctuations. Freeport’s Grasberg mine in Indonesia is one of the largest copper and gold mines in the world. Its high copper grade and high gold content effectively lower the cost of copper production, placing Freeport appropriately at the low end on the cost curve (Exhibit 5).

Exhibit 5: Freeport’s Grasberg Assets Low on Copper Cost Curve

As of May 31, 2022. Source: Vertical Research Partners.

Additionally, Freeport has been improving its balance sheet by paying down debt (Exhibit 1), with $19 billion in net debt reduction from 2015 to 2021. Its pristine balance sheet enables it to invest confidently in its business and ensure the ability to return cash to shareholders (Exhibit 2).

As a result, the company has been able to institute a base-plus-variable dividend that offers investors upside participation in strong commodity markets and a base dividend that is sustainable even in a commodity bear market.

Favorable Supply/Demand Balances for Natural Gas, Oil and Copper

While commodities are highly cyclical, we believe the energy transition and the shift away from reliance on Russian raw materials have improved the secular price outlooks for oil, natural gas and copper. In the very long run, the energy transition should lead to less demand for oil and natural gas. But in the intermediate term we see continued growth of both for many years to come.

Gas Market Has Tightened, Due to Lower Associated Gas Production and Increased Global Demand

Natural gas has long held appeal due to its ESG bona fides. Combustion of natural gas releases 50% less CO2 than coal, 25% less CO2 than gasoline and dramatically less particulate and pollution, per the U.S. Energy Information Administration (EIA). Further, all energy transition scenarios contemplate the increased use of natural gas as a bridge fuel to wean the world off coal and offset the intermittency of renewables (on days the wind does not blow through turbines and the sun does not shine on solar panels).

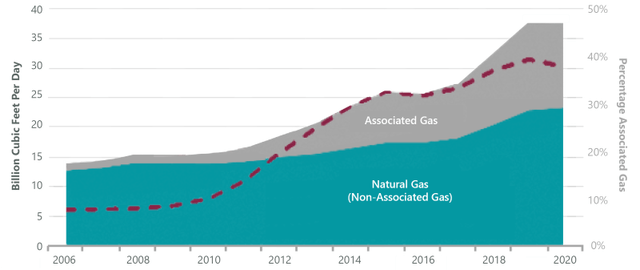

Unfortunately, until this year the investment case for gas was unattractive. Prices were weak, due to record-high oil production from the Permian basin bringing with it large volumes of associated gas — gas produced as a by-product of oil production (Exhibit 6). Associated natural gas production in the U.S. grew from 4.3 billion cubic feet per day in 2006 to 15.0 bcf/d in 2018; its share of total natural gas production during this period grew from roughly 8% to 16% (measured as gross withdrawals), according to the EIA.

Because the economics of associated gas production were driven by the price of oil, the equilibrium clearing price in the gas market (where supply meets demand) was completely decoupled from the cost of natural gas production. Despite years of gas prices below the industry’s break-even rate, pricing never rebalanced higher because associated gas production is driven by the price of oil, not gas.

Exhibit 6: Growth of Associated Gas

As of Aug. 31, 2021. Source: EIA, Enverus. Dotted line indicates percentage of associated gas (right hand axis).

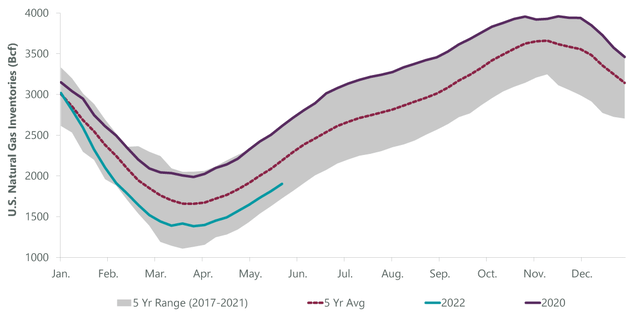

When COVID-19 hit, oil production rolled over and associated gas levels went down. While production has increased since early pandemic lows, rigs have been slow to come back online as the larger oil and gas companies now emphasize free cash flow generation instead of production growth. As a result, the gas market has tightened considerably (Exhibit 7).

Exhibit 7: Natural Gas Inventories Indicate Tight Markets

As of Jun. 3, 2022. Source: ClearBridge Investments, Bloomberg.

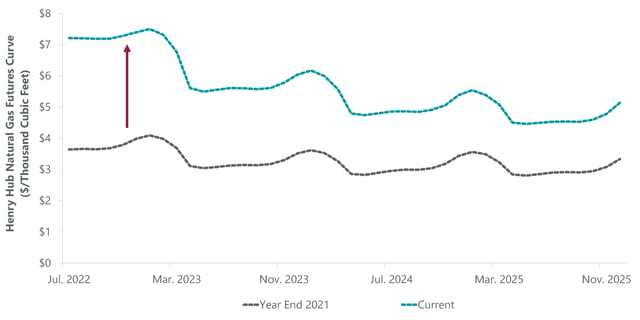

Against this backdrop of a healthier natural gas market, the Russian invasion of Ukraine in February 2022 catalyzed a significant jump in the gas price outlook (Exhibit 8) as Europe quickly decided to wean itself off Russian natural gas (historically 30%–40% of their total supply). While it will take years to fully displace Russian volumes, U.S. liquified natural gas (LNG) is likely to be one of the large market share beneficiaries of this rebalance. This shift will drive long-term demand for U.S. gas (and prices) higher.

Exhibit 8: Natural Gas Futures Have Jumped in 2022

As of Jun.14, 2022. Source: ClearBridge Investments, Bloomberg

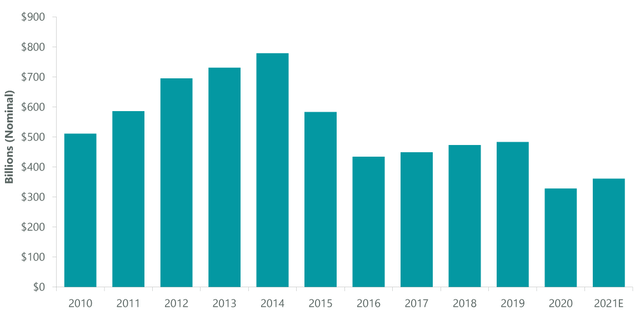

Oil Supply/Demand Imbalances Should Persist

Oil, meanwhile, has seen a dramatic drop in investment in production by upstream exploration and production (E&P) companies (Exhibit 9). This has been driven in part by pressure on companies to reduce debt and return cash to shareholders, which E&Ps have largely done. At the same time, spending has also been constrained due to ESG-driven fears of declining demand as the energy transition unfolds. Yet oil and gas demand has now returned to pre-pandemic highs and should continue to grow for some time. While we expect upstream spending will return, years of past underinvestment will constrain the outlook for near-term production growth.

Exhibit 9: Top Oil Project Spending by Year

Copper Central to Electrification and Decarbonization

Copper, like natural gas, has a robust outlook driven by increasing demand from the energy transition coupled with a favorable supply backdrop. As one of the most effective conductors of electricity, copper has long been the backbone of the modern industrial economy. Over the last 20 years, growth in China has been the biggest growth driver for copper, but we now see that baton being passed to the global energy transition.

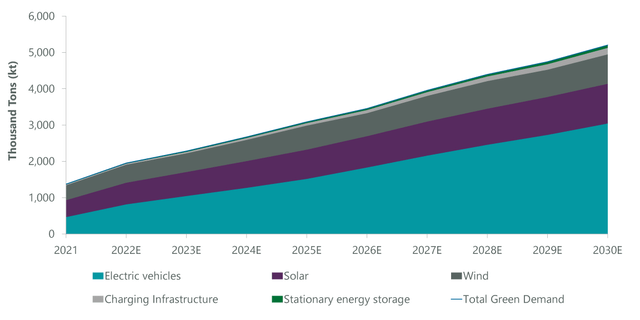

Electrification of the global economy — the process of replacing technologies that use fossil fuels with those that use electricity as a source of energy — will require substantial amounts of copper. This is already taking place in the growth of electric vehicles, which use up to 4x more copper than internal combustion engine vehicles. Growing renewable power production (wind and solar) will also require tremendous amounts of copper. A wind farm can contain between 4 million and 15 million pounds of copper, which is used in generators, wiring, tubing, cable and transformers. The decarbonized economy will be a copper-intensive environment (Exhibit 10).

Exhibit 10: Energy Transition or “Green” Demand for Copper

As of April 7, 2022. Source: Goldman Sachs Global Investment Research

Meanwhile, amid growing demand, the outlook for copper supply is very restrained. Current production is reliant on large legacy projects given underinvestment by the industry over many years. There are few large, high-grade copper resources to be developed and bringing a new mine online can take up to 10 years.

Modest Positioning Sufficient for Inflation Protection

Positions in appropriate commodity companies need not be large to make an impact in a dividend portfolio. Freeport-McMoRan is the largest publicly traded copper company in the world and yet is only ~15 basis points in the S&P 500 Index (as of May 2022); EQT is the largest natural gas producer in the U.S. and is not in the S&P 500. While we see limited value in positioning vis-à-vis an index, given the high beta of these commodity companies, it is possible to get sufficient exposure with modest, even surgical positions.

Fundamental strength and ample dividend coverage in the cases described above are especially attractive as they occur against the backdrop of high inflation. Post-pandemic energy demand, the push for energy security and the drive to decarbonize the global economy will need to depend on commodity resources that are both critical and finite. Exposure to these resources through companies with strong fundamentals that limit commodity risk is a good way to make the inflation resilience of a conservative dividend portfolio even stronger.

About the Authors

John Baldi is a Portfolio Manager and co-manages the Dividend Strategy and Dividend Strategy ESG portfolios.

Michael Clarfeld, CFA is a Portfolio Manager and co-manages the Dividend Strategy and Energy MLP products.

Adam Meyers is a Research Analyst for Energy/Basic Materials at ClearBridge.

Be the first to comment