Darren415/iStock via Getty Images

The cannabis sector continues to trade at decimated levels, but the market isn’t correctly separating the strong U.S. multi-state operators (MSOs) from the struggling Canadian cannabis firms. Columbia Care (OTCQX:CCHWF) remains an incredible play in the sector with the quick boost from the Cresco Labs (OTCQX:CRLBF) merger adding extra juice to a position. My investment thesis remains ultra-Bullish on the combination by obtaining a position via Columbia Care.

Big Deal

Each share of Columbia Care will obtain 0.5579 shares of Cresco Labs. At the current Cresco Labs price of $3.71 following an irrational and massive dip, the deal values Columbia Care up at $2.07 per share for solid 15% upside from the current $1.80 price.

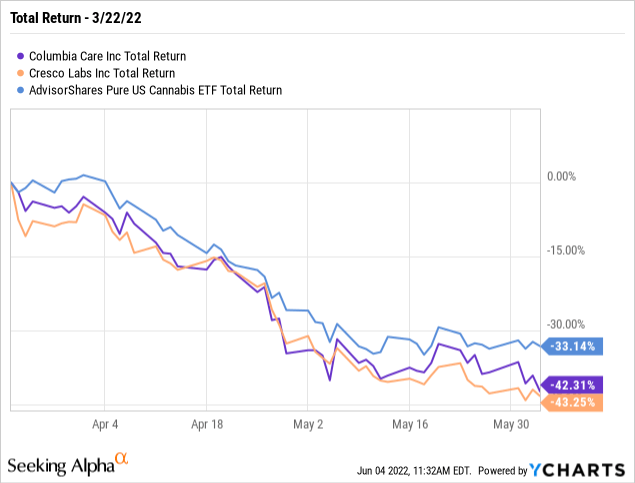

Despite an attractive and accretive deal, Cresco Labs has fallen 43% since the deal was announced. The market hasn’t liked the sector due to delays in the Federal government approval and weak consumer sales to start the year.

An investor buying Columbia Care here would see ~10% upside from Cresco Labs just rallying back to the $6.53 stock price on March 22 before the deal was announced. The deal provides Cresco Labs access to the just launched New Jersey recreational cannabis market along with another New York license owned by the small MSO.

Buying At A Discount

Investors should note the above 100% upside is just for the stock price to return to pre-merger levels. The new Cresco Labs, along with most MSOs, deserves to trade at far higher stock prices.

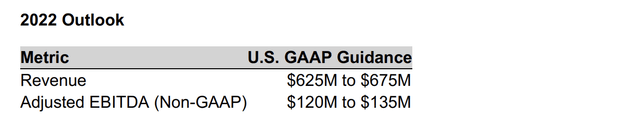

Even Columbia Care maintained strong guidance for 2022 when recently reporting Q1’22 earnings. Due to the launch of New Jersey in April, the MSO is finally on target for meeting the prescribed strong growth for the year.

Columbia Care Q1’22 Earnings Release

Cresco Labs is now only paying substantially less for this business producing $650 million in revenues this year. These numbers don’t even include a full year of New Jersey sales, nor do the numbers factor in any revenues from the upcoming launch of recreational cannabis in New York.

The market can only ignore these strong fundamentals for so long. Columbia Care forecasts $128 million in adjusted EBITDA for the year for margins just below 20%. The launch of New York and combination with Cresco Labs will push margins into the 30% range where a lot of other MSOs operate.

Again, these aren’t the type of numbers where stocks are usually decimated. The combined Cresco Labs trades at a valuation of around 4x adjusted EBITDA targets for 2023. Buying Columbia Care here provides an additional discount on those incredibly cheap numbers.

Investors won’t find many better values where one can buy a discounted sector, such as cannabis MSOs, with one still trading at a major discount to a merger price. In addition, the official launch of recreational cannabis sales in New Jersey places pressure on surrounding states such as New York and Virginia to officially launch their approved programs next year and pushes a state like Pennsylvania to move forward with approving recreational cannabis after already having a successful medical program. These states will start losing out on substantial cannabis taxes with state residents crossing state lines to purchase legal cannabis.

The combined company is poised to further benefit from consolidating Florida operations of the 2 firms trailing the market and consolidating into one provider with 30 stores. At the same time, Cresco Labs will likely be forced to sell the duplicate licenses in both Florida and New York and collect up to $500 million in cash to fund investments or pay down debt.

To recap, the stock has nearly 100% upside to reach where the stocks traded prior to the beneficial merger deal. At that price, the new Cresco Labs was estimated to only trade at ~2x 2023 sales targets making the stock a huge buy, even if one misses the opportunity to buy the stock at a discount to the discount.

Takeaway

The key investor takeaway is that investors should quickly light up the deep value inherent in this deal price. So many MSO cannabis stocks are now cheap spreading out investment dollars, but buying Cresco Labs via Columbia Care is one of the best bargains around.

Be the first to comment