Leon Neal

As I’ve covered in previous articles, I’m a long-term investor and my portfolio is spread within a few secular growth trends, including digital payments, so I decided to take a look at Coinbase Global (NASDAQ:COIN) as an alternative to other stocks that I own in this investing theme, namely PayPal (PYPL) and Block (SQ). However, I’m not impressed by its business fundamentals and the crypto winter is leading to very bad results, thus Coinbase is not a compelling investment right now.

Coinbase Overview

Coinbase’s core business is the offering of technology and financial infrastructure products and services that enable its customers to transact and engage with crypto assets. It serves clients worldwide and has close to 90 million customers, in more than 100 countries. Its aim is to be the leading financial services provider for retail and institutional users in the crypto asset ecosystem.

Coinbase has been listed since 2021 and has nowadays a market value of about $20 billion, a much lower value than when it was listed. Indeed, its shares are down by more than 75% from its all-time high reached last November, due to a lower valuation for growth stocks and a weaker market for crypto assets in recent months.

Coinbase was founded in 2012 initially providing access to Bitcoin (BTC-USD) markets, but since then its business has grown considerably, being currently the largest U.S.-based crypto asset exchange by trading volume. Despite its already relatively large size, Coinbase has good growth prospects over the long term as its business grows with the cryptoeconomy, as more interactions are expected to grow and crypto assets become more widely used, plus the cryptoeconomy should continue to increase as a percentage of the broader financial industry.

Business Model & Competition

Coinbase can be considered a leading player in the crypto market, given that its platform was key to the rapid growth of crypto assets over the past few years. Coinbase’s exchange business has become an easy-to-use, retail-friendly, platform being one of the first crypto asset exchanges to launch.

At the beginning, Coinbase offered the possibility to send and receive cryptocurrencies, but its product offering has evolved in the following years to many more applications, like invest, pay, or lend, beyond others, through its platform.

Coinbase’s business model is similar to other exchanges, such as stock exchanges, generating revenues both from transactions and subscriptions & services. It receives a fee or a spread on a per-transaction basis for a variety of products and also provides several subscription offerings and services that accrue fees over time, including staking, custody, and other products.

At the end of 2021, Coinbase stored and custodied over $278 billion in crypto assets on behalf of its customers, representing some 11.5% of the total market capitalization of crypto assets. The company believes that its market-leading share of crypto assets operated through its platform is a competitive advantage, allowing it to build deeper customer relationships and the offer of a broader range of products and services.

This market share and high number of customers are justified by Coinbase’s focus on retail clients, which have been the bulk of its business since inception. Indeed, in the last quarter, about 94% of Coinbase’s net revenues were generated by its retail customers, even though when looking at transaction volumes or assets on the platform it is much more balanced between retail and institutional customers.

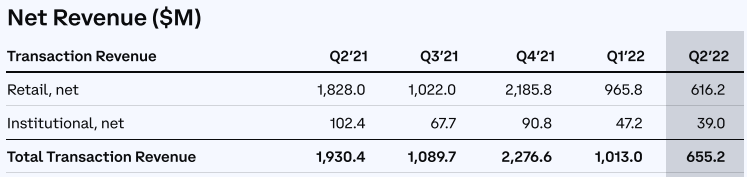

Revenue (Coinbase)

This happens because Coinbase charges much higher fees for retail than institutional customers, a trend that is explained by Coinbase’s being one of the safest and best ways to deal with crypto assets in the U.S. However, the difference is quite significant, with retail customers paying trading fees up to 4% while institutional customers can be charged less than 10 bps as they are mainly driven by price.

Indeed, competitors such as FTX or Binance focus more on the institutional side, putting downward pressure on fees in this segment. For instance, Coinbase’s competitor Binance has recently reduced Bitcoin’s trading fees for institutional customers to zero and is preparing to do the same for Ethereum (ETH-USD) in the coming months, showing that competition in the crypto assets is rapidly approaching the “stockbroker” approach.

In the retail segment, there are some factors that justify Coinbase’s high fees, such as its leading position in the industry, being based in the U.S. while competitors are based in foreign countries (providing, therefore, more safety for customers), but despite that this fee structure doesn’t seem to be sustainable over the long term.

Thus, higher trading fees at Coinbase and fierce competition from other exchanges, especially in the institutional segment, is likely to lead to lower fees in the future, a trend that may also happen in the retail channel as well over the medium term. Beyond competition from other crypto exchanges, in recent months there are also other more ‘traditional’ companies starting to offer the possibility to invest in some crypto assets, such as Block or PayPal, which increases competition for Coinbase in the retail segment.

Therefore, even though the cryptoeconomy may have good growth prospects over the long term, as the industry matures and evolves from just speculation to real-world utility in the future, the headwind of fee compression is a major negative factor for Coinbase’s investment case over the medium to long term that investors should not overlook.

Another key risk, in my opinion, is increasing regulation of the cryptoeconomy and Coinbase in particular, as it becomes more mainstream. The company invests significantly in compliance tools, for example in know-your-customer and anti-money laundering programs, but the risk of misconduct is also a risk that investors should be aware of.

For instance, according to recent news from Bloomberg, Coinbase is under investigation by the SEC due to some potential issues regarding the trade of trade digital assets by some of its customers that should have been registered as securities, which can potentially lead to fines or some business restrictions in the future. Given that many of its competitors operate in jurisdictions that lack, if have any, type of regulations, this may be an issue that can hurt Coinbase’s growth in the future as more volume (especially in the institutional segment) move to competitors with less demanding compliance procedures.

Financial Overview & Valuation

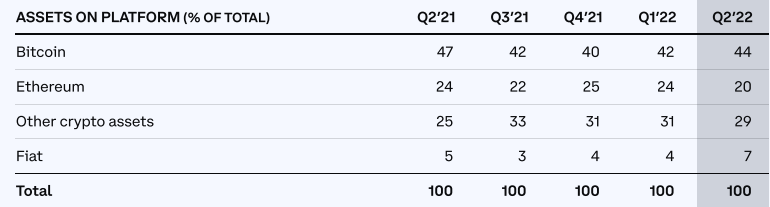

Regarding its financial performance, Coinbase’s history is quite volatile and highly related to the price of major crypto assets, namely Bitcoin and Ethereum. While Coinbase has expanded its products and services throughout its history, at the end of last quarter, some 64% of its assets under custody were related to these two coins, which makes its revenues and earnings highly exposed to share price fluctuations of these cryptocurrencies.

Assets (Coinbase)

As it is well known, 2021 was a banner year for Coinbase, boosted by a hot crypto market. This was a strong boost to Coinbase’s business, with revenues increasing by more than 500% to $7.8 billion during 2021, while net profit amounted to $3.6 billion, compared to just $322 million in 2020.

However, Coinbase’s financial performance has changed dramatically in recent months, as the crypto market turned much more negative and the price of Bitcoin and other crypto assets declined considerably.

Not surprisingly, Coinbase’s trading volume has been much lower during the first six months of 2022, explaining why its revenues are also way below last year’s levels. Indeed, in Q2 2022, Coinbase generated some $802 million in revenues, representing a decline of 61% YoY. This is explained by lower transaction revenues, while revenues from services & subscriptions increased by 44% YoY to $147 million.

Even though the company has made some efforts to control expenses, like reducing its headcount, its operating expenses amounted to $1.85 billion in Q2, which means that the company lost nearly $1.1 billion in Q2. This is a very poor performance and clearly shows how volatile Coinbase’s business is, not boding well for visibility regarding its long-term earnings power. Indeed, according to analysts’ estimates, Coinbase is expected to lose more than $2 billion in 2022, and to report losses for the next three years, a performance that is not particularly impressive.

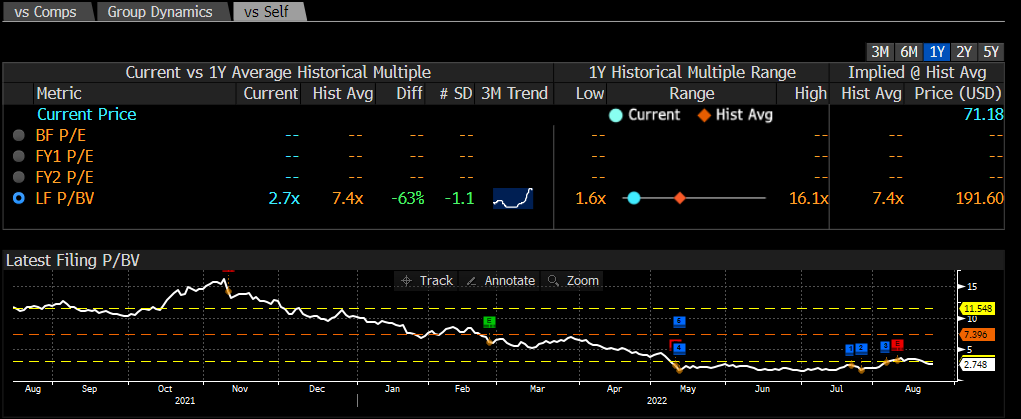

As the company’s performance has been quite poor recently, it is not surprising to see that its valuation has plummeted in recent months, as shown in the next graph. Given that Coinbase turned from profits to losses very rapidly, earnings multiples are no longer meaningful, thus book value seems to be the best alternative to value Coinbase. Coinbase’s valuation reached a peak back in November above 15x book value while currently is trading at only 2.7x. Note that this valuation is much lower than its historical average over the past year, justified by tough environment in the crypto market.

Valuation (Bloomberg)

As Coinbase is not profitable and is not expected to be in the next three years, investors should keep in mind that its valuation is highly speculative and, therefore, a valuation closer to book value may seem fair. Indeed, Coinbase’s bottom valuation was about 1.6x book value a few months ago, thus its shares may not be particularly cheap right now.

Conclusion

Coinbase has a leading position in the crypto exchanges industry, but competition is fierce and there is a lot of pressure on its high fees to compress over the next few years. In addition to a challenging fundamental profile, from a cyclical perspective, the outlook is even worse with the company being affected by the crypto winter.

Its business is too much exposed to crypto prices and, so far, I believe crypto is mainly used for speculation rather than having some daily use, thus for me personally I don’t think Coinbase is a good fit for my portfolio. Its shares aren’t also that cheap, thus I don’t see Coinbase as a compelling investment right now.

Be the first to comment