Chinnapong

COIN’s Birthright – Born With A Golden Spoon

Cryptocurrency exchange Coinbase Global (NASDAQ:COIN) is the 800-pound gorilla in the American crypto space. Founded by Brian Armstrong in 2012, it COIN quickly grew to become the dominant US crypto exchange by volume and user base.

From 2019 to 2021, COIN grew revenues 26-fold from $533 million to $14 billion. More importantly, it did so while growing profits from a $36 million loss to a $3.6 billion gain.

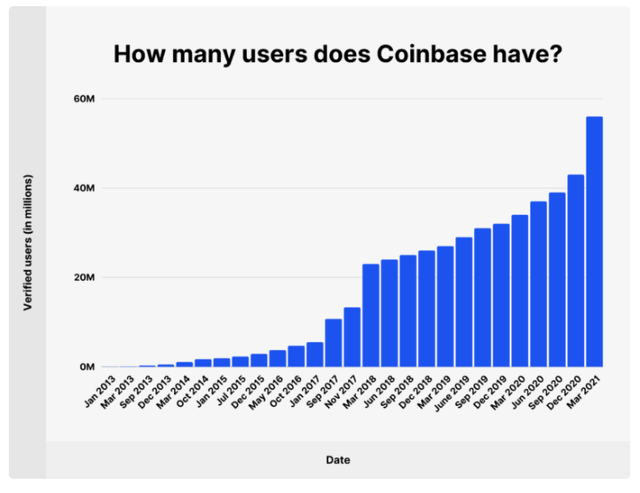

COIN makes its money from users trading crypto for a commission. The more users the better, and COIN was growing these at a blistering pace:

Coinbase verified users in millions (Backlingo, Coinbase, Alistair Milne)

Heady stuff, that. The market thought so too.

Armstrong timed his market entry perfectly: COIN went public at the height of crypto mania during a time of still euphoric stock markets. COIN’s value immediately shot up from $250 to an intraday high of $429.54 before closing the day at $328.28. In so doing, it achieved an $86 billion valuation.

Kudos to the CEO. This was arguably the best time for raising capital to fund a company and provide a powerful exit ramp for its angel investors. Unfortunately, it proved to be close to the worst possible entry point for retail investors.

With the plunge in stock markets and cryptos since then, COIN’s market cap subsequently dropped by 91% to $40.80 in May of 2022. At one point in the first quarter of 2022, there were even rumors of bankruptcy circulating, though most analysts dismissed these given the company’s strong cash holdings.

Today, COIN seems to have found a bottom rallying up to $116 in May before giving some of that up. It trades at $75 as I write this article.

Perfect Entry Point Or Dead Cat?

Investors are asking: is this a great time to buy? Or would they be purchasing a very alluring, but nevertheless irremediably dead cat?

The Bullish Case

There are many bullish factors to propel COIN much much higher. COIN arguably has the easiest interface for welcoming newbies to the crypto world. The vast majority of consumers are still relatively new to crypto. They vastly prefer the tried and proven to the complicated and unproven.

This more than offsets its relatively high transactions costs compared to other central crypto exchanges. With its 56 million strong existing user base, COIN is uniquely poised to leverage up its earnings by introducing new product lines and features.

This compelling interface and proven market knowhow have now attracted big institutional players. Recently , Coinbase announced an agreement to partner with Blackrock, the world’s largest asset manager, to bring crypto assets to institutional investments. Over time, trading earnings from institutional clients should dwarf those of retail investors that COIN now caters to.

Finally, the very same legislative push to reign in crypto by US legislators that has temporarily hurt COIN’s stock price (see SEC suing Coinbase) should quickly work to COIN’s favor.

Adhering to regulations means hiring more lawyers and auditors to conform to those regulations. Bigger players, like Coinbase, Binance or FTX, can spread these costs over a wider user base. Smaller competitors, unable to do so, may be forced to close shop.

In publishing 2nd quarter financial results, CEO Armstrong stated as much: “Somehow, the more regulation for crypto, the better for Coinbase (…) We are more than happy to engage with any regulators around the world who will take the time to meet with us. We don’t see that as a bad thing. On the contrary, we think it’s the best way to help the industry move forward.”

In my view, COIN is indubitably going to embrace and be embraced by US legislators as the approved “right” way for the American public to invest in crypto in a manner easily subject to government control and scrutiny.

I would argue that this “stamp of government approval” will unleash the hordes of retail and institutional investors to finally embrace cryptocurrencies with both hands. When crypto goes mainstream (it’s close now), COIN will be a major beneficiary.

The Bearish Case

COIN is intrinsically linked at the hip to the popularity of cryptos and crypto-trading. In case you have not noticed, these have suffered a bit lately.

Readers know that I’m an avowed crypto bull. Long term I believe the crypto space will eclipse all banking and financial transaction, and that on a global level.

But in the near term, I see the major cryptocurrencies dropping hard, due to the risk off environment the world now finds itself in. See my takes on Ethereum (ETH-USD) and Bitcoin (BTC-USD) in related Seeking Alpha articles.

My belief is that if the majors are going to take a hard hit, the minor leagues – the altcoins – are going to just get eviscerated during this upcoming bear market.

As go cryptos, so will go COIN’s stock price. Theoretically, it should not matter if cryptos go up or down as long as they trade actively, from COIN’s point of view. COIN makes a transaction fee either way.

But that’s the hitch. Most investors, including a surprising number of institutional investors, have a difficult time shorting stocks or betting on their retractions. Rather than using short positions, bearish option plays, or futures markets, investors just move to the sidelines.

If that’s true of stocks, it’s even more true of cryptos. It’s far more difficult – though not impossible – to bet on cryptos dropping in value. That’s why most people don’t do it. When cryptos are dropping, they just prefer to take their shovels and pails out of that sandbox and go play elsewhere.

So for whatever duration we get of a bear market in cryptos, COIN will suffer in lowered transactional revenues.

The other argument against COIN is that other players are lining up to take away big chunks of their conventional retail business. FTX arguably has a much better interface and far more competitive trading costs. Interactive Brokers – in my opinion the best traditional financial brokerages – has now embraced crypto with both hands after previously foreswearing any interactions with cryptos. Merrill Lynch, Fidelity, Robinhood, and many other big brokerages are all eagerly getting into the game.

Cryptos Trade Like Equities On Steroids

Perhaps because of the increasing institutional participation in the crypto space, cryptos and equities now trade in synchrony, but at higher amplification. In other words, what the Nasdaq is to the S&P, Bitcoin and Ethereum are to the Nasdaq.

Fundamentals Dictate To Be A Short Term Bear Long Term Bull

I’ve argued elsewhere in this blog that we’re going to see stagflation, higher interest rates for longer, a strong recession and plunging equities markets.

So in the near term, over the next 18 months or so, I see cryptos plunging in value. With this, COIN will drop in value.

So I’d be a near term Bear.

Longer term, I expect we’ll come out of this recession with a greater wariness of Fed monetary policy guidance and a healthy aversion to the vagaries of government controlled fiat money printing.

This will benefit the crypto space. New technologies in crypto will provide investors with better means of sheltering their portfolios from government whims and national downturns.

Blockchain technologies will become ever more sophisticated and dramatically lower the cost of running most businesses.

What Story Do Technicals Tell?

In the long term, real fundamentals determine the path of equities. But in the short term, equity prices are guided by mass psychology. That’s why it’s imperative to consider technical analysis.

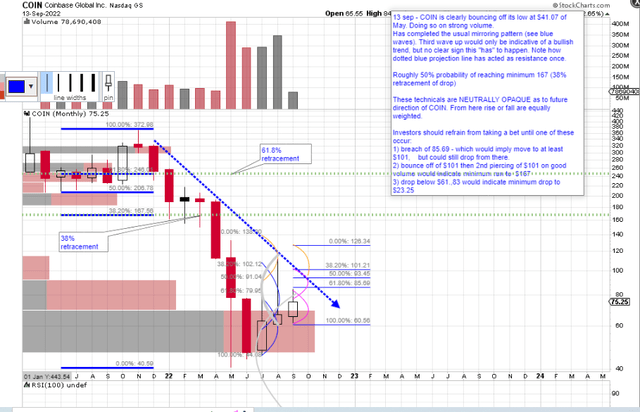

Take a look at the chart below, showing you the monthly candles of COIN prices since it began trading.

COIN prognosis September 2022 (Stockcharts )

An examination of the chart reveals a significant correction off of the lows of $41.07 reached last May. The stock is making higher highs. It retraced in two waves that matched expected Fibonacci moves, shown here in the dark blue ellipses, to reach $116.35 (point A). That point represented a 50% retracement of the distance since the March high. It’s more common to see a 61.8% retracement which would bring the price up to $141.66.

Note how this rise was exactly halted by the sloping resistance line shown in dotted blue. At ever lower points this acts as a natural barrier to the price that must first be tested and overcome.

The $116 price was a sufficient correction to match Elliott wave modelling (corresponding to the 4th wave in dominant down cycle) and it would not be surprising to see COIN move down from here. But nothing in the technicals precludes COIN from moving higher, after pausing again at the sloping blue line.

The first significant overhead resistance occurs around a price level of $205 (point D) where the volume indicates a lot of stocks changed hands.

Before that, the green dotted horizontal lines show a 38.2% Fibonacci rise over the span to the Nov’ 21 high. This is the most common level at which Elliott wave retracements peak out.

If COIN can break through the dotted blue resistance, I think the ultimate high will be between $167 (38.2%) and $205 (point D).

However, there is an equal chance the stock could bounce again off the blue price slope and then move lower. Sometimes, technical indicators are opaque and don’t give us a clear direction.

Usually, I would use RSI indicators at this point to shed more light on probable directions of movement. But we don’t have sufficient historical bars to construct even a 14- or 30-period indicator.

So we’re left waiting for a wave formation (with a required retracement of at least 24%-68%) and that wave’s subsequent breach beyond its peak or trough.

Personally, I’ll wait to take a position until one of the following occurs:

1) a breach of $85.69 would signify a minimum move up to $101 (see pink ellipses)

2) a drop below $59.42 would imply a mirrored move down to $23.35, and eventually much lower.

3) If a wave has formed at $101.21 and that subsequently breaks through resistance (blue dotted line) to move higher, then we’re off to reach the points B or C shown in the graph, namely $141 or $157.

What Action Should I Take Now?

The hardest part of both investing and trading is to know how to exercise patience. I think both the fundamental and technical indicators are evenly weighed now, with a slight bias to the downside.

So I’ll sit pat for now. Within one week or two at the most, I should get a more reliable signal, and can go long or short. You could use stock only positions, but I prefer using broken wing butterfly or calendar option trades. These allow you to obtain reward ratios of 3 to 10 times your risk.

Be the first to comment