Justin Sullivan

Investment Thesis

The Coca-Cola Company (NYSE:KO) has remained a solid consumer defensive stock in the past two decades, given its highly popular product range, especially the Classic Coca-Cola. Given how the soft drink has been consistently ranked top globally with a brand value of over $74B in 2021, it is no wonder the company has the majority at 53% of value share for the sparkling beverage market then. Combined with its improving net income/ FCF profitability, tight operating efficiencies, and decent dividend yields, we expect KO to continue outperforming for many years ahead indeed.

Nonetheless, it is also evident that KO is trading at a slight premium now, with a minimal margin of safety. Given the bearish sentiments and the market’s fear regarding the potential recession, we may see a moderate retracement ahead, similar to the recession in 2009. The KO stock had fallen by 37.3% then, from $31.15 in January 2008 to $19.52 in March 2009. Therefore, we recommend patience for now, since we may see a more attractive entry point to this stellar Blue Chip stock.

KO Is The Cash-Cow King Despite Multiple Headwinds

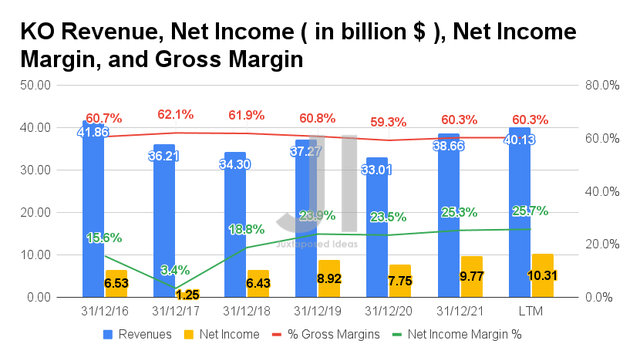

Despite the brief fall in its revenues and net income in FY2020, KO had picked itself up very quickly in the past year. By the last twelve months (LTM), the company reported revenues of $40.13B and gross margins of 60.3%, representing impressive revenue growth of 7.6% and a minimal decline of -0.5 percentage gross margin points to FY2019 levels, respectively. In addition, KO also reported record net incomes of $10.31B with margins of 25.7% in the LTM, representing an excellent increase of 15.5% and 1.8 percentage points from FY2019 levels, respectively. Therefore, highlighting the company’s stellar supply chain management and operating efficiencies in the current macro environment.

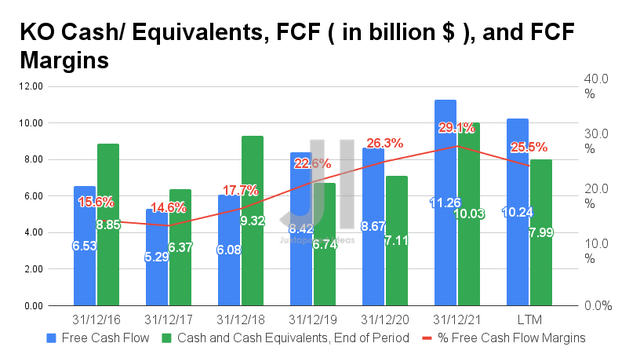

Therefore, KO also improved its Free Cash Flow (FCF) generation, with an FCF of $10.24B and an FCF margin of 25.5% in the LTM, representing an excellent improvement of 21.6% and 2.9 percentage points from FY2019 levels, respectively. Its cash and equivalents on the balance sheet remain stellar as well, with $7.99B reported in the LTM. Notably, in FY2009, KO reported an impressive increase of 17.5% in its net income profitability and 10.5% in FCF generation, despite the 3% YoY drop in its revenues during the recession then. Thereby, underscoring the massive relevance and resilience of its cash-cow business during the rising inflation and the potential recession. As a result, we have no doubt that KO will indeed prevail for the next few decades ahead.

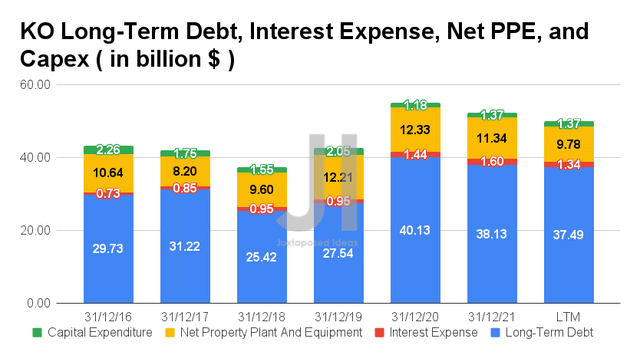

Given the devastating effects of the COVID-19 pandemic, it is evident that KO also took on more financial obligations in the past two years. The company reported $37.49B of long-term debts with $1.34B of interest expenses in the LTM, representing a notable increase of 36.1% and 41% from FY2019 levels, respectively. Nonetheless, it is also essential to note that KO had also trimmed its net PPE assets to $9.78B with a reduced capital expenditure of $1.37B in the LTM, indicating a strategic reduction of 20% and 33.1% from FY2019 levels, respectively. Thereby, highlighting the management’s competent capital management.

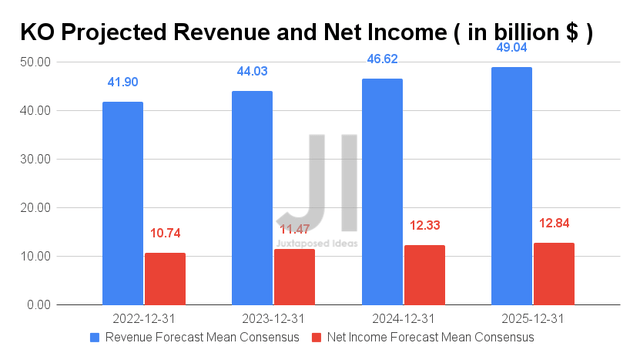

Over the next four years, KO is expected to report revenue and net income growth at an impressive CAGR of 6.13% and 7.07%, respectively. In addition, its net income margin is expected to continue improving from 25.3% in FY2021 to 26.1% in FY2025, a notable improvement from its pre-pandemic averages of 19.1%.

For FY2022, consensus estimates that KO will report revenues of $41.9B and net incomes of $10.74B, representing tremendous YoY improvement of 8.4% and 9.9%, respectively. This is important, since the market believes that the company is able to sustain its hyper-pandemic sales and profitability moving forward. In addition, analysts will be closely watching KO’s FQ2’22 performance, given consensus revenue estimates of $10.53B and EPS of $0.67, representing YoY increase of 3.96% and -1.66%, respectively. Nonetheless, we are confident that the company will continue to smash estimates, as it had in the past ten consecutive quarters.

KO Remains A Decent Dividend Stock For Long-Term Hold

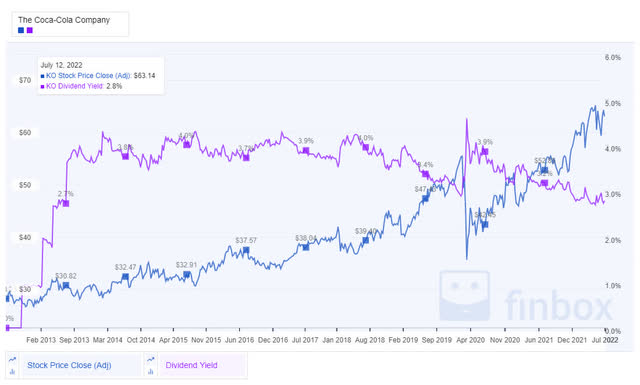

KO 10Y Share Price (adj) and Dividend Yield

KO has had a discernible long-term stock price uptrend over the last ten years. Though the stock had a slight decline in its dividend yield from 3.8% in 2014 to 3% in 2022, its dividend payout has been increasing at a CAGR of 4.9% in the past eight years. The fact is also undeniable that KO has had an excellent 10Y Price Total Return of 124.8% and a 5Y Price Total Return of 66.1%, given the steady growth of its stock price.

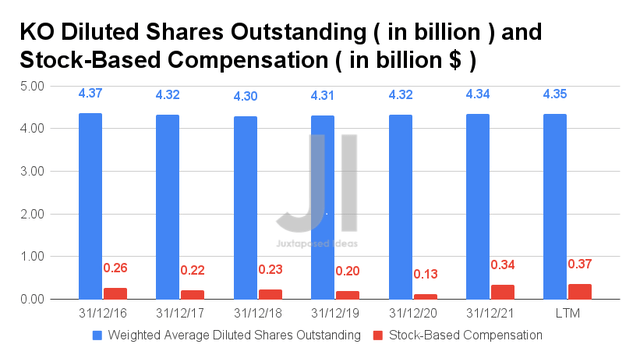

As evident from the chart, KO has also kept its diluted shares outstanding and stock-based compensation (SBC) expenses relatively stable in the past few years. For FY2022, we expect to see a moderate decline in its share count of up to 4.2M, given the company’s share-buyback program worth $500M for approximately 160M shares. Thereby, returning even more value to its long-term investors, despite the macro issues.

So, Is KO Stock A Buy, Sell, Or Hold?

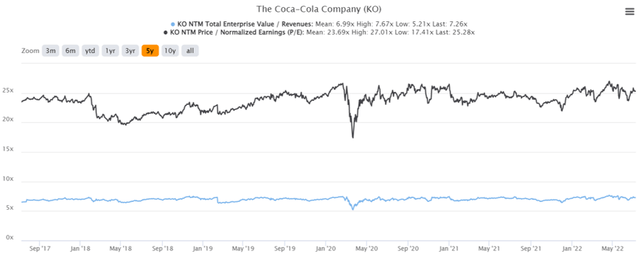

KO 5Y EV/Revenue and P/E Valuations

KO is currently trading at an EV/NTM Revenue of 7.26x and NTM P/E of 25.28x, higher than its 5Y Revenue mean of 6.99x though elevated from its 5Y P/E mean of 23.69x. The stock is also trading at $62.94, down 6.3% from its 52-week high of $67.20, though at a premium of 20.3% from its 52-week low of $52.28. It is evident that despite the brief plunge during the start of the COVID-19 pandemic, the KO stock has had a strong rally in the past two years with no signs of abating.

KO 5Y Stock Price

Nonetheless, we have to admit that the KO stock is also trading with a minimal margin of safety now, given the consensus estimates’ price target of $70.14 with only an 11.44% upside. Given the current bearish market sentiments, we cannot justify paying this premium, despite the company’s improving net income/ FCF profitability and decent dividend yields of 2.73% in the past decade.

In addition, KO is expected to report its FQ2’22 earnings on 26 July 2022, which will provide us a better clarity of its performance thus far. Combined with the S&P 500 Index declining by 21.8% in H1’22, we encourage all investors’ patience and even more patience, before adding any exposure during this highly volatile market condition.

Therefore, we rate KO stock as a Hold for now.

Be the first to comment