Marina113/iStock Editorial via Getty Images

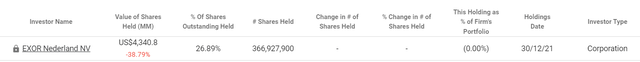

After our follow-up note on Exor N.V. (EXXRV), today we will deep-dive into another company in their family galaxy after our coverage of Ferrari (RACE), Iveco (OTCPK:IVCGF), and Stellantis (STLA). Indeed, Exor is the main shareholder of CNH Industrial (NYSE:CNHI) with an equity stake of 26.89%.

Source: TIKR

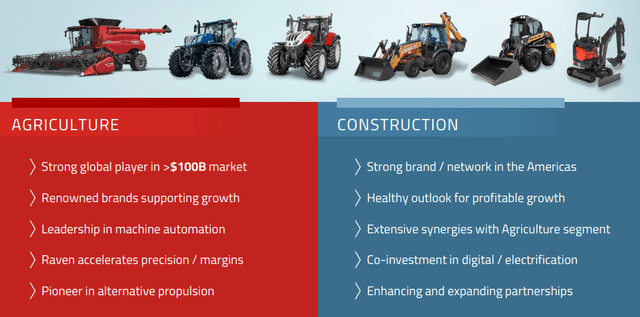

The company is engaged in the design, production and selling of construction and agriculture equipment such as trucks, buses, tractors and specialty vehicles. CNH is dual-listed in New York and Milan. It is headquartered in London and was founded in 1842. Thanks to a global presence, the company’s top-line sales are very diversified (both North America and Europe account for 37% of total sales, followed by South America and APAC region with 16% and 11% share respectively). In divisional sales, the agriculture segment is the main revenue generator with 76% of the top-line and then the construction and financial service divisions represent 16% and 8% respectively.

Source: Capital Market Day 2022 (Opening Remarks Presentation)

Why are we positive? MACRO and MICRO view.

We analyzed the trend in our Corteva publication. We are confident that also CNH could be a long-term winner of the world’s population needs. It is forecasted that we will reach 10 billion people by 2057 and also food per capita consumption is estimated to significantly increase given the better conditions of the Emerging Markets. As already seen retrospectively, countries such as Nigeria, India and China will likely consume more food, largely multiplying the possibility of food scarcity over the short-term horizon. As already explained, in this future environment, “it is becoming increasingly important to scale food production to absorb the enormous and growing demand. This is possible in two ways: increase cultivated areas or increase the productivity of existing ones”. At the moment, the former option would add pressure to an ecosystem that is already precarious. Whereas, the latter choice is the only truly sustainable way to feed an ever-growing population thanks to an increase in productivity within the same cultivated area. How? leveraging two specific capabilities:

- Thanks to corporations such as Corteva, Yara International and LSB Industries (all covered by the Mare Evidence Lab team). In fact, their internal R&D department constantly develops new products (such as modified crops & seeds) which aim to be more resistant to climate change and natural adversity;

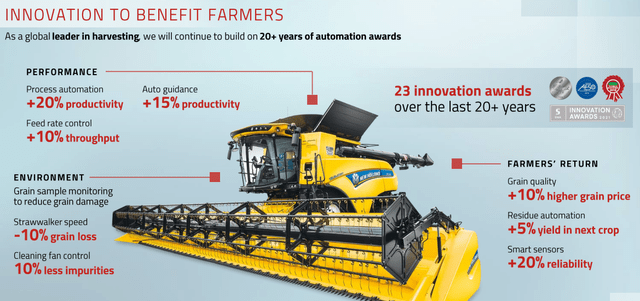

- Or companies such as CNH Industrial that develop and innovate new machines to increase food production capacity that benefit farmers in their day-to-day work. Here is below a snap taken from the Agriculture Segment update, presented during the 2022 capital market day, in which CNH explained how with this new equipment a 10% minus in grain loss occurs.

Source: Capital Market Day 2022 (Agriculture Segment presentation)

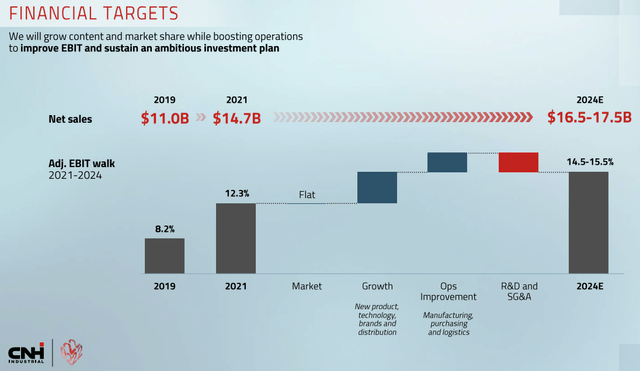

Aside from the reduction in grain damage, there are financial implications that sustained our investment thesis. With the new grain harvest machine in mind, with smart sensors and lower dispersion in grain, CNH Industrial is estimated to reach a new level of profitability. The company aims to reach an adjusted operating profit margin of 15% by 2024.

Source: Capital Market Day 2022 (Agriculture Segment presentation)

Q2 Results

Very briefly, CNH Industrial communicated the financial results for H1 2022 on the 1st of September, a period that closed its accounts with a strong improvement in revenues and a positive performance confirmation in the second quarter. The Group’s turnover recorded consolidated revenues of $6.08 billion with a +17.5% compared to the second quarter of 2021, and a net profit of 552 million up in abs value by a plus 38 million compared to the last year’s result. Improved prices and sales volumes offset the significant increase in costs, with EBITDA improving by $174 million over the previous year.

However, components scarcity affected production, resulting in a FCF of industrial activities of $0.4 billion which, although it represents a huge improvement compared to the previous quarter (-1.1 billion dollars), is nonetheless almost 50% lower than in the second quarter of 2021.

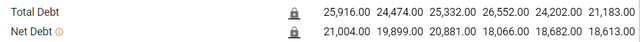

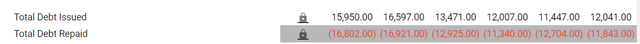

Inventories continue to be high due to the constraints in the production logistic chain, while inventories of finished products are low. At June’s end, total debt was $20.8 billion down from the previous quarter which was at $21.3 billion. At the segment performance level, the agriculture segment was between lights and shadows. However, the segment’s order book increased by almost 5% over the previous year. Moreover, orders remain more than 3x higher than pre-pandemic levels, despite CNH only accepting orders until the first quarter of 2023 due to cost uncertainties.

Valuation and Risks

During the Q2 results Q&A, the company confirms its guidance on the industrial activities for the year. As already announced at the beginning of the year, revenues will be up between 12% and 14%, and expected free cash flow will be in excess of $1 billion with SG&A and R&D expenses at 7.5% of revenues and approximately at $1.4 billion.

Two days ago, CNH also announced a $300 million buyback following the € 100 million share repurchase completed on September 14th. Financed by the company’s liquidity, the buyback aims to optimize CNH’s capital structure and allow the company to meet its obligations deriving from the existing equity incentive plans. The program will close when the maximum amount is reached or by the 12th of October 2023.

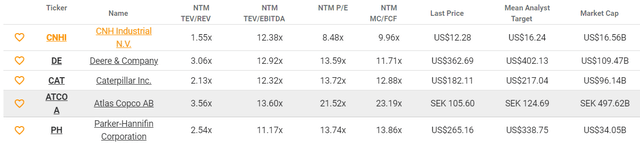

Regarding CNH valuation, even if the company is supported by MACRO to MICRO reason, we feel that this stock is already priced in by the market and we prefer to wait for a better entry-price momentum. Moreover, based on our two-stage DCF model with a long-term growth rate set at 2% and a WACC of 10%, we derive a target price of $12.5 per share in line with the current stock price. We should keep in mind that CNH ended H1 2022 with more than $20 billion in debt and over the last years, the company was able to benefit from lower interest rates. However, with inflation expectations and rising rates, despite our forecast of better future profitability at the operating profit level, this trend might reverse lowering CNH’s FCF.

Total debt evolution Revolving debt facility management

Source: CNH TIKR

Looking also to the comps analysis, we see that CNH’s valuation on an EV/EBITDA basis is in line with its closest peers, so our internal team has decided to initiate covering CNH with a neutral rating. Risks factors that might affect our target price: 1) higher competition (in particular incoming Chinese new players), 2) interest rate developments, 3) new models execution risks, 4) changes in regulations, 5) chip shortage, 6) supply chain constraints, 7) rising material costs, 8) lower backlog if commodity & emerging markets begin to weaken and 9) higher working capital requirements resulting in new debt.

Source: TIKR

Be the first to comment