PeopleImages/iStock via Getty Images

Investment thesis: Clorox (NYSE:CLX) is a solid company that is a member of a rising market sector. Despite a sharp drop in March, the stock has rallied back, indicating the bad news is likely priced in.

Clorox is a consumer staples company:

The Clorox Company manufactures and markets consumer and professional products worldwide. It operates through four segments: Health and Wellness, Household, Lifestyle, and International.

According to Finviz.com, it is the 7th largest company in the household and consumer products segment of the market.

My standard methodology for looking at a company is to first analyze the macroeconomic backdrop in which the company is operating. This is followed by a look at the financials with an emphasis on safety, and, lastly, an analysis of the stock charts.

The US consumer is in good shape and able to spend.

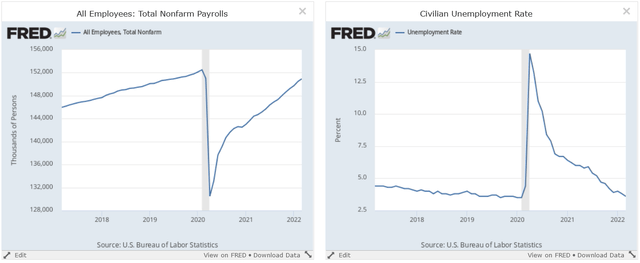

Payroll employment and unemployment rate (FRED)

Total payroll employment continues to grow (left) which has lowered the unemployment rate (right).

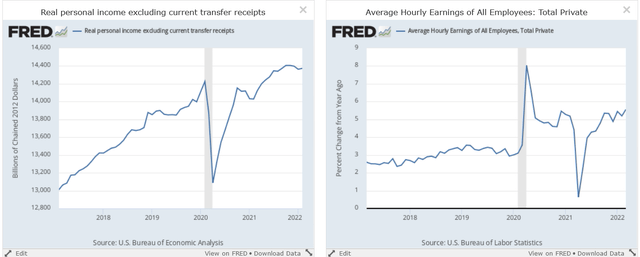

Personal income less transfer payments and Y/Y percentage change in wages (FRED)

A strong labor market caused rising wages. Personal income less transfer payments (left) is just shy of a 5-year high while the Y/Y percentage change in average hourly earnings is over 5%.

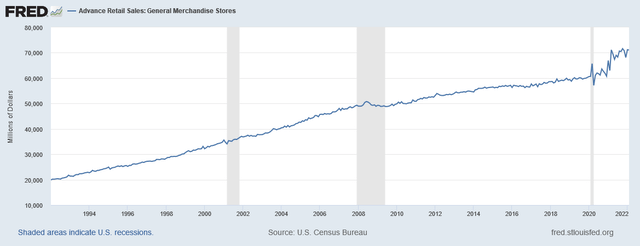

General merchandise sales (FRED)

Rising income supports rising sales, which is evident in the total sales at general merchandise stores data above.

However, remember that we’re in a rising rate environment, which means we can expect slower growth. This favors Clorox since it’s a consumer staples company.

Let’s turn to the company’s financials.

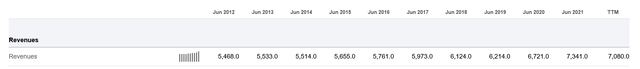

Clorox gross revenue (Seeking Alpha)

Clorox’s gross sales picture is remarkably strong for a company of its size and stature. The overall pattern is generally higher, save for the trailing 12 months.

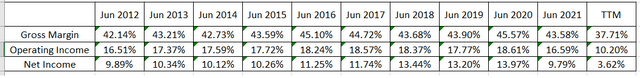

Clorox income statement percentages (Seeking Alpha)

Again with the exception of the last 12 months, the gross, operating, and net margins have been very consistent. This is something you’d expect with a company of Clorox’s size.

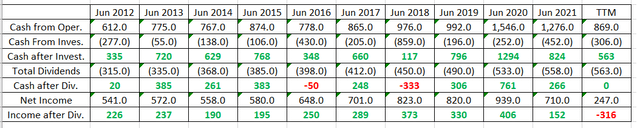

Clorox’s cash flow data (Seeking Alpha)

The above data spotlights the safety of Clorox’s dividend payment (which is currently 3.19% and which has been raised for 44 years). The third row shows that, after spending on internal investments, Clorox has a positive cash flow. The fifth row shows that in 8 of the last 11 accounting periods, the company has generated sufficient cash to make dividend payments. In the trailing 12 months, that number was exactly 0. The bottom row assumes that Clorox makes its dividend payment after calculating net income. That number has been mostly positive as well.

With safe financials, let’s take a look at the charts:

Weekly and daily charts for Clorox (StockCharts)

That is not a set of charts you’d expect with a company of Clorox’s stature, especially given last year’s bull market and this year’s turn towards a more conservative investment environment. However, the yearly charts are clearly lower while the daily chart shows a large drop at the beginning of this year.

Here’s why that happened:

In a week with some major individual stock volatility, few would have pegged Clorox to be a candidate to lose 14% in a single day. Yet that’s exactly what happened on Friday, as the maker of cleaning products and other household items posted its fiscal second-quarter financial report .

Clorox’s numbers showed a sharp reversal from its pandemic-boosted results from the previous year. Quarterly revenue was down 8% to $1.7 billion, as unit sales volume tumbled 10% year over year.

…..

Unfortunately, CEO Linda Rendle doesn’t expect the cost pressures that Clorox is facing to let up anytime through the remainder of fiscal 2022. The company projected sales to decline 1% to 4% for the full year, with adjusted earnings of $4.25 to $4.50 per share down roughly 40% from fiscal 2021 levels.

Higher manufacturing, logistics, and commodity costs caused Clorox’s gross margin to plunge from 45% to 33%, and adjusted earnings of $0.66 per share were down by two-thirds from year-ago levels.

In retrospect, this news shouldn’t have been surprising. Pricing pressures caused by supply chain issues have been in the news for at least a year. And Clorox’s cleaning products were uniquely positioned to sell well during a pandemic. It’s only natural that sales would decline after the pandemic receded.

On the plus side, the chart is saying the bad news is likely priced into the stock price. Prices cratered sharply in March but then quickly rebounded to the 145 price area. Adding to the strength of Clorox’s position is the rising strength of defensive market sectors, which I highlighted in yesterday’s market wrap.

If you have to have an equity position in your portfolio, this is a buy.

Be the first to comment