CS0523183/iStock via Getty Images

The Clorox Company (NYSE:CLX) has held up far better than what we anticipated. When we last wrote on this, we expected the stock to drop really hard as it was facing multiple headwinds.

Risks here are to the downside as pricing power tends to be weak in recessions and investors will start questioning dividend safety if we maintain 100% plus payout ratios beyond two years. We will note that we have already had a fiscal year where the dividend was not covered from earnings. Based on the information here, we are downgrading this again to a Sell Rating.

Source: When Will Investors Question The Dividend Safety?

The company reported its Q1-2023 results (fiscal year end is June) and the headline numbers appeared ok. There were modest beats on topline and the bottom line. The stock dropped, nonetheless. What is going on?

Q1-2023

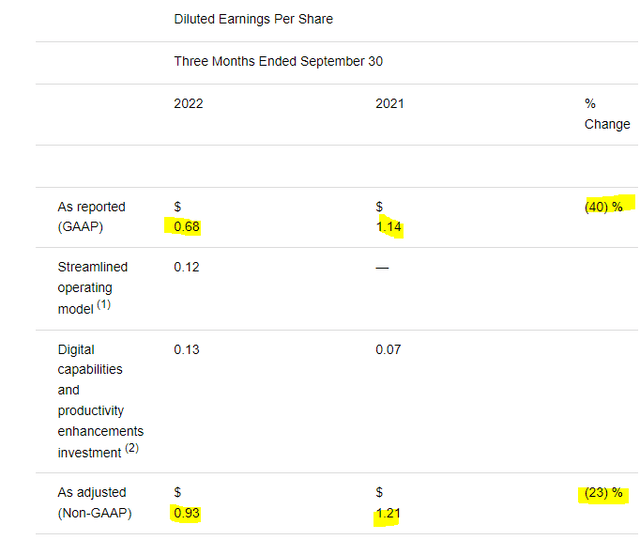

If we view this from a direct lens, without looking at estimates, this was a brutally bad result. Net sales were down 4% driven largely by lower volume. Gross margins dropped 1.10% from the previous quarter and came in at 36%. CLX faced inflationary pressures across the board and blamed higher manufacturing and logistics costs, higher commodity costs, and lower volume. GAAP EPS decreased 40% to 68 cents per share. Non-GAAP EPS which added back the company’s streamlining costs, came in at 93 cents.

People tend to overlook the 25-cent differential, but we do not. These are actual expenses and are coming in at a time when the earnings are outright collapsing. This is true even if you run these numbers against pre-COVID-19 quarters.

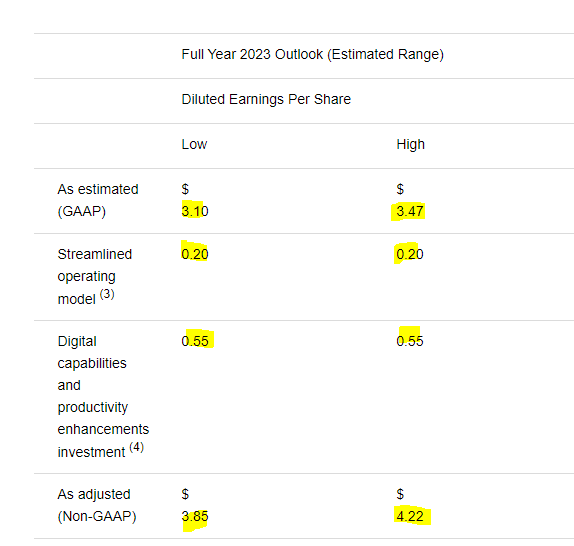

Guidance for the year ahead was maintained. This was interesting in a way as the company basically repeated everything that they said when they reported Q4-2022 results. One change was the currency headwind.

Foreign exchange headwinds now represent about a 2-point reduction in sales from 1.5 points assumed in the prior outlook.

Source: CLX Q1-2023 Earnings Release

CLX still maintained the EPS guidance, but it was pretty bad to begin with.

CLX Q1-2023 Earnings Release

Outlook

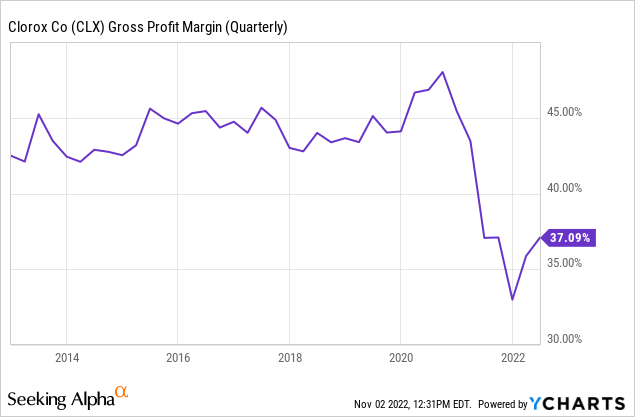

CLX is facing extreme headwinds and gross margins are far from historical trend.

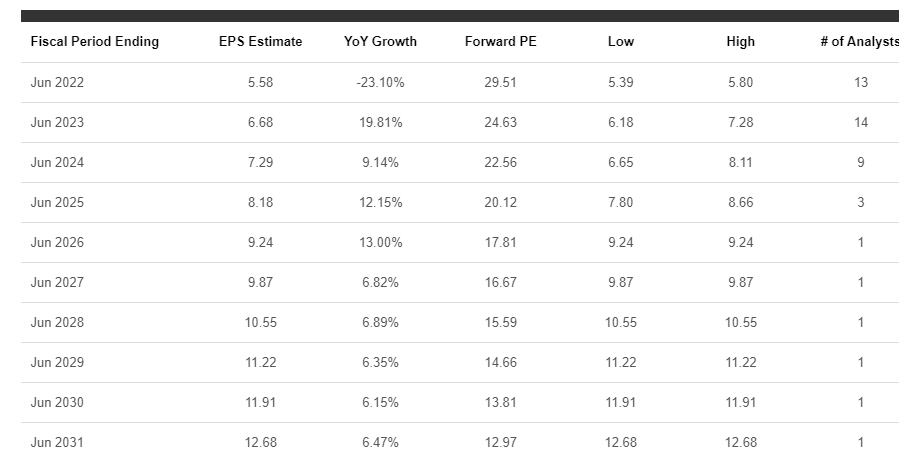

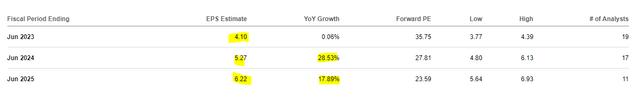

Note that the graph above has not been updated for the most recent quarter where gross margins came in at 36%. Weak pricing has coupled with inflation in costs and store brands are eating CLX’s lunch. Investors should not be surprised if bears romp all over this with the company reporting a 4% net sales decline in the biggest inflation environment we have had in decades. Just price increases should push net sales into positive territory, and yet it did not. The ever-optimistic analyst community has made a beeline for the $6.00 earnings mark.

Those kind of growth numbers will require some heroics and the expectation is that margins will expand right back to historic levels. This is easy to decipher when you see earnings growing at high double-digit rates and sales expected to grow at about 3% a year.

This in essence sums up the case for CLX. The very best case here is that analysts are right for once. We say “for once” as their projections have been so hopelessly optimistic in the face of repeated warnings by the company. These are estimates from 1 year back.

Author’s October 2021 Article

It is “always sunny in Philadelphia” with this bunch. But even if they are right, CLX is trading at an incredible 27X, 2024 earnings. A consumer staples stock when the risk-free interest rate is over 4%, should be trading at 20X, in the very best case. We will add here that these are heavily fluffed up Non-GAAP earnings where you remove everything bad like it was a PG-13 movie. What if these analysts are wrong and CLX struggles to clear $5.00 in Non-GAAP earnings for the next 3 years. Care to see what your downside is if you apply a 15X multiple?

Verdict

CLX dropped like a lead balloon after earnings, but fair value remains well under $100.00 per share. The dividend was not covered by earnings last year and won’t be covered in fiscal 2023 based on their own guidance. We are going to go out on a limb and say it won’t be covered in fiscal 2024 either. For now, no one cares, and the stock is trading at 40X GAAP earnings for 2023. We are downgrading this to a Strong Sell from a Sell and look for this to be one of the worst performers in the consumer staples sector.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment