sdlgzps

Investment thesis

Cleveland-Cliffs Inc. is the largest producer of flat-rolled steel and iron pellets in North America, and a major supplier to the auto industry. The company is vertically integrated from mined raw materials, direct reduced iron, and ferrous scrap to primary steelmaking and downstream finishing, stamping, tooling, and tubing.

In recent months, Cleveland-Cliffs’ (NYSE:CLF) stock price suffered a colossal crash, falling over 58% in the last 6 months:

Seeking Alpha, CLF’s main page

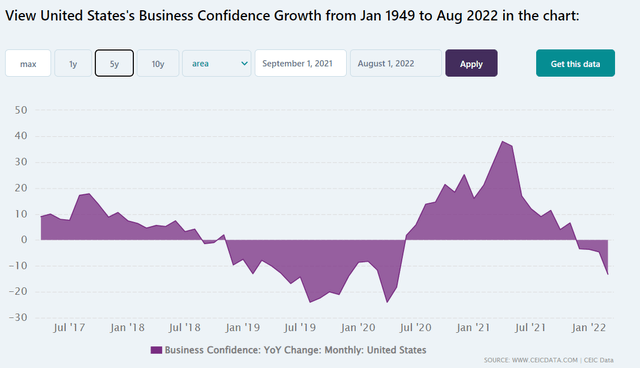

This was the result of a decline in business activity in U.S. manufacturing in the face of the threat of recession. As a result, the U.S. Business Confidence index dropped by 13.8% in August 2022, compared to a 14.2% decline in the previous month, according to CEIC’s data:

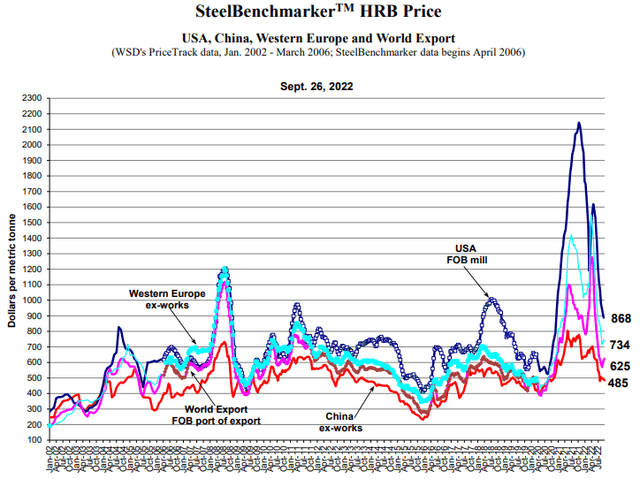

The slowdown in economic activity led to a decline in demand for steel – this was clearly reflected in the dynamics of its price:

However, I believe that now is the perfect time to be greedy while others remain fearful – buying CLF on such a sharp decline allows an investor to buy a highly oversold fundamental quality asset that still has many catalysts in store.

I reiterate my buy recommendation for CLF for the reasons described below – this is my 8th article on a company whose future I believe in [link to my previous calls].

The reasoning for my CLF buy rating

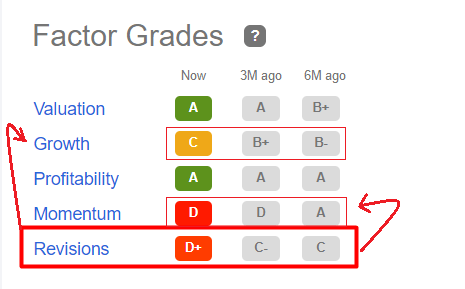

It would be foolish to suggest that the decline in steel prices will have no impact on the company. Cleveland-Cliffs will indeed earn less than analysts had previously expected – earnings revisions fell from “C-” to “D+” on Seeking Alpha’s Factor Grade scale in 3 months, ultimately impacting the Momentum factor. These revisions also affected the Growth factor – the forwarding dividend growth rate slowed to the Material sector level.

Seeking Alpha, CLF, author’s notes

At the same time, however, we see that U.S. steel demand is picking up again as a result of the supply cuts – we can see that from the recently published Goldman Sachs (GS) chartbook.

Goldman Sachs [September 27], author’s notes![Goldman Sachs [September 27], author's notes](https://static.seekingalpha.com/uploads/2022/10/3/53838465-16647745867157035.png)

A month earlier [August 24th], Cliffs announced it was raising prices on its products – perhaps confirming the infographic above about recovering demand in the steel market.

Cleveland-Cliffs closed +2% in Wednesday’s trading after saying it raised current spot market base prices for all carbon steel hot rolled, cold rolled and coated steel products by a minimum of $75/ton, Dow Jones reported.

Cleveland-Cliffs easily has more exposure to the auto industry than any other steelmaker, and perhaps the spot market price hike means stalled production rates are finally starting to improve.

Source: SA News [highlighting added by the author]

Shortly thereafter, CLX announced an agreement with its employees that improved wages, strengthened existing employee and retiree health insurance arrangements without increasing costs, and committed CLF to invest $4 billion over 4 years in USW-represented facilities.

The 47-month contract will run from October 1 and cover around 2,000 employees at mining and pelletizing locations in the Michigan Upper Peninsula and Northern Minnesota.

Cleveland-Cliffs has now reached two tentative labor contracts covering 14,000 employees – more than half of its total workforce – represented by United Steelworkers. The first contract was announced less than two weeks ago.

Source: SA News [September 26th]

The management, represented by CEO Lourenco Goncalves, tried in this way to avoid a strike by the workers. This is a great step for the company because in this way it has significantly reduced its operational risk profile.

For example, CLF’s competitor – United States Steel (X) – was unable to reach an agreement with its employees:

Integrated steelmaker US Steel and its union membership appear to be at an impasse over contract negotiations.

The United Steelworkers (USW) rejected on 24 August a contract proposal from Pittsburgh-based US Steel as negotiations continue to replace contracts that expire on 1 September, according to a statement by the union.

Source: Argusmedia

This increases the risk of strike for X while creating an additional tailwind for CLF. If X’s workers strike, there will be production losses and some volume may go to competitors – CLF will be one of them.

I am not saying that X is a bad investment – the company is very cheap and also quite good from a fundamental perspective. But between the two, I still choose CLF.

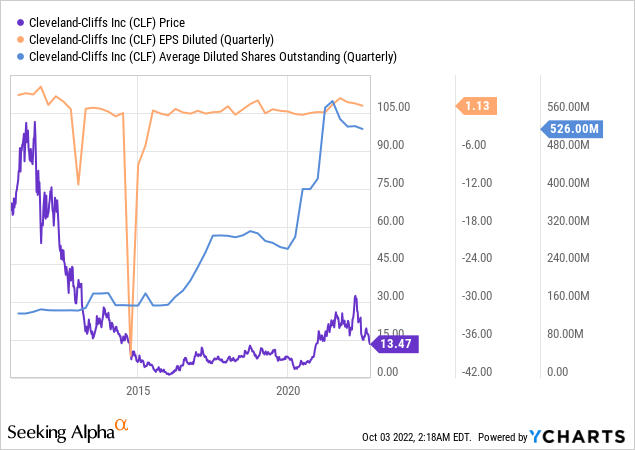

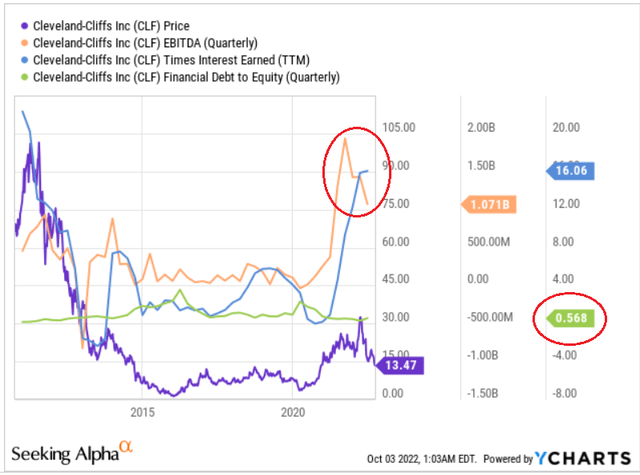

Yes, by historical standards, CLF has quite a bit of debt on its balance sheet – nearly $4.7 billion in the most recent reporting quarter. However, debt is terrible when it’s not paid, and Cleveland-Cliffs has minimal such risk in the near term due to its astronomically high interest coverage ratio (>16x) and debt-to-equity of only 0.57x. At the same time, despite a slight recent decline, the volume of EBITDA generation is still significantly higher than in 2010-2015 when the stock was worth many times more than today.

It is clear that this is far from all that affects the price – the number of shares outstanding has tripled since 2010 (with 2x lower long-term debt).

However, the company generates about the same diluted EPS today as it did then. CLF also repurchased 1 million shares for about $19 million in 1Q22 and 4.5 million shares for about $94 million in 2Q22.

The company also repurchased its most expensive bonds in a recent transaction. As the company continues to generate strong EBITDA, which is likely to remain strong even in a mild recession, the management will likely continue to act similarly – reducing debt and buying back its shares.

I expect share buybacks to accelerate even more as long as the share price is at such a low level, far from its fair value. I see an undervaluation when I look at the absolute figures of CLF’s valuation multiples in their historical context.

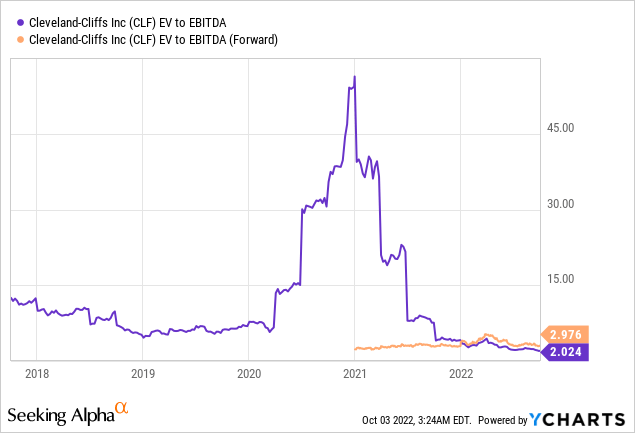

EV/EBITDA (TTM) is currently at a historically low level (2.02x) while forwarding EV/EBITDA is not much higher (2.98x). Argus Research analysts conclude in their latest report on CLF [Sept. 29] that the company’s shares are attractively valued at the current $13 price (their target price = $23 per share). This puts the stock at the low end of the 52-week range of $13 to $34 and trades near the low end of the average historical P/E ratio of 3-15x.

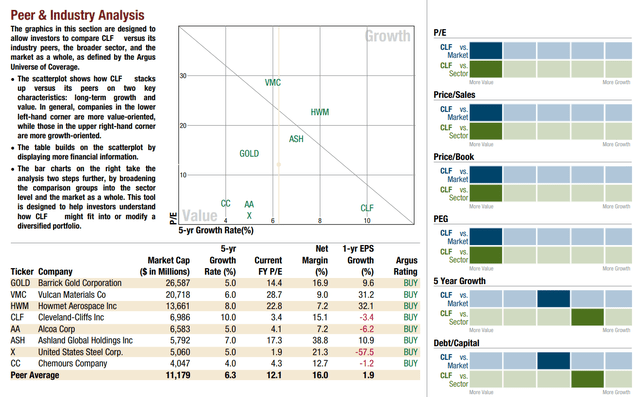

Argus analysts’ comparative analysis also suggests undervaluation – Cliffs is about as undervalued as United States Steel Corp. (in terms of multiples) and has a higher projected EPS growth rate (10% over the next 5 years), making it the best-positioned company in the sample analyzed.

Argus, Analysis by David Coleman, September 27, 2022

This sample, in my opinion, is fairly diverse; some of the firms are not appropriate for comparative analysis. I propose to consider CLF in the context of its closest competitors – from the Steel industry of the Materials sector.

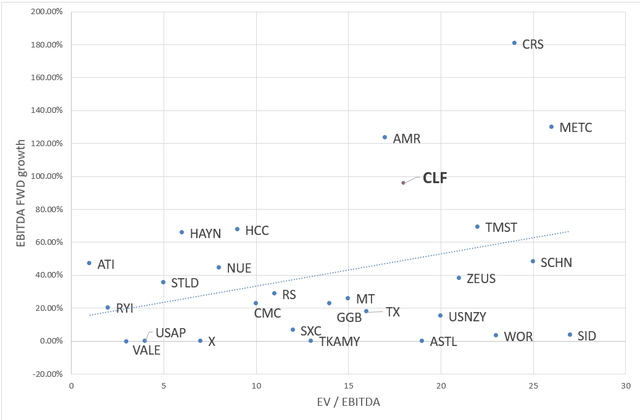

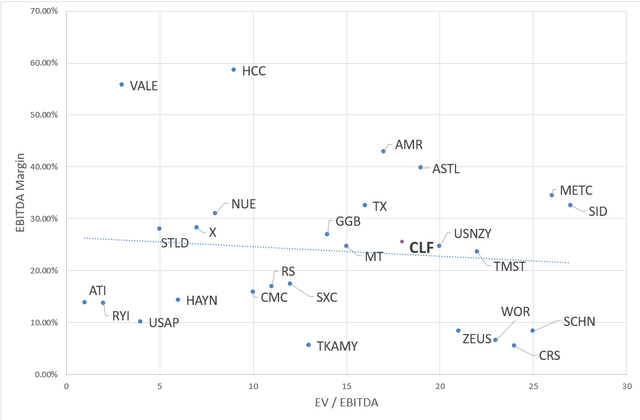

Of all the companies in the sample – 27 names – only 1 is above the CLF stock in terms of value-to-growth score (I took the growth-oriented EBITDA and the EV/EBITDA multiple) – that’s Alpha Metallurgical Resources (AMR):

Author’s work, based on Seeking Alpha’s data

At the same time, AMR focuses on mining and selling coal rather than steel.

If we look at margin instead of growth, CLF does not stand out much from the general public – the company’s EBITDA margin (25.46%) is slightly higher than the group’s median (24.7%).

Author’s work, based on Seeking Alpha’s data

However, considering that CLF’s forwarding EBITDA growth is much higher than the median (95.86% vs. 35.54%), I conclude not only that the company is undervalued in absolute terms, but also in relative terms.

Apparently, the management itself is aware of how much CLF is now underestimated. The Goncalves family has long sought to transform CLF into an owner-managed steel company and has been actively engaged in insider buying for several years:

Openinsider.com, author’s notes

So I conclude that Cleveland-Cliffs stock is a good investment over the next 1-3 years – that’s the medium-term time horizon we use as the benchmark for our Wall Street Model Portfolio in Beyond the Wall Investing.

In my opinion, the energy crisis we are in today will be an additional catalyst for the bull cycle in steel to last longer than today’s market prices in.

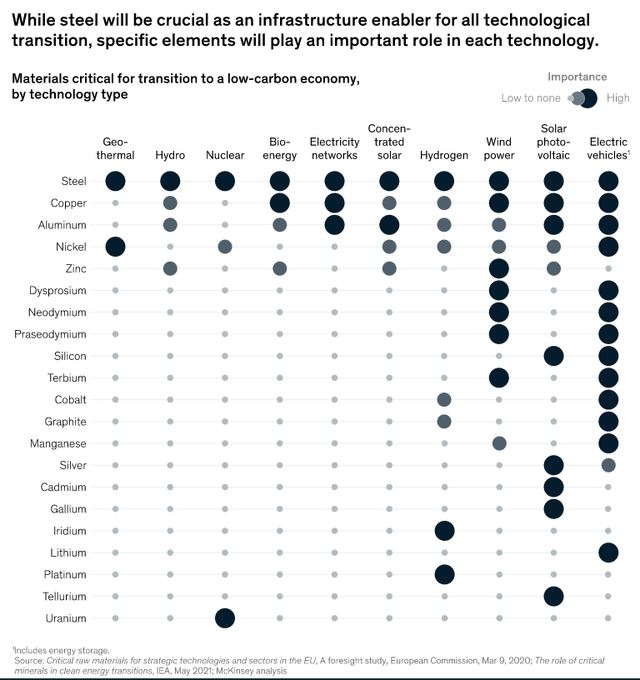

Many are concerned about the copper shortage that humanity will face if/when we switch to electric vehicles everywhere. That’s true, but not everyone is thinking of using steel to convert energy supplies from natural gas and oil to alternative sources.

In early January 2022, McKinsey & Co. published a report examining the impact of the energy transition on the metals and mining sectors. According to this study, steel, unlike other components, will be absolutely essential to providing the infrastructure capacity for absolutely all alternative low-carbon technologies.

McKinsey & Co., January 10, 2022

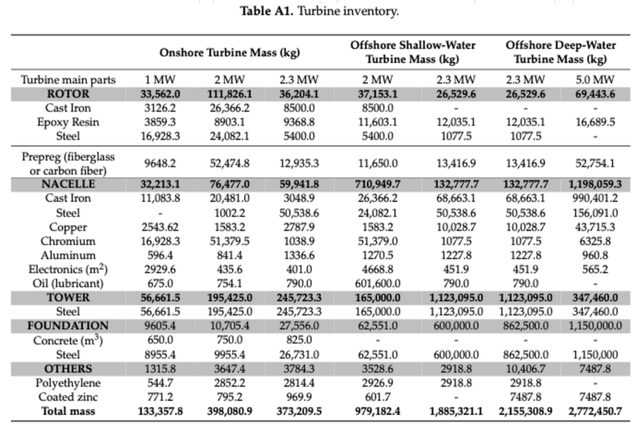

And this is not surprising. According to ArcelorMittal, one of the largest steel producers in Europe, each new MW of solar energy requires between 35 and 45 tons of steel, and each new MW of wind energy requires 120 to 180 tons of steel. And here is what the turbine inventory looks like, according to FreeingEnergy.com:

Turbine inventory, FreeingEnergy

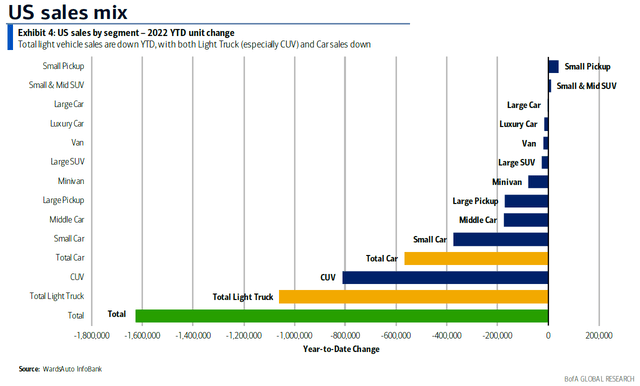

Also, do not forget that CLF is the largest supplier of steel to automakers, an industry that is currently in decline due to a shortage of chips. According to BofA’s latest report – Weekly automotive pit stop [Sept. 30] – year-to-date U.S. auto sales are down >1.6 million from a year ago.

Bank of America, September 30th, 2022

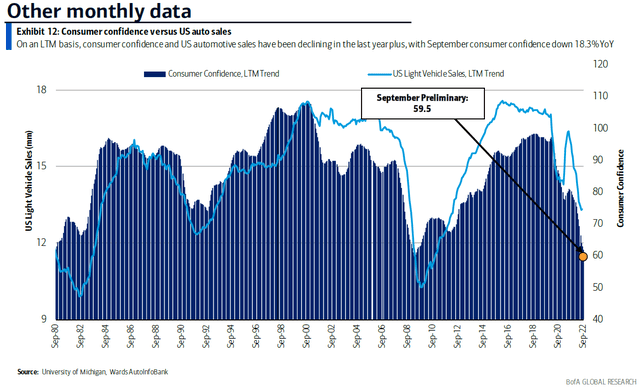

At the same time, prices for used cars have skyrocketed, and consumer confidence has fallen to 2008 lows against this backdrop.

Bank of America, September 30th, 2022

In my opinion, while this may continue for a while – demand for cars has historically been quite price elastic, and many cannot afford to buy a new car with today’s high borrowing rates – when this is all over, CLF will be able to quickly take over the steel supply. This is a powerful catalyst for the company over the next few years – sooner or later, the depression in this sector will end and CLF will increase its volumes significantly. In the meantime, even without the automotive sector, Cliffs will be supported by other end markets – both old and new, which I have described above.

Bottom Line

My thesis has risks that need to be mentioned. The pricing of the steel and iron ore products that Cleveland-Cliffs sells to its customers as well as the prices of the goods that these customers sell determine how profitable the business is. During contract renewal talks, in particular, CLF may experience pricing pressure from automakers looking to benefit from competition among steel suppliers and risk losing market share to new or current competitors. The firm may not realize the anticipated cost or revenue benefits from its recent mergers with AK Steel and ArcelorMittal USA. The company also faces integration risks linked to these deals.

However, due to a combination of factors, CLF looks like a rather strongly positioned company with an asymmetric risk-reward profile in favor of the buyers.

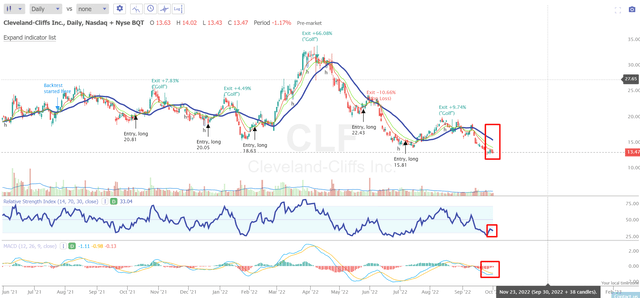

Even the technical picture supports my buy thesis – the share price has hit a strong support level with the RSI below 35, indicating a great contrarian buy signal:

Investing.com, CLF, author’s notes

Using TrendSpider software, which we actively use in analysis for Beyond the Wall Investing, I have developed a trading strategy for buying CLF based on the crossing of the MACD with the signal line. Over the past year, such an approach would have given a potential investor a cumulative gain of 83.47% in just 5 trades, while the stock itself fell 37.53% over the same period:

| Stock, timeframe | CLF, D |

| Data Analyzed | a year |

| Net Profit | 83.47% |

| Asset Perf. | -37.53% |

| Beta (vs Asset) | 0.03 |

| Positions | 5 |

| Wins | 80% |

| Losses | 20% |

| Max Drawdown | -23.74% |

| Average Win | 22.03% |

| Average Loss | -10.66% |

| Average Return | 15.50% |

| Rew/Risk Ratio | 2.07 |

| Expectancy | 1.45 |

TrendSpider, CLF, author’s inputs, and notes

As you can see on the chart above, we are now fast approaching the moment when this system will advise buying again – the MACD is about to cross the signal line and the RSI looks very depressed, as does the entire price action.

As a postscript, on October 2, 2022 (Sunday), Larry McDonald of Bear Traps published his latest report adding CLF to his medium-term portfolio:

Bear Traps, October 2nd, 2022 [with author’s notes]![Bear Traps, October 2nd, 2022 [with author's notes]](https://static.seekingalpha.com/uploads/2022/10/3/53838465-16647881607520094.png)

Pay attention to the share of the purchase – 1/4. That means Larry is likely waiting for a more attractive entry point – I think that makes sense. I reaffirm my previous buy rating on CLF.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment