vm/E+ via Getty Images

Introduction

I’ve covered Cleveland-Cliffs (NYSE:CLF) frequently prior to the pandemic, when I followed the company’s transition from a diversified commodity play to a US-focused producer of iron ore. Then, after the pandemic, the company expanded its business, becoming North America’s largest flat-rolled steel producer. I haven’t covered the stock publicly since late 2019 as I’ve been working a lot on the stock with (larger) private clients. I wanted to avoid a conflict of interest. Now, the coast is clear. Investors and traders have abandoned CLF to some extent, sending shares down 50% from recent highs. We’re at a tricky point in the cycle as high long-term expectations meet midterm recession fears. It’s bad news for impatient traders, but good news for investors looking to buy quality “value” exposure.

Now, let me walk you through the details!

The Transformation & Secular Tailwinds

When I started covering the stock roughly 6 years ago, it was still named Cliffs Natural Resources. The company had assets overseas, which were sold after the devastating commodity downtrend and manufacturing recession of 2014/2015.

Now, the company is one of the world’s largest steel companies as a result of CEO Lourenco C. Goncalves’ vision for the company.

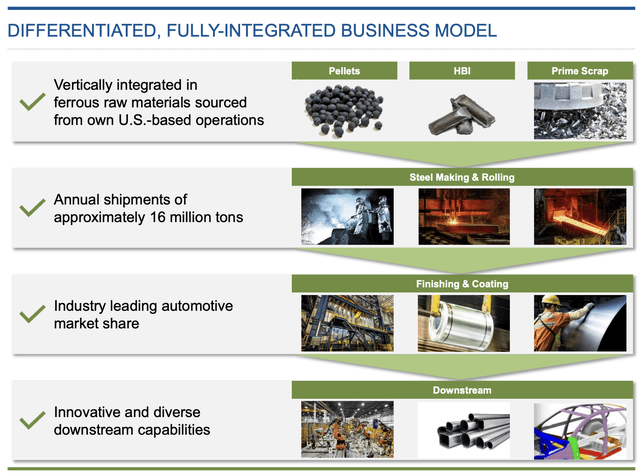

Between 2019 and 2021, the company went from no finished steel shipments to 15.9 million tons of steel shipments, making it the largest flat-rolled steel producer in North America, thanks to the acquisition of ArcelorMittal’s (MT) US assets and AK Steel – both deals were announced in 2020.

The company is now the only US-based steel producer with a fully-integrated business model.

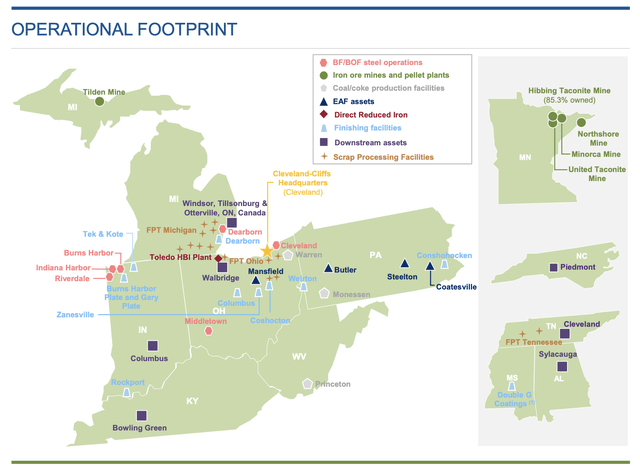

Thanks to its integrated supply chain, the company has very short supply chains, which lowers risks compared to companies who procure iron ore in Brazil or other emerging markets. Especially in these times, Cliffs benefits from the fact that it does not get supplies from Russia or Ukraine. Both countries are 2 of the 5 largest net steel exporters in the world.

Cleveland estimates that Russia and Ukraine are responsible for roughly 30% of US ore consumption. That’s approximately 4 million tons of pig iron.

Moreover, Cleveland-Cliffs isn’t just a steel producer. Its products go very high up the value chain. For example, 28% of 1Q22 sales came from auto customers. Only 27% of sales were generated in infrastructure and related manufacturing. 34% of the company’s output is coated steel. Lower-margin plate steel accounted for just 6% of total sales.

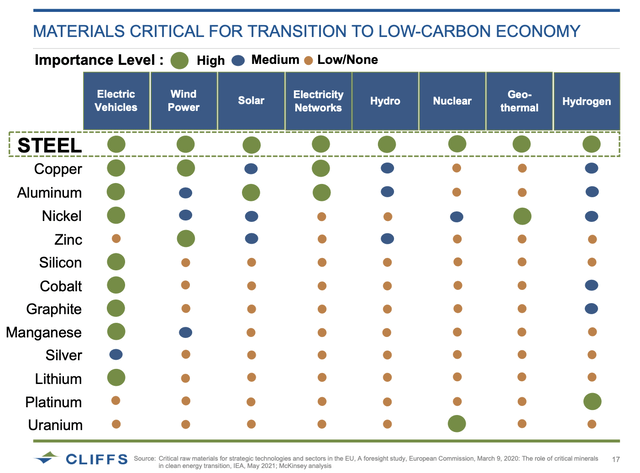

I’m mentioning this not only to make the case that it operates in higher-margin segments, but also because the company is a major supplier in the ongoing energy transition. One megawatt of wind energy power needs 130 tons of steel. An MW of solar power needs 40 tons of steel. Moreover, the infrastructure bill contains $65 billion for the modernization of the US electric grid. That’s a best-case scenario for Cliffs.

Not only that, but steel is a major component in every single “renewable” technology.

Steel is way more common than any of the commodities in that list, yet it cannot be understated how important steel players are with solid supply chains.

Last month, I wrote an article highlighting the issues related to high commodity demand as a result of the shift to “green” energy using the Metals and Mining ETF (XME) as an example, which contains more than 40% steel stocks.

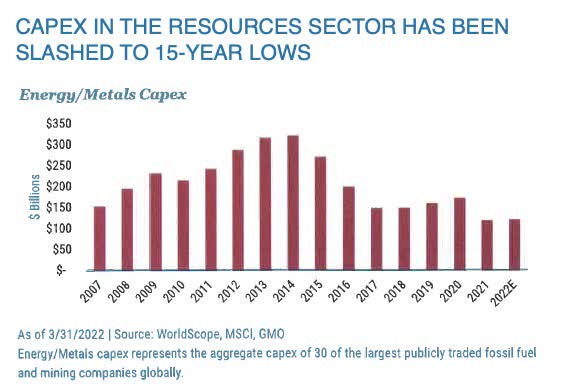

One chart that I used in that can be seen below. Global capital expenditures in mining and energy are well below peak levels. It’s not just oil and gas, but mining companies as well, who have become very careful when it comes to starting new (expensive) projects.

Mining.com

Moreover, US-based steel producers have another benefit: a strategic one. Europe is currently suffering from an energy crisis much worse than the one in the US. Even without Putin shutting off natural gas exports, the continent is not able to maintain steel production as companies shut down after failing to offset input inflation with higher volumes and pricing.

Even after the war, I believe that this will remain an issue due to climate targets and the basic failure to create an environment where heavy industrial companies have access to affordable feedstock like natural gas.

The US is in a terrific position to benefit from re- and near-shoring after the pandemic. European companies will shift production to the place where their products are sold, and (in general) companies are shortening supply chains after the pandemic. Cleveland-Cliffs is in a terrific spot to benefit from that.

One Big Headwind

With that said, Cleveland-Cliffs has lost momentum. Even worse, the stock is down 50% from its 52-week high. It’s also the reason I’m covering Cleveland-Cliffs again. Large traders have left the stock and many companies related to consumer products, manufacturing, and automotive.

Economic growth is suffering big time.

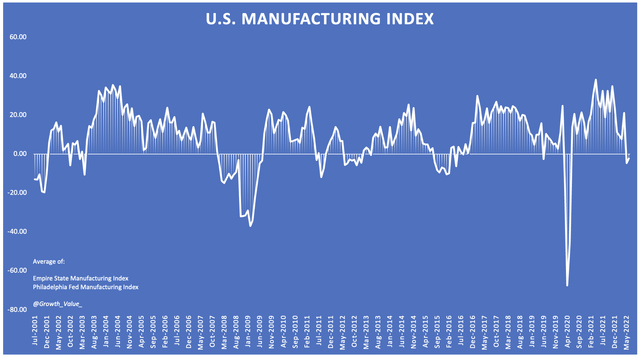

Manufacturing sentiment as measured by the Empire State and Philadelphia Fed survey shows a steep decline for the first time since the 2020 pandemic.

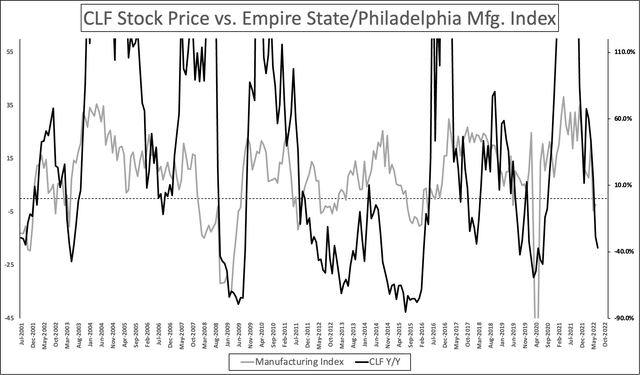

When I overlay the chart above with the year-on-year performance of the CLF stock price, we get a chart that looks like this:

Bear in mind that this performance will drop to -50% as that’s the current decline from the 52-week high.

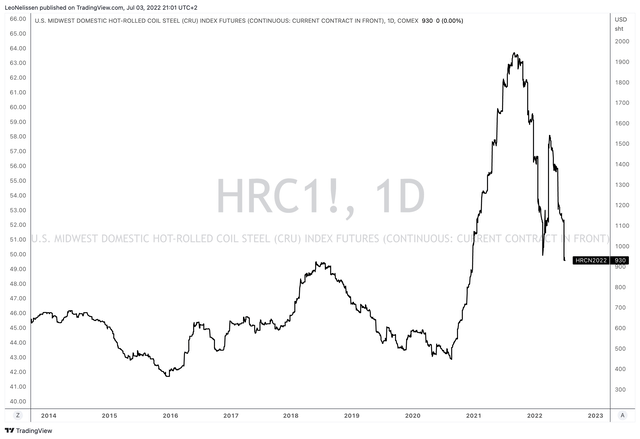

COMEX hot-rolled coil futures have also sold off close to 50%. While supply is an issue, investors have started to price in lower demand as a result of aggressive Federal Reserve tightening and the impact of high inflation on consumer behavior. The “pent-up demand” thesis after the first pandemic lockdowns is dead.

Needless to say, a lot has been priced in. Yes, in 2015 the selloff was much worse, but this time is different. Commodities are not suffering from too much supply, and Cleveland-Cliffs is a different business.

Valuation & Related

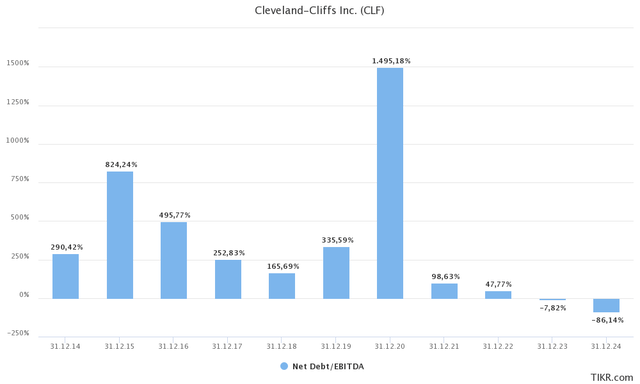

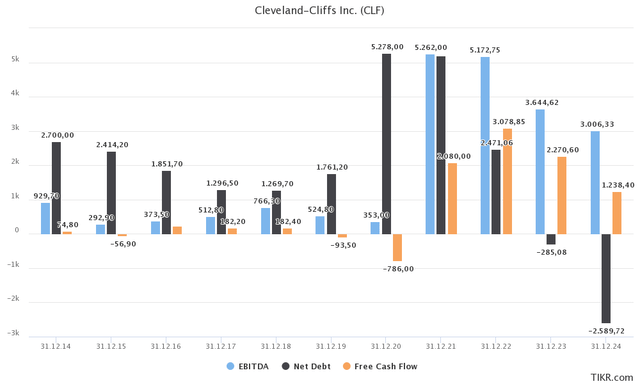

Cliffs is truly a mind-blowing company. Prior to the pandemic, the company had elevated net debt levels that exploded during recessions as a result of slower EBITDA. In 2015, the company briefly had a net leverage ratio of 8.2x. The crisis didn’t last long, but these numbers are dangerous and caused the stock to implode.

In 2020, the net debt ratio exploded. This was the result of subdued EBITDA as the chart below shows and the fact that the company bought both AK Steel and Arcelor’s US operations in that year. It caused net debt to rise to $5.3 billion.

That’s a steep increase, but it unlocks so much value, as I explained in the first half of this article. This year, the company is expected to do $3.1 billion in free cash flow. Free cash flow is net income adjusted for non-cash operating expenses and capital expenditures. It’s cash a company can return to shareholders and/or use to reduce debt.

2022 is still a somewhat unique year, given that steel prices were high in the first six months. In a more normalized situation, the company is still in a good spot to do more than $2.0 billion in free cash flow.

That’s 24% of the company’s $8.3 billion market cap. That number is absolutely wild. Even during weak economic times, the company will be in a good spot to service debt and return cash to shareholders. If analysts are right and if we assume no new stock buybacks, the company could be net cash positive next year.

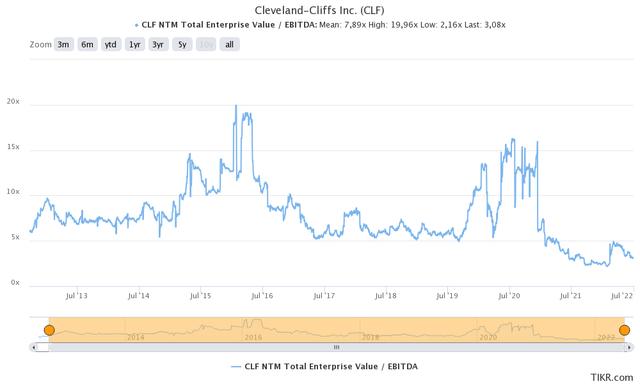

Moreover, using conservative estimates, the company is trading at just 3.8x EBITDA. In this case, I’m using its $8.3 billion market cap, zero net debt (instead of pricing in negative net debt after 2022), $2.9 billion in pension-related liabilities, and $270 million in minority interest. I used $3.0 billion in expected EBITDA, which is below what the company can do in an elevated demand scenario (an economic recovery scenario).

This valuation is way too low. Even in 2018 and 2019, the company was trading at 5x NMT EBITDA. Now the company is much stronger, more value-adding, and less prone to commodity swings. It’s still extremely cyclical, but it operates with much higher margins.

Hence, I would make the case that the company is at least 40% undervalued. And that’s without pricing in high growth or its high free cash flow generation, resulting in a load of cash after 2023.

The problem is getting there. I like the risk/reward, but calling for a market bottom is risky.

If investors want exposure, the best way to play this is by buying gradually. For example, buying 25% now and adding over time allows investors to average down if the market keeps falling. If the stock suddenly takes off, investors have a foot in the door.

And please be aware of the cyclical behavior of CLF.

Takeaway

Cleveland-Cliffs has become an impressive company. In this article, I used the term “mind-blowing”, which isn’t an exaggeration. In less than two years, the company has gone from not producing any steel to becoming North America’s leader in flat-rolled steel products.

The company has a short, efficient, and reliable supply chain, providing the company with stability in times of the Ukraine war and a lot of support in a scenario where North America becomes more manufacturing-focused.

Moreover, Cliffs is now generating loads of free cash flow in “normal” economic years, providing the company with the possibility to become net cash positive in 2023.

This opens the door to aggressive buybacks, potential dividends, and less volatility during downswings thanks to a healthy balance sheet.

Additionally, investors have priced in a manufacturing recession, providing investors an attractive valuation to start buying a position in a company that isn’t just a steel company, but the backbone of the transition towards renewable energy as well.

However, please be aware of the company’s very cyclical behavior and volatile stock price. Keep your position small if you decide that CLF shares are the right fit for your portfolio.

(Dis)agree? Let me know in the comments!

Be the first to comment