peterschreiber.media/iStock via Getty Images

Shares of therapy-enabling platform company ClearPoint Neuro (NASDAQ:CLPT) have lost 20% of their value since the initial public offering was priced at $23.50 in February of 2021. So far in 2022, shares have posted a respectable +25% gain in what has been a difficult year.

The company returned to my radar in July after the regulatory approval for Core Biotech holding PTC Therapeutics’ (PTCT) gene therapy Upstaza for AADC Deficiency. This is because Upstaza is administered directly to the brain and this can only be accomplished via use of ClearPoint’s SmartFlow Neuro Cannula for minimally invasive infusion of gene therapies like Upstaza.

Looking at the company’s “pipeline” and assorted applications for its technology, I came to realize that delivery of biologics and drugs was just the tip of the iceberg with $4 billion or more of peak sales potential achievable across all products. Contrast this to current enterprise value below $300M and it’s clear why I chose to revisit this name and present it to my readers.

Chart

FinViz

Figure 1: CLPT weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares hit a parabolic high of $30 at the beginning of 2021. From there they fell to lows below $10 and are currently consolidating in the low teens. My initial take is that readers who appreciate long term prospects here would do well to accumulate a position on pullback to 20-day and 50-day moving averages ($12 level or so).

Overview

Founded in 1998 and based in Irvine, California, ClearPoint Neuro is a commercial-stage medical device company whose platforms help physicians perform minimally invasive surgical procedures in the brain. In 2021, they expanded efforts beyond MRI-guided interventions to develop novel neurosurgical device products for the operating room setting as well as offer consulting services for big pharmaceutical companies. The company has experienced significant validation for its technologies as its products have been used in over 5,000 clinical trial procedures in the US, Canada, EU and UK at approximately 60 neurosurgery centers.

ClearPoint’s operations consist of two parts, the first being providing medical devices for neurosurgery applications and the second being partner of choice for pharmaceutical companies in the biologics and drug delivery space. Currently they have 40 customers evaluating or using the SmartFlow cannula or other products to inject gene and cell therapies directly in the brain. The company estimates $7 billion market potential across product categories and 15 distinct disease states.

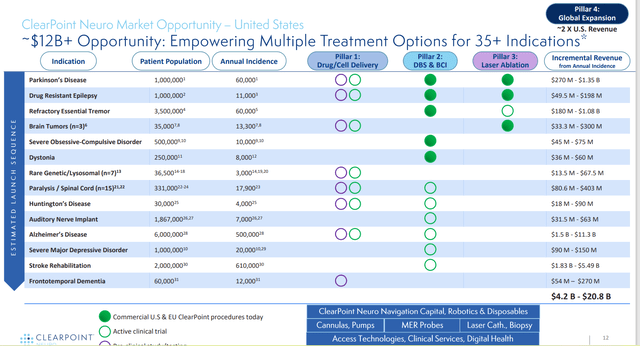

Corporate Slides

Figure 2: Neuro market opportunity and peak revenue by indication (Source: corporate presentation)

The company believes there are over 140,000 potential neurosurgical procedures per year in the US in which the ClearPoint system could be used as a navigational platform for functional stereotactic neurosurgery including current FDA approved indications of Parkinson’s disease, drug resistant epilepsy, refractory essential tremor and brain tumors. Potential procedures include electrode placement, considering that 120,000 Parkinson’s and essential tremor patients alone are potential candidates for deep brain stimulation utilizing ClearPoint’s system each year. Aside from that, patients suffering from drug resistant epilepsy, refractory essential tremor, dystonia, severe obsessive compulsion disorder, severe major depressive disorder, paralysis, Huntington’s disease, auditory nerve implantation, Alzheimer’s disease and stroke rehabilitation may create additional potential procedure opportunities in the future. Other applications of note include brain tumor biopsy (15,000 procedures per year) and gene therapy/drug delivery directly in the brain (for indications such as AADC Deficiency, Friedreich’s Ataxia, and Angelman Syndrome, to name a few).

As for differentiation versus prior standard of care, which relies on indirect guidance of pre-operative imaging, the ClearPoint system enables the physician to be guided by real-time, high-resolution MRI. Additional revenue-generating opportunities are available via sale of software and hardware components.

As for key collaboration partners of note, in 2020 Philips licensed to Clearpoint use of the technology underlying its Philips Brain Model in their ClearPoint Maestro Brain Model (ClearPoint owes royalties on sales and in 2022 collaboration was expanded to include use with Computed Tomography or CT imaging). In 2020, the company entered into multi-product development agreement with Blackrock including for the Microelectric Recording Platform and implanting Blackrock’s brain computer interfaces into patients with a wide range of neurological disorders. Also in 2020, the company entered into a collaboration agreement with CLS to sell its portfolio of products when used with MRI guidance including the Tranberg line for high precision ablation. UCSF agreement was inked all the way back in 2013 and provides design features which are incorporated into ClearPoint’s SmartFlow cannula (owes royalties on sales).

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $45M as compared to increased operating expenses of $7.5M. Total revenue rose 52% to $5.2M, while functional neurosurgery navigation revenue grew 17% to $2.2M and biologics/drug deliver revenue increased 73% to $2.4M. Capital equipment and software revenue rose a whopping 282% to $0.6M. On the con side, gross margin fell slightly to 63% and on the whole revenues are quite small relative to current valuation. Cumulative deficit stands at $134M since inception, which I consider a green flag of sorts because it certainly is not excessive.

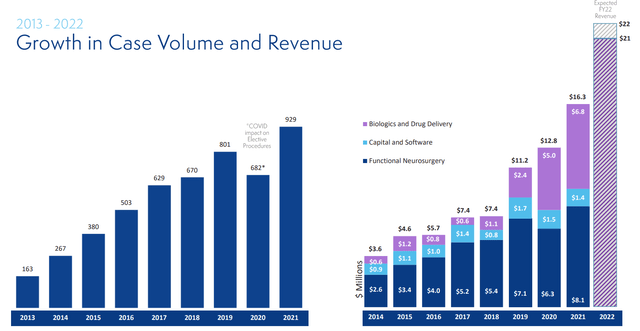

Corporate Slides

Figure 3: Historical & current case volume and revenue growth (Source: corporate presentation)

As for the conference call, management notes that they continue to make progress across their four-pillar growth strategy consisting of biologics and drug delivery, functional neurosurgery navigation, therapy and access products. They continue to expect full year 2022 revenue of $21M to $22M representing 30% to 35% annualized growth.

The goal for their SmartFlow family of cannula products is to be referenced in labeling for therapies across multiple partners and indications as THE go-to delivery mechanism for pharma delivery to the brain and spine. Keep in mind each partner is commonly working on more than one indication and that these are often high-risk programs (not all will make it to regulatory approval and launch).

As for institutional investors of note, it’s worth noting that Bigger Capital Fund owns a 5.2% stake (Founder’s Twitter is an insightful follow). As for insiders, President and CEO Joseph Burnett owns over 260,000 shares. Also, Core Biotech holding PTC Therapeutics owns an 8% stake in ClearPoint.

As for the management team as a whole, CEO Joseph Burnett previously served as President of Neuro Diagnostics at Philips and prior to that as SVP Business Leader of Image Guided Therapy Devices after Vocano Corporation was acquired. CFO Danilo D’Alessandro served prior as Global Head of Finance for the Image Guided Therapy Devices Division at Philips (representing cumulative inorganic investments of $4 billion and over 3,000 employees).

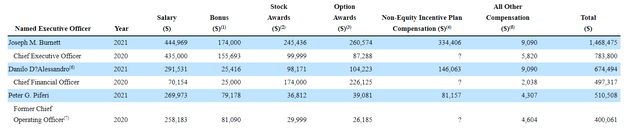

As for executive compensation, cash component is definitely reasonable for a company this size and I was pleasantly surprised to see stock and option awards at levels as low as these (perhaps a sign of good stewardship).

Proxy Filing

Figure 4: Executive compensation table (Source: proxy filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Moving on to IP, company notes they have a significant patent portfolio in the field of MRI-guided interventions with over 75 issued US patents (some set to expire at various dates beginning 2023).

Final Thoughts

To conclude, I think that ClearPoint Neuro has real appeal to long-term investors as a “picks and shovels” play that sports multiple value drivers including supporting biologics and drug delivery as well as aiding additional neurosurgical procedures in the brain. A state-of-the-art platform has created quite a moat for itself and could become neurosurgeons’ “go-to” option for obtaining real-time guidance to achieve impressive accuracy in these brain-oriented procedures. Conversely, it’s worth pointing out that the cash position is on the low side and valuation is high if looking at a trailing basis (trading at around 15x projected 2022 revenues or so). Innovation does not come cheap however, and here we can expect accelerating revenue growth over a multi-year period.

For readers who are interested in the story and have done their due diligence, CLPT is a Buy and I suggest accumulating a pilot position in the near term. A wise strategy could be to buy dips to just below the $12 level (200-day moving average) should market volatility take the stock lower.

From a Core Biotech perspective (emphasis on next 3 to 5 years), this one does fit my criteria in terms of sporting multiple value drivers, shots on goal and potential for accelerating sales growth as partners rack up approvals for additional indications. However, I would prefer to wait for a lower valuation as I don’t feel comfortable scooping this up at 15x 2022 revenues. I promise to keep it on my radar in case we get a chance to scoop up at lower levels.

Key risks include additional dilution within the next year to boost the company’s cash resources and combat burn rate, as well as disappointing data readouts for pharmaceutical partners or inability to gain regulatory approval for key indications of note. Intellectual property disclosures in the 10-K filing were on the vague side, and I did not like the look of expirations taking place in the late 2020s.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. I look forward to your thoughts in the Comments section below. Lastly, be aware that most of my articles appear first to members of the ROTY community.

Be the first to comment