smshoot/iStock via Getty Images

The recent volatility in equity markets sparked a discussion about fundamentals, timing, and processes in relation to growth stocks. To put it all into context, we recruited two of our analysts, Jake Boak and John Beitter, from our Technology Group Investment Research team to dissect today’s issues and share how clearly defined processes are instrumental to staying committed to growth investing when markets get choppy.

The recent challenges growth stocks have seen are related to macroeconomic issues – interest rates and inflation – with less emphasis on current geopolitical turmoil, which are secondary influences.

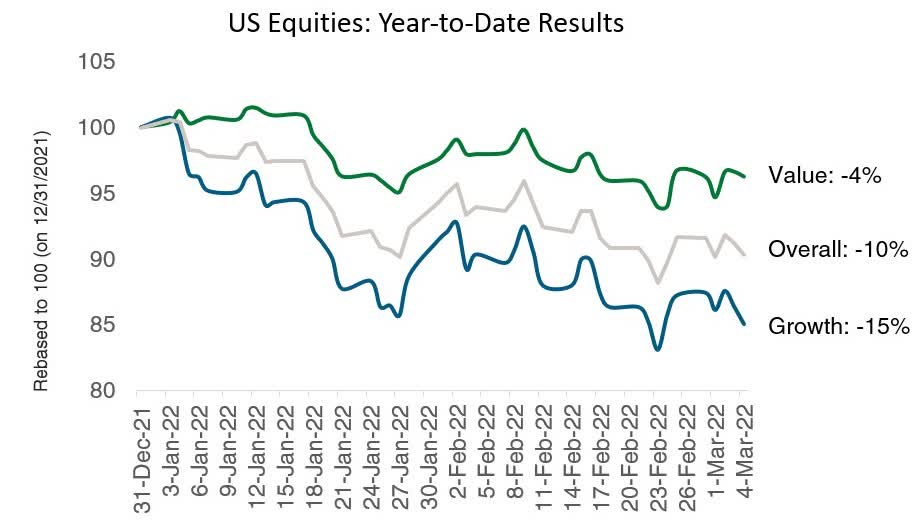

Sources: Refinitiv (12/31/2021 – 03/04/2022)

Overall, Value, and Growth data are per Russell 1000, Russell 1000 Value, and Russell 1000 Growth indices. This data is as of the webinar on March 8, 2022.

Let’s dive into the topic more, starting with this snippet from our latest webinar that provides insight into our analyst groups and the thinking and process behind our stock selections.

First, with all that’s happening, what keeps you up at night?

John – I think it’s certainly true that interest rates and inflation are driving negative sentiment and indiscriminately compressing valuations year to date. But I think the evidence that they’re a death knell for tech stocks, or more broadly growth stocks, is pretty poor, at least over an extended time period.

Putting that argument aside for a moment, ultimately Jake and I are fundamental analysts. We think strong fundamentals win out long term, regardless of what style or sentiment is in vogue at the moment. So, with that in mind, certainly inflation and interest rates can have downstream effects on fundamentals. However, our processes remain consistent through all market environments, and they naturally screen for companies that are less exposed to macro factors.

The Profile Strategy captures most of our growth exposure. One of the key aspects of the Profile Strategy is pricing power, which is to say that during periods such as now, where input costs are rising, we’re looking for companies that are able to pass those costs through to their customers and maintain, or expand, their margins. With interest rates, we’re looking for companies with strong balance sheets and cash flows, and who are less reliant on capital markets to fund their operations. We’re looking for companies with durable secular growth prospects through different macro environments.

To answer the question, I cover semiconductors, which is a cyclical area within tech. I worry in the near term, after a period of intense supply constraints, that the market overcorrects by adding too much capacity too soon, and we enter a period of oversupply. Even with that overarching worry, I’m drilling down to specifics of individual companies that I cover, not all of whom are going to suffer from that the same way.

Jake – I sleep pretty well. It’s not to say I’m not concerned with some of the things John pointed out. I’m certainly hopeful the Fed doesn’t make a policy mistake. I’m keeping an eye on rising energy prices and how that impacts the consumer balance sheet.

I’m less concerned about many of the issues that are front-page news, and more concerned about what’s coming down the pipeline that we don’t know about today. So, that’s what worries me the most.

If you force me to give you something, I’d say one area that comes to mind for me is increased regulatory scrutiny with some of these large digital platforms. It’s evident that regulators are trying to figure out the best lens to view these types of businesses, but I would expect that the mega-cap tech companies of the world will continue to remain under the microscope for years to come. I worry regulators will move their anti-trust framework away from a “consumer harm” approach, and that these businesses might have to alter business practices. I expect it to play out over multiple years, so it’s not an acute concern, but it is something we’re keeping an eye on.

Jake, in general, you have a calm approach in regard to everything happening in the markets right now, how do cope with bouts of volatility?

Jake – I think volatility gets a bad rap, personally. The term has an odious stench directly associated to it, yet I don’t think it’s inherently bad. Benjamin Graham [famed author of the Intelligent Investor] once said that ‘in the short term the stock market is a voting machine, and in the long run it’s a weighing machine,’ and that really resonates with me.

How a stock performs on any given day, and the magnitude of that performance, says almost nothing about the value of the underlying assets. It’s really a result of the collective buying/selling going on over that day.

In periods of heightened volatility, I’m looking for ways that I can exploit that. It might be an opportunity for me to buy more of an existing holding that’s getting thrown out with the bathwater. Or maybe, I’ve been on the sidelines waiting for a particular company to become cheap enough to price out, and I can finally initiate a position. So, I try to focus on what I can control, and volatility just isn’t one of those things.

How do you determine “quality”?

John – The Profile Strategy, at a high level, is the highest-quality companies. It’s companies that have pricing power, high switching costs for their product, high barriers to entry, and are taking share in large and secular growing markets. The easiest way to differentiate quality is by asking: Does the company make money consistently?

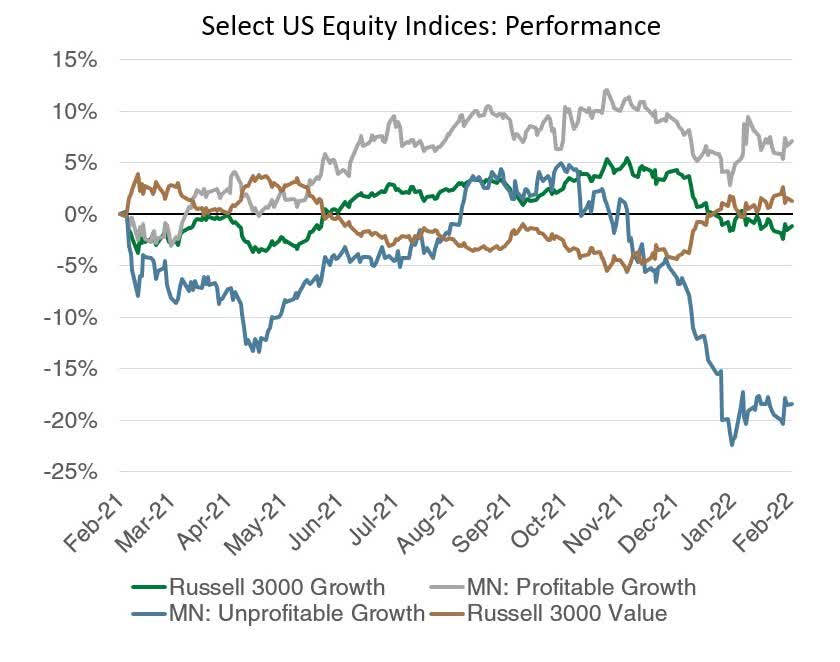

We took a look at this via the Russell 3000 Growth index, which is about 1,700 companies that Russell determined to have relatively higher sales and earnings growth, and relatively higher valuations than the over main Russell 3000 index. We divided that growth index into companies that generated positive cash flow consistently over the past three years and into those that haven’t.

Source: Bloomberg (02/26/2021 – 03/01/2022)

MN Profitable Growth and Unprofitable Growth indices are an internal analysis based upon the Russell 3000 Growth Index as a starting point with individual names screened out based upon a profitability analysis measure. The measure is defined as 3-year average free cash flow margin greater than zero. Analysis: Manning & Napier.

You can see that over the last year, profitable growth names have consistently outperformed unprofitable growth names, as well as the market as a whole. As market sentiment started to shift in late 2021, that disparity became even starker.

Tech is expensive. How do you stay disciplined?

Jake – I might push back a bit on whether tech is expensive. We’re not having a hard time finding new ideas, nor are we having to stretch a bull case model for existing holdings, which is typically what happens when things start to get pricey.

So, how do we invest in growth without paying through the nose and exposing clients to the risk of significant losses? Every good investment process hinges on a playbook and set of pricing disciplines, whether you are a growth or deep value investor. To me, a playbook is a culmination of knowledge with different tools and exercises to help avoid blow-ups, and to support doubling or tripling down on winners.

Our playbook very much focuses on monitoring the strategy fit, understanding rates of change, combatting biases, and constantly evaluating position size in context of other holdings. I’d say the most robust part of our process is to evaluate how things play out relative to our expectations. We do this for every single company, including companies we own and ones we’re tracking. This allows us better track when companies are/are not meeting expectations, and it creates a lens in which we can use when working on new investment ideas.

To summarize, rather than following the style box that’s trendy at the moment, our growth investment strategy relies on clear buy/sell disciplines, a flexible asset allocation process, and a long-term perspective to select names based on their profile.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment