onurdongel/iStock via Getty Images

The ClearBridge Energy MLP Opportunity Fund (NYSE:EMO) is having an exceptional year amid the strong momentum in the sector. Structured as a closed-end fund, EMO has returned nearly 40% in 2022 as one of the best-performing midstream energy CEFs. While the fund has had a volatile history with a few distribution cuts in the last decade, it appears the portfolio management team is making all the right moves with this current winning streak.

Our data shows that EMO has outperformed its CEF peer group going back to the 2020 pandemic lows. The attraction here is the fund’s 7% yield, with the quarterly rate increasing twice already this year. EMO also trades at a curiously wide 21% discount to NAV which we see room to narrow going forward adding an incremental return. We are bullish on EMO as a good option to gain exposure to more upside in midstream and MLPs.

What is the EMO Fund?

With $460 million in total assets under management, EMO has a stated fund objective of seeking a high level of total return with an emphasis on cash distributions. The strategy utilizes approximately 26% leverage targeting MLPs “master-limited partnerships” and regular corporations with a relatively concentrated portfolio of just 34 holdings.

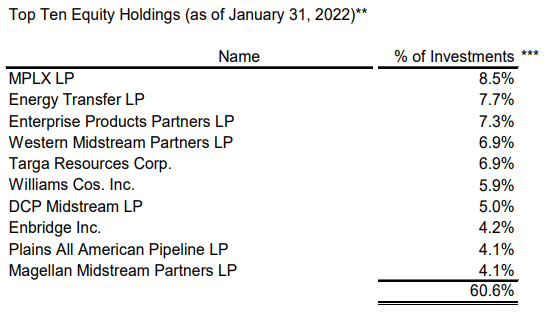

The top holdings include MPLX LP (MPLX) with a 9% weighting, followed by Energy Transfer LP (ET) at 8%, and Enterprise Products Partners LP (EPD) with a 7% weighting at the end of January. Note that the fund is actively managed which means all positions are at the discretion of the management team and are not meant to track any particular index.

Source: ClearBridge Investments

The group here includes the who’s who of midstream leaders that are involved with the distribution and logistics side of energy products often through pipelines but also including storage and wholesale marketing. It’s understood that midstream players don’t necessarily have direct exposure to the commodity prices, high oil and gas prices are positive for the group given the higher sector activity levels represent a positive operating backdrop.

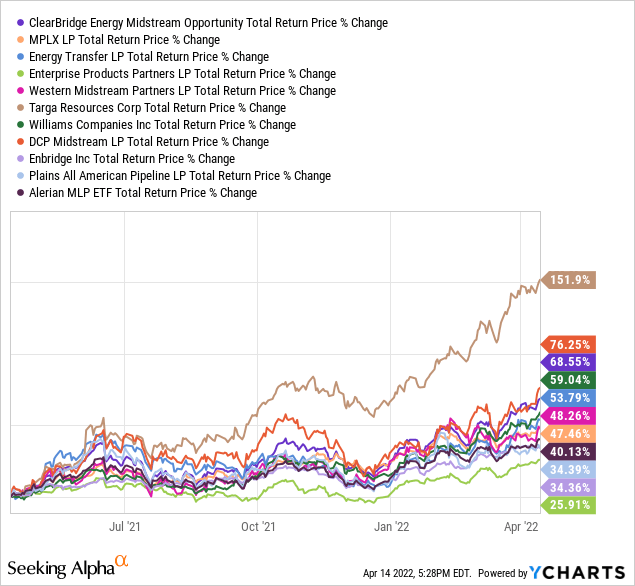

Headline-making supply chain disruptions as a macro theme have added demand for midstream services which has translated into strong cash flows and earnings that are seen accelerating. EMO has returned a very impressive 69% over the past year with all the top holdings in the fund effectively in a bull market. Targa Resources Corp (TRGP) stands out gaining 152% over the period.

The chart above also includes the Alerian MLP ETF (AMLP) as a passive benchmark for this market segment which gained 40% over the past year. In this case, EMO has been able to strongly outperform AMLP highlighting the allure of the fund. A large part of that spread is based on EMO’s use of leverage.

This is important because one of the first criticisms of EMO and other MLP-focused CEFs is their high stated expense ratio considering EMO is listed at 3.09% by the fund manager compared to AMLP as a low-cost alternative at 0.9%. The key to recognize is that EMO’s expense ratio includes the underlying interest expense as the borrowing fee the fund pays to invest beyond its asset base. The actual “management fee” of 1.41% is more in line with similar CEFs.

In other words, the leveraged strategy works great when the portfolio is trending higher but can also lead to large losses during a correction as a risk to watch. The underlying MLPs often utilize leverage themselves which adds another layer of risk to this segment.

That’s the case back in 2015 when the broader energy market got shaken up amid the oil pricing crash that year with many MLPs being over-leveraged. EMO lost 40% of its value at NAV that year which was also accompanied by a distribution cut at the time. That loss was eventually surpassed in 2020 when EMO lost 60% of its value. The point here is to say that it’s been a rough decade for MLPs and midstream energy overall, but the sense is that the pendulum has swung around.

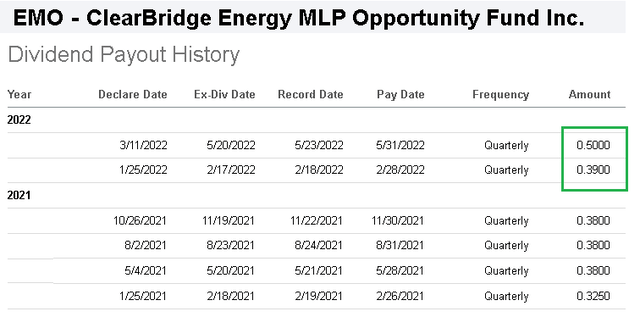

EMO Distribution

With the recent strong returns, the good news is that EMO has delivered 2 dividend hikes to its quarterly distribution already this year. The latest increase to a rate of $0.50 per share, will be paid at the end of May for shareholders on record as of May 23rd. The forward yield is 6.8% at the current share price. Finally, we note that historically approximately two-thirds of the distribution has been classified as a return of capital (ROC).

EMO Performance

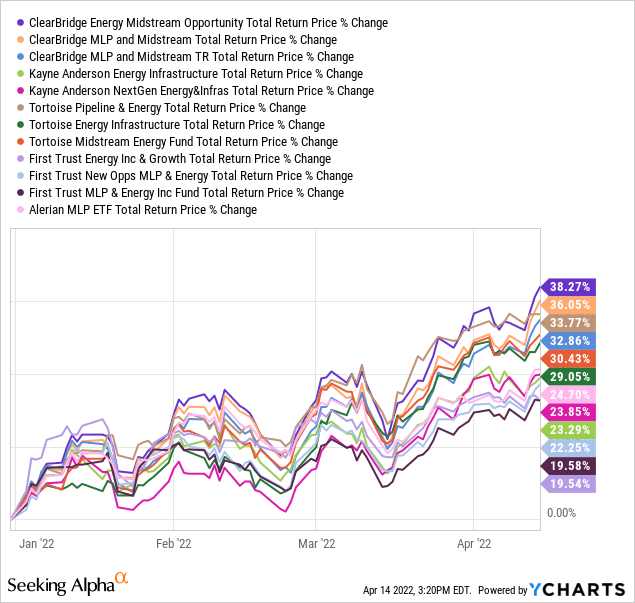

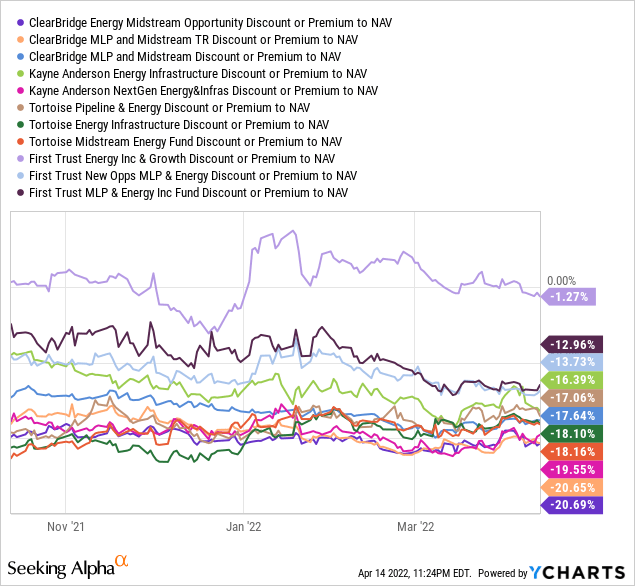

With a peer group of 10 other energy midstream/ MLP and pipeline CEFs, EMO has outperformed them all this year returning 38%. Again, the investing leverage has played a role but the trend is also reflected in the net asset value. In this case, EMO’s strong return is separate from any changes in the spread to NAV that have remained flat over the period.

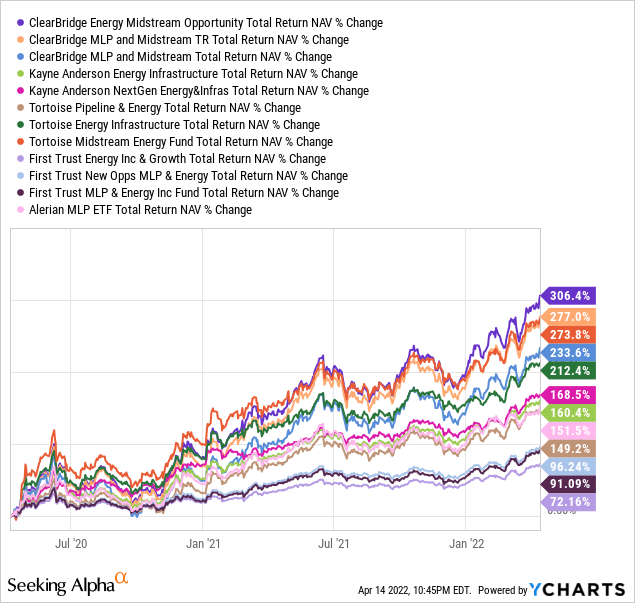

Going back 2-years which was right around the pandemic crash low in 2020, EMO has gained a remarkable 306% on a total return basis at NAV which is nearly double the group average closer to 150%. We’re including funds like the Kayne Anderson Energy Infrastructure Fund, Inc (KYN), Tortoise Energy Infrastructure (TYG), and the First Trust MLP & Energy Income Fund (FEI). EMO has also outperformed its sister CEFs from the same fund family like ClearBridge MLP and Midstream Fund (CEM) and the ClearBridge Energy MLP Total Return Fund (CTR).

While all of these peer funds target similar investments, they each have their differences in terms of strategy and execution. Some funds offer higher yields while others in the group can be seen as lower risk with more diversified portfolios. We can say that EMO stands out as utilizing the most leverage at 26% while most other funds are closer to 20% on average. In this regard, EMO’s effective leverage becomes its differentiator with the more aggressive approach paying off in the strong market momentum.

EMO 21% Discount to NAV

The other distinction EMO hold is one of the widest discount to net asset values among MLP and midstream infrastructure CEFs at 21%. The fund’s spread has also widened compared to a 3-year average of 18% and a 5-year average closer to 13%. This part of the dynamic goes back to the fund’s high use of leverage with the market essentially discounting the fund based on its higher risk profile and also the thought that rising interest rates can add to interest costs for the strategy going forward.

Still, the argument we make is that there is room for the discount to narrow considering the fund’s strong performance. We got a series of distributing hikes this year, and EMO is beating its competition which should in theory help narrow the pricing spread. At the margin, the potential that the discount narrows just marginally can add an incremental return to shareholders as part of the bullish case for the fund.

Final Thoughts

There’s a lot to like about the ClearBridge Energy Midstream Opportunity Fund. While its long-term history has been rocky, the current portfolio management team deserves some credit for delivering results. With a bullish outlook on the sector, we expect the fund to continue delivering positive returns with the leveraged strategy helping it outperform peers.

Whether it’s further global supply chain disruptions due to the Russia-Ukraine conflict, or because of strong demand in a global post-pandemic recovery, we see the current environment as positive for the energy sector. Midstream players are well-positioned to benefit and we believe EMO has the right exposure in this scenario.

Be the first to comment