LewisTsePuiLung/iStock Editorial via Getty Images

CK Hutchison Holdings logo (CK Hutchison Holdings homepage)

Investment Thesis

In my last article from June 2021, on CK Hutchison Holdings (OTCPK:CKHUY) titled “Up 32% Since The Last Call” I changed my earlier stance from a “Buy” to a “Hold”.

Purely based on fundamentals, this conglomerate is still attractive, as this article will show, however it is hard to determine what will be the catalyst that can unlock its true value.

Almost one year has passed since the last article was published. With CKHUY’s full-year result just out, it is a good time to assess their results and what my stance is this time around.

Let us start with the financials.

2021 Financial Results

CKHUY reported earnings attributable to shareholders of HKD 33.48 billion, which was an improvement of 15% from 2020 when they recorded HKD 29.14 billion.

Consolidated funds from operations (“FFO”) before cash profits from disposals, capital expenditures, investments, and changes in working capital was HKD 54.5 billion for 2021. This was a slight decrease of 2% against 2020 when it was HKD 55.5 billion.

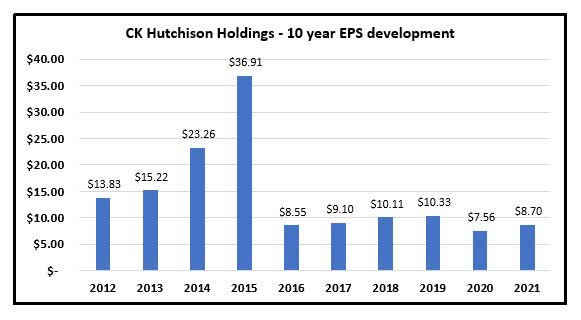

EPS was HKD 8.70 up from HKD 7.56 Therefore, based on current share price of HKD 57 we get a very reasonable P/E of just 6.5

CK Hutchison – last 10 years EPS (Data: CK Hutchison Holdings 2021 Annual Report)

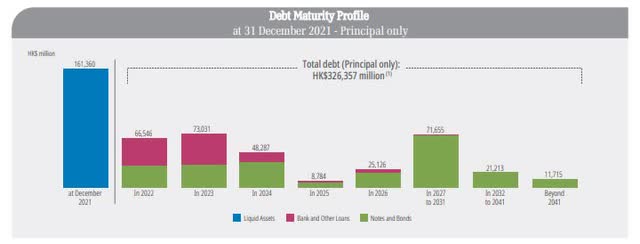

The company has total debt of HKD 326 billion and holds cash and other liquid funds of HKD 161 billion. This means their net debt is HKD 168 billion.

Total assets book value is HKD 660 billion.

CK Hutchison – Debt maturity profile (CK Hutchison Holdings 2021 Annual Report)

Their debt maturity is very comfortable as can be seen above.

They have enough cash and liquid assets to pay the debt for 2022, 2023, and almost all of 2024 without earning a dollar in between.

The Group’s consolidated finance costs for the year, which include interest expenses, amortization of finance costs, and other costs related to financing, amounted to HKD 14.7 billion. This was 3% lower than the year before.

Their weighted average cost of debt for 2021 was 1.6%.

At the end of 2021, about 31% of the debts were at floating rates and the remaining 69% were at fixed rates.

The group only discloses EBIT and net earnings for each business segment, as financing costs and taxes are dealt with on a group basis.

It would have been useful to see net earnings from each segment to get an idea of how effective ROE is for each division.

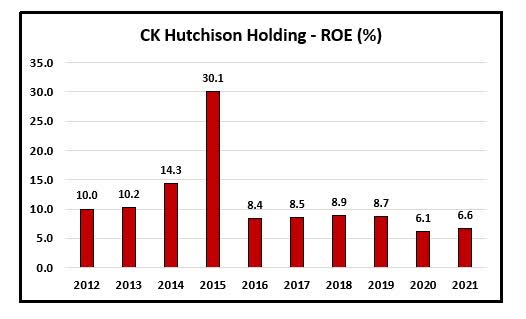

Here is the ROE for the group.

CK Hutchison – Last 10 years ROE (Data: CK Hutchison Holdings 2021 Annual Report. Graph by author)

The very high ROE in 2015 was a result of the reorganization of Cheung Kong Holdings and Hutchison Whampoa which merged their assets and businesses into CKHH and simultaneously reallocated them between CKHUY and CK Asset (OTCPK:CHKGF) on 3rd June 2015. This abnormally high number can also be seen later in the graph of the EPS.

We shall report EBIT from each division with the development that took place in 2021.

CK Hutchison – Telecommunication division (CK Hutchison Holdings 2021 Annual Report)

3 Group Europe has telecommunication businesses in the UK, Ireland, Italy, Austria, Sweden, and Denmark. In addition, CKHUY owns 66% of Hutchison Telecommunication Hong Kong Holdings which is listed on the Hong Kong Stock Exchange. They also have Hutchison Asia Telecommunication which has mobile-phone operations in Indonesia, Vietnam, and Sri Lanka.

3 UK covers 99% of the UK’s outdoor population with its combined 3G and 4G network, and it carries 28% of the mobile data traffic in the country. According to Hutchison, it is recognized as the UK’s fastest 5G network.

In my previous article, I did mention the huge deal of selling their telecom tower assets in Italy and Sweden. These were completed in 2021 and CK Hutchison recognized a net gain of HK$25.3 billion. The Group obtained conditional regulatory approval for the tower asset transaction in the UK on 3 March 2022, which is expected to complete in the second half of this year.

The group’s largest EBIT contribution comes from this division.

In 2021 it contributed 36% of the EBIT which was HKD 24.5 billion. This was still 27% lower than the EBIT in 2020 which was HKD 33.5 billion.

CK Hutchison – Infrastructure division (CK Hutchison Holdings – 2021 Annual Report)

The infrastructure division comprises a 75.7% interest in CK Infrastructure Holdings Ltd. (OTCPK:CKISY)

CKI is the largest publicly listed infrastructure company on the Hong Kong Stock Exchange, with a market capitalization of HKD 135 billion, which equals about USD 17.2 billion.

It owns and operates utilities, water infrastructure, waste management, waste-to-energy, household infrastructure, and other infrastructure-related businesses in Hong Kong, Mainland China, the UK, Continental Europe, Australia, New Zealand, Canada, and the United States.

ESG and a journey towards a lower carbon economy are especially important for this division since it consumes large quantities of fossil fuels.

In 2021, their subsidiary Australian Gas Networks opened Australia’s first hydrogen production facility, Hydrogen Park South Australia, and commenced blending renewable hydrogen into part of its natural gas distribution network in Adelaide.

We can expect that future Capex will go into several “green initiatives”.

CKI announced a net profit attributable to shareholders under Post-IFRS 16 basis of HKD 7,515 million, 3% higher than last year. More importantly, they had a record high FFO amounting to HKD 8.4 billion, which was an increase of 8% Y-O-Y.

The infrastructure division contributed 28% to the group’s total EBIT with HKD 19.1 billion in EBIT.

CK Hutchison – Retail division (CK Hutchison Holdings – 2021 Annual Report)

Their retail division consists of the A.S. Watson group of companies. With 16,398 stores in 28 markets worldwide, CKHUY claims it is still the world’s largest international Health and Beauty retailer with 142 million loyalty members.

In 2020, Watson Group announced a joint business initiative with Grab (GRAB) the largest offline plus online health and beauty partnership in Southeast Asia, involving over 2,200 Watsons stores across six markets.

Retail contribution to EBIT was 20% with HKD 13.4 billion in EBIT. This was an improvement of HKD 1.48 billion to EBIT in 2021, or 12% y-o-y which was encouraging when we take into account that the world is still grappling with the COVID-19 pandemic in many parts of the world.

It does show that some segments within the retail space are quite resilient. Watson is mainly selling beauty and healthcare products.

- Ports and related services

CK Hutchison – Ports division (CK Hutchison Holdings – 2021 Annual Report)

It was very positive results from this division last year.

They handled 88 million containers of TEU in 2021 through 291 operating berths around the world. This was a 5% growth compared to last year.

Last year I highlighted the fact that their customers, which are big liner companies like COSCO, Maersk, and MSC were minting money last year with the price of moving containers having increased more than 100%. I went on to state that this should hopefully give CKHUY some pricing power too. Going through their annual report, we learn that revenue did, in fact, increase by 29% to HKD 42.3 billion from higher throughput and improvements in margins.

Hutchison Ports Felixstowe and Harwich were granted Freeport status by the UK government in 2021. This should strengthen its position as the country’s major trade hub. It has underdeveloped sites around the ports that should also benefit from tax and customs incentives and attract more businesses, especially green energy and technological businesses.

A part of their Port and related service division is a business trust called Hutchison Port Holdings Trust (OTCPK:HCTPF)(OTC:HUPHY).

Over the years, I have shared with my readers my portfolio. There are companies that have done well, but there are also companies I like to refer to as “ugly ducklings” in my portfolio. It is not necessarily because they do poorly in terms of their profits or financial position. They get this description if their share price is considerably lower than what I paid for it.

One such “ugly duckling” is Hutchison Port Holdings Trust, listed in Singapore with ticker code NS8U.SI

It has performed poorly over the last couple of years. I did expect their results to improve and I am pleased to report that they did. Their DPU increased by 20.8% from HK cents 12 to HK cents 14.5

It actually yields 7.6% for those that might be interested.

In 2021, Hutchison Port Holdings Trust entered into a joint venture agreement with Shenzhen Yantian Port to develop Yantian East Port Phase I to cater to the growing demand for container shipping.

Ports and related services contributed 17% towards total EBIT for the group with HKD 10.8 billion in EBIT. That was a 60% improvement y-o-y.

- Finance & Investments division

CK Hutchison – Finance & Investment division (CK Hutchison Holdings – 2021 Annual Report)

This division holds the Group’s cash and liquid investments plus various private and listed associate companies, such as TOM Group, the Marionnaud businesses, CK Life Sciences Group, and Hutchison Telecommunications Australia.

In January 2021 they merged Husky Energy with Cenovus Energy (CVE) in Canada. CKHUY owns 15.8% of Cenovus Energy.

This segment recorded a one-off net loss of HK$5.0 billion, which comprised a non-cash foreign exchange reserve loss following the energy business merger of HK$3.5 billion and the Group’s share of non-cash pre-tax impairment on the energy business’ US refinery assets of HK$1.5 billion.

This is compared to the one-off net loss of HK$14.8 billion last year, which comprised the share of impairment and write-downs of the energy business, partly offset by a net dilution gain of HK$10.1 billion arising from the merger of the Australian Telecommunication businesses.

Excluding these one-off items, underlying EBITDA and EBIT grew 52% and 726% respectively from 2020 primarily due to the turnaround contribution from the energy business’ underlying operations.

As a result of this, the division posted a negative EBIT of HKD 1.2 billion.,

Returning capital to shareholders

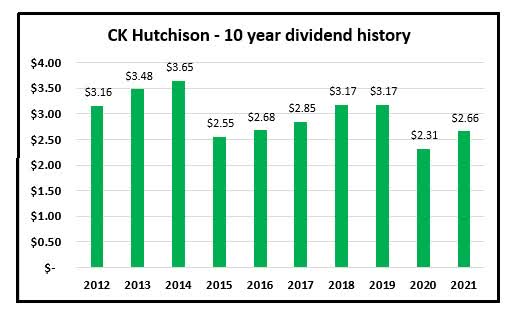

Their dividend has fluctuated quite a lot over the years. We can see this from looking at the past ten years.

CK Hutchison – Last 10 year dividends. (Data: CK Hutchison. Graph by author)

It is well covered, as their low pay-out ratio from their EPS means that their dividend coverage is safe. Since 2016 the dividend coverage has been 3.2 to 3.3

One could argue that their cash flow is generally higher than their earnings so their ability to pay a somewhat higher dividend is there. But we have to bear in mind that many of their division’s business activities are very capital intensive so there is Capex to take care of plus maintaining a solid balance sheet.

Their dividend yields 4.6% which is acceptable. Not great, but acceptable.

In addition to this dividend, the company does from time to time buy back its own shares.

During the last financial year, CKHUY bought back 21.7 million ordinary shares at an aggregate sum of about HKD 1.23 billion. All these shares were subsequently canceled.

As of 31 December 2021, the total number of shares in issue was 3,834,634,500.

What is it worth?

There are many blue-chip companies based in Hong Kong that trade at attractive prices compared to their net tangible asset values.

I have just written an article on Hongkong Land, which is trading at a ridiculous Price/NAV of just 0.32

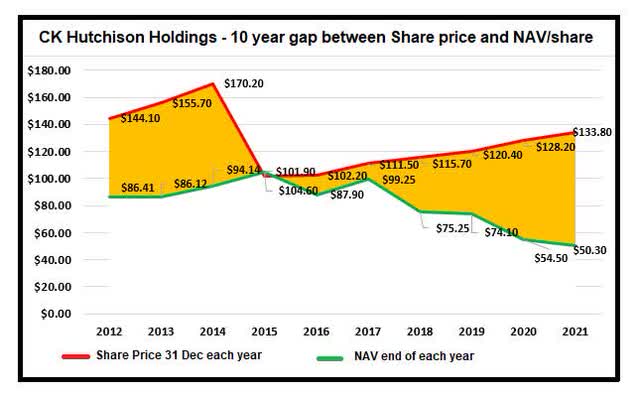

But back to CKHUY. Their NAV/Share is HKD 133.8

Based on HKD 57 per share we get a low price/NAV is just 0.43

CK Hutchison – 10 year gap between share price and NAV/share (Data from CK Hutchison. Graph by author )

CKHUY should be commended for improving the NAV by roughly 30% since 2015. That is a CAGR of 5% which is not bad.

However, it seems that investors care less about the value of the sum of the assets, and want a discount in the price. This discount could be because the company is headquartered and listed in Hong Kong. My assumption is based on what I just stated about the fact that many Hong Kong companies are trading at very low prices to their net asset values.

But should they?

CKHUY gets only 13.2% of its EBIT from Hong Kong and mainland China.

When investors decide how much they are willing to pay for or sell a share they should base this price on facts, such as P/E, P/NAV, and yield. But these numbers are about the past. We are investing for the future. Since nobody can predict with any certainty about the future, it has to be based on some projections and a good dose of perception.

The late legendary investor John Bogle once said:

If there is a gap between perception and reality, it is only a matter of time until reality takes over”.

I have shown you the gap, but I have no idea how long time it may take to close that gap. Or even, if it will happen. And herein lies the crux of the matter.

Conclusion

In June last year I concluded as follows:

I have no doubt that CKHUY will make good money and lots of free cash flow for many decades to come. However, I am uncertain as to how much of it will be returned to its shareholders.”

Even though the company clearly delivered improved results in 2021, my previous conclusion remains the same. For me, nothing has changed that makes me more convinced that it is worth investing in at this point in time.

Conglomerates which CKHUY really is, often trade at lower prices than what the pieces could be worth individually.

Maybe it could unlock values by splitting the divisions up?

My Hold stance remains for now.

Be the first to comment