Dan Kitwood/Getty Images News CK Hutchison Holding logo (CK Hutchison home page)

Investment thesis

In my last article on CK Hutchison Holdings (OTCPK:CKHUY) dated April 21, 2022, I had concerns about how much of the free cash flow they generate would be returned to its shareholders. Another concern was whether their conglomerates status is a reason the shares are trading at such a large discount to its net tangible book value.

CKHUY has just come out with their 2022 interim report and as such, I would like to update to see if my hold stance remains or if it needs to be revised.

Financials Results FH 2022

CKHUY posted net earnings of HKD 19.1 billion for the FH 2022. This was an improvement of 4% from the same period last year

EPS was HKD 4.98

The net earnings were affected by a net gain of HKD 5.1 billion from the completion of the merger of the Indonesian telecommunication business, which again was partly offset by a non-cash impairment in the Group’s telecommunication business in Sri Lanka.

They also recognized a one-off net earnings benefit of HKD 6.3 billion comprising the disposal gains from the tower asset sales in Italy and Sweden, partly offset by a noncash impairment of goodwill on the Italian telecommunication business.

On top of this, they also took a non-cash FX reserve loss arising from the merger with Cenovus Energy (CVE) in Canada.

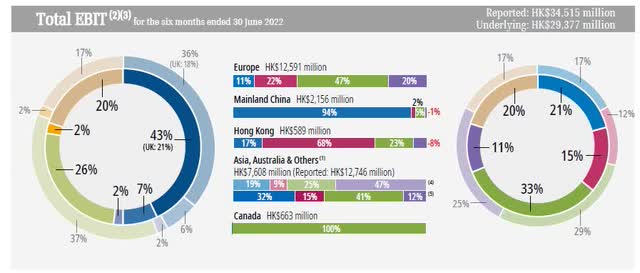

Here is the total EBIT for the group.

EBIT on group level FH 2022 (CK Hutchison Holding FH 2022 presentation)

Free cash from its operation was HKD 16 billion, which was HKD 1.6 billion lower than last year.

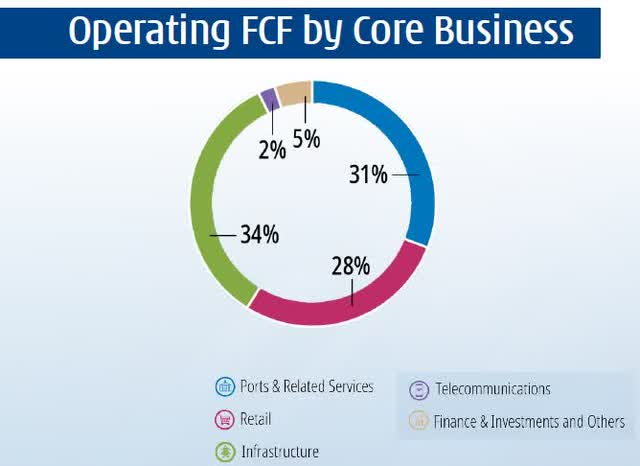

Operating FCF by business divisions (CK Hutchison Holding FH 2022 presentation)

Roughly one-third each comes from ports, retail, and infrastructure. Telecomm which actually requires a lot of capital was the lowest contributor to the cash flow.

With regards to their balance sheet, they have a very comfortable gearing of just 20.5%

During the SH of 2022, they will also receive large cash from sales of cell tower assets, which will bring down the gearing to 17.5%

They have stated that they want to accelerate shareholders’ return and declared a dividend of HKD 0.84 which was also up 5% from last year. That was positive news, as I had earlier stated that they seemed rather reluctant to grow the dividend.

In addition to this dividend, the company does from time to time buy back its own shares.

During the last financial year, CKHUY bought back 21.7 million ordinary shares at an aggregate sum of about HKD 1.23 billion. All these shares were subsequently canceled.

However, from my research the total number of shares in issue as of 31 December 2021 was 3,834,634,500 and it was 3,834,484,500 shares as of 1 August. That implies that they only reduced the number of shares outstanding by just 150,000 shares so far this year.

Business operation

I do question whether this business is good business for the group. It is very capital intensive and seems to generate very little cash sometimes.

When we look at the EBIT before one-off items of the whole 3G group it is HKD 2.2 billion down from HKD 5 billion the year before. The depreciation and amortization were very large. It was HKD 9.5 billion.

After the completion of the disposal of the Group’s interest in the UK tower assets to Cellnex for approximately GBP 3.7 billion, they will get a disposal gain will be recognized in the second half of 2022 from this.

The infrastructure division comprises a 75.67% interest in CK Infrastructure Holdings Limited (OTCPK:CKISY) plus 10% of the economic benefits deriving from the Group’s direct holdings in six co-owned infrastructure investments with CKI.

I was concerned that CKISY would suffer from potential losses from their Australian power assets, as Hong Kong-based China Light & Power suffered its biggest loss since it went public 24 years ago, posting a loss of HKD 4.8 billion in FH 2022. The reason for this large loss was that the wholesale prices of electricity had risen sharply above those that EnergyAustralia had agreed to in its forward contracts. As such an unrealized accounting loss of HK$7.96 billion was recorded.

Fortunately, CKHUY’s net profit attributable to shareholders was HKD 4.4 billion. That was 46% higher than the same period last year, primarily due to the inclusion of deferred tax charges arising from the revision of the UK corporate tax rates in the first half of 2021 which was partly offset by an adverse FX impact. Funds from operations amounted to HKD 4.2 billion.

I would like to remind our readers that this is a big operation. The Retail division has 16,244 stores across 28 markets.

The revenue increased by 3% to HKD 84.9 billion, but the EBIT was down 12% to HKD 4.3 billion.

Watson dual pillars of clicks and bricks (Watson home page)

Their dual strategy of physical retail and internet is working well. Their 142 million loyalty customer base delivered a solid 65% sales participation rate in the FH of 2022. They are strengthening their strategic “Offline + Online” pillars and increasing customer engagement.

- Ports and related services

With so much focus in the media these days about the supply chain bottlenecks and the doubling in the cost of shipping containers around the world, one would think that the ports handling all these would also get a “piece of this cake”.

Just in the first six months this year, they handled 42.4 million TEU, which is twenty-foot equivalent units. That is a lot of containers.

The numbers tell us that they did get a piece of the cake. Their total revenue of HKD 22.7 billion and EBIT of HKD 6.6 billion was an increase of 13.6% and 22.5% from last year.

Unfortunately, I was not as lucky as the numbers for Hutchison Port Holdings Trust (OTCPK:HCTPF) which is a part of this, only managed to eke out slightly lower numbers with revenue of HKD 1.4 billion which grew 7%, and an EBITDA of HKD 785 million which was 2% lower than the year before. I am long HPHT.

This division is taking action to solve some of the bottlenecks in logistics by investing in expansion to its existing facilities to cater to growth. They are also diversifying their revenues through expanding logistics businesses and maximizing landside income.

- Finance & Investments division

HutchMed China (HCM), is one of the investments held by this division, as they have a 38.5% stake in this company. In May this year, they failed to win approval from the FDA in the US for its pancreatic cancer treatment drug. They declined to approve its drug known as Surufatinib for the treatment of pancreatic and extrapancreatic neuroendocrine tumors.

A multi-regional clinical trial, which includes subjects more representative of the US patient population and medical practices would be required for US approval.

Furthermore, following the merger of the Group’s energy business with Cenovus Energy in January 2021, this asset now forms part of the Finance & Investments division of the group.

Their 16.3% investment in Cenovus made promising contributions to the Group’s profitability in the FH this year. The Group’s share of Cenovus Energy’s Post-IFRS 16 net earnings were HKD 3.9 billion, which was an increase of 787%

Risks to the thesis

Geopolitical risks, recession, and whether it can pass on the cost of inflation to its customers are risks that most businesses now have to consider.

Some parts of CKHUY’s business are somewhat sheltered from the negative effects, as a lot of the goods and services they sell are essentials.

Their infrastructure assets come to my mind. They operate in a steady regulatory environment with no regulatory reset in 2022. They pointed out in their FH 2022 financial report that higher inflation will benefit the performance of this division.

Retail may see lower revenue, but a lot of what they sell is considered essential, so I doubt that we would see much reduction.

As such, I see limited risks.

One potential risk is that CKHUY might continue to be a “value trap”.

Despite it having the majority of its business revenue outside of Hong Kong and China, it is still valued as a play on China.

A stock that is down 17% over the last twenty years, should perhaps be labeled a value trap.

The share price the last 20 years (Yahoo Finance)

What could be the catalyst that can unlock the value?

Conclusion

My earlier concerns about their willingness to distribute capital to shareholders might be put to rest with their increase in dividends this time.

As I have been stating about CKHUY in the past, it is a good business, with a sound balance sheet. It will be around for a very long time and will continue to pay its shareholders a dividend.

Year in and year out.

This I have no doubt about. But one has to consider that the present value of a dollar that was invested twenty years ago is worth considerably less today.

As a matter of fact, the average inflation has been 2%, according to smartasset.com. Accumulative, that is 54.5% over that period.

Perhaps it would get a better valuation if it was listed elsewhere, like on the London Stock Exchange or if it were to spin off some of its divisions to separate companies. These could be listed outside of Hong Kong.

I maintain a hold stance.

Be the first to comment