Chadchai Krisadapong/iStock via Getty Images

What makes investing both interesting and challenging is the fact that investment opportunities, even when they do work out right, do not always go the way you want them when you think they should. Markets can be volatile and individual stocks even more so. And one firm that has experienced a tremendous amount of volatility, despite some rather bullish news, is Civeo Corporation (NYSE:CVEO). Although the past few months have been painful from a share price perspective, the fundamentals of the company remain robust and its near-term future looks bright. Add in a rather significant contract the company just locked down last month to how cheap shares are on an absolute basis, and I have a difficult time believing that shares will deserve to trade at current levels for any meaningful amount of time.

Great wins clouded by market pessimism

I have always found myself drawn to companies that have unique business models and value propositions. Few companies are as novel as Civeo, which provides lodging and other accommodation-related services to customers in Canada, Australia, and select parts of the U.S. for the purpose of extracting natural resources in sparsely populated locales. Back in May of this year, I wrote an article that was bullish about the company. I lauded the robust fundamental performance of the company and concluded that, despite seeing shares surge in the months leading up to that, it likely had further upside to go. As a result of my findings, I rated the company a “buy,” reflecting my belief that it would probably outperform the broader market for the foreseeable future. Unfortunately, things have not gone exactly according to plan. While the S&P 500 is down just 1% since that article was published, shares of Civeo have plunged by 8.2%.

Given this return disparity, you might expect that the picture for the business has been rather bleak. But that couldn’t be further from the truth. On July 18th, for instance, management announced the renewal of a long-term contract that involves it providing rooms and hospitality services at its Wapasu Lodge in the Canadian oil sands for Imperial Oil Resources Limited for the 12 years ending October 31st of 2034. This contract includes no less than C$500 million in take-or-pay revenue for the company. This means that it will get paid no matter what kind of activity takes place at that lodge. It also leaves open the door for additional revenue based on current occupancy levels, with that revenue potential being defined by management as “significant.”

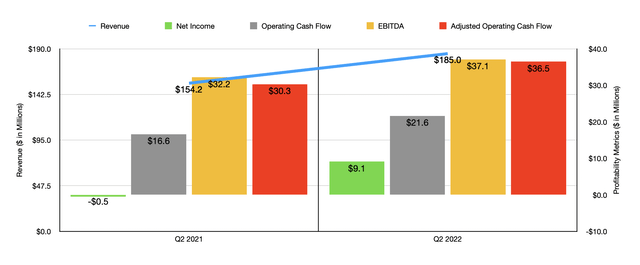

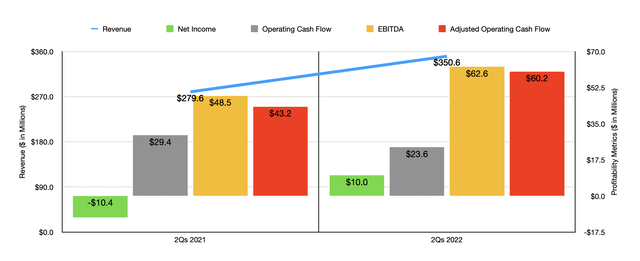

In addition to announcing this contract, which does not commence until November 1st of this year, the company also has boasted strong financial performance for the second quarter of its 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the firm. According to management, revenue came in at $185 million. That’s 20% higher than the $154.2 million the company generated one year earlier. This follows a strong first quarter for the year, bringing total revenue for the first half of 2022 up to $350.6 million. That’s 25.4% above the $279.6 million generated the same time of 2021.

It’s important to note that financial performance for the company has occurred across all three of the regions in which it operates. In the latest quarter, for instance, sales in Canada totaled $109 million. That’s 30.9% above the $83.3 million generated during this second quarter of 2021. Revenue growth in Australia was a more modest 5.9%, while in the U.S., a market that comprises just 4.4% of the company’s revenue, sales grew by roughly 18%. Management attributed much of this increase to improved occupancy at its lodges, particularly throughout Canada, and increased Canadian mobile camp activity. Pricing for its lodges, however, has been somewhat mixed. In Canada, daily rates rose by 7.3%, while in Australia the company experienced a decline of 4.9%. This follows a similar trend to what the firm has seen for the first half of the year as a whole.

With revenue rising, profitability has followed suit. Net income in the latest quarter was $9.1 million. That compares favorably to the $0.5 million loss experienced just one year earlier. Operating cash flow went from $16.6 million to $21.6 million. If we adjust for changes in working capital, it would have risen from $30.3 million to $36.5 million. Meanwhile, EBITDA for the firm rose from $32.2 million to $37.1 million. It should come as no surprise that this represents a continuation of strong bottom line performance for the first half of the year as a whole. Net income of $10 million dwarfed the $10.4 million loss experienced in the first half of 2021. Admittedly, operating cash flow did fall in the first half of the year, declining from $29.4 million to $23.6 million. But if we adjust for changes in working capital, it would have soared from $43.2 million to $60.2 million, while EBITDA increased from $48.5 million to $62.6 million.

When it comes to the 2022 fiscal year as a whole, management has forecasted revenue of between $660 million and $675 million. If this comes to fruition, it would represent an increase of 12.3%, at the midpoint, compared to the $594.5 million generated in 2021. When it comes to EBITDA, the company is forecasting a reading of between $95 million and $105 million. That’s lower than the $109.1 million generated in 2021. And after making certain adjustments related to non-controlling interests and preferred distributions, I calculated operating cash flow for the year at around $78.5 million. That would also represent a decrease compared to what the company achieved last year.

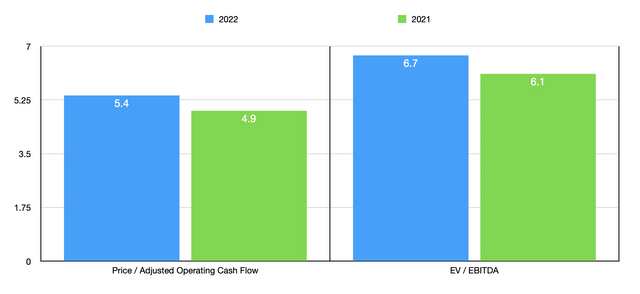

Clearly, while customers are coming back to the table, the company has not yet been able to exercise any meaningful pricing power over them. That is one negative to the business. But even this being the case, shares look quite cheap right now. On a forward basis, the firm is trading at a price to operating cash flow multiple of 5.4. That compares to the 4.9 reading that we get using 2021 data. Meanwhile, the EV to EBITDA multiple should come in at 6.7. That stacks up against the 6.1 multiple that we use if we use the 2021 figures.

Takeaway

Based on all the data provided, I must say that Civeo continues to strike me is a really attractive company. It is true that the firm has certain exposure, namely because it provides accommodation services to customers that extract some of the highest-cost natural resources, particularly in Canada. So in the event that the market takes a significant turn lower, it could very well be exposed. But I feel like the price is low enough to more than account for this kind of risk. And with a foreword net leverage ratio of 1.48, the company is not particularly indebted. So at the end of the day, I still believe that a “buy” rating is appropriate for the business.

Be the first to comment